Question

1. Assess the attractiveness of the U.S. Music industry as of 2023. Specifically speaking, identify all five forces and describe the industry structure by using

1. Assess the attractiveness of the U.S. Music industry as of 2023. Specifically speaking, identify all five forces and describe the industry structure by using the underpinnings of five forces. For the power of buyers, be sure to include the projection of market growth over the next three years.

2. Explain Spotify's two unique features that competitors or substitutes don't have. Using a resource-based view, evaluate whether those features will provide the Company with a significant advantage and discuss whether the advantage is sustainable.

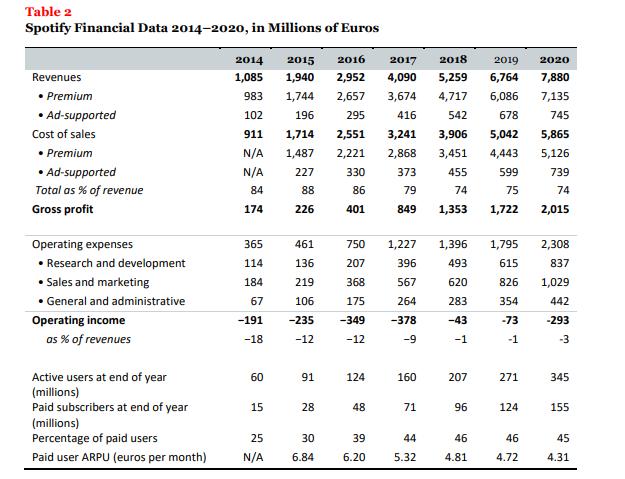

3. Spotify has been losing money for a long time, as shown in Table 2. Analysts believe that cost and expense problems could be both temporary and structural. Based on the content of this case, identify a single item in Table 2 (e.g., cost of sales in premium, cost of sales in ad-supported, R&D expenses, sales & marketing expenses, general and administrative expenses) that relates to a structural, not temporary, cost/expense problem and that Spotify must improve first. Discuss why the identified cost/expense problem should be the first thing to fix and suggest how to solve the problem strategically.

4. Do some research on the value chain of the music industry and explain the current bargaining power among artists, labels, and streaming service providers like Spotify and Apple Music. Identify a current or future event (e.g., TikTok, podcasts, new entrants/substitutes, M&A among labels, etc.) that may change the current industry structure and provide strategic recommendations on what Spotify should do to achieve strategic competitiveness in that change.

Table 2 Spotify Financial Data 2014-2020, in Millions of Euros 2014 Revenues Premium 1,085 983 Ad-supported Cost of sales 102 196 1,744 2,657 295 2015 2016 2017 1,940 2,952 4,090 3,674 2018 2019 2020 5,259 6,764 7,880 4,717 6,086 7,135 416 911 1,714 2,551 542 3,241 3,906 5,042 678 745 5,865 Premium N/A 1,487 2,221 2,868 3,451 4,443 5,126 Ad-supported N/A 227 330 373 455 599 739 Total as % of revenue 84 88 86 79 74 75 74 Gross profit 174 226 401 849 1,353 1,722 2,015 Operating expenses 365 461 750 1,227 1,396 1,795 2,308 Research and development 114 136 207 396 493 615 837 Sales and marketing 184 219 368 567 620 826 1,029 General and administrative 67 106 175 264 283 354 442 Operating income -191 -235 -349 -378 -43 -73 -293 as % of revenues -18 -12 -12 -9 -1 -1 -3 Active users at end of year (millions) 60 91 124 160 207 271 345 Paid subscribers at end of year 15 28 48 71 96 124 155 (millions) Percentage of paid users 25 25 30 39 44 46 46 45 Paid user ARPU (euros per month) N/A 6.84 6.20 5.32 4.81 4.72 4.31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Assessment of the US Music Industry Threat of New Entrants Moderate While barriers to entry are relatively low due to digital distribution established players like Spotify and Apple Music dom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started