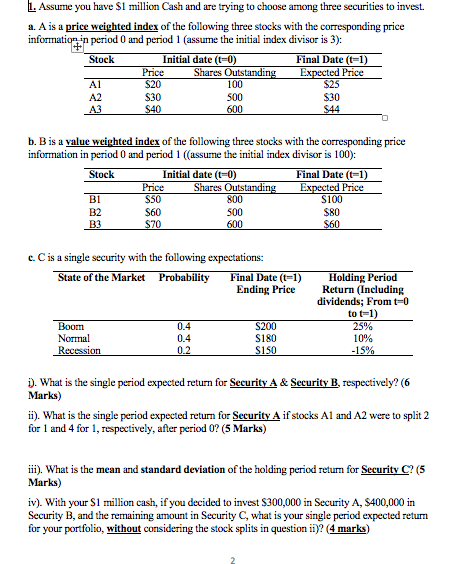

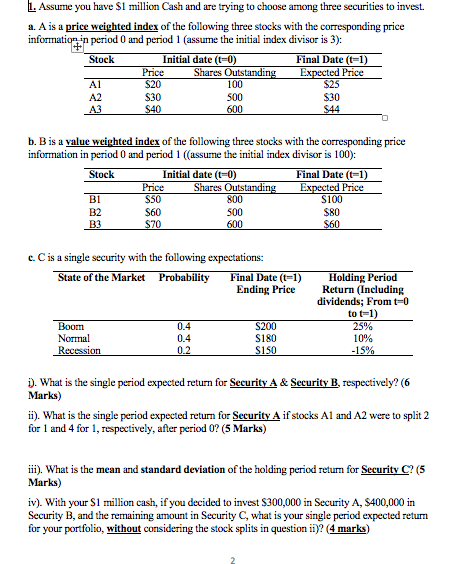

1. Assume you have $1 million Cash and are trying to choose among three securities to invest. a. A is a price weighted index of the following three stocks with the corresponding price information in period 0 and period 1 (assure the initial index divisor is 3): Stock Initial date (t=0) Final Date (t=1) Price Shares Outstanding Expected Price S20 100 $25 A2 $30 SOO $30 A3 $40 600 $44 b. Bis a value weighted index of the following three stocks with the corresponding price information in period 0 and period 1 ((assume the initial index divisor is 100): Stock Initial date (t-0) Final Date (t-1) Price Shares Outstanding Expected Price B1 SSO 800 S100 B2 S60 500 $80 $70 600 $60 B3 c.Cis a single security with the following expectations: State of the Market Probability Final Date (t-1) Ending Price Holding Period Return (Including dividends; From-0 to t=1) 25% 10% -15% Boom Normal Recession 0.4 0.4 0.2 S200 $180 S150 D. What is the single period expected return for Security A & Security B, respectively? (6 Marks) ii). What is the single period expected return for Security A if stocks A1 and A2 were to split 2 for 1 and 4 for 1, respectively, after period 0? (5 Marks) 4 ii). What is the mean and standard deviation of the holding period return for Security C? (5 Marks) iv). With your $1 million cash, if you decided to invest $300,000 in Security A, 5400,000 in Security B, and the remaining amount in Security C, what is your single period expected return for your portfolio, without considering the stock splits in question in)? (4 marks) 1. Assume you have $1 million Cash and are trying to choose among three securities to invest. a. A is a price weighted index of the following three stocks with the corresponding price information in period 0 and period 1 (assure the initial index divisor is 3): Stock Initial date (t=0) Final Date (t=1) Price Shares Outstanding Expected Price S20 100 $25 A2 $30 SOO $30 A3 $40 600 $44 b. Bis a value weighted index of the following three stocks with the corresponding price information in period 0 and period 1 ((assume the initial index divisor is 100): Stock Initial date (t-0) Final Date (t-1) Price Shares Outstanding Expected Price B1 SSO 800 S100 B2 S60 500 $80 $70 600 $60 B3 c.Cis a single security with the following expectations: State of the Market Probability Final Date (t-1) Ending Price Holding Period Return (Including dividends; From-0 to t=1) 25% 10% -15% Boom Normal Recession 0.4 0.4 0.2 S200 $180 S150 D. What is the single period expected return for Security A & Security B, respectively? (6 Marks) ii). What is the single period expected return for Security A if stocks A1 and A2 were to split 2 for 1 and 4 for 1, respectively, after period 0? (5 Marks) 4 ii). What is the mean and standard deviation of the holding period return for Security C? (5 Marks) iv). With your $1 million cash, if you decided to invest $300,000 in Security A, 5400,000 in Security B, and the remaining amount in Security C, what is your single period expected return for your portfolio, without considering the stock splits in question in)? (4 marks)