Question

(1). Based on their financial performance in FY2017 and FY2018, please comment on each one's strength and weakness on profitability level. (2). which one is

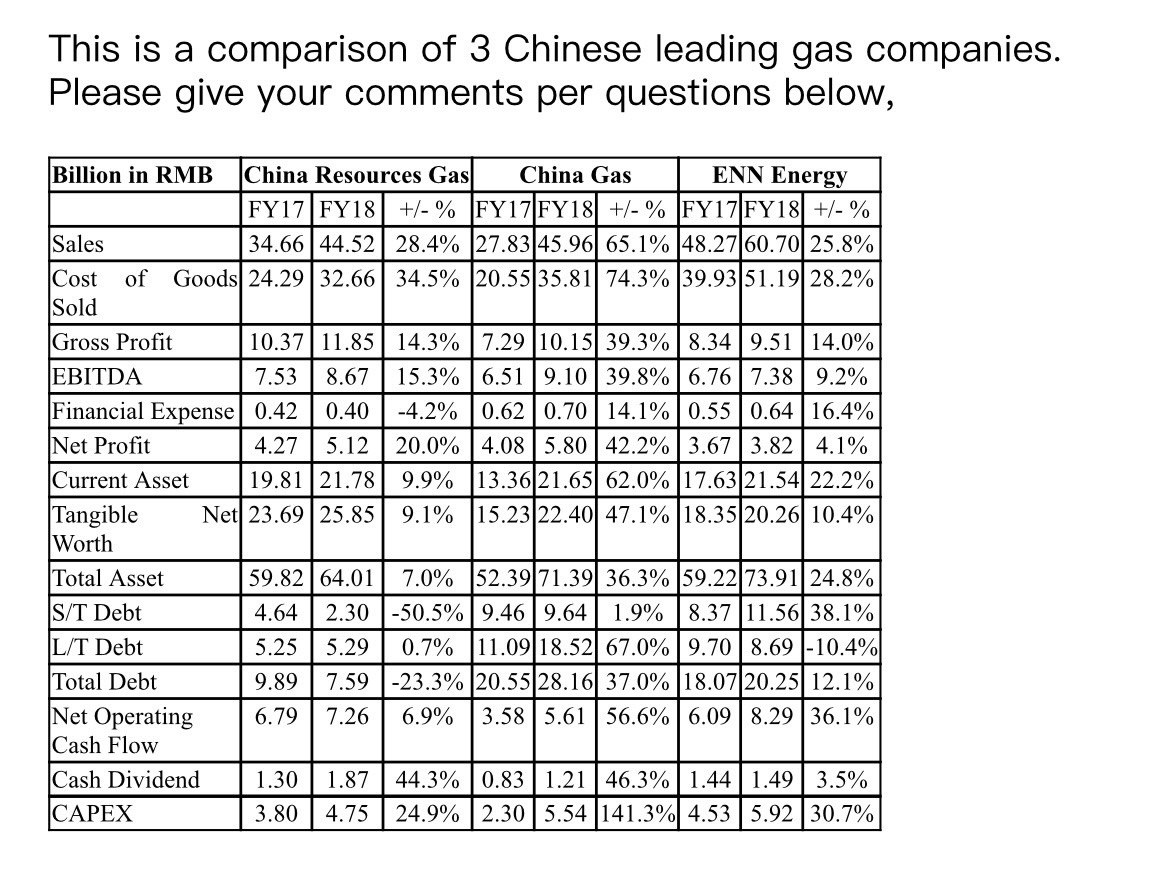

(1). Based on their financial performance in FY2017 and FY2018, please comment on each one's strength and weakness on profitability level.

(1). Based on their financial performance in FY2017 and FY2018, please comment on each one's strength and weakness on profitability level.

(2). which one is relatively stronger in terms of its overall financial performance? What are your supporting points of your view?

(3). which formula shall be used when calculating of working capital cycle? What is the correlation between "account receivable", "account payable", "inventory" towards "net operational cash flow", pls elaborate the formula simultaneously.

(4). How to access financial leverage of the above 3 companies; please give the brief comments for those 3 companies' total debt level.

(5). Where is competitive edge for this industry in the domestic market, pls choose any of these 3 companies to elaborate per your understanding?

(6). Based on your knowledge, please choose any of these 3 companies to give your "SOWT" analysis.

(7). Please give your forecast on gas industry's performance.

This is a comparison of 3 Chinese leading gas companies. Please give your comments per questions belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started