Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Auroras financial vice president polled some pension fund investment managers on the minimum rate of return they would have to expect pm Auroras common

1. Auroras financial vice president polled some pension fund investment managers on the minimum rate of return they would have to expect pm Auroras common to make them willing to buy the common rather than Aurora bonds, when the bonds yield 7%. The responses suggested a risk premium over Aurora bonds of 3 to 5 percentage points.

2.Aurora in the 30% tax bracket.

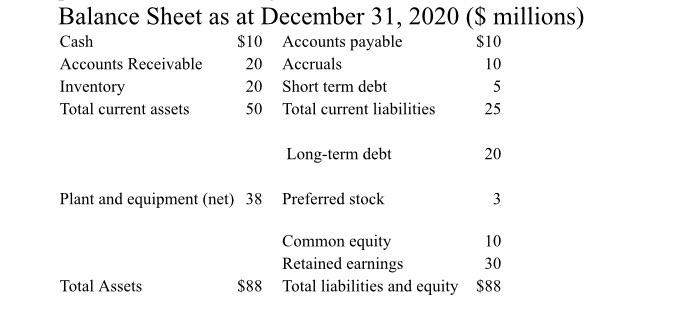

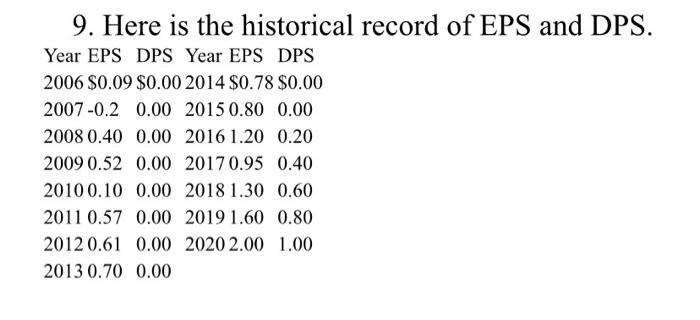

determine cost of equity on the basis of the data

Balance Sheet as at December 31, 2020 ($ millions) Cash $10 Accounts payable $10 Accounts Receivable 20 Accruals 10 Inventory 20 Short term debt 5 Total current assets 50 Total current liabilities 25 Long-term debt 20 Plant and equipment (net) 38 Preferred stock Common equity 10 Retained earnings 30 $88 Total liabilities and equity $88 Total Assets 9. Here is the historical record of EPS and DPS. Year EPS DPS Year EPS DPS 2006 $0.09 $0.00 2014 $0.78 $0.00 2007 -0.2 0.00 2015 0.80 0.00 2008 0.40 0.00 2016 1.20 0.20 2009 0.52 0.00 20170.95 0.40 2010 0.10 0.00 2018 1.30 0.60 2011 0.57 0.00 2019 1.60 0.80 2012 0.61 0.00 2020 2.00 1.00 2013 0.70 0.00 Balance Sheet as at December 31, 2020 ($ millions) Cash $10 Accounts payable $10 Accounts Receivable 20 Accruals 10 Inventory 20 Short term debt 5 Total current assets 50 Total current liabilities 25 Long-term debt 20 Plant and equipment (net) 38 Preferred stock Common equity 10 Retained earnings 30 $88 Total liabilities and equity $88 Total Assets 9. Here is the historical record of EPS and DPS. Year EPS DPS Year EPS DPS 2006 $0.09 $0.00 2014 $0.78 $0.00 2007 -0.2 0.00 2015 0.80 0.00 2008 0.40 0.00 2016 1.20 0.20 2009 0.52 0.00 20170.95 0.40 2010 0.10 0.00 2018 1.30 0.60 2011 0.57 0.00 2019 1.60 0.80 2012 0.61 0.00 2020 2.00 1.00 2013 0.70 0.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started