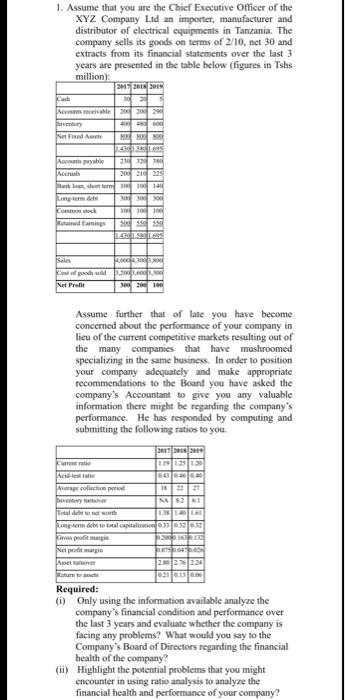

1. Assume that you are the Chief Executive Officer of the XYZ Company Ltd an importer, manufacturer and distributor of electrical equipments in Tanzania. The company sells its goods on terms of 2/10, net 30 and extracts from its financial statements over the last 3 years are presented in the table below (figures in Tshs million): 2015 2016 2015 . 20 2002 400 Peter Net Fred Acum puyable Metals) 1435 SLAS 2017 300 1235 10019 No 0 100 100 stock Sales 1.30 nam pad Net Pro 10 Assume further that of late you have become concerned about the performance of your company in lieu of the current competitive markets resulting out of the many companies that have mushroomed specializing in the same business. In order to position your company adequately and make appropriate recommendations to the Board you have asked the company's Accountant to give you any valuable information there might be regarding the company's performance. He has responded by computing and submitting the following ratios to you. 2007 ISBN kurie 129 13030 Aitole 1000 collect remover NAS faldet Nogom dobila A Newari 7040 23 020000 Required: (1) Only using the information available analyze the company's financial condition and performance over the last 3 years and evaluate whether the company is facing any problems? What would you say to the Company's Board of Directors regarding the financial health of the company? (ii) Highlight the potential problems that you might encounter in using ratio analysis to analyze the financial health and performance of your company? 1. Assume that you are the Chief Executive Officer of the XYZ Company Ltd an importer, manufacturer and distributor of electrical equipments in Tanzania. The company sells its goods on terms of 2/10, net 30 and extracts from its financial statements over the last 3 years are presented in the table below (figures in Tshs million): 2015 2016 2015 . 20 2002 400 Peter Net Fred Acum puyable Metals) 1435 SLAS 2017 300 1235 10019 No 0 100 100 stock Sales 1.30 nam pad Net Pro 10 Assume further that of late you have become concerned about the performance of your company in lieu of the current competitive markets resulting out of the many companies that have mushroomed specializing in the same business. In order to position your company adequately and make appropriate recommendations to the Board you have asked the company's Accountant to give you any valuable information there might be regarding the company's performance. He has responded by computing and submitting the following ratios to you. 2007 ISBN kurie 129 13030 Aitole 1000 collect remover NAS faldet Nogom dobila A Newari 7040 23 020000 Required: (1) Only using the information available analyze the company's financial condition and performance over the last 3 years and evaluate whether the company is facing any problems? What would you say to the Company's Board of Directors regarding the financial health of the company? (ii) Highlight the potential problems that you might encounter in using ratio analysis to analyze the financial health and performance of your company