Question

Assume tax professionals determine the 10% rate does not meet the MLTN threshold when evaluating uncertain tax positions.Determine the amount of the unrecognized tax benefit

- Assume tax professionals determine the 10% rate does not meet the MLTN threshold when evaluating uncertain tax positions. Determine the amount of the unrecognized tax benefit (UTB), or "reserve" as it is generally referred to in the case, if the settlement of the management fee upon audit is assumed to be 4%. Ignore any impact on the liability that would result from interest and penalties.

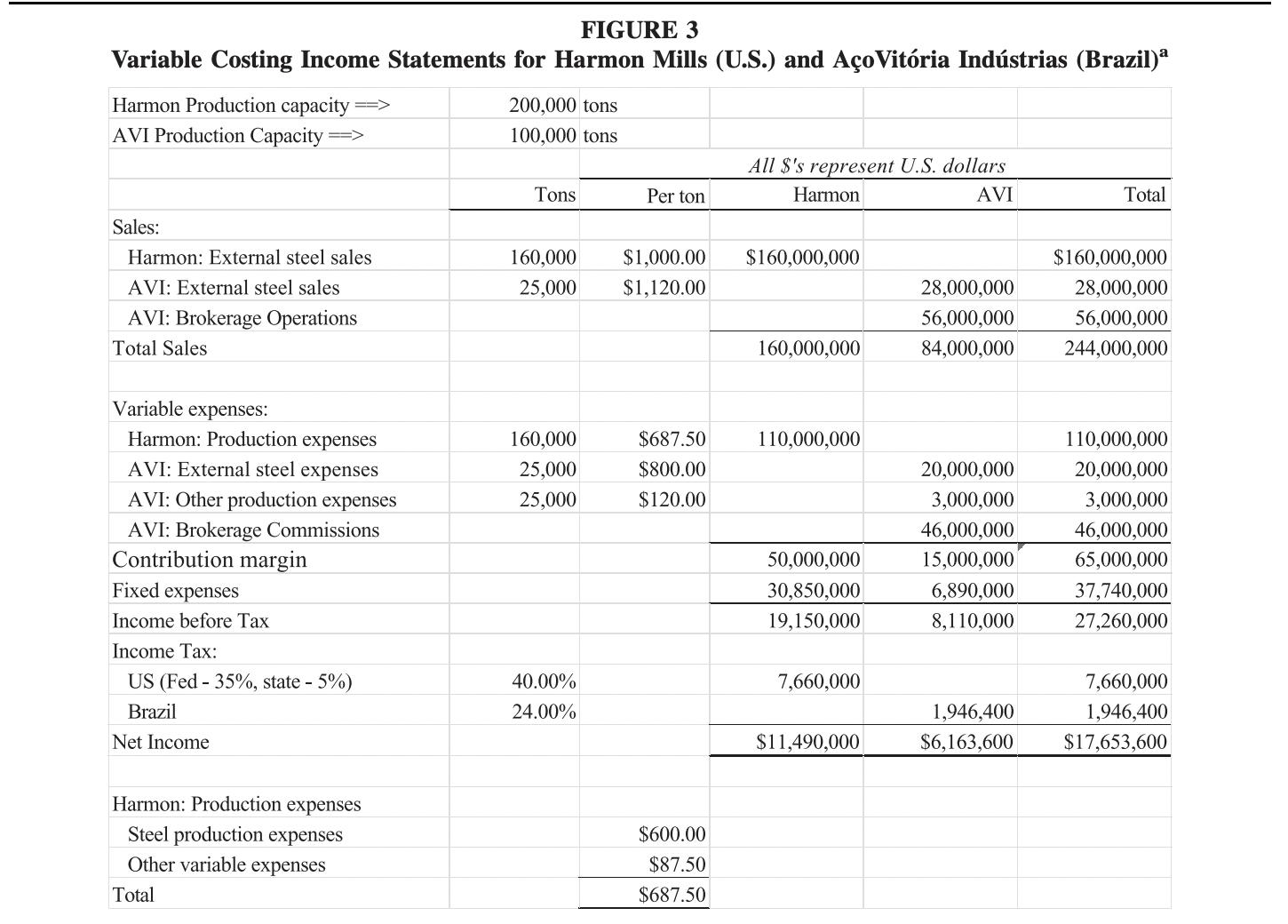

To increase cash flow flexibility, the companies under the Lenzini operating umbrella either engage in or are considering four inter-company transactions (ICTs) related to: (1) product sales, (2) working capital loans, (3) royalty payments for licensed intellectual property, and (4) management fees for machine acquisition/refitting. Appendix A provides a summary of the ICTs. Also, Figure 2 illustrates how the ICTs impact the three divisions.

ICT 4: Management Fees for Machine Acquisition/Refitting Before the AVI sale opportunity arose, Harmon Mills was looking to add capacity by purchasing three next-generation mini-mills from Lenzini. Lenzini had encouraged Harmon to purchase the newer equipment in an effort to receive immediate cash that would support Lenzini's R&D operation. Lenzini will first purchase base machines from a Greek manufacturer for $10 million. Lenzini will refit the base machines with $2 million worth of proprietary components and software to enhance production efficiency. The machine purchase contract also stipulates that Harmon Mills will pay Lenzini a 10 percent management fee ($1.2 million) to facilitate the acquisition and refitting of the machines, as well as installation of the completed machines in Harmon's facilities. Harmon already has paid Lenzini a $5 million refundable deposit as part of the purchase contract.

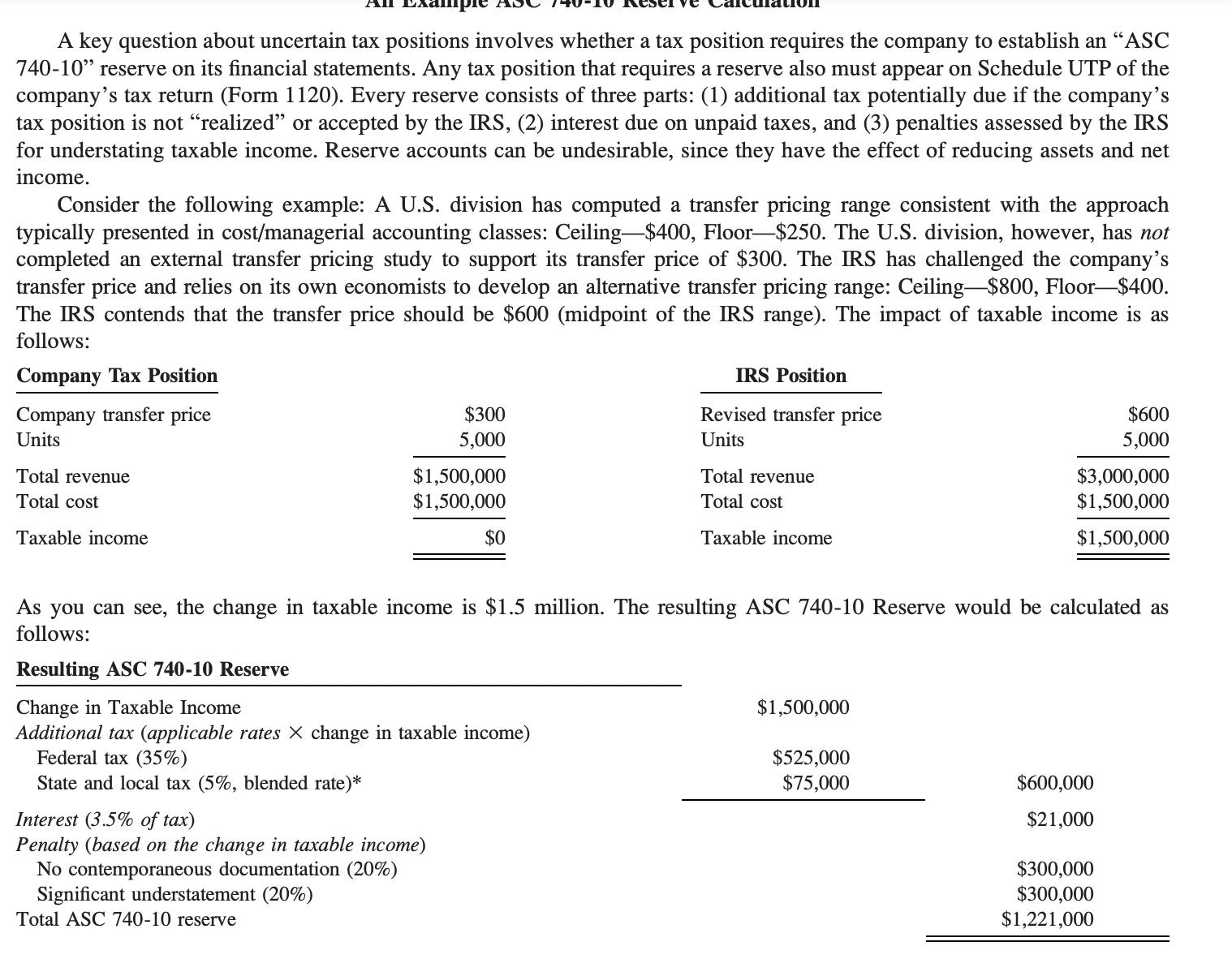

A key question about uncertain tax positions involves whether a tax position requires the company to establish an "ASC 740-10" reserve on its financial statements. Any tax position that requires a reserve also must appear on Schedule UTP of the company's tax return (Form 1120). Every reserve consists of three parts: (1) additional tax potentially due if the company's tax position is not "realized" or accepted by the IRS, (2) interest due on unpaid taxes, and (3) penalties assessed by the IRS for understating taxable income. Reserve accounts can be undesirable, since they have the effect of reducing assets and net income. Consider the following example: A U.S. division has computed a transfer pricing range consistent with the approach typically presented in cost/managerial accounting classes: Ceiling-$400, Floor-$250. The U.S. division, however, has not completed an external transfer pricing study to support its transfer price of $300. The IRS has challenged the company's transfer price and relies on its own economists to develop an alternative transfer pricing range: Ceiling-$800, Floor-$400. The IRS contends that the transfer price should be $600 (midpoint of the IRS range). The impact of taxable income is as follows: Company Tax Position Company transfer price Units Total revenue Total cost Taxable income $300 5,000 $1,500,000 $1,500,000 Interest (3.5% of tax) Penalty (based on the change in taxable income) No contemporaneous documentation (20%) Significant understatement (20%) Total ASC 740-10 reserve $0 Change in Taxable Income Additional tax (applicable rates X change in taxable income) Federal tax (35%) State and local tax (5%, blended rate)* IRS Position Revised transfer price Units Total revenue Total cost Taxable income As you can see, the change in taxable income is $1.5 million. The resulting ASC 740-10 Reserve would be calculated as follows: Resulting ASC 740-10 Reserve $1,500,000 $525,000 $75,000 $3,000,000 $1,500,000 $1,500,000 $600 5,000 $600,000 $21,000 $300,000 $300,000 $1,221,000

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Calculating the Unrecognized Tax Benefit UTB Based on the information provided we can calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started