Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. As a financial analyst, you evaluate financial data and extract relevant information to make investment recommendations. This time, you are tasked with analyzing

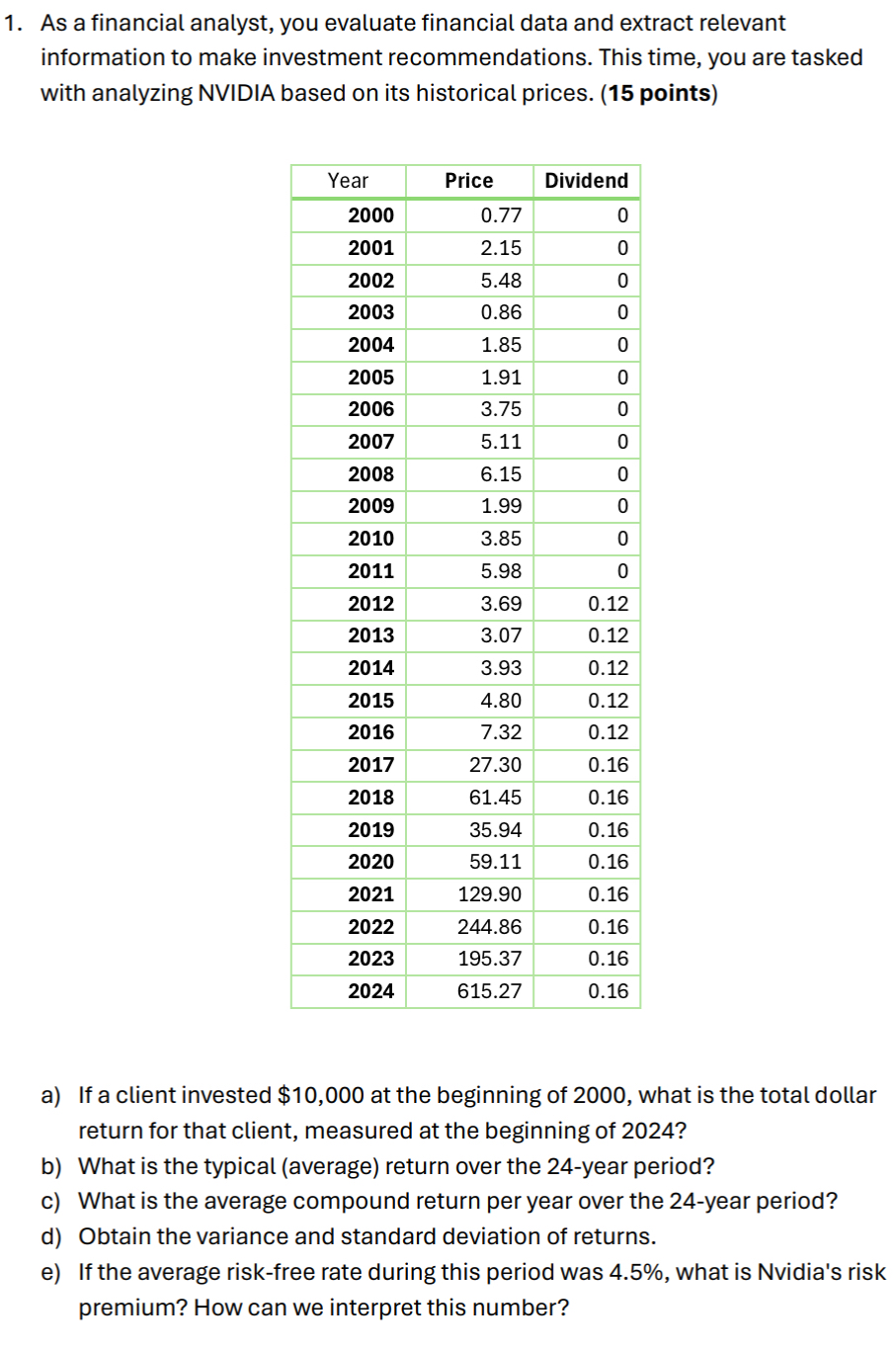

1. As a financial analyst, you evaluate financial data and extract relevant information to make investment recommendations. This time, you are tasked with analyzing NVIDIA based on its historical prices. (15 points) Year Price Dividend 2000 0.77 0 2001 2.15 0 2002 5.48 0 2003 0.86 0 2004 1.85 0 2005 1.91 0 2006 3.75 0 2007 5.11 0 2008 6.15 0 2009 1.99 0 2010 3.85 0 2011 5.98 0 2012 3.69 0.12 2013 3.07 0.12 2014 3.93 0.12 2015 4.80 0.12 2016 7.32 0.12 2017 27.30 0.16 2018 61.45 0.16 2019 35.94 0.16 2020 59.11 0.16 2021 129.90 0.16 2022 244.86 0.16 2023 195.37 0.16 2024 615.27 0.16 a) If a client invested $10,000 at the beginning of 2000, what is the total dollar return for that client, measured at the beginning of 2024? b) What is the typical (average) return over the 24-year period? c) What is the average compound return per year over the 24-year period? d) Obtain the variance and standard deviation of returns. e) If the average risk-free rate during this period was 4.5%, what is Nvidia's risk premium? How can we interpret this number?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started