Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Archegos-inspired margin buying question. In 2021, Credit Suisse financed the margin buying spree of Archegos Capital, a hedge fund. This spree ended with the

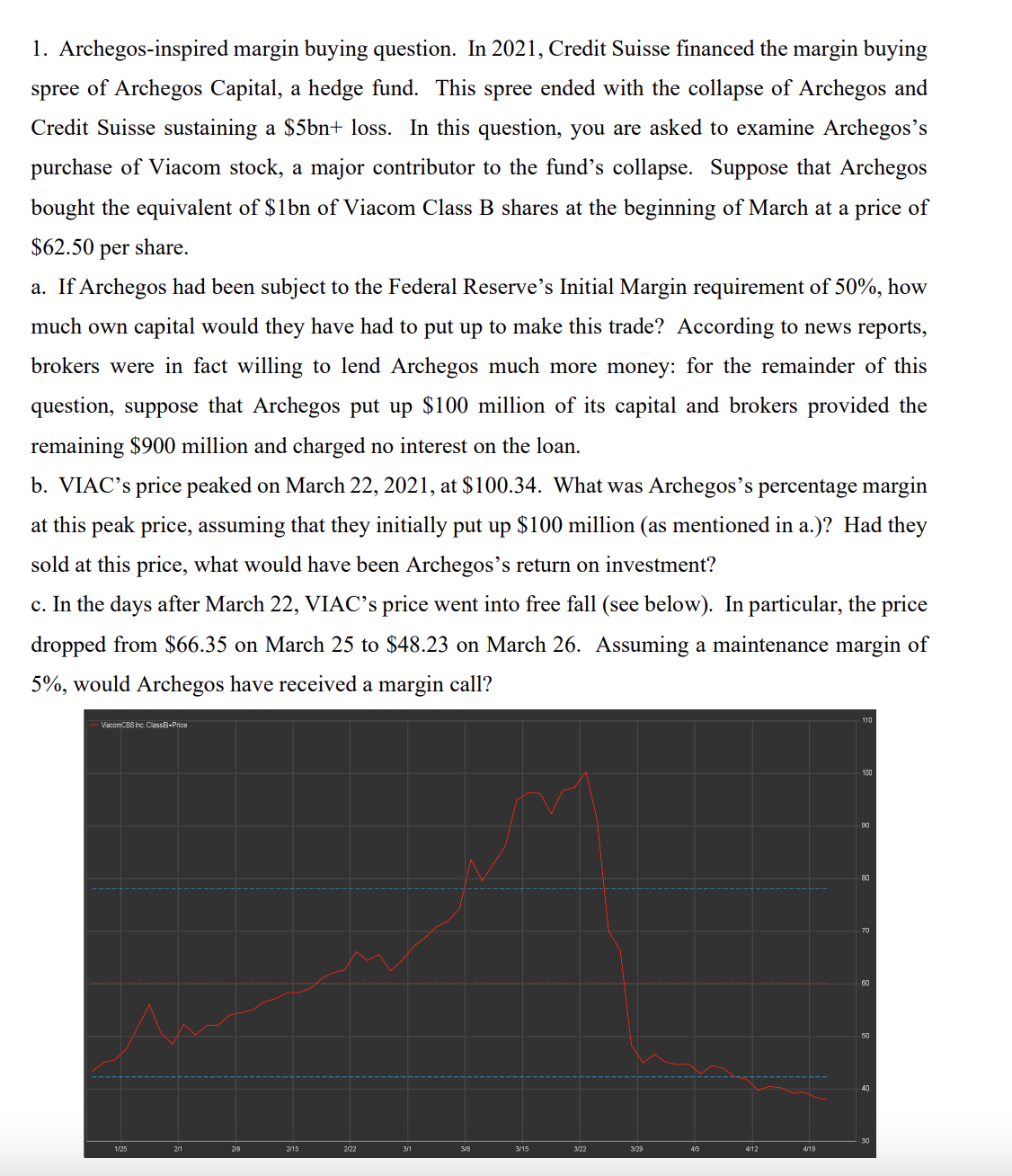

1. Archegos-inspired margin buying question. In 2021, Credit Suisse financed the margin buying spree of Archegos Capital, a hedge fund. This spree ended with the collapse of Archegos and Credit Suisse sustaining a $5bn+ loss. In this question, you are asked to examine Archegos's purchase of Viacom stock, a major contributor to the fund's collapse. Suppose that Archegos bought the equivalent of $1bn of Viacom Class B shares at the beginning of March at a price of $62.50 per share. a. If Archegos had been subject to the Federal Reserve's Initial Margin requirement of 50\%, how much own capital would they have had to put up to make this trade? According to news reports, brokers were in fact willing to lend Archegos much more money: for the remainder of this question, suppose that Archegos put up $100 million of its capital and brokers provided the remaining $900 million and charged no interest on the loan. b. VIAC's price peaked on March 22, 2021, at \$100.34. What was Archegos's percentage margin at this peak price, assuming that they initially put up $100 million (as mentioned in a.)? Had they sold at this price, what would have been Archegos's return on investment? c. In the days after March 22, VIAC's price went into free fall (see below). In particular, the price dropped from $66.35 on March 25 to $48.23 on March 26. Assuming a maintenance margin of 5%, would Archegos have received a margin call

1. Archegos-inspired margin buying question. In 2021, Credit Suisse financed the margin buying spree of Archegos Capital, a hedge fund. This spree ended with the collapse of Archegos and Credit Suisse sustaining a $5bn+ loss. In this question, you are asked to examine Archegos's purchase of Viacom stock, a major contributor to the fund's collapse. Suppose that Archegos bought the equivalent of $1bn of Viacom Class B shares at the beginning of March at a price of $62.50 per share. a. If Archegos had been subject to the Federal Reserve's Initial Margin requirement of 50\%, how much own capital would they have had to put up to make this trade? According to news reports, brokers were in fact willing to lend Archegos much more money: for the remainder of this question, suppose that Archegos put up $100 million of its capital and brokers provided the remaining $900 million and charged no interest on the loan. b. VIAC's price peaked on March 22, 2021, at \$100.34. What was Archegos's percentage margin at this peak price, assuming that they initially put up $100 million (as mentioned in a.)? Had they sold at this price, what would have been Archegos's return on investment? c. In the days after March 22, VIAC's price went into free fall (see below). In particular, the price dropped from $66.35 on March 25 to $48.23 on March 26. Assuming a maintenance margin of 5%, would Archegos have received a margin call Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started