Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is NOT $130,000 capital gain. Question 21 0/2 points A&W corporation is owned as follows (800 shares issues and outstanding): Mr. B Sr

The answer is NOT $130,000 capital gain.

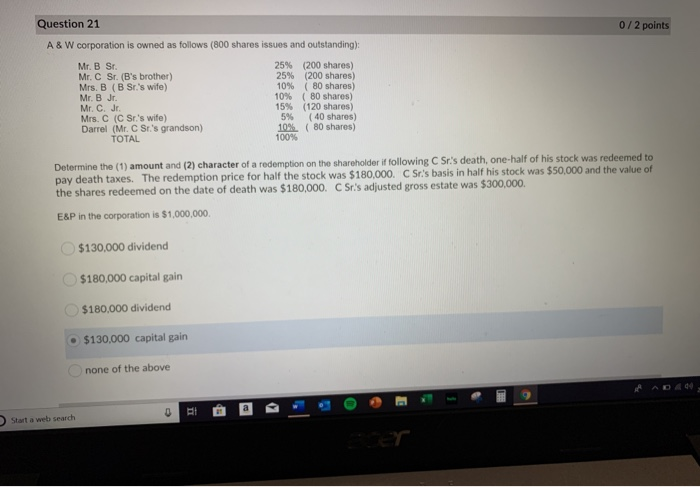

Question 21 0/2 points A&W corporation is owned as follows (800 shares issues and outstanding): Mr. B Sr 25% (200 shares) Mr. C Sr. (B's brother) 25% (200 shares) Mrs. B (BSr.'s wife) 10% (80 shares) Mr. B Jr. 10% (80 shares) Mr. CJe 15% (120 shares) Mrs. C (C Sr's wife) 5% (40 shares) Darrel (Mr. C Sr's grandson) 10% (80 shares) TOTAL 100% Determine the (1) amount and (2) character of a redemption on the shareholder if following C Sr's death, one-half of his stock was redeemed to pay death taxes. The redemption price for half the stock was $180,000. C Sr's basis in half his stock was $50,000 and the value of the shares redeemed on the date of death was $180,000. C Sr's adjusted gross estate was $300,000 E&P in the corporation is $1,000,000 $130,000 dividend $180,000 capital gain $180,000 dividend $130,000 capital gain none of the above AAD Start a web search Question 21 0/2 points A&W corporation is owned as follows (800 shares issues and outstanding): Mr. B Sr 25% (200 shares) Mr. C Sr. (B's brother) 25% (200 shares) Mrs. B (BSr.'s wife) 10% (80 shares) Mr. B Jr. 10% (80 shares) Mr. CJe 15% (120 shares) Mrs. C (C Sr's wife) 5% (40 shares) Darrel (Mr. C Sr's grandson) 10% (80 shares) TOTAL 100% Determine the (1) amount and (2) character of a redemption on the shareholder if following C Sr's death, one-half of his stock was redeemed to pay death taxes. The redemption price for half the stock was $180,000. C Sr's basis in half his stock was $50,000 and the value of the shares redeemed on the date of death was $180,000. C Sr's adjusted gross estate was $300,000 E&P in the corporation is $1,000,000 $130,000 dividend $180,000 capital gain $180,000 dividend $130,000 capital gain none of the above AAD Start a web search Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started