Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. As credit manager of Oman Oasis LLC, you have been asked by your financial director to assess the feasibility of increasing the credit facility

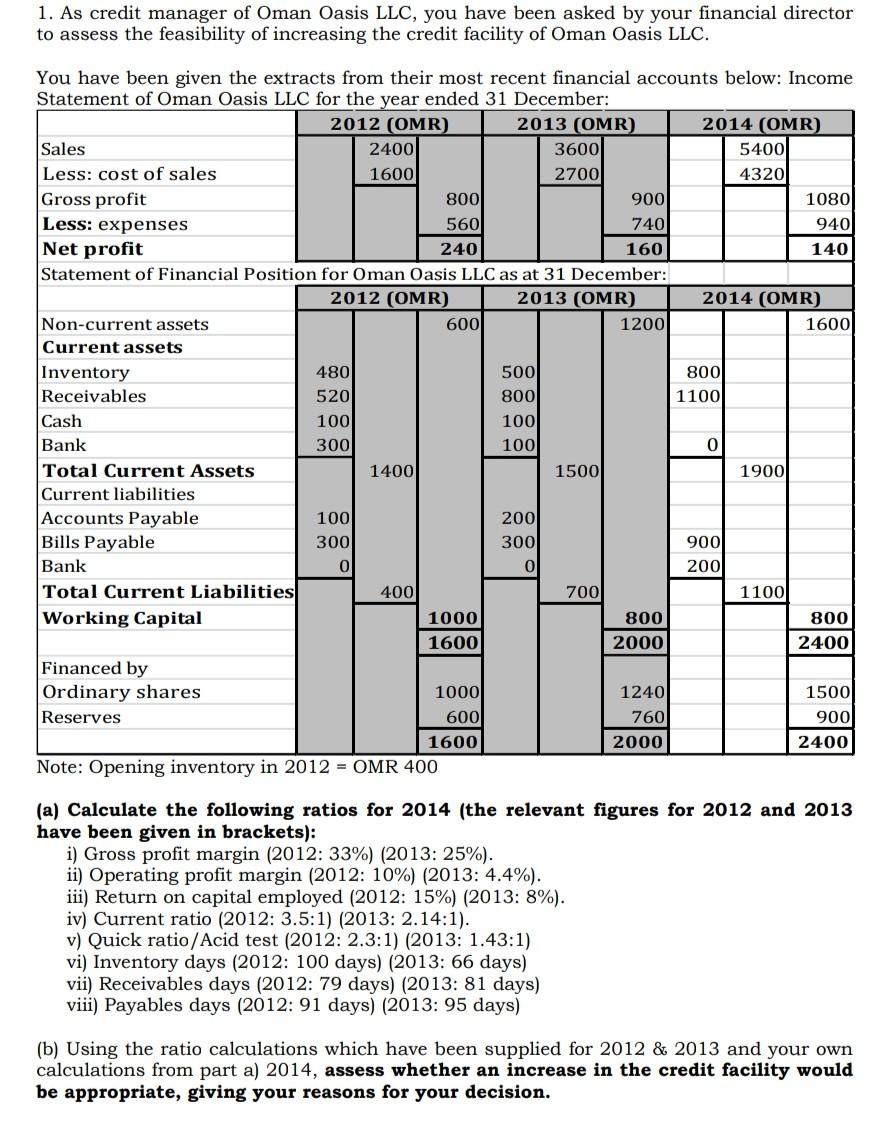

1. As credit manager of Oman Oasis LLC, you have been asked by your financial director to assess the feasibility of increasing the credit facility of Oman Oasis LLC. You have been given the extracts from their most recent financial accounts below: Income Statement of Oman Oasis LLC for the year ended 31 December: 2012 (OMR) 2013 (OMR) 2014 (OMR) Sales 2400 3600 5400 Less: cost of sales 1600 2700 4320 Gross profit 800 900 1080 Less: expenses 560 740 940 Net profit 240 160 140 Statement of Financial Position for Oman Oasis LLC as at 31 December: 2012 (OMR) 2013 (OMR) 2014 (OMR) Non-current assets 600 1200 1600 Current assets Inventory 480 500 800 Receivables 520 800 1100 Cash 100 100 Bank 300 100 0 Total Current Assets 1400 1500 1900 Current liabilities Accounts Payable 100 200 Bills Payable 300 300 900 Bank 0 0 200 Total Current Liabilities 400 700 1100 Working Capital 1000 800 800 1600 2000 2400 Financed by Ordinary shares 1000 1240 1500 Reserves 600 760 900 1600 2000 2400 Note: Opening inventory in 2012 - OMR 400 (a) Calculate the following ratios for 2014 (the relevant figures for 2012 and 2013 have been given in brackets): i) Gross profit margin (2012: 33%) (2013: 25%). ii) Operating profit margin (2012: 10%) (2013: 4.4%). iii) Return on capital employed (2012: 15%) (2013: 8%). iv) Current ratio (2012: 3.5:1) (2013: 2.14:1). v) Quick ratio/Acid test (2012: 2.3:1) (2013: 1.43:1) vi) Inventory days (2012: 100 days) (2013: 66 days) vii) Receivables days (2012: 79 days) (2013: 81 days) viii) Payables days (2012: 91 days) (2013: 95 days) (b) Using the ratio calculations which have been supplied for 2012 & 2013 and your own calculations from part a) 2014, assess whether an increase in the credit facility would be appropriate, giving your reasons for your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started