Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1, Based on your analysis of the ratios you calculated above, which cruise chain appears to be better financially equipped to sustain the financial burdens

1, Based on your analysis of the ratios you calculated above, which cruise chain appears to be better financially equipped to sustain the financial burdens incurred by the COVID-19 pandemic? Please explain your reasoning.

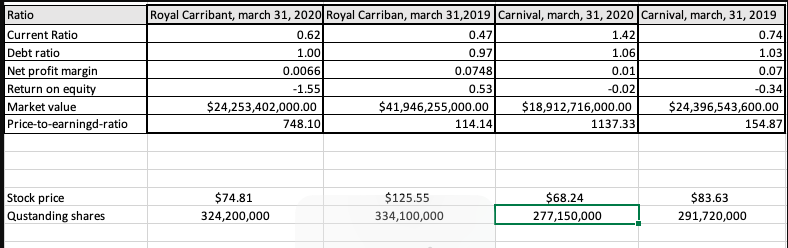

Ratio Current Ratio Debt ratio Net profit margin Return on equity Market value Price-to-earningd-ratio Royal Carribant, march 31, 2020 Royal Carriban, march 31,2019 Carnival, march, 31, 2020 Carnival, march, 31, 2019 0.62 0.47 1.421 0.74 1.00 0.97 1.06 1.03 0.0066 0.0748 0.01 0.07 -1.55 0.53 -0.02 -0.34 $24,253,402,000.00 $41,946,255,000.00 $18,912,716,000.00 $24,396,543,600.00 748.10 114.14 1137.33 154.87 Stock price $74.81 324,200,000 $125.55 334,100,000 $68.24 277,150,000 $83.63 291,720,000 Qustanding sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started