Question

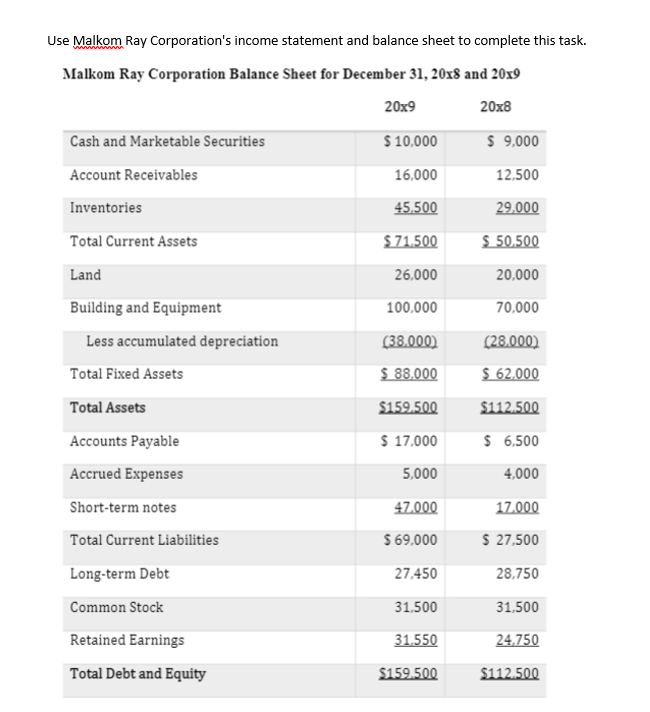

1- Based on the financial statements provided, answer the following premises: 1. Calculate the change in the company's net working capital between the years 2018

1- Based on the financial statements provided, answer the following premises: 1. Calculate the change in the company's net working capital between the years 2018 and 2019. Explain what the change in working capital could be due to that period.

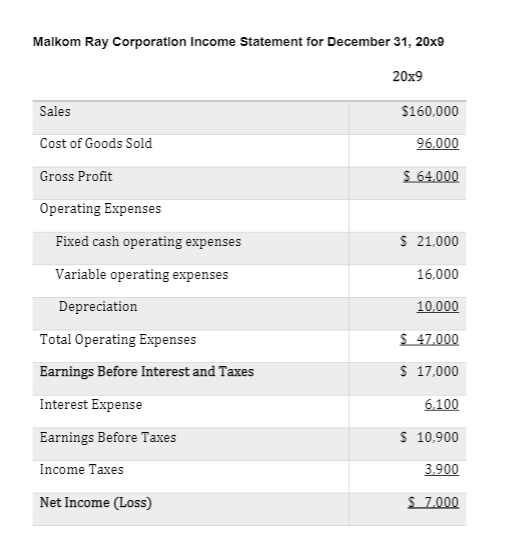

2-Calculate the following values for the company for the year ending in 2019. Present evidence of all your calculations.

a. NOPAT - Net Operating Profit after

b. OCF - Operating Cash Flow

c. FCF - Free Cash Flow

3- Discuss what meaning each of the measures calculated in the previous question has, both for management and for investors and creditors, among other constituents.

4-What is the main cause of the differences that exist between the profits of the company and the cash flows of the same evaluated period?

Use Malkom Ray Corporation's income statement and balance sheet to complete this task. Malkom Ray Corporation Balance Sheet for December 31, 20x8 and 20x9 20x9 20x8 Cash and Marketable Securities $ 10,000 $ 9,000 16.000 12,500 Account Receivables Inventories 45,500 29.000 $ 50.500 Total Current Assets $ 71.500 26,000 Land 20,000 70,000 100,000 (38.000) Building and Equipment Less accumulated depreciation Total Fixed Assets Total Assets (28.000) $ 62.000 $ 88,000 $159.500 $112.500 Accounts Payable $ 17,000 $ 6,500 Accrued Expenses 5,000 4,000 47.000 17.000 Short-term notes Total Current Liabilities $ 69,000 $ 27,500 Long-term Debt 27.450 28.750 Common Stock 31.500 31,500 31.550 24.750 Retained Earnings Total Debt and Equity $159.500 $112.500 Malkom Ray Corporation Income Statement for December 31, 20x9 20x9 Sales $160,000 Cost of Goods Sold Gross Profit Operating Expenses 96.000 $ 64.000 $ 21,000 Fixed cash operating expenses Variable operating expenses Depreciation 16,000 Total Operating Expenses Earnings Before Interest and Taxes 10,000 $ 47,000 $ 17,000 Interest Expense 6.100 Earnings Before Taxes $ 10,900 Income Taxes 3,900 Net Income (Loss) S 7.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started