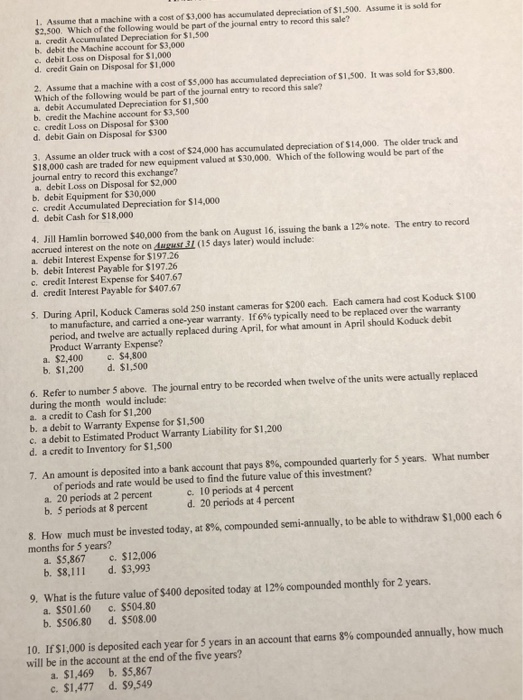

1. Assume that a machine with a cost of $3,000 has accumulated depreciation of $1.500. Assume it is sold for $2,500. Which of the following would be part of the journal entry to record this sale? a credit Accumulated Depreciation for $1,500 b. debit the Machine Account for $3.000 c. debit Loss on Disposal for $1.000 d. credit Gain on Disposal for $1.000 2. Assume that a machine with a cost of $5,000 has accumulated depreciation of $1,500. It was sold for $3,800 Which of the following would be part of the journal entry to record this sale? a. debit Accumulated Depreciation for $1.500 b. credit the Machine account for $3.500 C. credit Loss on Disposal for $300 d. debit Gain on Disposal for $100 3. Assume an older truck with a cost of $24,000 has accumulated depreciation of $14,000. The older truck and S18,000 cash are traded for new equipment valued at $10,000. Which of the following would be part of the journal entry to record this exchange? a debit Loss on Disposal for $2.000 b. debit Equipment for $30,000 C. credit Accumulated Depreciation for $14,000 d. debit Cash for S18,000 4. Jill Hamlin borrowed $40,000 from the bank on August 16, issuing the bank a 12% note. The entry to record accrued interest on the note on August 31 (15 days later) would include: a. debit Interest Expense for $197.26 b. debit Interest Payable for $197.26 C. credit Interest Expense for S407.67 d. credit Interest Payable for $407.67 5. During April, Koduck Cameras sold 250 instant cameras for $200 each. Each camera had cost Koduck $100 to manufacture, and carried a one-year warranty. 176% typically need to be replaced over the warranty period, and twelve are actually replaced during April, for what amount in April should Koduck debit Product Warranty Expense? a. $2,400 c. $4,800 b. $1,200 d. $1,500 6. Refer to number 5 above. The journal entry to be recorded when twelve of the units were actually replaced during the month would include: a. a credit to Cash for $1,200 b. a debit to Warranty Expense for $1,500 c. a debit to Estimated Product Warranty Liability for $1,200 d. a credit to Inventory for $1,500 7. An amount is deposited into a bank account that pays 8%, compounded quarterly for 5 years. What number of periods and rate would be used to find the future value of this investment? a. 20 periods at 2 percent c. 10 periods at 4 percent b. 5 periods at 8 percent d. 20 periods at 4 percent 8. How much must be invested today, at 8%, compounded semi-annually, to be able to withdraw $1,000 each 6 months for 5 years? a. $5,867 c. $12,006 b. 58,111 d. $3,993 9. What is the future value of $400 deposited today at 12% compounded monthly for 2 years. a. $501.60 . 504,80 b. $506.80 d. $508.00 10. If $1,000 is deposited each year for 5 years in an account that earns 8% compounded annually, how much will be in the account at the end of the five years? a. $1,469 b. $5.867 c. $1,477 d. $9,549