Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) At current time t = 0 an asset is traded at 100. Its volatility is 30% and it pays 2% continuous dividend yield.

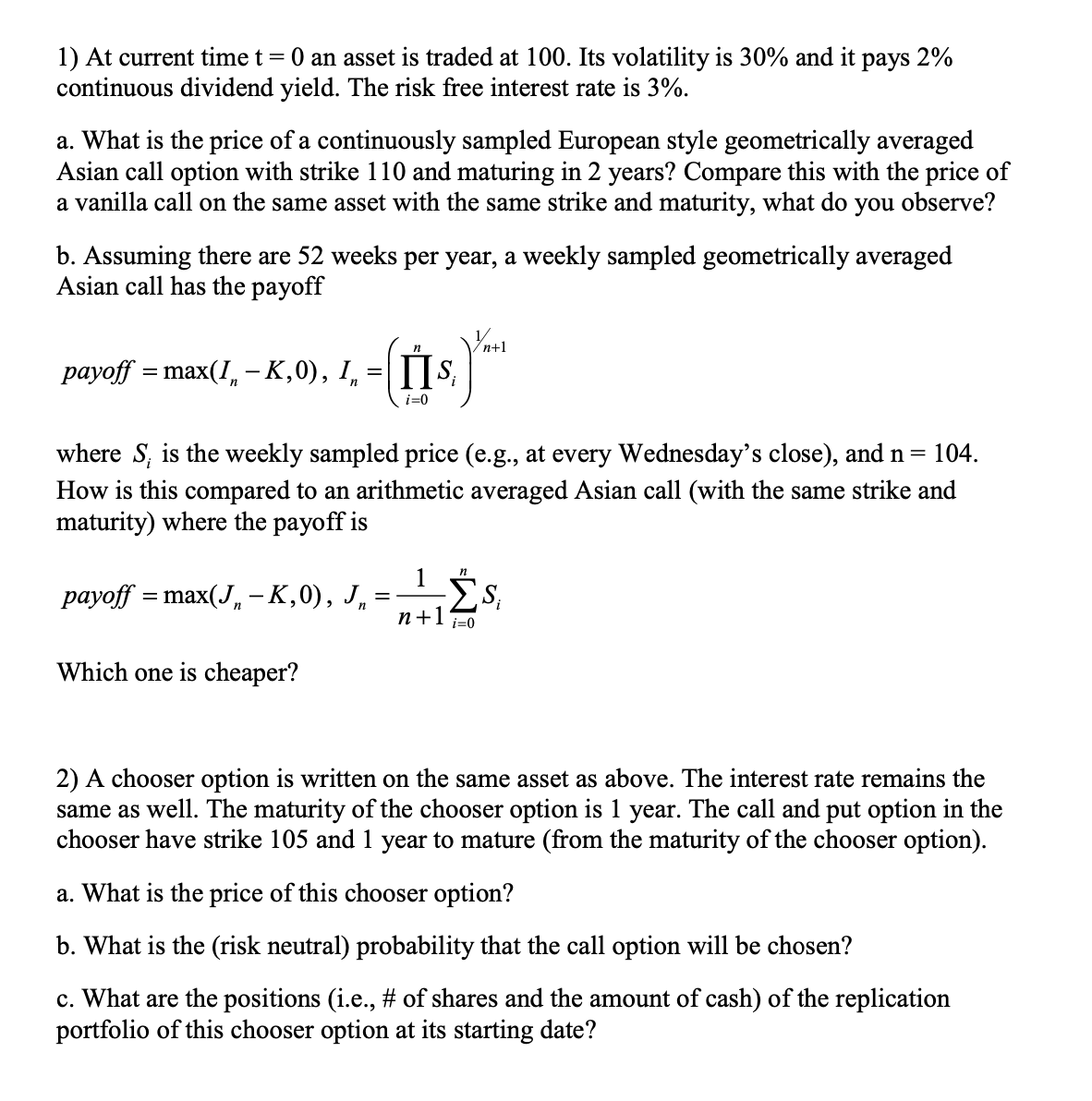

1) At current time t = 0 an asset is traded at 100. Its volatility is 30% and it pays 2% continuous dividend yield. The risk free interest rate is 3%. a. What is the price of a continuously sampled European style geometrically averaged Asian call option with strike 110 and maturing in 2 years? Compare this with the price of a vanilla call on the same asset with the same strike and maturity, what do you observe? b. Assuming there are 52 weeks per year, a weekly sampled geometrically averaged Asian call has the payoff n payoff = max(I K,0), I, =]]S; i=0 where S, is the weekly sampled price (e.g., at every Wednesday's close), and n = 104. How is this compared to an arithmetic averaged Asian call (with the same strike and maturity) where the payoff is payoff = max(J K,0), Jn = Which one is cheaper? n n+1 1 n+1 i=0 ;S; 2) A chooser option is written on the same asset as above. The interest rate remains the same as well. The maturity of the chooser option is 1 year. The call and put option in the chooser have strike 105 and 1 year to mature (from the maturity of the chooser option). a. What is the price of this chooser option? b. What is the (risk neutral) probability that the call option will be chosen? c. What are the positions (i.e., # of shares and the amount of cash) of the replication portfolio of this chooser option at its starting date?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the price of a continuously sampled European style geometrically averaged Asian call option we can use the BlackScholes formula for Asian options The formula for the price of a geometri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started