| 1. | Assume that Kwik Kopy uses straight-line depreciation and prepare the following entries: |

| | (a) Adjusting entries for depreciation on December 31 of 20-3 through 20-5. |

| | Additional InstructionGeneral Journal Instructions PAGE 3PAGE 4PAGE 5 GENERAL JOURNAL | | DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | | 1 | | | | | | | 2 | | | | | | | | (b) Adjusting entry for depreciation on June 30, 20-6, just prior to trading in the asset. | | | (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kwik Kopy must trade in the old copy machine and pay $22,000 for the new machine. | PAGE 1 GENERAL JOURNAL | | DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | | 1 | | | | | | | 2 | | | | | | | 3 | | | | | | | 4 | | | | | | | 5 | | | | | | | 6 | | | | | | | 7 | | | | | | | 2. | Assume that Kwik Kopy uses sum-of-the-years-digits depreciation and prepare the following entries: | | | (a) Adjusting entries for depreciation on December 31, 20-3 through 20-5. | | | Additional Instruction PAGE 3PAGE 4PAGE 5 GENERAL JOURNAL | | DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | | 1 | | | | | | | 2 | | | | | | | | (b) Adjusting entry for depreciation on June 30, 20-6, just prior to trading in the asset. | | | (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kwik Kopy must trade in the old copy machine and pay $22,000 for the new machine. | PAGE 1 GENERAL JOURNAL | | DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | | 1 | | | | | | | 2 | | | | | | | 3 | | | | | | | 4 | | | | | | | 5 | | | | | | | 6 | | | | | | | 7 | | | | | | | |

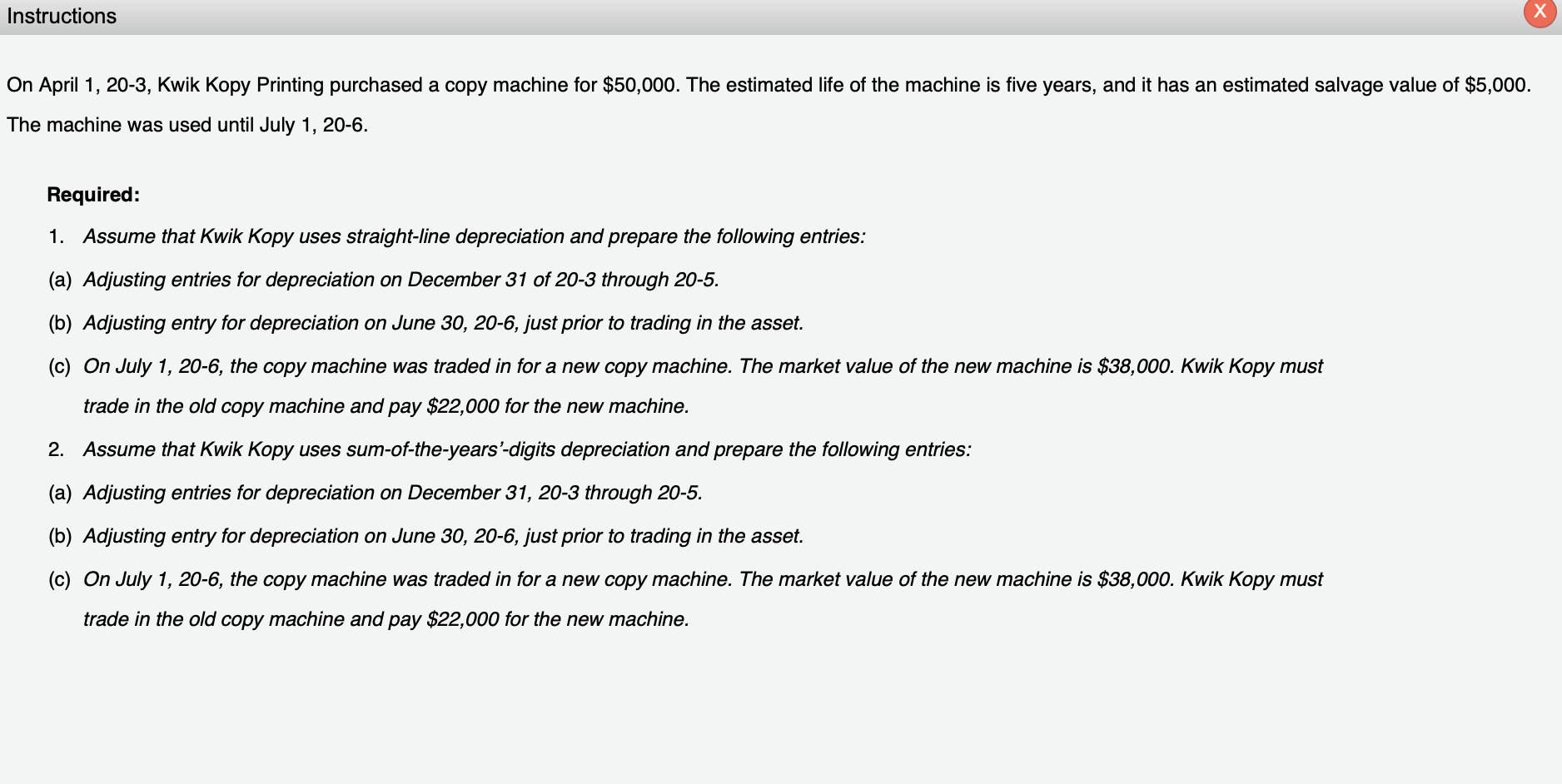

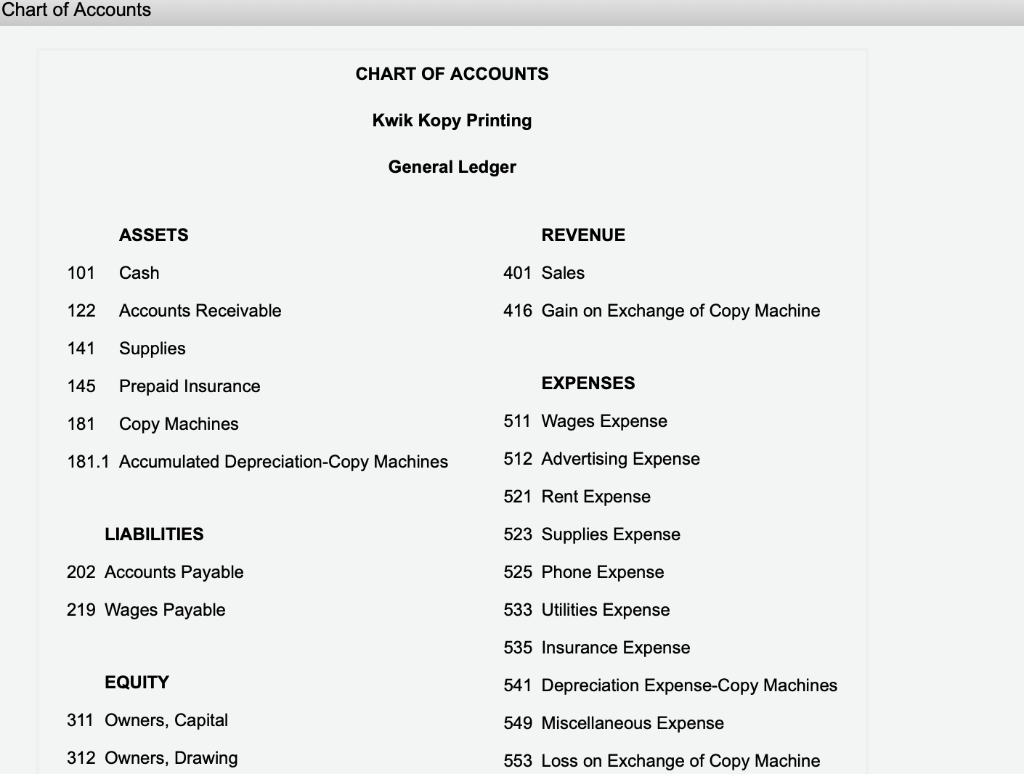

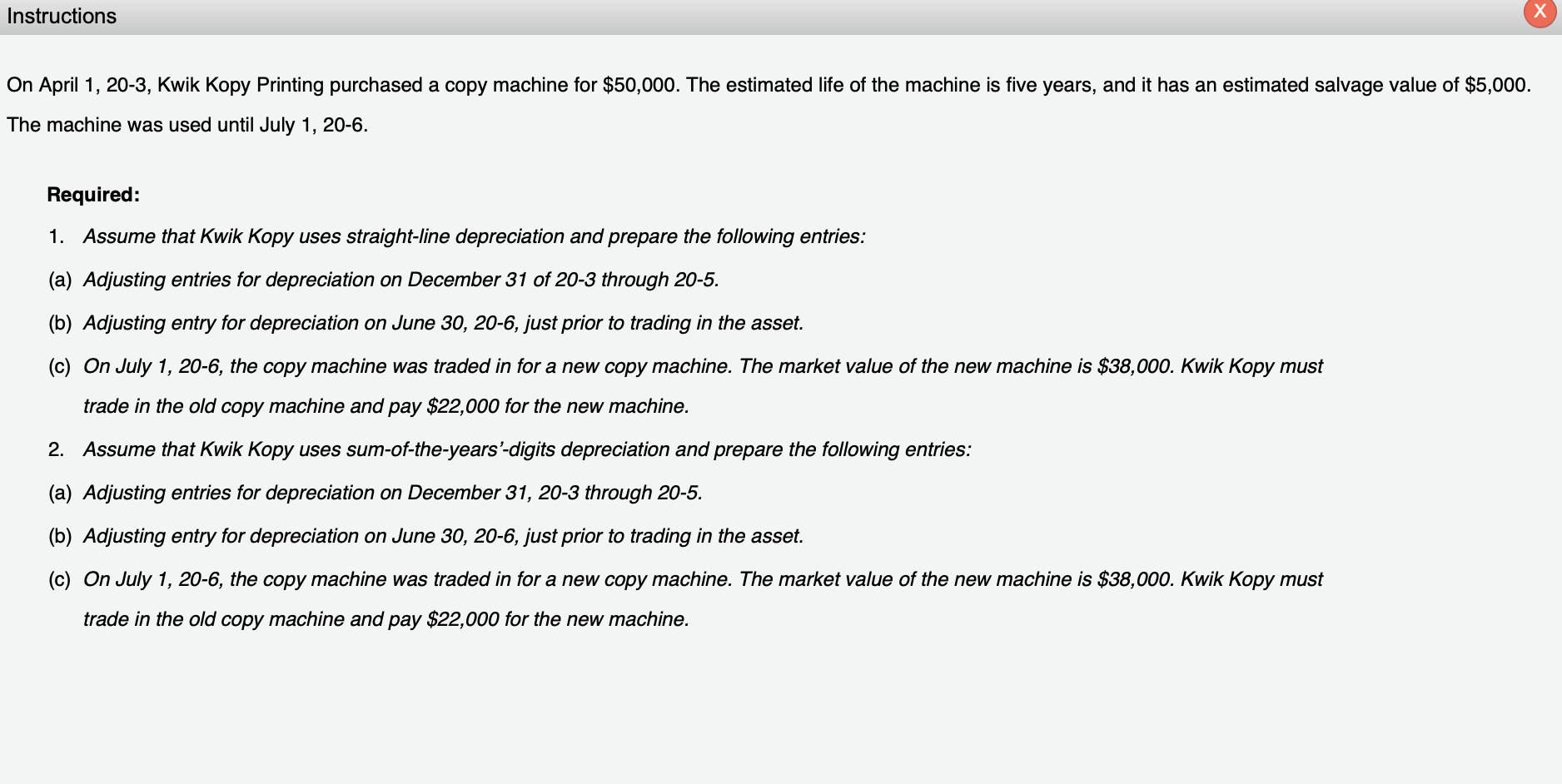

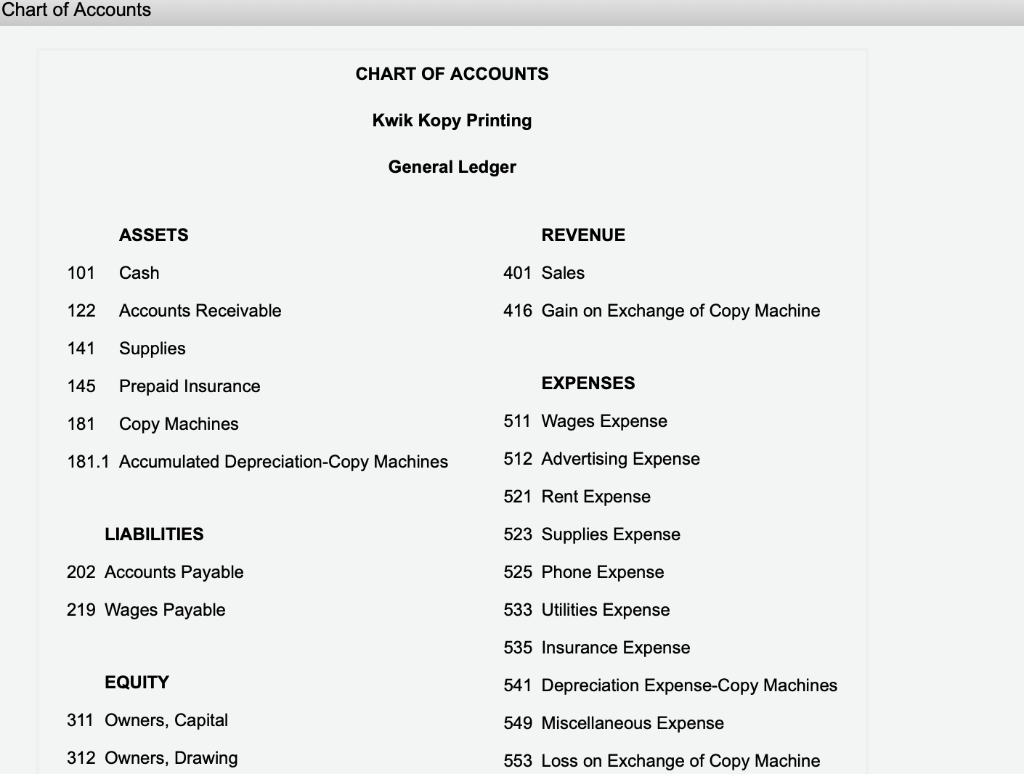

Instructions On April 1, 20-3, Kwik Kopy Printing purchased a copy machine for $50,000. The estimated life of the machine is five years, and it has an estimated salvage value of $5,000. The machine was used until July 1, 20-6. Required: 1. Assume that Kwik Kopy uses straight-line depreciation and prepare the following entries: (a) Adjusting entries for depreciation on December 31 of 20-3 through 20-5. (b) Adjusting entry for depreciation on June 30, 20-6, just prior to trading in the asset. (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kwik Kopy must trade in the old copy machine and pay $22,000 for the new machine. 2. Assume that Kwik Kopy uses sum-of-the-years'-digits depreciation and prepare the following entries: (a) Adjusting entries for depreciation on December 31, 20-3 through 20-5. (b) Adjusting entry for depreciation on June 30, 20-6, just prior to trading in the asset. (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kwik Kopy must trade in the old copy machine and pay $22,000 for the new machine. Chart of Accounts CHART OF ACCOUNTS Kwik Kopy Printing General Ledger ASSETS REVENUE 101 Cash 401 Sales 122 Accounts Receivable 416 Gain on Exchange of Copy Machine 141 Supplies 145 Prepaid Insurance EXPENSES 181 Copy Machines 511 Wages Expense 181.1 Accumulated ation-Copy Machines 512 Advertising Expense 521 Rent Expense LIABILITIES 523 Supplies Expense 202 Accounts Payable 525 Phone Expense 219 Wages Payable 533 Utilities Expense 535 Insurance Expense EQUITY 541 Depreciation Expense-Copy Machines 311 Owners, Capital 549 Miscellaneous Expense 312 Owners, Drawing 553 Loss on Exchange of Copy Machine