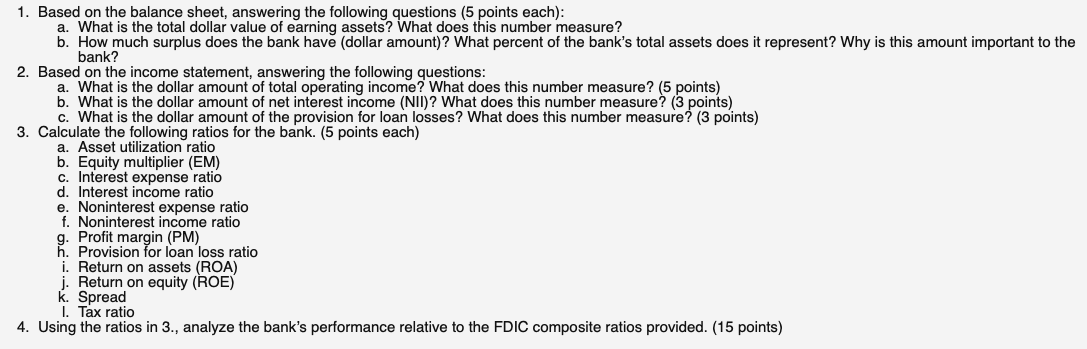

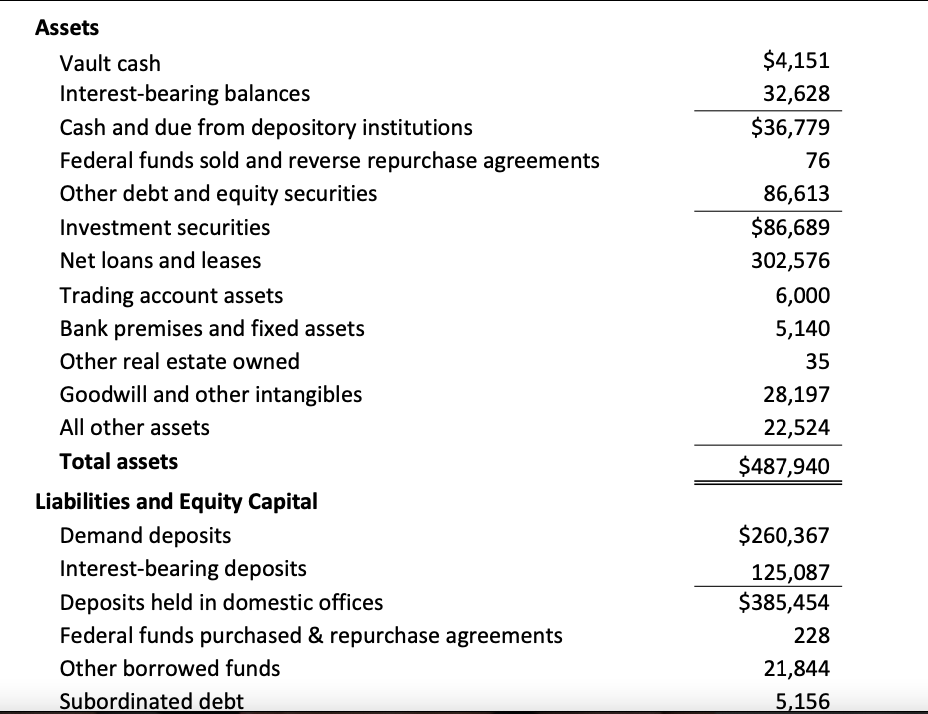

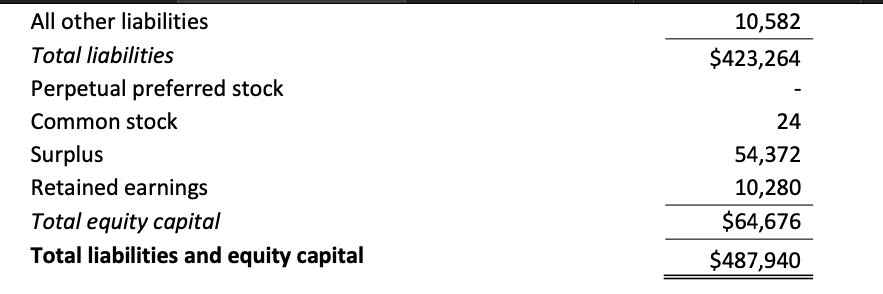

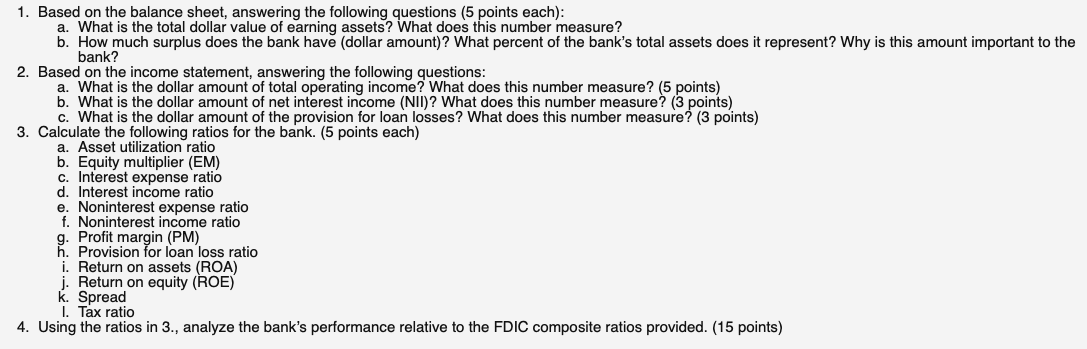

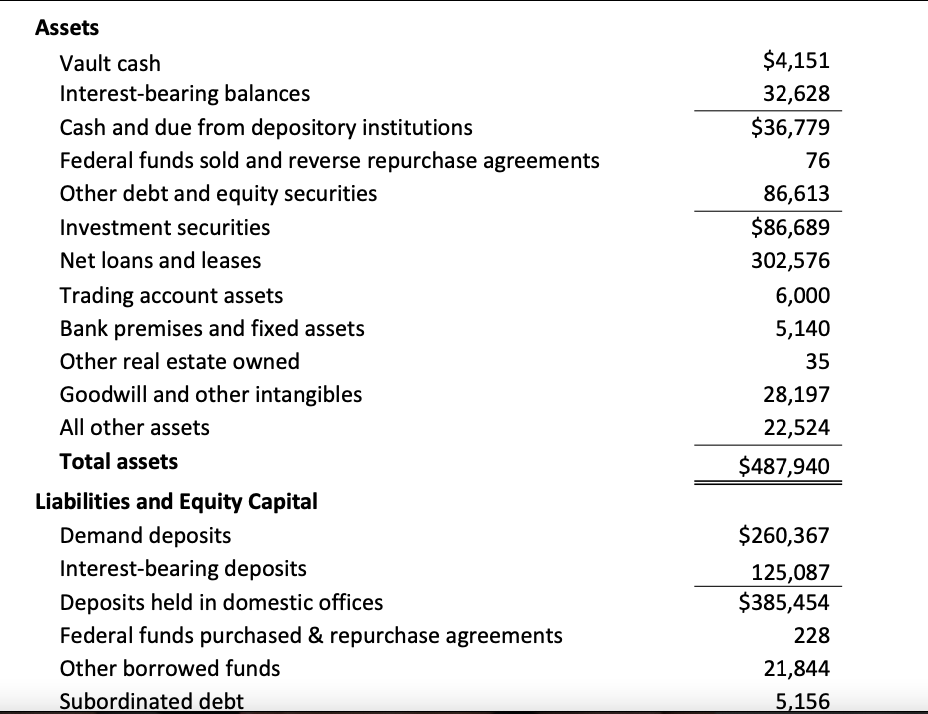

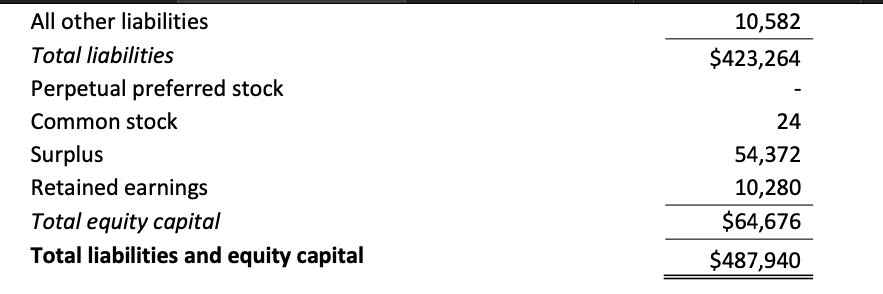

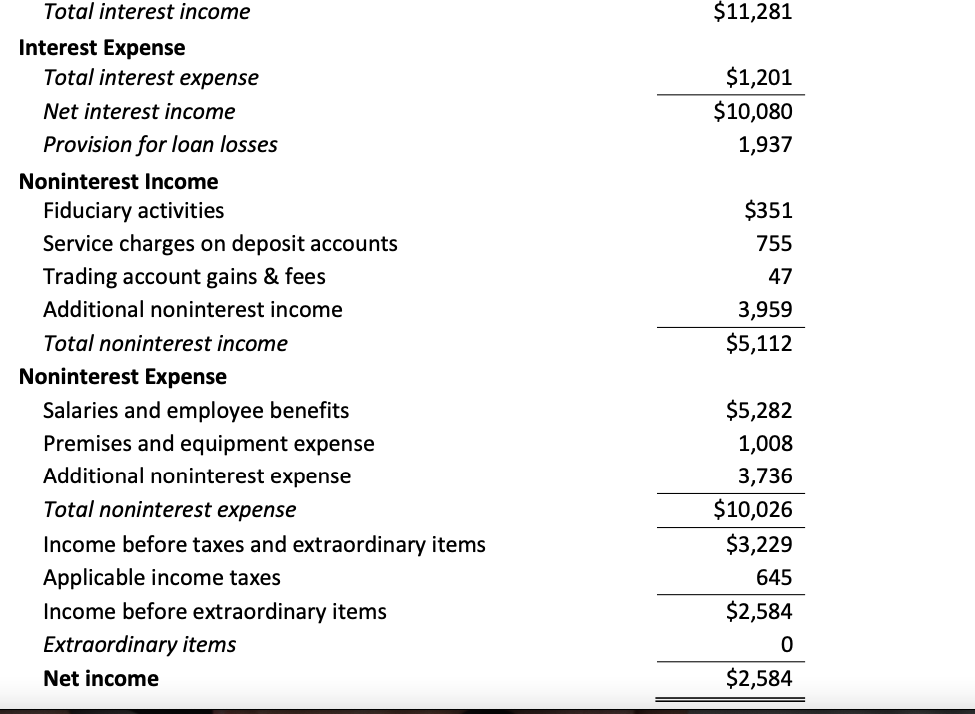

1. Based on the balance sheet, answering the following questions (5 points each): a. What is the total dollar value of earning assets? What does this number measure? b. How much surplus does the bank have (dollar amount)? What percent of the bank's total assets does it represent? Why is this amount important to the bank? 2. Based on the income statement, answering the following questions: a. What is the dollar amount of total operating income? What does this number measure? (5 points) b. What is the dollar amount of net interest income (NII)? What does this number measure? (3 points) c. What is the dollar amount of the provision for loan losses? What does this number measure? (3 points) 3. Calculate the following ratios for the bank. (5 points each) a. Asset utilization ratio b. Equity multiplier (EM) c. Interest expense ratio d. Interest income ratio e. Noninterest expense ratio f. Noninterest income ratio g. Profit margin (PM) h. Provision for loan loss ratio i. Return on assets (ROA) j. Return on equity (ROE) k. Spread 1. Tax ratio 4. Using the ratios in 3., analyze the bank's performance relative to the FDIC composite ratios provided. (15 points) Assets Vault cash Interest-bearing balances Cash and due from depository institutions Federal funds sold and reverse repurchase agreements Other debt and equity securities Investment securities Net loans and leases Trading account assets Bank premises and fixed assets Other real estate owned Goodwill and other intangibles All other assets Total assets Liabilities and Equity Capital Demand deposits Interest-bearing deposits Deposits held in domestic offices Federal funds purchased & repurchase agreements Other borrowed funds Subordinated debt $4,151 32,628 $36,779 76 86,613 $86,689 302,576 6,000 5,140 35 28,197 22,524 $487,940 $260,367 125,087 $385,454 228 21,844 5,156 10,582 $423,264 All other liabilities Total liabilities Perpetual preferred stock Common stock Surplus Retained earnings Total equity capital Total liabilities and equity capital 24 54,372 10,280 $64,676 $487,940 $11,281 $1,201 $10,080 1,937 Total interest income Interest Expense Total interest expense Net interest income Provision for loan losses Noninterest Income Fiduciary activities Service charges on deposit accounts Trading account gains & fees Additional noninterest income Total noninterest income Noninterest Expense Salaries and employee benefits Premises and equipment expense Additional noninterest expense Total noninterest expense Income before taxes and extraordinary items Applicable income taxes Income before extraordinary items Extraordinary items Net income $351 755 47 3,959 $5,112 $5,282 1,008 3,736 $10,026 $3,229 645 $2,584 0 $2,584 1. Based on the balance sheet, answering the following questions (5 points each): a. What is the total dollar value of earning assets? What does this number measure? b. How much surplus does the bank have (dollar amount)? What percent of the bank's total assets does it represent? Why is this amount important to the bank? 2. Based on the income statement, answering the following questions: a. What is the dollar amount of total operating income? What does this number measure? (5 points) b. What is the dollar amount of net interest income (NII)? What does this number measure? (3 points) c. What is the dollar amount of the provision for loan losses? What does this number measure? (3 points) 3. Calculate the following ratios for the bank. (5 points each) a. Asset utilization ratio b. Equity multiplier (EM) c. Interest expense ratio d. Interest income ratio e. Noninterest expense ratio f. Noninterest income ratio g. Profit margin (PM) h. Provision for loan loss ratio i. Return on assets (ROA) j. Return on equity (ROE) k. Spread 1. Tax ratio 4. Using the ratios in 3., analyze the bank's performance relative to the FDIC composite ratios provided. (15 points) Assets Vault cash Interest-bearing balances Cash and due from depository institutions Federal funds sold and reverse repurchase agreements Other debt and equity securities Investment securities Net loans and leases Trading account assets Bank premises and fixed assets Other real estate owned Goodwill and other intangibles All other assets Total assets Liabilities and Equity Capital Demand deposits Interest-bearing deposits Deposits held in domestic offices Federal funds purchased & repurchase agreements Other borrowed funds Subordinated debt $4,151 32,628 $36,779 76 86,613 $86,689 302,576 6,000 5,140 35 28,197 22,524 $487,940 $260,367 125,087 $385,454 228 21,844 5,156 10,582 $423,264 All other liabilities Total liabilities Perpetual preferred stock Common stock Surplus Retained earnings Total equity capital Total liabilities and equity capital 24 54,372 10,280 $64,676 $487,940 $11,281 $1,201 $10,080 1,937 Total interest income Interest Expense Total interest expense Net interest income Provision for loan losses Noninterest Income Fiduciary activities Service charges on deposit accounts Trading account gains & fees Additional noninterest income Total noninterest income Noninterest Expense Salaries and employee benefits Premises and equipment expense Additional noninterest expense Total noninterest expense Income before taxes and extraordinary items Applicable income taxes Income before extraordinary items Extraordinary items Net income $351 755 47 3,959 $5,112 $5,282 1,008 3,736 $10,026 $3,229 645 $2,584 0 $2,584