Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) As a Concordia student, you know that even with limited to no income, you have many options in choosing student-specific credit cards that

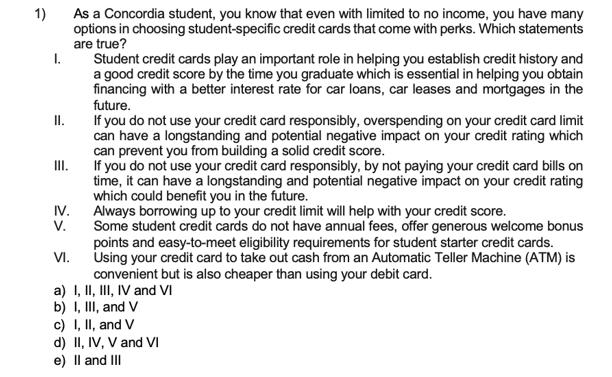

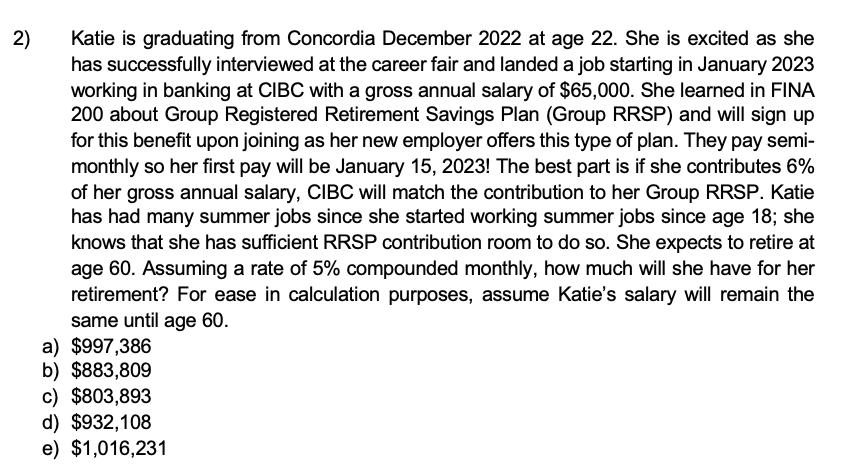

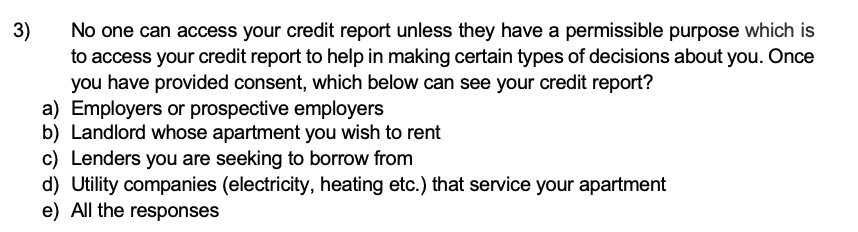

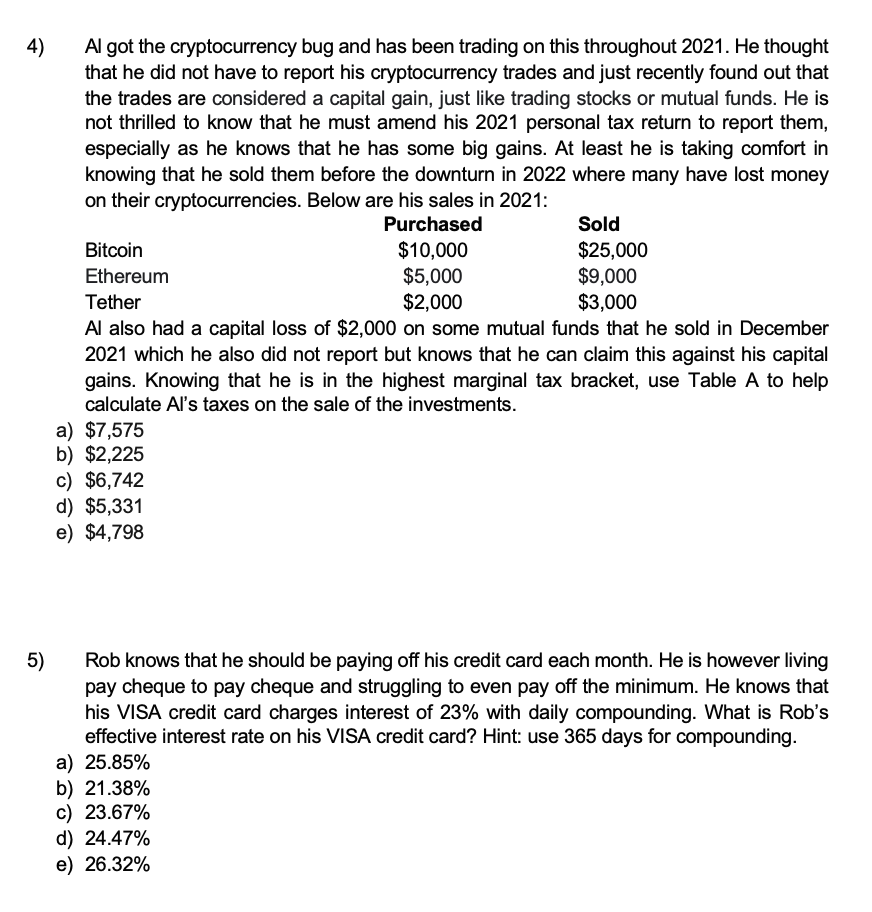

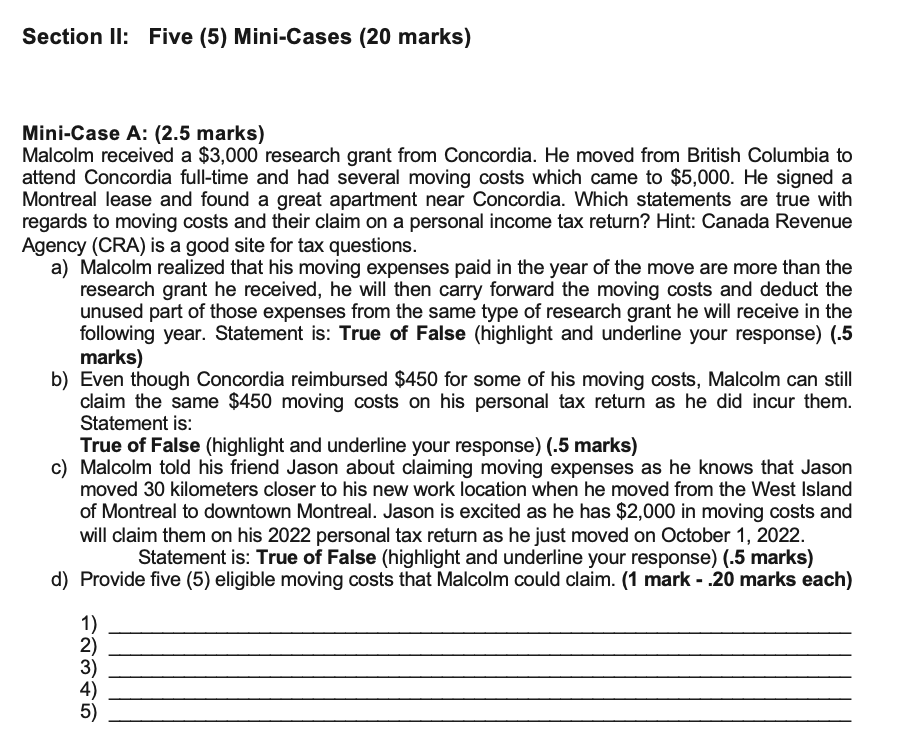

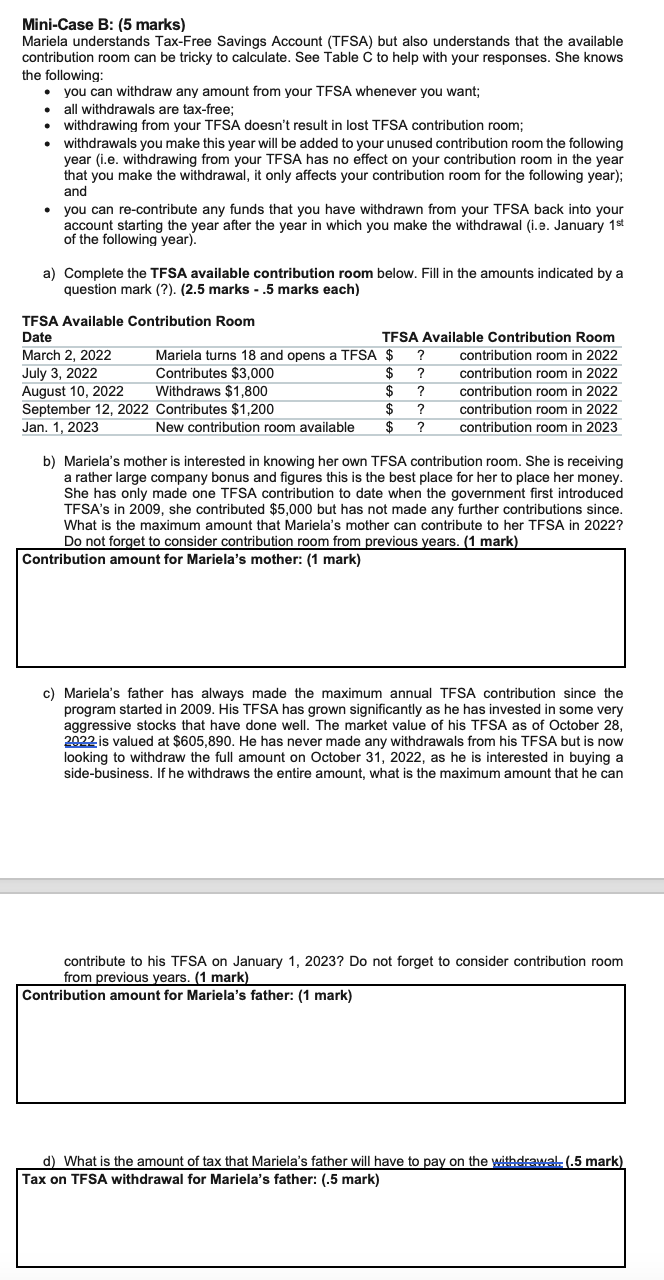

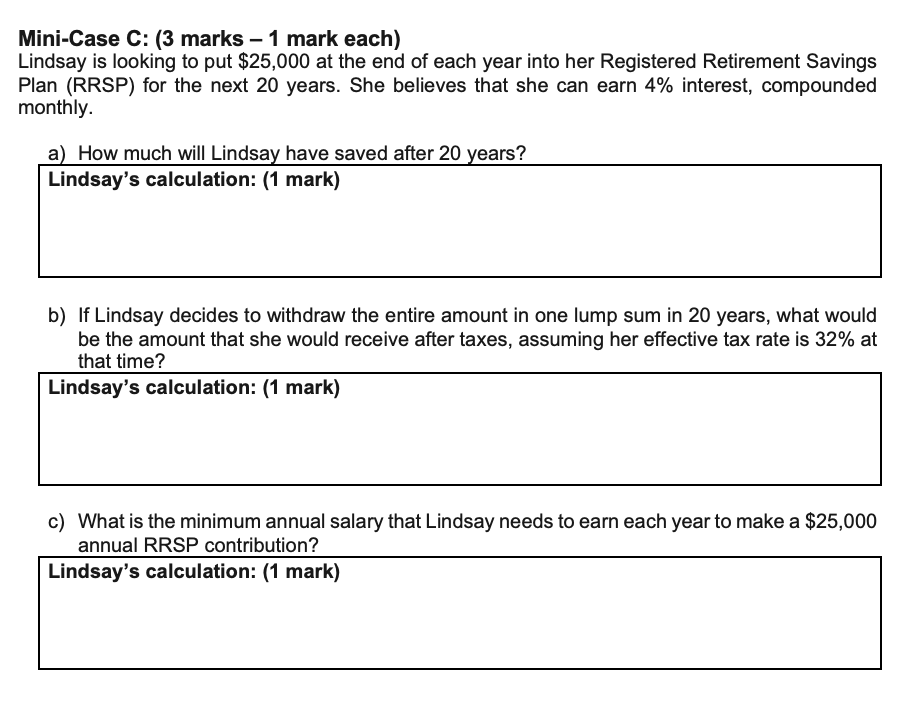

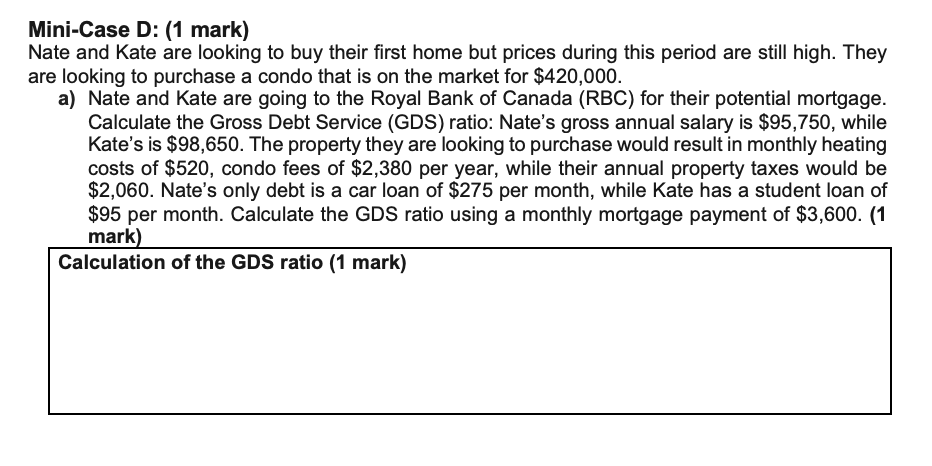

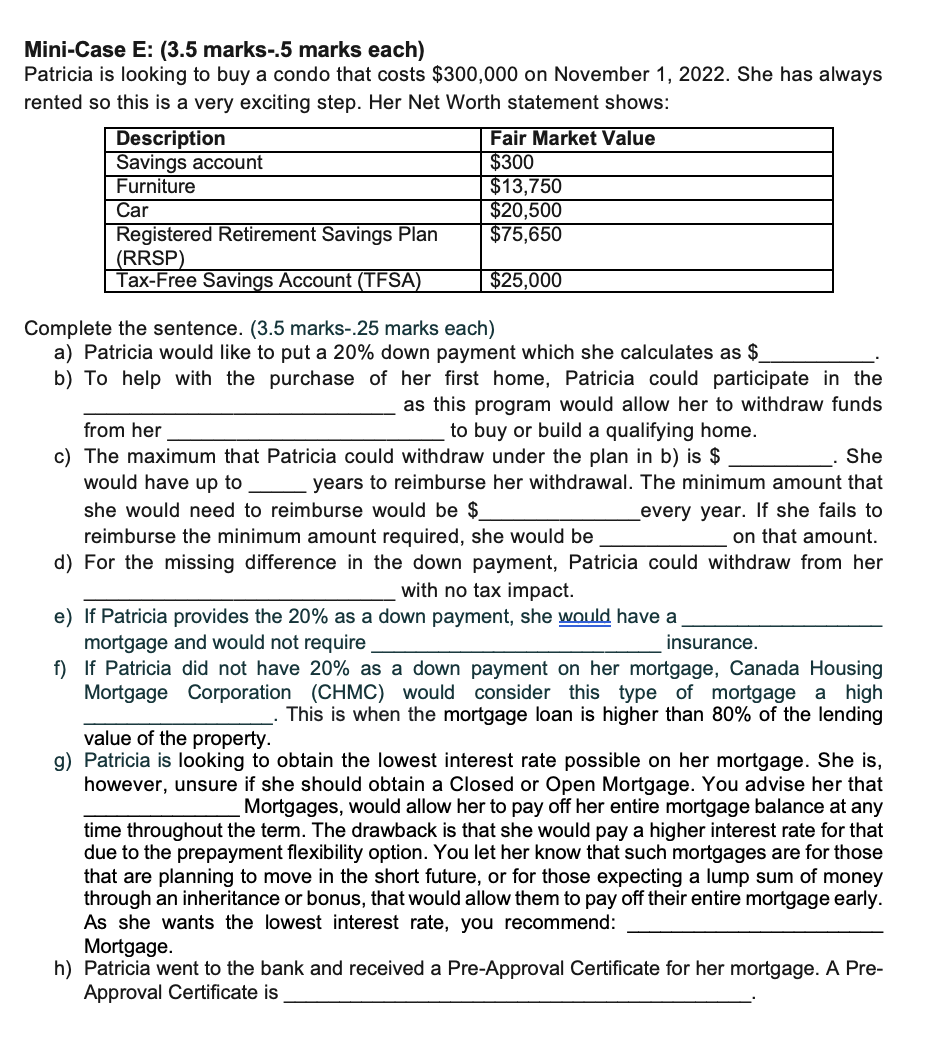

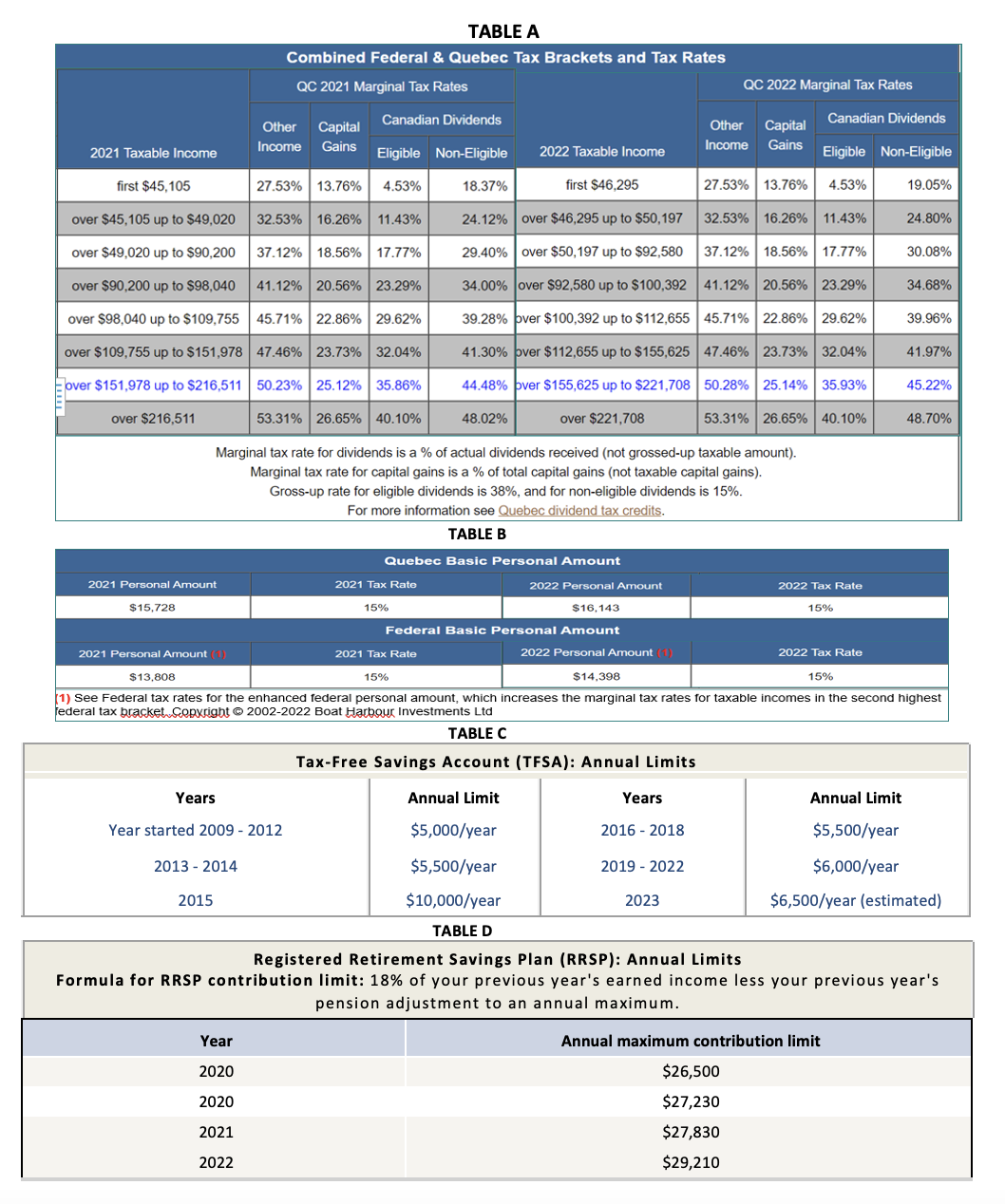

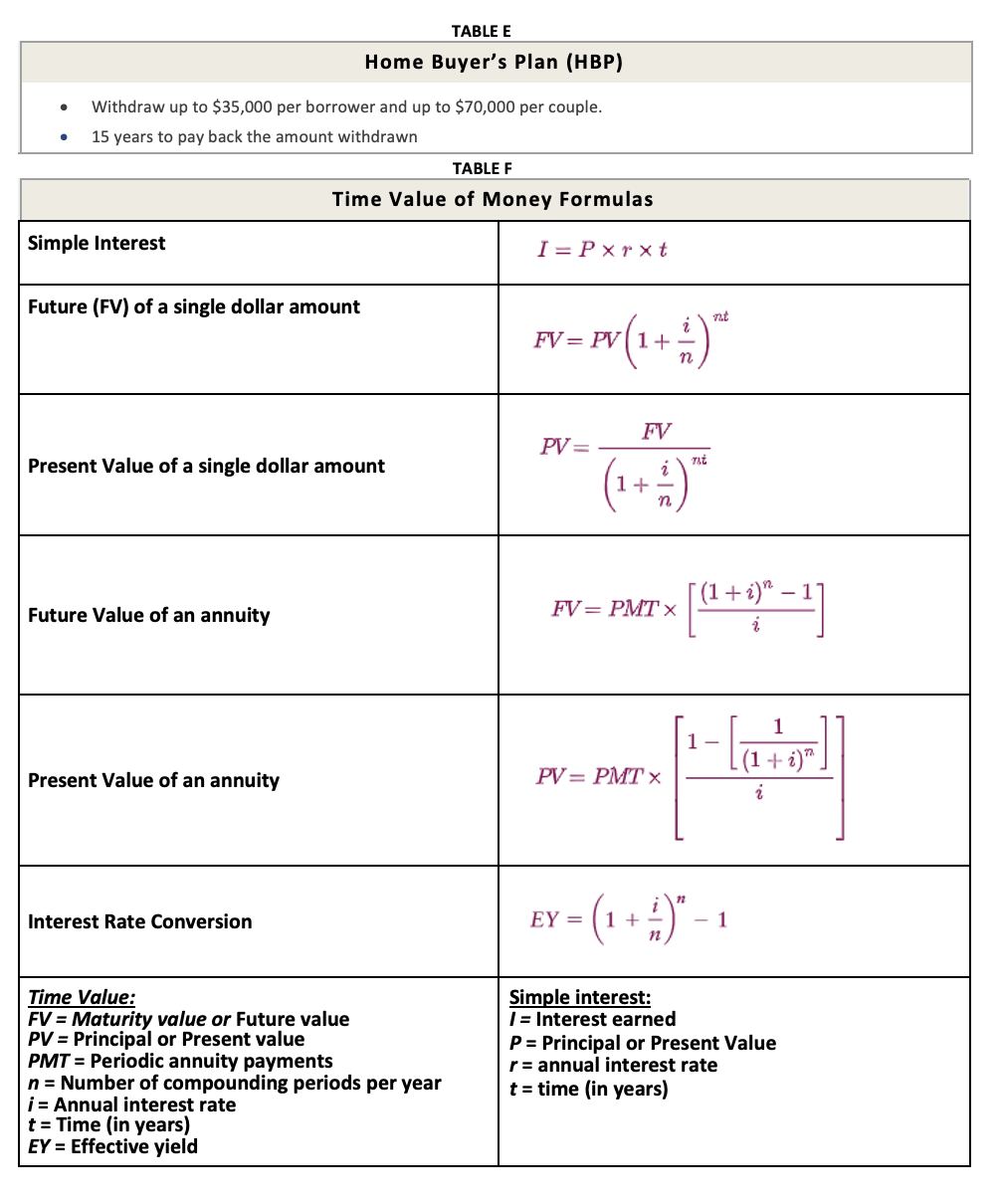

1) As a Concordia student, you know that even with limited to no income, you have many options in choosing student-specific credit cards that come with perks. Which statements are true? I. Student credit cards play an important role in helping you establish credit history and a good credit score by the time you graduate which is essential in helping you obtain financing with a better interest rate for car loans, car leases and mortgages in the future. II. III. If you do not use your credit card responsibly, by not paying your credit card bills on time, it can have a longstanding and potential negative impact on your credit rating which could benefit you in the future. Always borrowing up to your credit limit will help with your credit score. Some student credit cards do not have annual fees, offer generous welcome bonus points and easy-to-meet eligibility requirements for student starter credit cards. Using your credit card to take out cash from an Automatic Teller Machine (ATM) is convenient but is also cheaper than using your debit card. a) I, II, III, IV and VI b) I, III, and V c) I, II, and V d) II, IV, V and VI e) II and III IV. V. If you do not use your credit card responsibly, overspending on your credit card limit can have a longstanding and potential negative impact on your credit rating which can prevent you from building a solid credit score. VI. 2) Katie is graduating from Concordia December 2022 at age 22. She is excited as she has successfully interviewed at the career fair and landed a job starting in January 2023 working in banking at CIBC with a gross annual salary of $65,000. She learned in FINA 200 about Group Registered Retirement Savings Plan (Group RRSP) and will sign up for this benefit upon joining as her new employer offers this type of plan. They pay semi- monthly so her first pay will be January 15, 2023! The best part is if she contributes 6% of her gross annual salary, CIBC will match the contribution to her Group RRSP. Katie has had many summer jobs since she started working summer jobs since age 18; she knows that she has sufficient RRSP contribution room to do so. She expects to retire at age 60. Assuming a rate of 5% compounded monthly, how much will she have for her retirement? For ease in calculation purposes, assume Katie's salary will remain the same until age 60. a) $997,386 b) $883,809 c) $803,893 d) $932,108 e) $1,016,231 3) No one can access your credit report unless they have a permissible purpose which is to access your credit report to help in making certain types of decisions about you. Once you have provided consent, which below can see your credit report? a) Employers or prospective employers b) Landlord whose apartment you wish to rent c) Lenders you are seeking to borrow from d) Utility companies (electricity, heating etc.) that service your apartment e) All the responses 4) 5) Al got the cryptocurrency bug and has been trading on this throughout 2021. He thought that he did not have to report his cryptocurrency trades and just recently found out that the trades are considered a capital gain, just like trading stocks or mutual funds. He is not thrilled to know that he must amend his 2021 personal tax return to report them, especially as he knows that he has some big gains. At least he is taking comfort in knowing that he sold them before the downturn in 2022 where many have lost money on their cryptocurrencies. Below are his sales in 2021: a) $7,575 b) $2,225 c) $6,742 Bitcoin Ethereum Tether Al also had a capital loss of $2,000 on some mutual funds that he sold in December 2021 which he also did not report but knows that he can claim this against his capital gains. Knowing that he is in the highest marginal tax bracket, use Table A to help calculate Al's taxes on the sale of the investments. d) $5,331 e) $4,798 Purchased $10,000 $5,000 $2,000 Sold $25,000 $9,000 $3,000 b) 21.38% c) 23.67% d) 24.47% e) 26.32% Rob knows that he should be paying off his credit card each month. He is however living pay cheque to pay cheque and struggling to even pay off the minimum. He knows that his VISA credit card charges interest of 23% with daily compounding. What is Rob's effective interest rate on his VISA credit card? Hint: use 365 days for compounding. a) 25.85% Section II: Five (5) Mini-Cases (20 marks) Mini-Case A: (2.5 marks) Malcolm received a $3,000 research grant from Concordia. He moved from British Columbia to attend Concordia full-time and had several moving costs which came to $5,000. He signed a Montreal lease and found a great apartment near Concordia. Which statements are true with regards to moving costs and their claim on a personal income tax return? Hint: Canada Revenue Agency (CRA) is a good site for tax questions. a) Malcolm realized that his moving expenses paid in the year of the move are more than the research grant he received, he will then carry forward the moving costs and deduct the unused part of those expenses from the same type of research grant he will receive in the following year. Statement is: True of False (highlight and underline your response) (.5 marks) b) Even though Concordia reimbursed $450 for some of his moving costs, Malcolm can still claim the same $450 moving costs on his personal tax return as he did incur them. Statement is: True of False (highlight and underline your response) (.5 marks) c) Malcolm told his friend Jason about claiming moving expenses as he knows that Jason moved 30 kilometers closer to his new work location when he moved from the West Island of Montreal to downtown Montreal. Jason is excited as he has $2,000 in moving costs and will claim them on his 2022 personal tax return as he just moved on October 1, 2022. Statement is: True of False (highlight and underline your response) (.5 marks) d) Provide five (5) eligible moving costs that Malcolm could claim. (1 mark - .20 marks each) 1) 2) 3) 4) 5) Mini-Case B: (5 marks) Mariela understands Tax-Free Savings Account (TFSA) but also understands that the available contribution room can be tricky to calculate. See Table C to help with your responses. She knows the following: you can withdraw any amount from your TFSA whenever you want; all withdrawals are tax-free; withdrawing from your TFSA doesn't result in lost TFSA contribution room; withdrawals you make this year will be added to your unused contribution room the following year (i.e. withdrawing from your TFSA has no effect on your contribution room in the year that you make the withdrawal, it only affects your contribution room for the following year); and you can re-contribute any funds that you have withdrawn from your TFSA back into your account starting the year after the year in which you make the withdrawal (i.e. January 1st of the following year). a) Complete the TFSA available contribution room below. Fill in the amounts indicated by a question mark (?). (2.5 marks - .5 marks each) TFSA Available Contribution Room Date March 2, 2022 July 3, 2022 August 10, 2022 September 12, 2022 Jan. 1, 2023 TFSA Available Contribution Room contribution room in 2022 contribution room in 2022 contribution room in 2022 contribution room in 2022 contribution room in 2023 Mariela turns 18 and opens a TFSA $ Contributes $3,000 $ ? Withdraws $1,800 $ ? Contributes $1,200 $ ? New contribution room available $ ? ? b) Mariela's mother is interested in knowing her own TFSA contribution room. She is receiving a rather large company bonus and figures this is the best place for her to place her money. She has only made one TFSA contribution to date when the government first introduced TFSA's in 2009, she contributed $5,000 but has not made any further contributions since. What is the maximum amount that Mariela's mother can contribute to her TFSA 2022? Do not forget to consider contribution room from previous years. (1 mark) Contribution amount for Mariela's mother: (1 mark) c) Mariela's father has always made the maximum annual TFSA contribution since the program started in 2009. His TFSA has grown significantly as he has invested in some very aggressive stocks that have done well. The market value of his TFSA as of October 28, 2022 is valued at $605,890. He has never made any withdrawals from his TFSA but is now looking to withdraw the full amount on October 31, 2022, as he is interested in buying a side-business. If he withdraws the entire amount, what is the maximum amount that he can contribute to his TFSA on January 1, 2023? Do not forget to consider contribution room from previous years. (1 mark) Contribution amount for Mariela's father: (1 mark) d) What is the amount of tax that Mariela's father will have to pay on the withdrawal. (.5 mark) Tax on TFSA withdrawal for Mariela's father: (.5 mark) Mini-Case C: (3 marks 1 mark each) Lindsay is looking to put $25,000 at the end of each year into her Registered Retirement Savings Plan (RRSP) for the next 20 years. She believes that she can earn 4% interest, compounded monthly. a) How much will Lindsay have saved after 20 years? Lindsay's calculation: (1 mark) b) If Lindsay decides to withdraw the entire amount in one lump sum in 20 years, what would be the amount that she would receive after taxes, assuming her effective tax rate is 32% at that time? Lindsay's calculation: (1 mark) c) What is the minimum annual salary that Lindsay needs to earn each year to make a $25,000 annual RRSP contribution? Lindsay's calculation: (1 mark) Mini-Case D: (1 mark) Nate and Kate are looking to buy their first home but prices during this period are still high. They are looking to purchase a condo that is on the market for $420,000. a) Nate and Kate are going to the Royal Bank of Canada (RBC) for their potential mortgage. Calculate the Gross Debt Service (GDS) ratio: Nate's gross annual salary is $95,750, while Kate's is $98,650. The property they are looking to purchase would result in monthly heating costs of $520, condo fees of $2,380 per year, while their annual property taxes would be $2,060. Nate's only debt is a car loan of $275 per month, while Kate has a student loan of $95 per month. Calculate the GDS ratio using a monthly mortgage payment of $3,600. (1 mark) Calculation of the GDS ratio (1 mark) Mini-Case E: (3.5 marks-.5 marks each) Patricia is looking to buy a condo that costs $300,000 on November 1, 2022. She has always rented so this is a very exciting step. Her Net Worth statement shows: Description Savings account Furniture Car Registered Retirement Savings Plan (RRSP) Tax-Free Savings Account (TFSA) Fair Market Value $300 $13,750 $20,500 $75,650 $25,000 Complete the sentence. (3.5 marks-.25 marks each) a) Patricia would like to put a 20% down payment which she calculates as $ b) To help with the purchase of her first home, Patricia could participate in the as this program would allow her to withdraw funds to buy or build a qualifying home. from her c) The maximum that Patricia could withdraw under the plan in b) is $ She would have up to years to reimburse her withdrawal. The minimum amount that she would need to reimburse would be $ every year. If she fails to reimburse the minimum amount required, she would be on that amount. d) For the missing difference in the down payment, Patricia could withdraw from her with no tax impact. e) If Patricia provides the 20% as a down payment, she would have a mortgage and would not require insurance. f) If Patricia did not have 20% as a down payment on her mortgage, Canada Housing Mortgage Corporation (CHMC) would consider this type of mortgage a high This is when the mortgage loan is higher than 80% of the lending value of the property. g) Patricia is looking to obtain the lowest interest rate possible on her mortgage. She is, however, unsure if she should obtain a Closed or Open Mortgage. You advise her that Mortgages, would allow her to pay off her entire mortgage balance at any time throughout the term. The drawback is that she would pay a higher interest rate for that due to the prepayment flexibility option. You let her know that such mortgages are for those that are planning to move in the short future, or for those expecting a lump sum of money through an inheritance or bonus, that would allow them to pay off their entire mortgage early. As she wants the lowest interest rate, you recommend: Mortgage. h) Patricia went to the bank and received a Pre-Approval Certificate for her mortgage. A Pre- Approval Certificate is 2021 Taxable Income first $45,105 over $45,105 up to $49,020 over $49,020 up to $90,200 over $90,200 up to $98,040 over $98,040 up to $109,755 over $109,755 up to $151,978 over $151,978 up to $216,511 over $216,511 QC 2022 Marginal Tax Rates Other Capital Canadian Dividends Eligible Non-Eligible Income Gains first $46,295 27.53% 13.76% 4.53% 32.53% 16.26% 11.43% 18.37% 24.12% over $46,295 up to $50,197 29.40% over $50,197 up to $92,580 34.00% over $92,580 up to $100,392 37.12% 18.56% 17.77% 41.12% 20.56% 23.29% 27.53% 13.76% 4.53% 32.53% 16.26% 11.43% 37.12% 18.56% 17.77% 41.12% 20.56% 23.29% 45.71% 22.86% 29.62% 47.46% 23.73% 32.04% 50.23% 25.12% 35.86% 53.31% 26.65% 40.10% 39.28% over $100,392 up to $112,655 45.71% 22.86% 29.62% 41.30% over $112,655 up to $155,625 47.46% 23.73% 32.04% 44.48% over $155,625 up to $221,708 50.28% 25.14% 35.93% 48.02% over $221,708 53.31% 26.65% 40.10% Marginal tax rate for dividends is a % of actual dividends received (not grossed-up taxable amount). Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains). Gross-up rate for eligible dividends is 38%, and for non-eligible dividends is 15%. For more information see Quebec dividend tax credits. TABLE B Quebec Basic Personal Amount 2021 Personal Amount $15,728 Years TABLE A Combined Federal & Quebec Tax Brackets and Tax Rates QC 2021 Marginal Tax Rates Year started 2009 - 2012 2013 - 2014 2015 Other Capital Income Gains Year 2020 2020 2021 2022 Canadian Dividends Eligible Non-Eligible 2021 Tax Rate 15% 2022 Taxable Income 2022 Personal Amount $16,143 Federal Basic Personal Amount 2022 Personal Amount (1) Years 016 - 2018 2021 Personal Amount (1) 2021 Tax Rate 2022 Tax Rate 15% $13,808 15% $14,398 (1) See Federal tax rates for the enhanced federal personal amount, which increases the marginal tax rates for taxable incomes in the second highest federal tax bracket Copyright 2002-2022 Boat Harbour Investments Ltd TABLE C Tax-Free Savings Account (TFSA): Annual Limits Annual Limit 2019-2022 2022 Tax Rate 15% 2023 $26,500 $27,230 $27,830 $29,210 Annual Limit 19.05% $5,000/year $5,500/year $10,000/year TABLE D Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum. Annual maximum contribution limit 24.80% 30.08% $5,500/year $6,000/year 34.68% 39.96% 41.97% 45.22% 48.70% $6,500/year (estimated) Withdraw up to $35,000 per borrower and up to $70,000 per couple. 15 years to pay back the amount withdrawn Simple Interest Future (FV) of a single dollar amount Future Value of an annuity Present Value of a single dollar amount Present Value of an annuity TABLE E Home Buyer's Plan (HBP) TABLE F Time Value of Money Formulas Interest Rate Conversion Time Value: FV = Maturity value or Future value PV = Principal or Present value PMT= Periodic annuity payments n = Number of compounding periods per year i = Annual interest rate t = Time (in years) EY = Effective yield I= Pxrxt nt FV = PV (1+1) * PV = FV ( + 1) " FV = PMT x PV = PMT x EY = [(+4)-1] 1- = ( + )" - - 1 (1 + i)". Simple interest: /= Interest earned P= Principal or Present Value r = annual interest rate t = time (in years)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 c I II and V 2 b 883809 3 e All the responses 4 c 6742 5 c 2367 MiniCase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started