Question

1) Assume that an economy is experiencing simultaneous equilibrium in both the product market and money market. Furthermore, assume the MPC is currently around a

1) Assume that an economy is experiencing simultaneous equilibrium in both the product market and money market. Furthermore, assume the MPC is currently around a normal level of 0.65 and the sensitivity of real money demand to also around a normal level. Based on this information, answer the following questions:

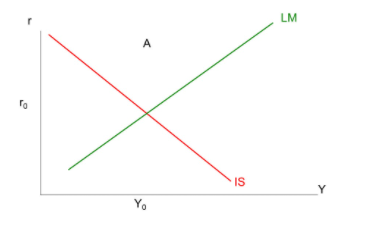

a) Using the AD-AS model and IS-LM model illustrate the impact of an expansionary fiscal policy. Label the initial points in both diagrams as A and the new points following the policy change as B.

b) What is meant by the term crowding out? In your answer also explain the implications of crowding out for the macroeconomy.

c) If the MPC rises to 0.8 and also the sensitivity of real money demand to changes in the income rises well, use the IS-LM model to illustrate the impact of an expansionary fiscal policy. Label the initial point prioer to the fiscal policy as A and the new point following the expansionary policy as B.

d) With reference to the diagrams you have prepared in parts a) and c) explain the reasons that underly differences in policy effectiveness.

2) If deposits in the banking system are $540, while the reserve ratio is 0.2 and the currency to deposit ratio is 0.09, then:

a) Calculate the total demand for high powered money.

b) Calculate the money multiplier.

3) An economy is currently experiencing inflation that exceeds the target rate set by the central bank. Answer the following questions:

a) Explain the process in full detail by which the central bank can bring the inflation rate down.

b) Illustrate this process from a)using the money market model, the loanable finds market model and the Aggregate Expenditure model.

c) Identify and explain costs to an economy that are associated with inflation.

d) Identify and explain the benefits to an economy that stem from having price level stability.

4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started