Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Assume company ABC has a target capital structure calling for 35% debt, 15% preferred stock, and 50% common stock. ABC's before-tax cost of debt,

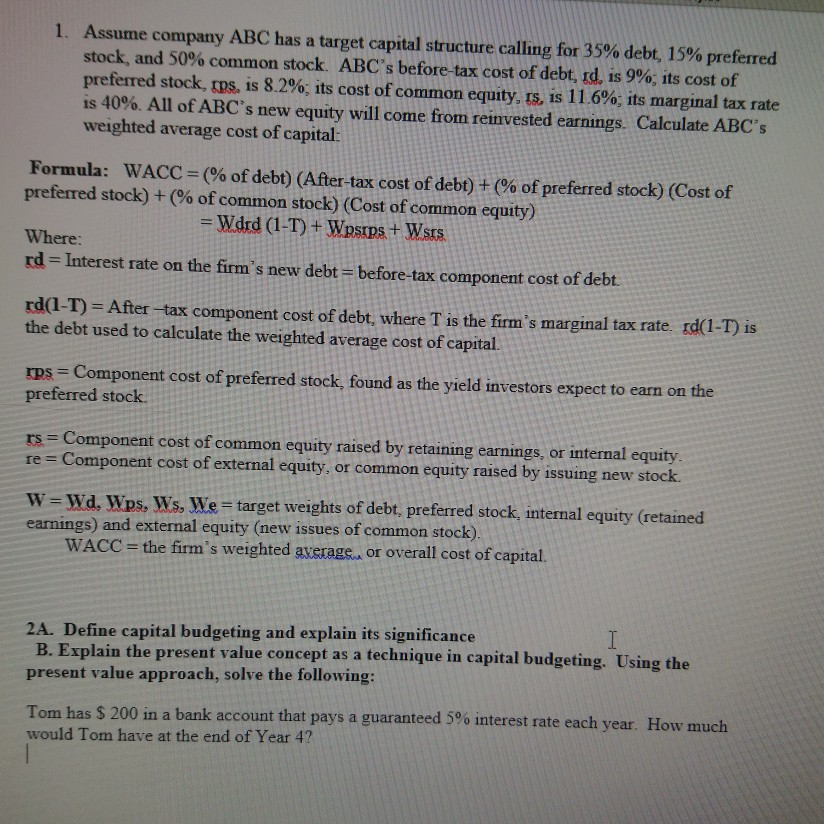

1. Assume company ABC has a target capital structure calling for 35% debt, 15% preferred stock, and 50% common stock. ABC's before-tax cost of debt, id, is 9%, its cost of preferred stock, ps, is 8.2%, its cost of common equity. IS, is 11.6%, its marginal tax rate is 40%. All of ABC's new equity will come from reinvested earnings. Calculate ABC's weighted average cost of capital: Formula: WACC = (% of debt) (After-tax cost of debt) + (% of preferred stock) (Cost of preferred stock) + (% of common stock) (Cost of common equity) =Wdrd (1-1) + Wpsips + Wsts. Where: rd = Interest rate on the firm's new debt = before-tax component cost of debt. rd(1-T) = After-tax component cost of debt, where T is the firm's marginal tax rate. [d(1-T) is the debt used to calculate the weighted average cost of capital. rps = Component cost of preferred stock, found as the yield investors expect to earn on the preferred stock rs = Component cost of common equity raised by retaining earnings, or internal equity. re = Component cost of external equity, or common equity raised by issuing new stock. W=Wd. Wps. Ws. We = target weights of debt, preferred stock, internal equity (retained earnings) and external equity (new issues of common stock) WACC = the firm's weighted average, or overall cost of capital. 2A. Define capital budgeting and explain its significance B. Explain the present value concept as a technique in capital budgeting. Using the present value approach, solve the following: Tom has $ 200 in a bank account that pays a guaranteed 5% interest rate each year. How much would Tom have at the end of Year 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started