Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) As firms increase the leverage, WACC can increase or decrease while the cost of equity always increases. (20points) a. True b. False 2) Capital

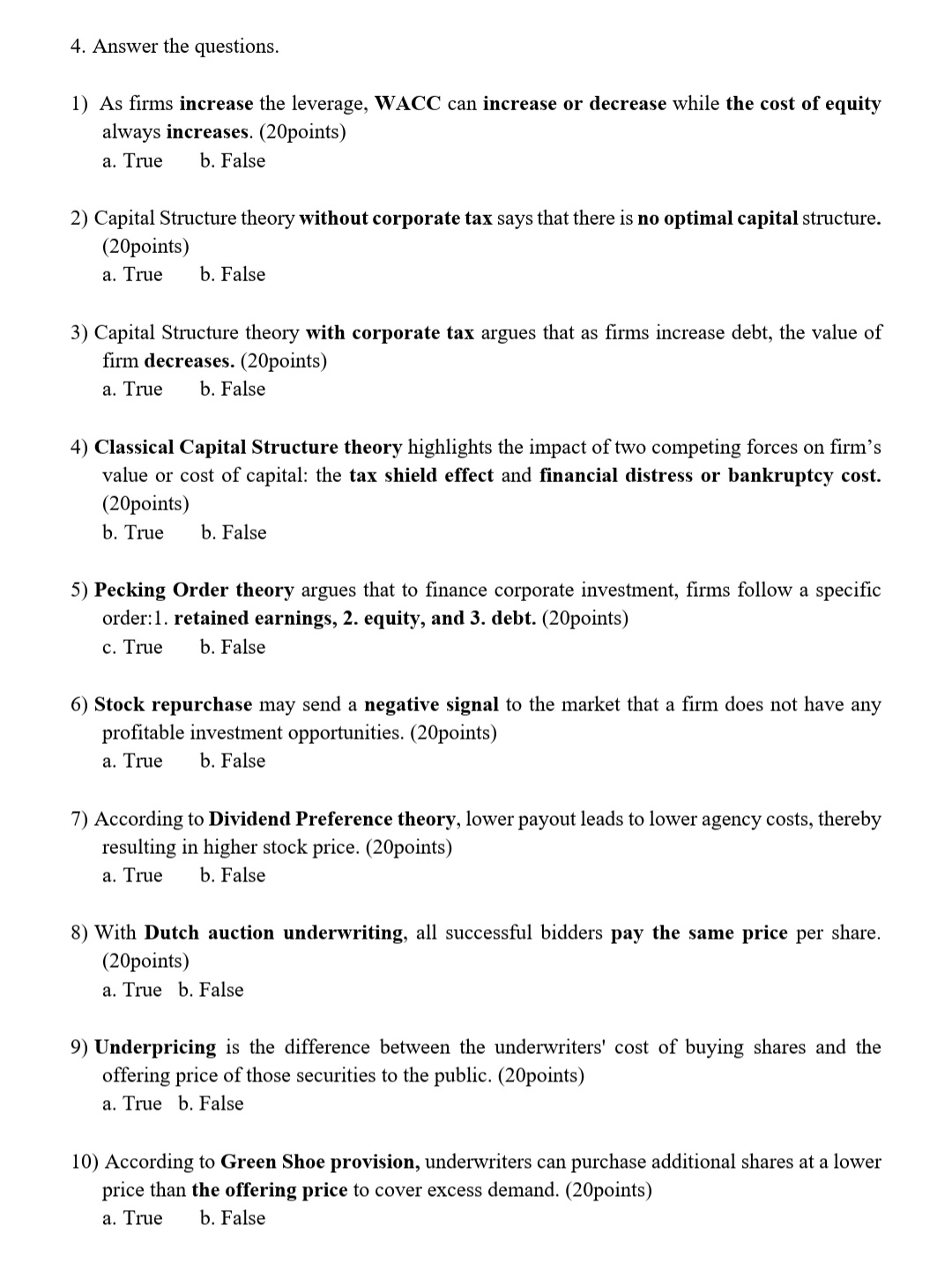

1) As firms increase the leverage, WACC can increase or decrease while the cost of equity always increases. (20points) a. True b. False 2) Capital Structure theory without corporate tax says that there is no optimal capital structure. (20points) a. True b. False 3) Capital Structure theory with corporate tax argues that as firms increase debt, the value of firm decreases. (20points) a. True b. False 4) Classical Capital Structure theory highlights the impact of two competing forces on firm's value or cost of capital: the tax shield effect and financial distress or bankruptcy cost. (20points) b. True b. False 5) Pecking Order theory argues that to finance corporate investment, firms follow a specific order:1. retained earnings, 2. equity, and 3. debt. (20points) c. True b. False 6) Stock repurchase may send a negative signal to the market that a firm does not have any profitable investment opportunities. (20points) a. True b. False 7) According to Dividend Preference theory, lower payout leads to lower agency costs, thereby resulting in higher stock price. (20points) a. True b. False 8) With Dutch auction underwriting, all successful bidders pay the same price per share. (20points) a. True b. False 9) Underpricing is the difference between the underwriters' cost of buying shares and the offering price of those securities to the public. (20points) a. True b. False 10) According to Green Shoe provision, underwriters can purchase additional shares at a lower price than the offering price to cover excess demand. (20points) a. True b. False

1) As firms increase the leverage, WACC can increase or decrease while the cost of equity always increases. (20points) a. True b. False 2) Capital Structure theory without corporate tax says that there is no optimal capital structure. (20points) a. True b. False 3) Capital Structure theory with corporate tax argues that as firms increase debt, the value of firm decreases. (20points) a. True b. False 4) Classical Capital Structure theory highlights the impact of two competing forces on firm's value or cost of capital: the tax shield effect and financial distress or bankruptcy cost. (20points) b. True b. False 5) Pecking Order theory argues that to finance corporate investment, firms follow a specific order:1. retained earnings, 2. equity, and 3. debt. (20points) c. True b. False 6) Stock repurchase may send a negative signal to the market that a firm does not have any profitable investment opportunities. (20points) a. True b. False 7) According to Dividend Preference theory, lower payout leads to lower agency costs, thereby resulting in higher stock price. (20points) a. True b. False 8) With Dutch auction underwriting, all successful bidders pay the same price per share. (20points) a. True b. False 9) Underpricing is the difference between the underwriters' cost of buying shares and the offering price of those securities to the public. (20points) a. True b. False 10) According to Green Shoe provision, underwriters can purchase additional shares at a lower price than the offering price to cover excess demand. (20points) a. True b. False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started