Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Assume an agent consumes only apples and bananas everyday for breakfast. The prices of apples and bananas are pa = 2 and p

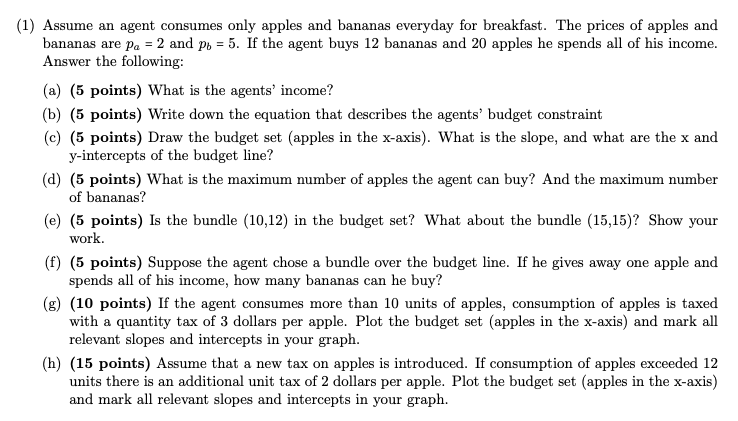

(1) Assume an agent consumes only apples and bananas everyday for breakfast. The prices of apples and bananas are pa = 2 and p = 5. If the agent buys 12 bananas and 20 apples he spends all of his income. Answer the following: (a) (5 points) What is the agents' income? (b) (5 points) Write down the equation that describes the agents' budget constraint (c) (5 points) Draw the budget set (apples in the x-axis). What is the slope, and what are the x and y-intercepts of the budget line? (d) (5 points) What is the maximum number of apples the agent can buy? And the maximum number of bananas? (e) (5 points) Is the bundle (10,12) in the budget set? What about the bundle (15,15)? Show your work. (f) (5 points) Suppose the agent chose a bundle over the budget line. If he gives away one apple and spends all of his income, how many bananas can he buy? (g) (10 points) If the agent consumes more than 10 units of apples, consumption of apples is taxed with a quantity tax of 3 dollars per apple. Plot the budget set (apples in the x-axis) and mark all relevant slopes and intercepts in your graph. (h) (15 points) Assume that a new tax on apples is introduced. If consumption of apples exceeded 12 units there is an additional unit tax of 2 dollars per apple. Plot the budget set (apples in the x-axis) and mark all relevant slopes and intercepts in your graph.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Assume an agent consumes only apples and bananas everyday for breakfast The prices of apples and bananas are pa 2 and pb 5 If the agent buys 12 bana...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started