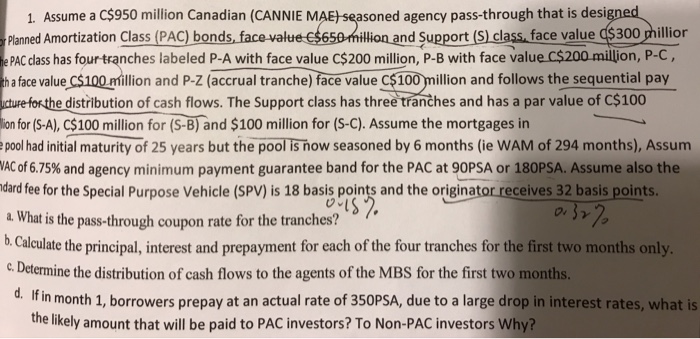

1. Assume a C$950 million Canadian (CANNIE MAE seasoned agency pass-through that is desi Planned Amortization Class (PAC) bonds, face value C650-million and Support (S) class face value ($300 PAC class has four tranches labeled P-A with face value C$200 million, P-B with face value C$200 million, P-C, h a face value C$100. million and P-Z (accrual tranche) face value C$100 illion and follows the sequential pay he distribution of cash flows. The Support class has three tranches and has a par value of C$100 on for (S-A), C$100 million for (S-B) and $100 million for (S-C). Assume the mortgages irn epool had initial maturity of 25 years but the pool Is how seasoned by 6 months (ie WAM of 294 months), Assum AC of 6.75% and agency minimum payment guarantee band for the PAC at 90PSA or 18PSA. Assume also the dard fee for the Special Purpose Vehicle (SPV) is 18 basis points and the originator receives 32 basis points a What is the pass-through coupon rate for the tranches? b. Calculate the principal, interest and prepayment for each of the four tranches for the first two months only c Determine the distribution of cash flows to the agents of the MBS for the first two months. 7. d. If in month 1, borrowers prepay at an actual rate of 350PSA, due to a large drop in interest rates, what is the likely amount that will be paid to PAC investors? To Non-PAC investors Why? 1. Assume a C$950 million Canadian (CANNIE MAE seasoned agency pass-through that is desi Planned Amortization Class (PAC) bonds, face value C650-million and Support (S) class face value ($300 PAC class has four tranches labeled P-A with face value C$200 million, P-B with face value C$200 million, P-C, h a face value C$100. million and P-Z (accrual tranche) face value C$100 illion and follows the sequential pay he distribution of cash flows. The Support class has three tranches and has a par value of C$100 on for (S-A), C$100 million for (S-B) and $100 million for (S-C). Assume the mortgages irn epool had initial maturity of 25 years but the pool Is how seasoned by 6 months (ie WAM of 294 months), Assum AC of 6.75% and agency minimum payment guarantee band for the PAC at 90PSA or 18PSA. Assume also the dard fee for the Special Purpose Vehicle (SPV) is 18 basis points and the originator receives 32 basis points a What is the pass-through coupon rate for the tranches? b. Calculate the principal, interest and prepayment for each of the four tranches for the first two months only c Determine the distribution of cash flows to the agents of the MBS for the first two months. 7. d. If in month 1, borrowers prepay at an actual rate of 350PSA, due to a large drop in interest rates, what is the likely amount that will be paid to PAC investors? To Non-PAC investors Why