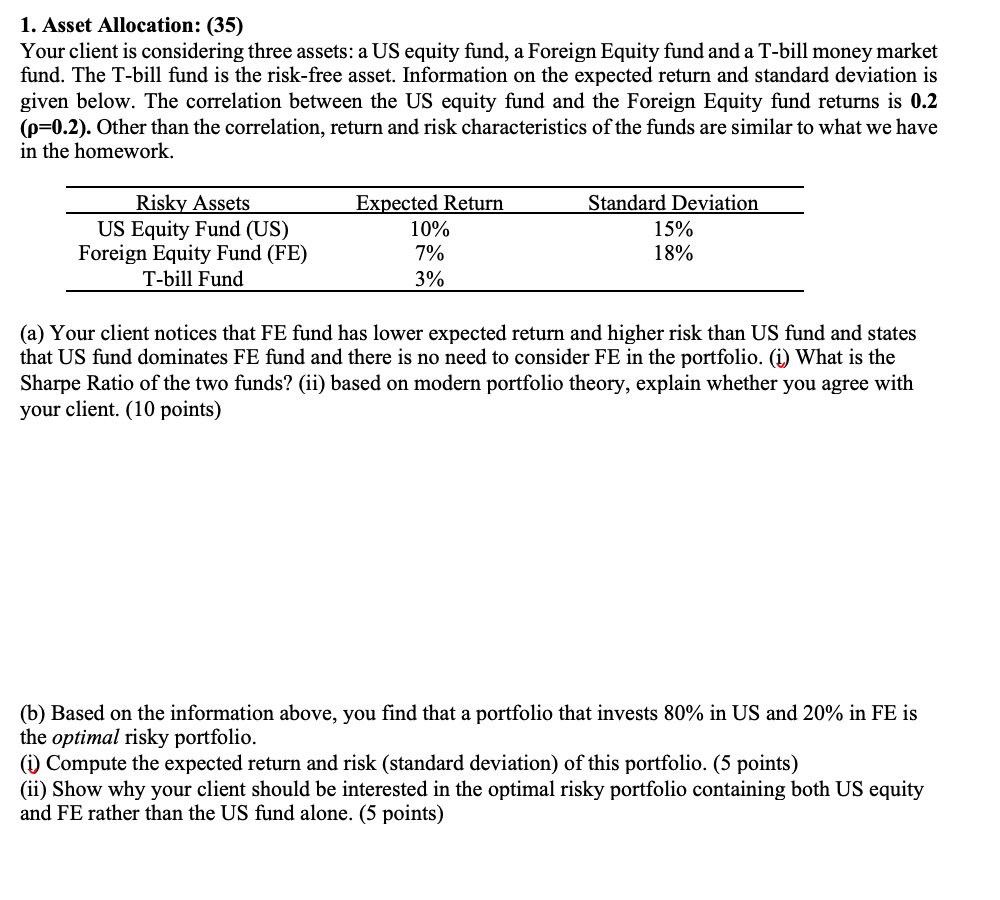

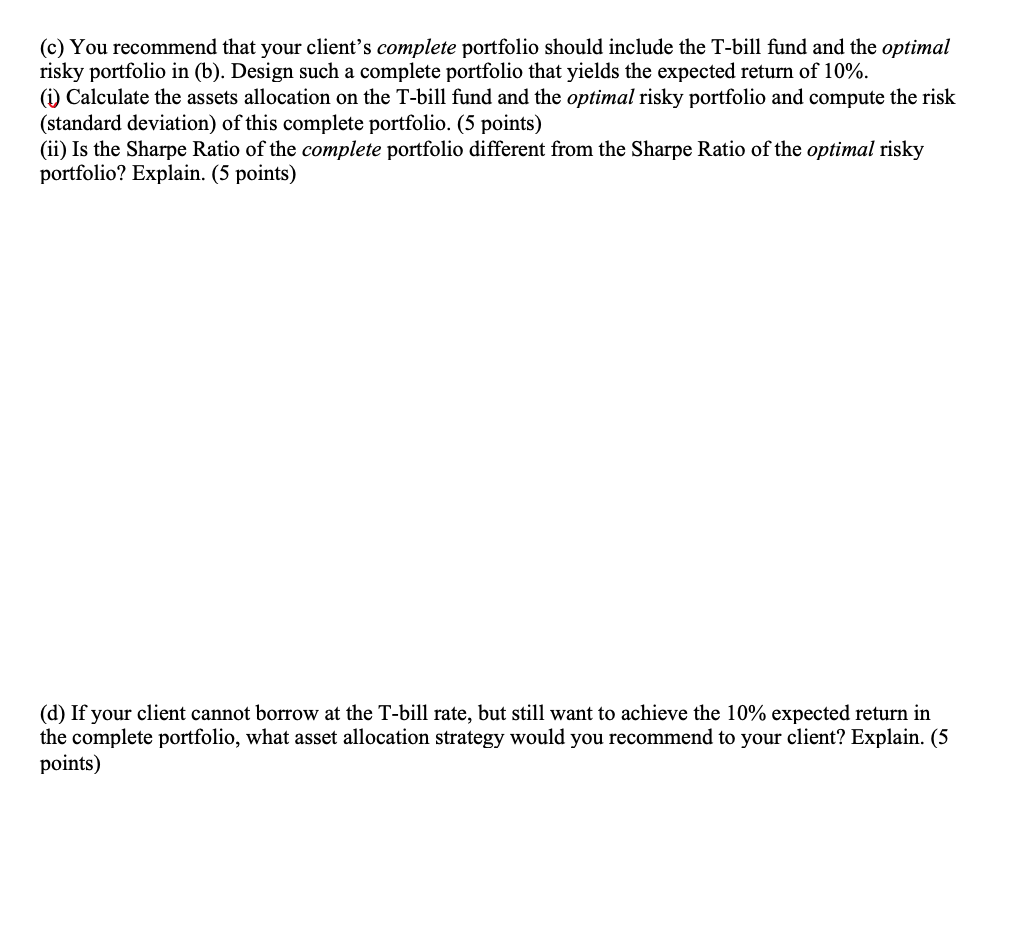

1. Asset Allocation: (35) Your client is considering three assets: a US equity fund, a Foreign Equity fund and a T-bill money market fund. The T-bill fund is the risk-free asset. Information on the expected return and standard deviation is given below. The correlation between the US equity fund and the Foreign Equity fund returns is 0.2 (p=0.2). Other than the correlation, return and risk characteristics of the funds are similar to what we have in the homework. Risky Assets US Equity Fund (US) Foreign Equity Fund (FE) T-bill Fund Expected Return 10% 7% 3% Standard Deviation 15% 18% (a) Your client notices that FE fund has lower expected return and higher risk than US fund and states that US fund dominates FE fund and there is no need to consider FE in the portfolio. (i) What is the Sharpe Ratio of the two funds? (ii) based on modern portfolio theory, explain whether you agree with your client. (10 points) (b) Based on the information above, you find that a portfolio that invests 80% in US and 20% in FE is the optimal risky portfolio. (i) Compute the expected return and risk (standard deviation) of this portfolio. (5 points) (ii) Show why your client should be interested in the optimal risky portfolio containing both US equity and FE rather than the US fund alone. (5 points) (c) You recommend that your client's complete portfolio should include the T-bill fund and the optimal risky portfolio in (b). Design such a complete portfolio that yields the expected return of 10%. (i) Calculate the assets allocation on the T-bill fund and the optimal risky portfolio and compute the risk (standard deviation) of this complete portfolio. (5 points) (ii) Is the Sharpe Ratio of the complete portfolio different from the Sharpe Ratio of the optimal risky portfolio? Explain. (5 points) (d) If your client cannot borrow at the T-bill rate, but still want to achieve the 10% expected return in the complete portfolio, what asset allocation strategy would you recommend to your client? Explain. (5 points) 1. Asset Allocation: (35) Your client is considering three assets: a US equity fund, a Foreign Equity fund and a T-bill money market fund. The T-bill fund is the risk-free asset. Information on the expected return and standard deviation is given below. The correlation between the US equity fund and the Foreign Equity fund returns is 0.2 (p=0.2). Other than the correlation, return and risk characteristics of the funds are similar to what we have in the homework. Risky Assets US Equity Fund (US) Foreign Equity Fund (FE) T-bill Fund Expected Return 10% 7% 3% Standard Deviation 15% 18% (a) Your client notices that FE fund has lower expected return and higher risk than US fund and states that US fund dominates FE fund and there is no need to consider FE in the portfolio. (i) What is the Sharpe Ratio of the two funds? (ii) based on modern portfolio theory, explain whether you agree with your client. (10 points) (b) Based on the information above, you find that a portfolio that invests 80% in US and 20% in FE is the optimal risky portfolio. (i) Compute the expected return and risk (standard deviation) of this portfolio. (5 points) (ii) Show why your client should be interested in the optimal risky portfolio containing both US equity and FE rather than the US fund alone. (5 points) (c) You recommend that your client's complete portfolio should include the T-bill fund and the optimal risky portfolio in (b). Design such a complete portfolio that yields the expected return of 10%. (i) Calculate the assets allocation on the T-bill fund and the optimal risky portfolio and compute the risk (standard deviation) of this complete portfolio. (5 points) (ii) Is the Sharpe Ratio of the complete portfolio different from the Sharpe Ratio of the optimal risky portfolio? Explain. (5 points) (d) If your client cannot borrow at the T-bill rate, but still want to achieve the 10% expected return in the complete portfolio, what asset allocation strategy would you recommend to your client? Explain. (5 points)