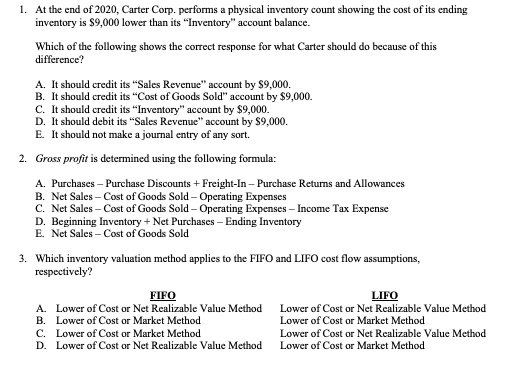

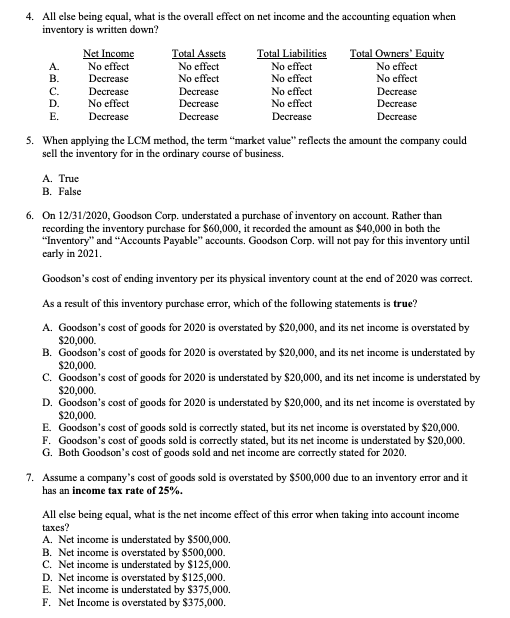

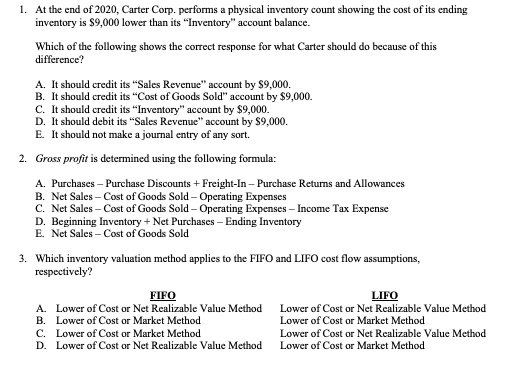

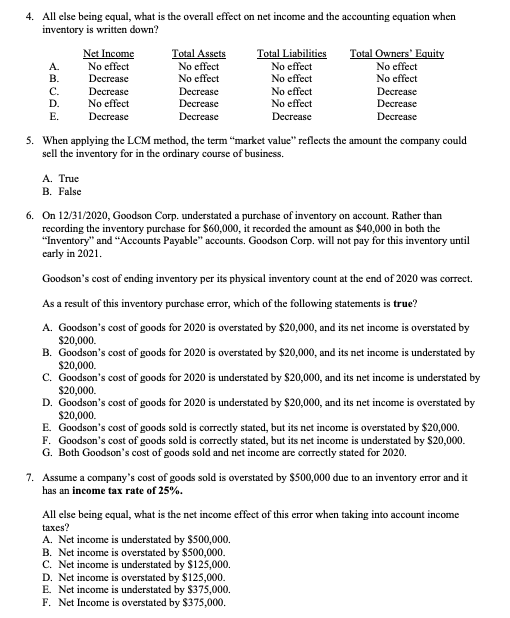

1. At the end of 2020, Carter Corp. performs a physical inventory count showing the cost of its ending inventory is $9,000 lower than its "Inventory" account balance. Which of the following shows the correct response for what Carter should do because of this difference? A. It should credit its Sales Revenue" account by 9,000. B. It should credit its "Cost of Goods Sold" account by $9,000. C. It should credit its "Inventory" account by $9,000. D. It should debit its "Sales Revenue" account by $9,000. E. It should not make a journal entry of any sort. 2. Gross profit is determined using the following formula: A. Purchases - Purchase Discounts + Freight-In Purchase Returns and Allowances B. Net Sales - Cost of Goods Sold - Operating Expenses C. Net Sales - Cost of Goods Sold - Operating Expenses - Income Tax Expense D. Beginning Inventory + Net Purchases - Ending Inventory E. Net Sales - Cost of Goods Sold 3. Which inventory valuation method applies to the FIFO and LIFO cost flow assumptions, respectively? FIFO A. Lower of Cost or Net Realizable Value Method B. Lower of Cost or Market Method C. Lower of Cost or Market Method D. Lower of Cost or Net Realizable Value Method LIFO Lower of Cost or Net Realizable Value Method Lower of Cost or Market Method Lower of Cost or Net Realizable Value Method Lower of Cost or Market Method 4. All else being equal, what is the overall effect on net income and the accounting equation when inventory is written down? Net Income Total Assets Total Liabilities Total Owners' Equity A No effect No effect No effect No effect B. Decrease No effect No effect No effect C. Decrease Decrease No effect Decrease D. No effect Decrease No effect Decrease E. Decrease Decrease Decrease Decrease 5. When applying the LCM method, the term market value reflects the amount the company could sell the inventory for in the ordinary course of business. A. True B. False 6. On 12/31/2020, Goodson Corp. understated a purchase of inventory on account. Rather than recording the inventory purchase for $60,000, it recorded the amount as $40,000 in both the "Inventory" and "Accounts Payable" accounts. Goodson Corp. will not pay for this inventory until early in 2021. Goodson's cost of ending inventory per its physical inventory count at the end of 2020 was correct. As a result of this inventory purchase error, which of the following statements is true? A. Goodson's cost of goods for 2020 is overstated by $20,000, and its net income is overstated by $20,000 B. Goodson's cost of goods for 2020 is overstated by $20,000, and its net income is understated by $20,000. C. Goodson's cost of goods for 2020 is understated by $20,000, and its net income is understated by $20,000 D. Goodson's cost of goods for 2020 is understated by $20,000, and its net income is overstated by $20,000 E. Goodson's cost of goods sold is correctly stated, but its net income is overstated by $20,000. F. Goodson's cost of goods sold is correctly stated, but its net income is understated by $20,000. G. Both Goodson's cost of goods sold and net income are correctly stated for 2020. 7. Assume a company's cost of goods sold is overstated by $500,000 due to an inventory error and it has an income tax rate of 25%. All else being equal, what is the net income effect of this error when taking into account income A. Net income is understated by $500,000. B. Net income is overstated by $500,000. C. Net income is understated by $125,000. D. Net income is overstated by $125,000. E. Net income is understated by $375,000. F. Net Income is overstated by $375,000. taxes