Answered step by step

Verified Expert Solution

Question

1 Approved Answer

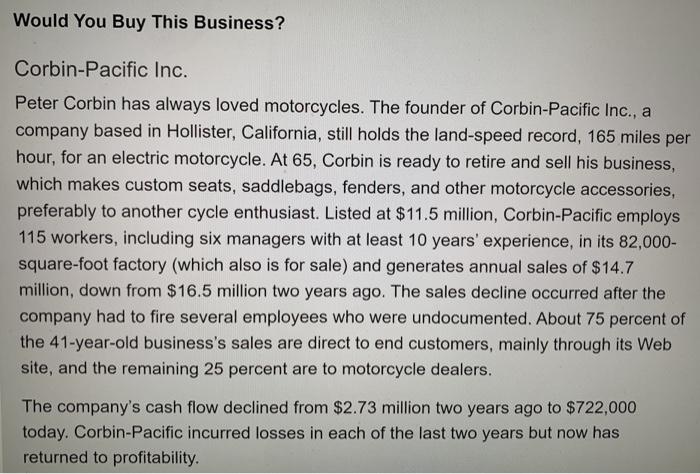

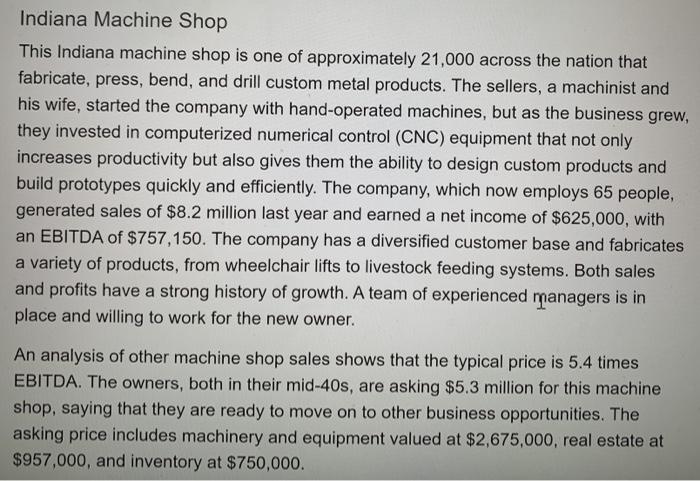

1. Assume the role of a prospective buyer for these two businesses. How would you conduct the due diligence necessary to determine whether they would

1. Assume the role of a prospective buyer for these two businesses. How would you conduct the due diligence necessary to determine whether they would be good investments?

2. Do you notice any red flags" or potential problems in either of these deals? Explain.

3. Which techniques for estimating the value of these businesses would be most useful to a prospective buyer of these companies? Are the owners' asking prices reasonable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started