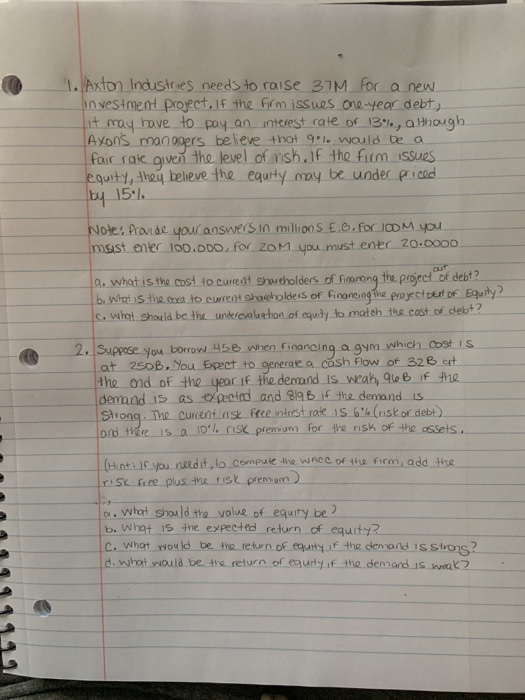

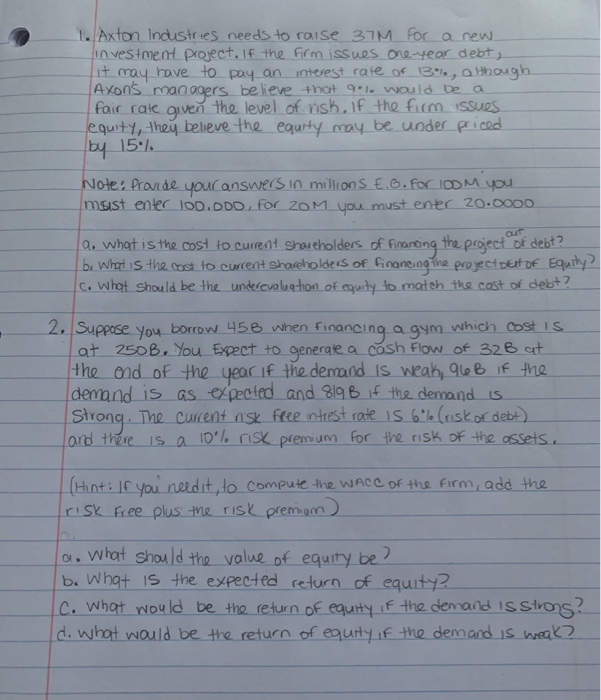

1. Axton Industries needs to raise 37M for a new investment project. If the firm issues one-year debt, it may have to pay an interest rate of 13., although Ayon managers believe that 91. Would be a fair rate given the level of risk. If the firm issues equity, they believe the equity may be under priced by 15.1. Note: Provide your answers in millions E.C. for IODM you! msist enter 100.DDD, for ZOM You must enter 20.0000 10. What is the cost to current Shareholders of forong the project of debt? b. What is the cost to current shareholders of financing the proyectoet of Equity? c. What should be the underevoluton of equidy to match the cost of debt? 2. Suppose you borrow 458 when financing a gym which cost is at 250B. You Expect to generate a cash flow of 32B at the end of the year if the demand is weak, ale B if the demand is as expected and 819 B if the demand is Strong. The current ask free intrest rate is 6. (niskor debt) and there is a 10% risk premium for the risk of the assets. (Hint: if you need it, lo compute the WACC of the firm, add the SK free plus the risk premom) a. What should the value of equity be? b. What is the expected return of equity? c. What would be the return of equity if the demand is strons? do what would be the return of equity if the demand is weak? 114999999 1. Anton Industries needs to raise 37M for a new investment project. If the firm issues one-year debt, lit may have to pay an interest rate of 13%, a though. AXOOS man agers believe that 91. would be a fair rale given the level of nish. If the firm issues equity, they believe the equity may be under priced by 15%. Nole: Provide your answers in millions E.S.foIOOM you meist ener .DDD, for ZOM you must enter 20.0000 a. what is the cost to current Shareholders of Financing the project of debt? b. What is the cost to current Shareholders of Ginone ng The proyectoet of Equity? c. What should be the underevaluation of equity to match the cast of debt? 2. Suppose you borrow 45B when financing a gym which cost is! at 250B. You Expect to generate a cash flow of 32B at. the end of the year if the demand is weak, 96 B if the demand is as expected and 819 B if the demand is Strong. The current ask free intrest rate is 6l.(risk of debt and there is a 10% risk premium for the risk of the assets. L(Hint: If you need it, to compute the WACC of the firm, add the risk free plus the risk premium la. What should the value of equity be Ib. What is the expected return of equity? C. What would be the return of equity if the demand is strons? d. what would be the return of equity if the demand is weak? 1. Axton Industries needs to raise 37M for a new investment project. If the firm issues one-year debt, it may have to pay an interest rate of 13., although Ayon managers believe that 91. Would be a fair rate given the level of risk. If the firm issues equity, they believe the equity may be under priced by 15.1. Note: Provide your answers in millions E.C. for IODM you! msist enter 100.DDD, for ZOM You must enter 20.0000 10. What is the cost to current Shareholders of forong the project of debt? b. What is the cost to current shareholders of financing the proyectoet of Equity? c. What should be the underevoluton of equidy to match the cost of debt? 2. Suppose you borrow 458 when financing a gym which cost is at 250B. You Expect to generate a cash flow of 32B at the end of the year if the demand is weak, ale B if the demand is as expected and 819 B if the demand is Strong. The current ask free intrest rate is 6. (niskor debt) and there is a 10% risk premium for the risk of the assets. (Hint: if you need it, lo compute the WACC of the firm, add the SK free plus the risk premom) a. What should the value of equity be? b. What is the expected return of equity? c. What would be the return of equity if the demand is strons? do what would be the return of equity if the demand is weak? 114999999 1. Anton Industries needs to raise 37M for a new investment project. If the firm issues one-year debt, lit may have to pay an interest rate of 13%, a though. AXOOS man agers believe that 91. would be a fair rale given the level of nish. If the firm issues equity, they believe the equity may be under priced by 15%. Nole: Provide your answers in millions E.S.foIOOM you meist ener .DDD, for ZOM you must enter 20.0000 a. what is the cost to current Shareholders of Financing the project of debt? b. What is the cost to current Shareholders of Ginone ng The proyectoet of Equity? c. What should be the underevaluation of equity to match the cast of debt? 2. Suppose you borrow 45B when financing a gym which cost is! at 250B. You Expect to generate a cash flow of 32B at. the end of the year if the demand is weak, 96 B if the demand is as expected and 819 B if the demand is Strong. The current ask free intrest rate is 6l.(risk of debt and there is a 10% risk premium for the risk of the assets. L(Hint: If you need it, to compute the WACC of the firm, add the risk free plus the risk premium la. What should the value of equity be Ib. What is the expected return of equity? C. What would be the return of equity if the demand is strons? d. what would be the return of equity if the demand is weak