Question

1. At December 31, 20x2, Scott Hobson Enterprises reported inventory (at cost) in the amount of $131,000 based on a physical count of inventory on

1. At December 31, 20x2, Scott Hobson Enterprises reported inventory (at cost) in the amount of $131,000 based on a physical count of inventory on hand, before any necessary adjustment for the following:Merchandise costing $21,000, shipped f.o.b. shipping point from a vendor on December 27, 20x2, was received by Hobson on January 5, 20x3.Merchandise costing $51,000 was shipped to a customer f.o.b. shipping point on December 28, 20x2, arrived at the customers location on January 6, 20x3.Merchandise costing $27,000 was being held on hand for Johnson Outboard Company on consignment.Estimated sales returns are 10% of annual sales. Sales revenue was $562,000 with a gross profit ratio of 25%.What amount should Scott Hobson Enterprises report as inventory in its balance sheet as of December 31, 20x2?

Multiple Choice

$146,150.

$200,275.

$197,150.

$167,150.

2. Amazing Products, Inc. sells inventory that is subject to a price fluctuations. A recent item that cost $21.60 was marked up $12.10, marked down for a sale by $6.40 and then had a markdown cancellation of $4.60. Calculate the latest selling price of this item.

Multiple Choice

$31.90.

$34.70.

$38.30.

$28.00.

Sorry for so many questions at one post i need help with these but i ran out of question to post ...

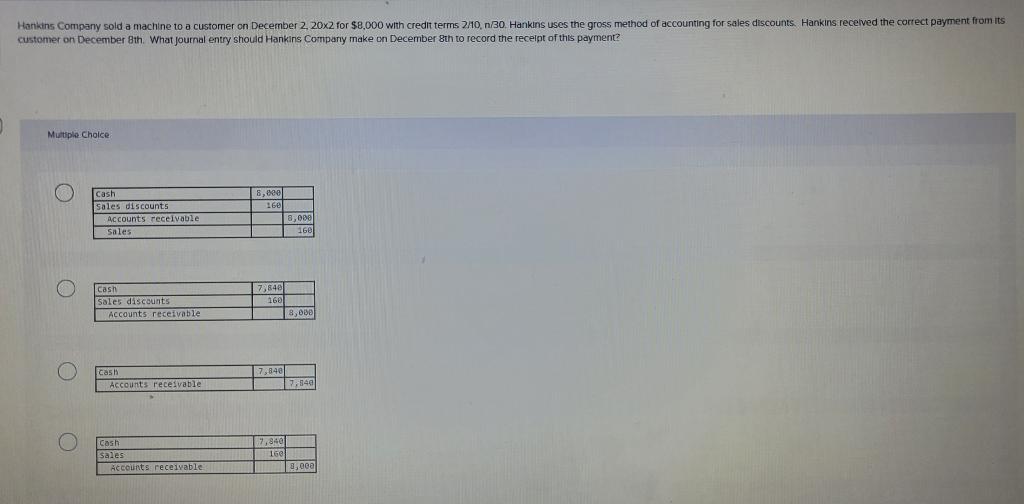

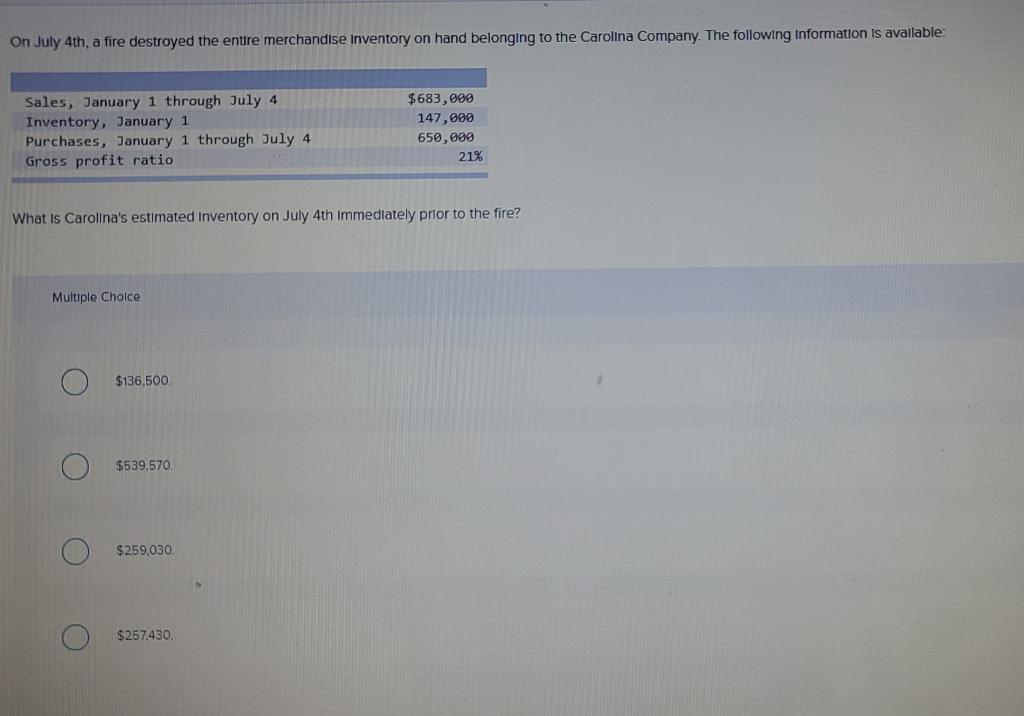

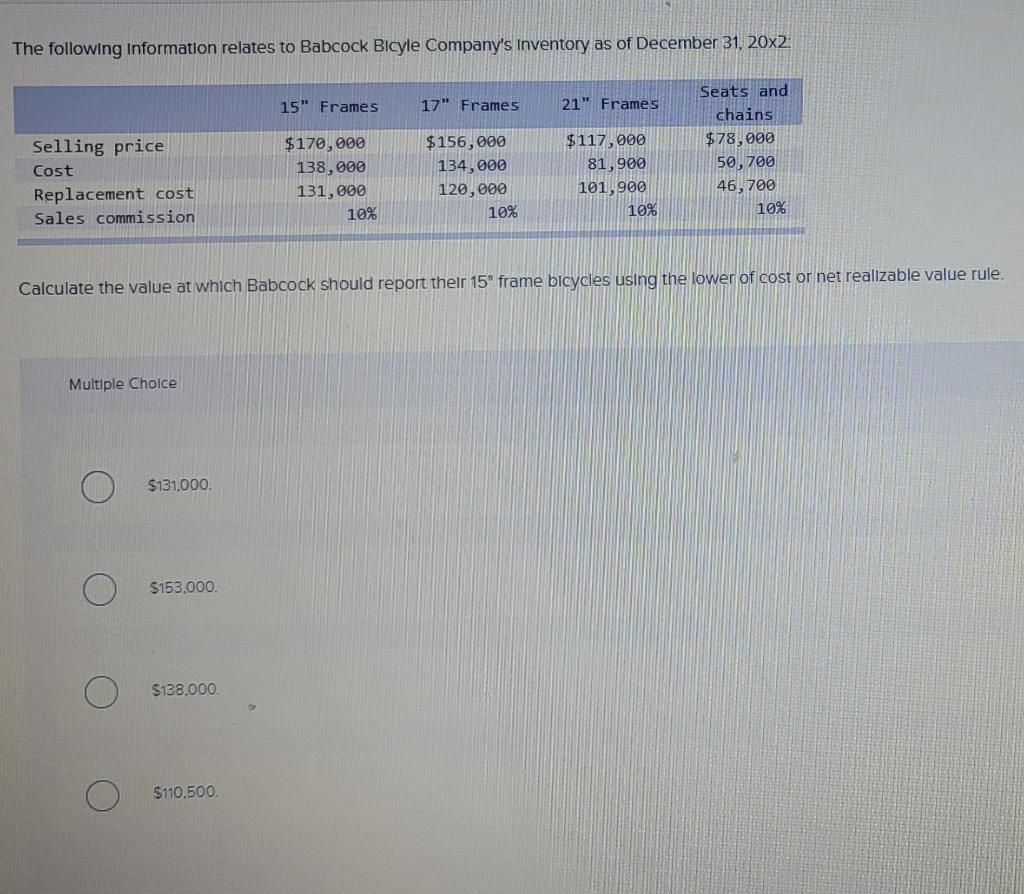

Hankins Company sold a machine to a customer on December 2, 20x2 for $8,000 with credit terms 2/10,n30. Hankins uses the gross method of accounting for sales discounts. Hankins received the correct payment from its customer on December 8th. What journal entry should Hankins Company make on December 8th to record the receipt of this payment? Multiple Choice 8,000 Cash sales discounts Accounts receivable Sales 8,000 166 7,640 Cash Sales discounts Accounts receivable 166 8,000 7,840 O cash Accounts receivable 7:14 7,840 O Cash sales Accounts receivable 2.000 On July 4th, a fire destroyed the entire merchandise Inventory on hand belonging to the Carolina Company. The following Information is available Sales, January 1 through July 4 Inventory, January 1 Purchases, January 1 through July 4 Gross profit ratio $683,000 147,000 650,000 21% What is Carolina's estimated Inventory on July 4th Immediately prior to the fire? Multiple Choice $136,500 $539,570 $259,030. $257,430 The following Information relates to Babcock Bicyle Company's Inventory as of December 31, 20x2: 15" Frames 17" Frames 21" Frames Seats and chains $78,000 50, 700 Selling price Cost Replacement cost Sales commission $170,000 138,000 131,000 10% $156,000 134,000 120,000 10% $117,000 81,900 101,900 10% 46,700 10% Calculate the value at which Babcock should report their 15" frame bicycles using the lower of cost or net realizable value rule. Multiple Choice $131.000 $153,000 $138.000 $110.500 Hankins Company sold a machine to a customer on December 2, 20x2 for $8,000 with credit terms 2/10,n30. Hankins uses the gross method of accounting for sales discounts. Hankins received the correct payment from its customer on December 8th. What journal entry should Hankins Company make on December 8th to record the receipt of this payment? Multiple Choice 8,000 Cash sales discounts Accounts receivable Sales 8,000 166 7,640 Cash Sales discounts Accounts receivable 166 8,000 7,840 O cash Accounts receivable 7:14 7,840 O Cash sales Accounts receivable 2.000 On July 4th, a fire destroyed the entire merchandise Inventory on hand belonging to the Carolina Company. The following Information is available Sales, January 1 through July 4 Inventory, January 1 Purchases, January 1 through July 4 Gross profit ratio $683,000 147,000 650,000 21% What is Carolina's estimated Inventory on July 4th Immediately prior to the fire? Multiple Choice $136,500 $539,570 $259,030. $257,430 The following Information relates to Babcock Bicyle Company's Inventory as of December 31, 20x2: 15" Frames 17" Frames 21" Frames Seats and chains $78,000 50, 700 Selling price Cost Replacement cost Sales commission $170,000 138,000 131,000 10% $156,000 134,000 120,000 10% $117,000 81,900 101,900 10% 46,700 10% Calculate the value at which Babcock should report their 15" frame bicycles using the lower of cost or net realizable value rule. Multiple Choice $131.000 $153,000 $138.000 $110.500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started