Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Assume that you are Turkish Lira (TL) based investor and has 5,000,000 TL. You are planning to make an investment in money markets and

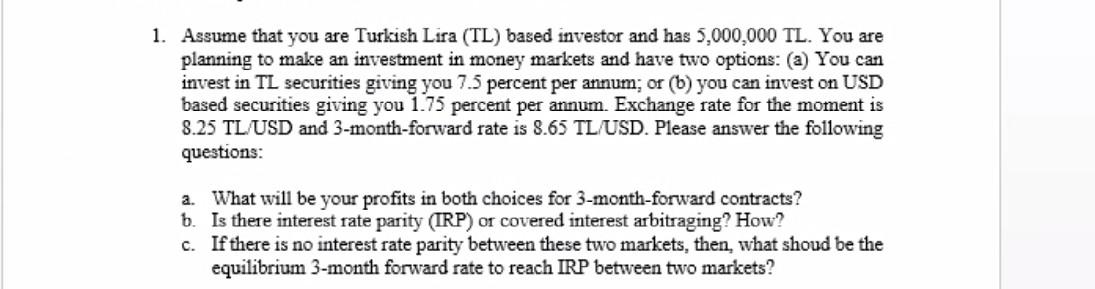

1. Assume that you are Turkish Lira (TL) based investor and has 5,000,000 TL. You are planning to make an investment in money markets and have two options: (a) You can invest in TL securities giving you 7.5 percent per annum; or (b) you can invest on USD based securities giving you 1.75 percent per annum. Exchange rate for the moment is 8.25 TL USD and 3-month-forward rate is 8.65 TL/USD. Please answer the following questions: a. What will be your profits in both choices for 3-month-forward contracts? b. Is there interest rate parity (IRP) or covered interest arbitraging? How? c. If there is no interest rate parity between these two markets, then, what shoud be the equilibrium 3-month forward rate to reach IRP between two markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started