Question

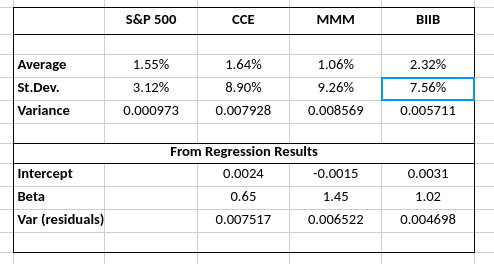

1. Based on the table above, if you are using regression-based approach to portfolio construction, which security will have the largest allocation of the investment

1. Based on the table above, if you are using regression-based approach to portfolio construction, which security will have the largest allocation of the investment funds?

a. CCE

b. MMM

c. BIIB

d. Can not tell based on the information provided

2. Based on the table above, which security appears to have the largest value of firm-specific risk?

a. CCE

b. MMM

c. BIIB

d. Can not tell based on the information provided

3. Based on the table above, which security appears to have the largest value of total risk?

a. CCE

b. MMM

c. BIIB

d. Can not tell based on the information provided

4. Based on the table above, which security appears to have the largest value of Market Driven Risk?

a. CCE

b. MMM

c. BIIB

d. Can not tell based on the information provided

5. Based on the table above, if you are currently holding a well-diversified portfolio and you would like to reduce the risk of that portfolio, which stock would you choose to add to your current holdings?

a. CCE

b. MMM

c. BIIB

d. Neither one of the stocks because each one of them will substantially increase the risk of a well-diversified portfolio

e. Cannot tell based on the information provided

6. Based on the table above, what is the proportion of Market Risk vs. Firm Specific Risk for the MMM?

A. 0.39 / 0.61

B. 0.21 / 0.65

C. 0.24 / 0.76

D. 0.67 / 0.33

7. Based on the table above, if you are using Intercept/Var(residuals) regression-based approach to portfolio construction, would you have to sell short any one of the securities?

Yes, CCE

Yes, MMM

Yes, BIIB

No

Cannot tell

8. Based on the table above, if you are using Intercept/Var(residuals) regression-based approach to portfolio construction, what would be your allocation to CCE stock?

0.0075

0.32

0.43

0.65

0.75

9. Based on the table above, and if Rf = 0.2%, what must be Jensen Alpha of BIIB security?

1.91%

0.74%

1.80%

0.019%

1.28%

PLEASE do all questions Ill give you a thumbs up and tell my friends to give you good ratings too. THanks!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started