Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Based on the information given, what is the amount of unpaid consulting services at December 31, 20X8, on work done by Pancake Company for

1. Based on the information given, what is the amount of unpaid consulting services at December 31, 20X8, on work done by Pancake Company for Syrup Company?

1. Based on the information given, what is the amount of unpaid consulting services at December 31, 20X8, on work done by Pancake Company for Syrup Company?

a. $10,000

b. $0

c. $15,000

d. $5,000

2. Based on the information given, what was the fair value of Syrup Company as a whole at the date of acquisition?

a. $115,000

b. $110,000

c. $135,000

d. $155,000

3. Based on the information given, what percentage of Syrup Company's shares were acquired by Pancake Company?

a. 75%

b. 60%

c. 100%

d. 80%

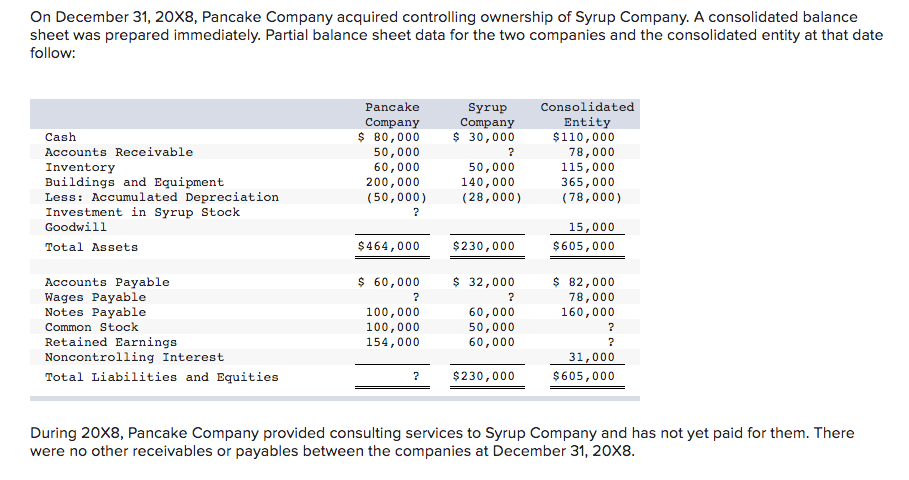

On December 31, 20X8, Pancake Company acquired controlling ownership of Syrup Company. A consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow: Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Syrup Stock Goodwill Total Assets Pancake Company $ 80,000 50,000 60,000 200,000 (50,000) ? Syrup Company $ 30,000 ? 50,000 140,000 (28,000) Consolidated Entity $110,000 78,000 115,000 365,000 (78,000) 15,000 $605,000 $ 464,000 $ 230,000 : Accounts Payable Wages Payable Notes Payable Common Stock Retained Earnings Noncontrolling Interest Total Liabilities and Equities $ 60,000 2 100,000 100,000 154,000 $ 32,000 2 60,000 50,000 60,000 $ 82,000 78,000 160,000 2 ? 31,000 $ 605,000 2 $ 230,000 During 20X8, Pancake Company provided consulting services to Syrup Company and has not yet paid for them. There were no other receivables or payables between the companies at December 31, 20X8. On December 31, 20X8, Pancake Company acquired controlling ownership of Syrup Company. A consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow: Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Syrup Stock Goodwill Total Assets Pancake Company $ 80,000 50,000 60,000 200,000 (50,000) ? Syrup Company $ 30,000 ? 50,000 140,000 (28,000) Consolidated Entity $110,000 78,000 115,000 365,000 (78,000) 15,000 $605,000 $ 464,000 $ 230,000 : Accounts Payable Wages Payable Notes Payable Common Stock Retained Earnings Noncontrolling Interest Total Liabilities and Equities $ 60,000 2 100,000 100,000 154,000 $ 32,000 2 60,000 50,000 60,000 $ 82,000 78,000 160,000 2 ? 31,000 $ 605,000 2 $ 230,000 During 20X8, Pancake Company provided consulting services to Syrup Company and has not yet paid for them. There were no other receivables or payables between the companies at December 31, 20X8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started