Answered step by step

Verified Expert Solution

Question

1 Approved Answer

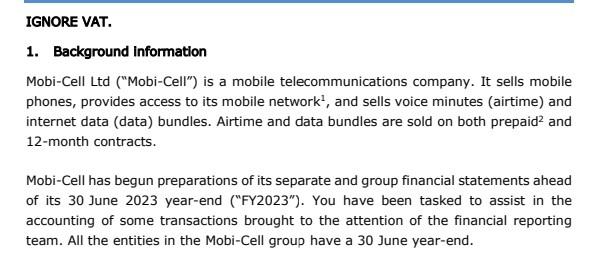

1. Background Information Mobi-Cell Ltd (Mobi-Cell) is a mobile telecommunications company. It sells mobile phones, provides access to its mobile network 1, and sells voice

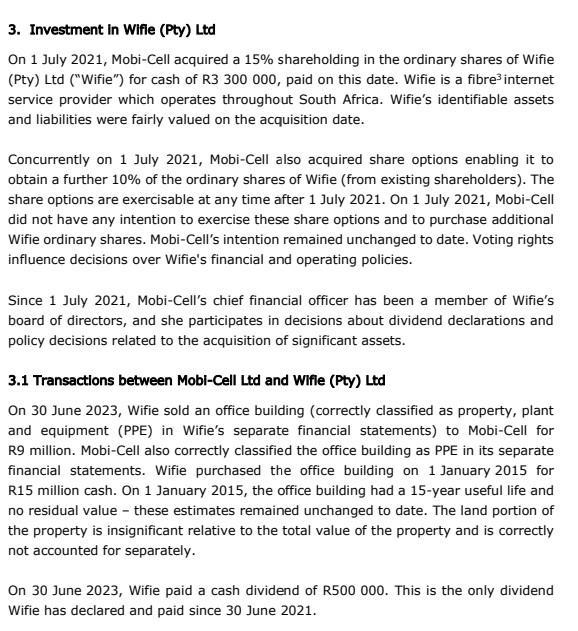

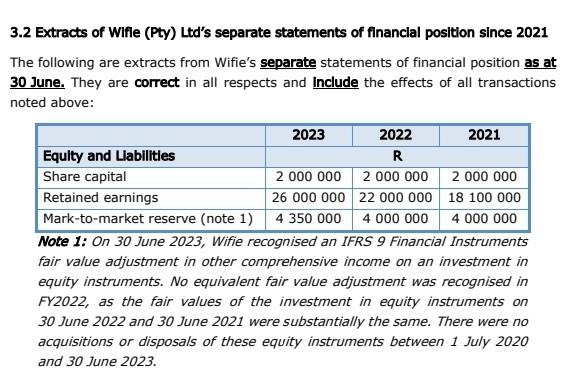

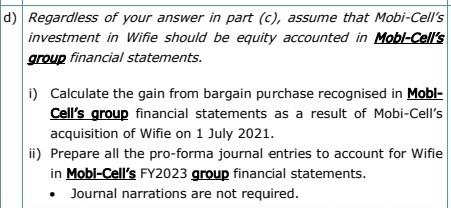

1. Background Information Mobi-Cell Ltd ("Mobi-Cell") is a mobile telecommunications company. It sells mobile phones, provides access to its mobile network 1, and sells voice minutes (airtime) and internet data (data) bundles. Airtime and data bundles are sold on both prepaid 2 and 12-month contracts. Mobi-Cell has begun preparations of its separate and group financial statements ahead of its 30 June 2023 year-end ("FY2023"). You have been tasked to assist in the accounting of some transactions brought to the attention of the financial reporting team. All the entities in the Mobi-Cell group have a 30 June year-end. Concurrently on 1 July 2021, Mobi-Cell also acquired share options enabling it to obtain a further 10% of the ordinary shares of Wifie (from existing shareholders). The share options are exercisable at any time after 1 July 2021. On 1 July 2021, Mobi-Cell did not have any intention to exercise these share options and to purchase additional Wifie ordinary shares. Mobi-Cell's intention remained unchanged to date. Voting rights influence decisions over Wifie's financial and operating policies. Since 1 July 2021, Mobi-Cell's chief financial officer has been a member of Wifie's board of directors, and she participates in decisions about dividend declarations and policy decisions related to the acquisition of significant assets. 3.1 Transactions between Mobi-Cell Ltd and Wifle (Pty) Ltd On 30 June 2023, Wifie sold an office building (correctly classified as property, plant and equipment (PPE) in Wifie's separate financial statements) to Mobi-Cell for R9 million. Mobi-Cell also correctly classified the office building as PPE in its separate financial statements. Wifie purchased the office building on 1 January 2015 for R15 million cash. On 1 January 2015, the office building had a 15 -year useful life and no residual value - these estimates remained unchanged to date. The land portion of the property is insignificant relative to the total value of the property and is correctly not accounted for separately. On 30 June 2023, Wifie paid a cash dividend of R500 000. This is the only dividend Wifie has declared and paid since 30 June 2021. 3.2 Extracts of Wifie (Pty) Ltd's separate statements of financial position since 2021 The following are extracts from Wifie's separate statements of financial position as at 30 June. They are correct in all respects and include the effects of all transactions noted above: Note 1: On 30 June 2023, Wifie recognised an IFRS 9 Financial Instruments fair value adjustment in other comprehensive income on an investment in equity instruments. No equivalent fair value adjustment was recognised in FY2022, as the fair values of the investment in equity instruments on 30 June 2022 and 30 June 2021 were substantially the same. There were no acquisitions or disposals of these equity instruments between 1 July 2020 and 30 June 2023. Regardless of your answer in part (c), assume that Mobi-Cell's investment in Wifie should be equity accounted in Mob/-Ce/Is group financial statements. i) Calculate the gain from bargain purchase recognised in MoblCell's group financial statements as a result of Mobi-Cell's acquisition of Wifie on 1 July 2021. ii) Prepare all the pro-forma journal entries to account for Wifie in Mobl-Cell's FY2023 group financial statements. - Journal narrations are not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started