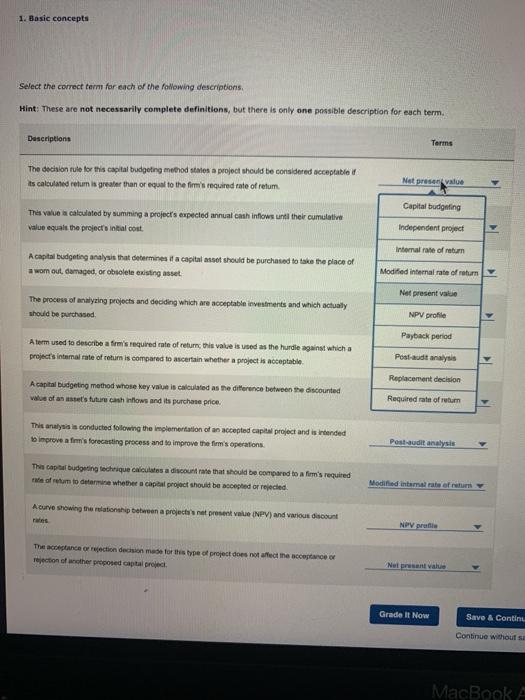

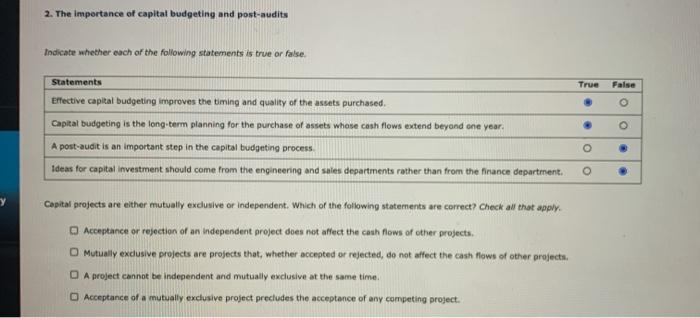

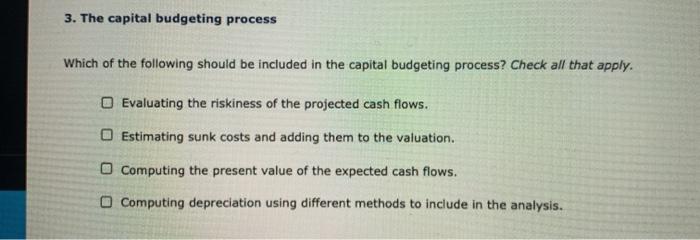

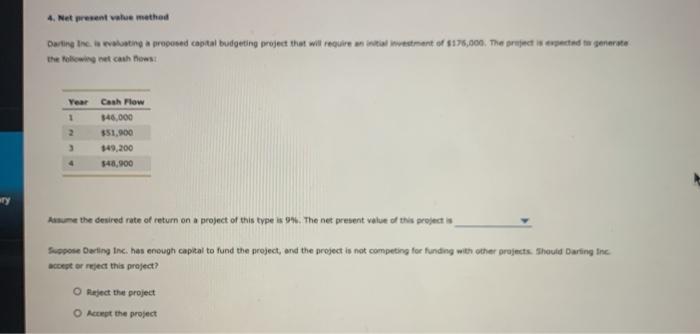

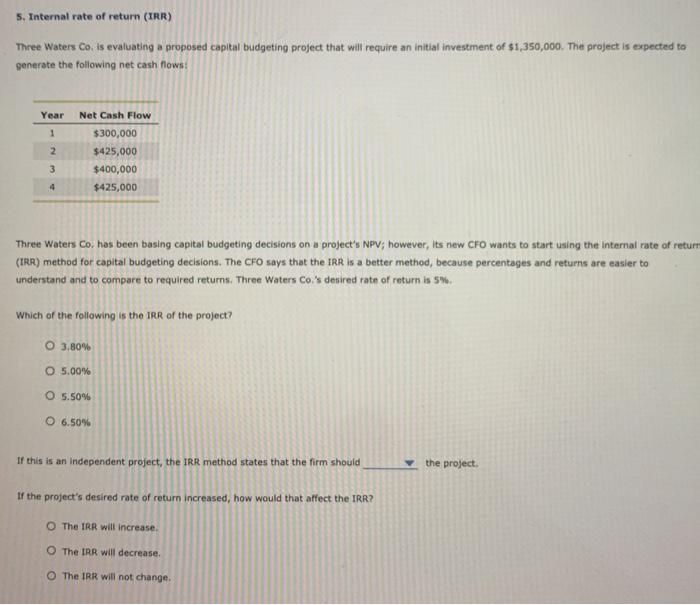

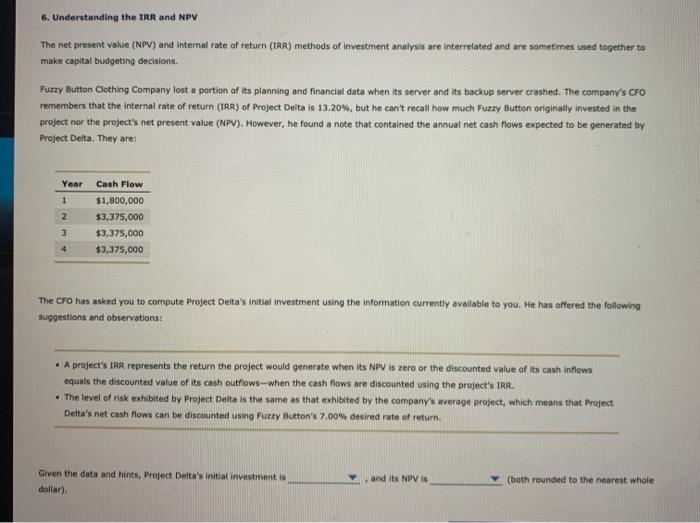

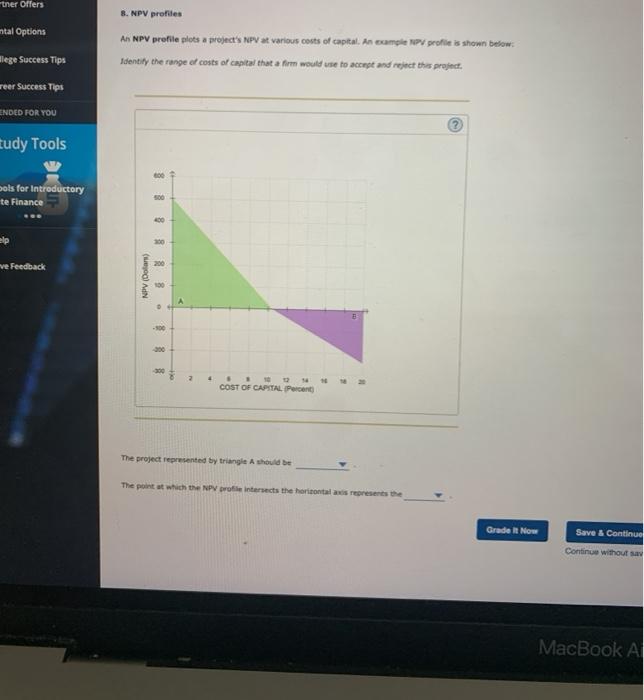

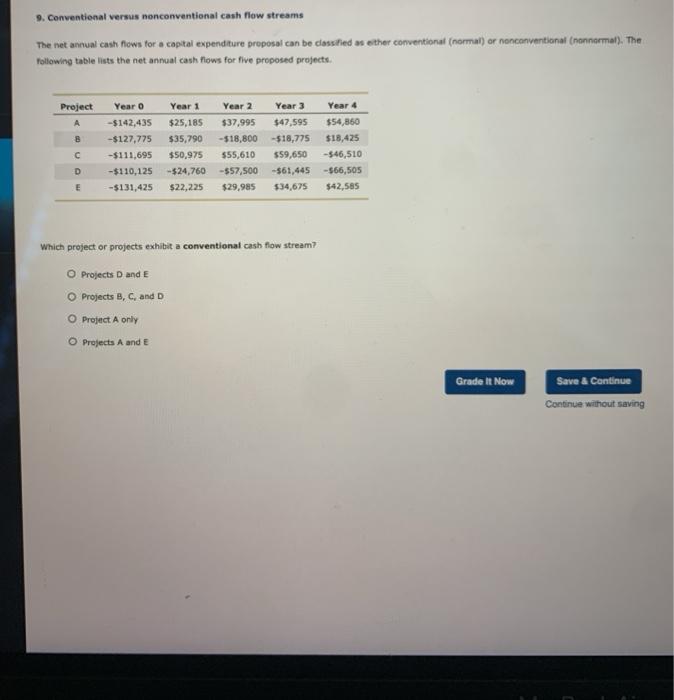

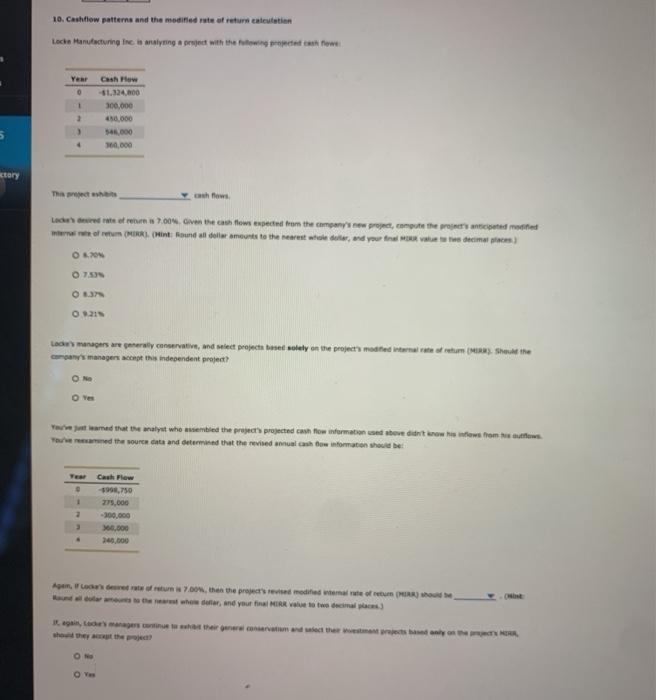

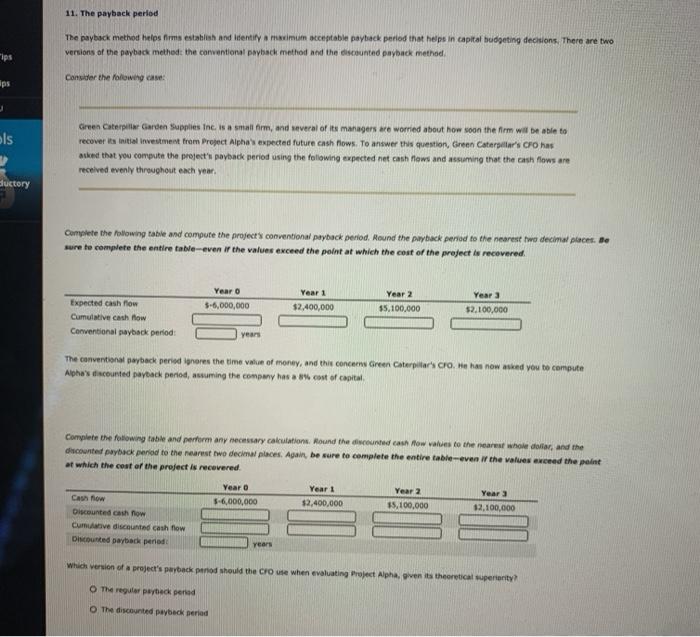

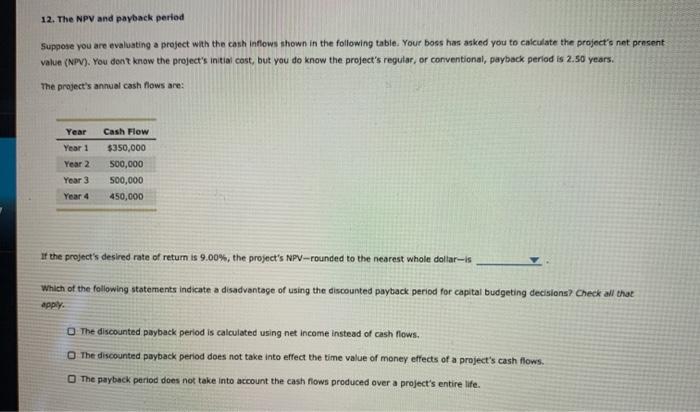

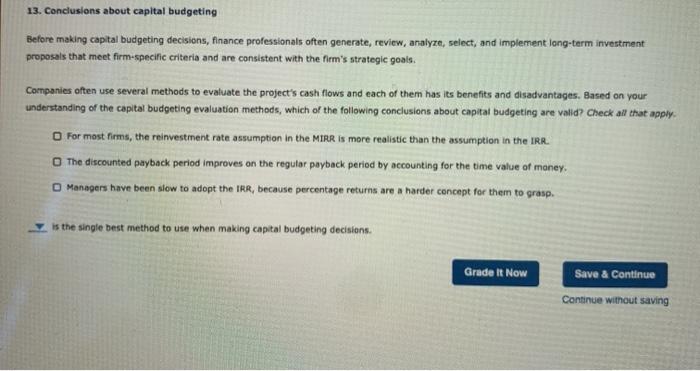

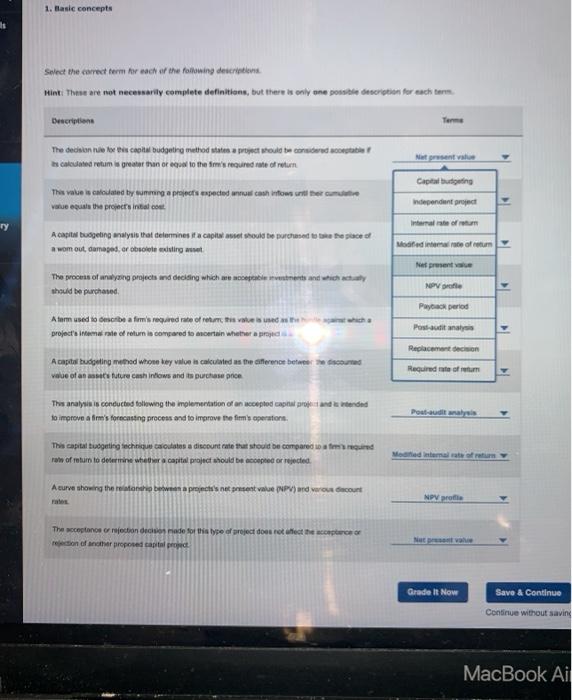

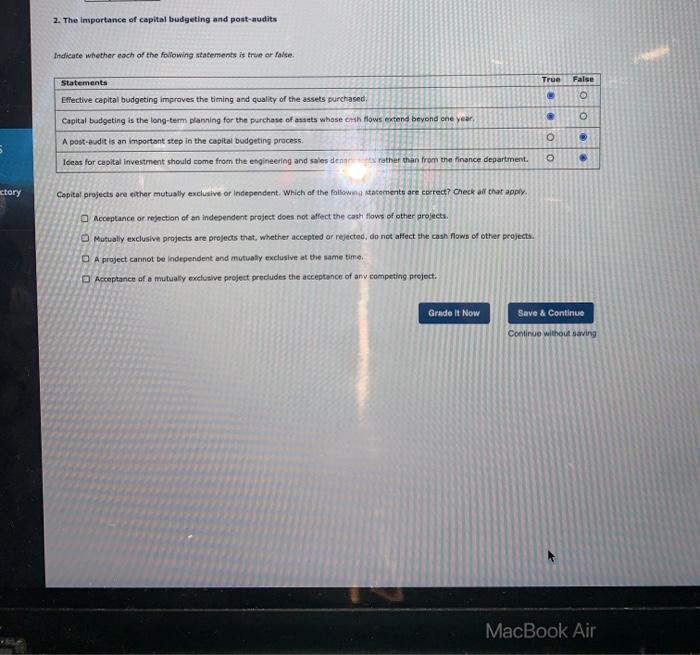

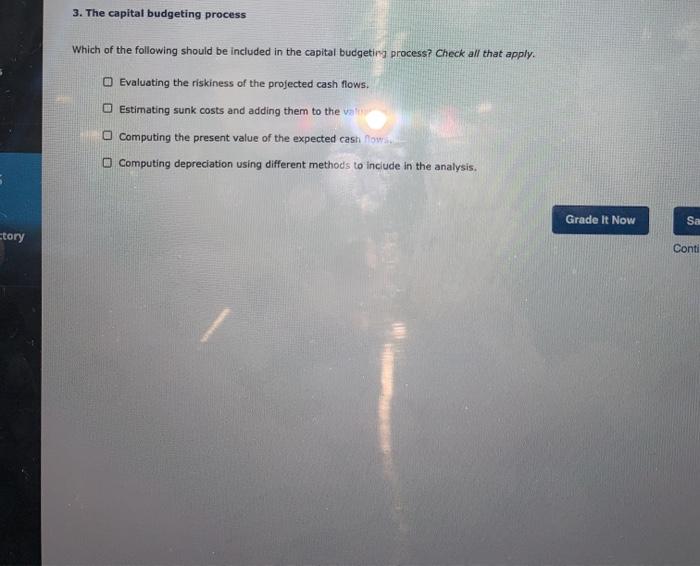

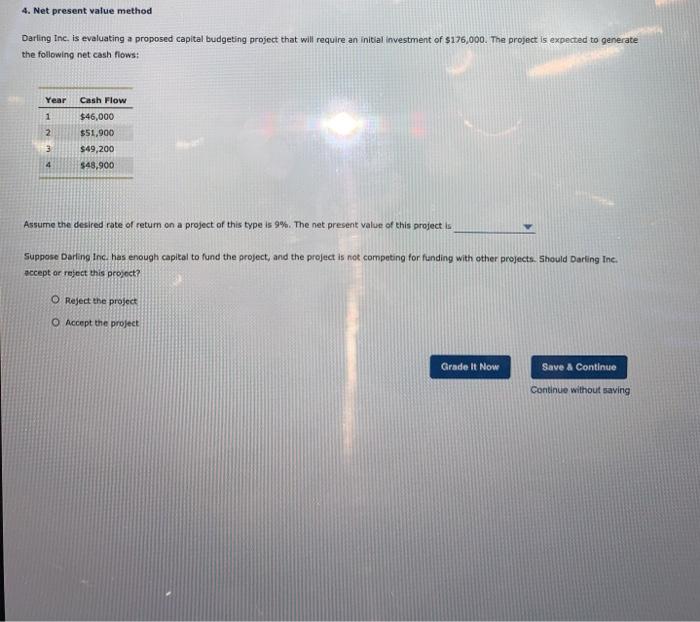

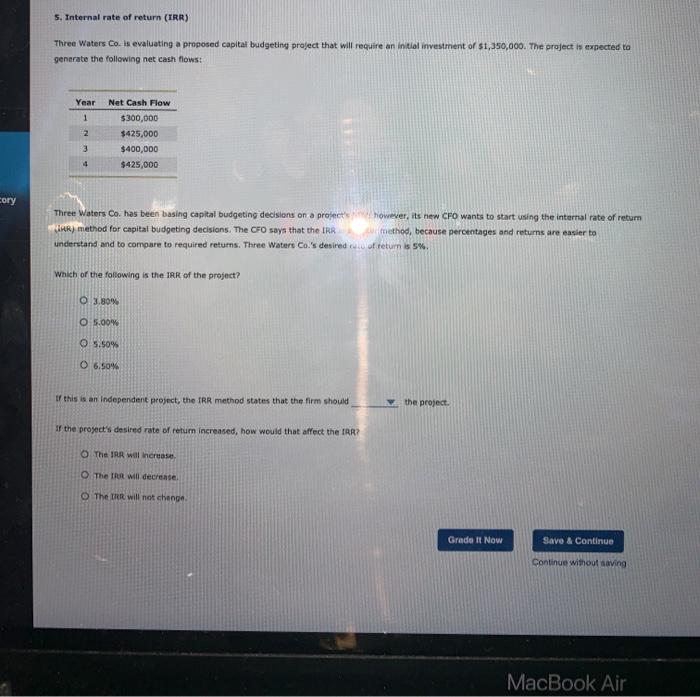

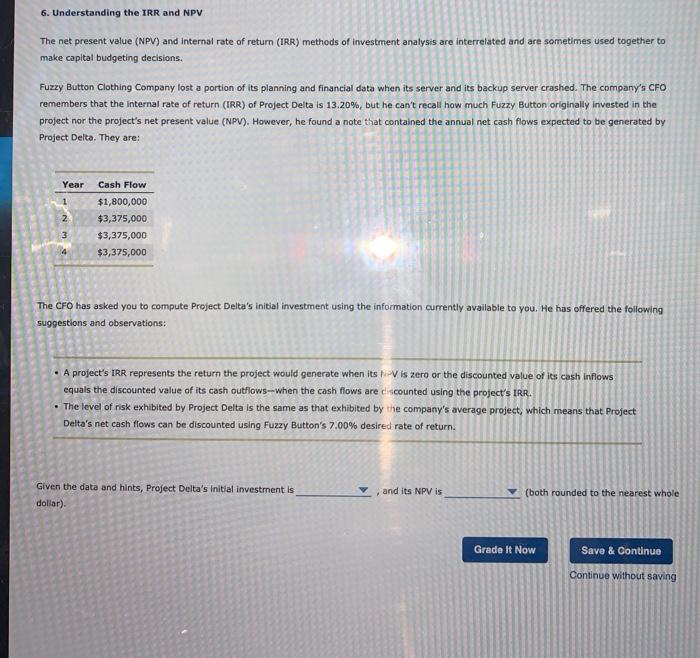

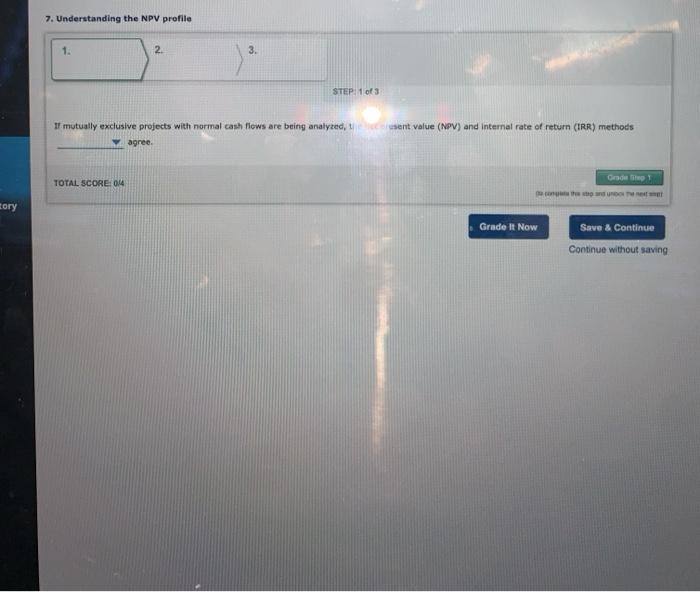

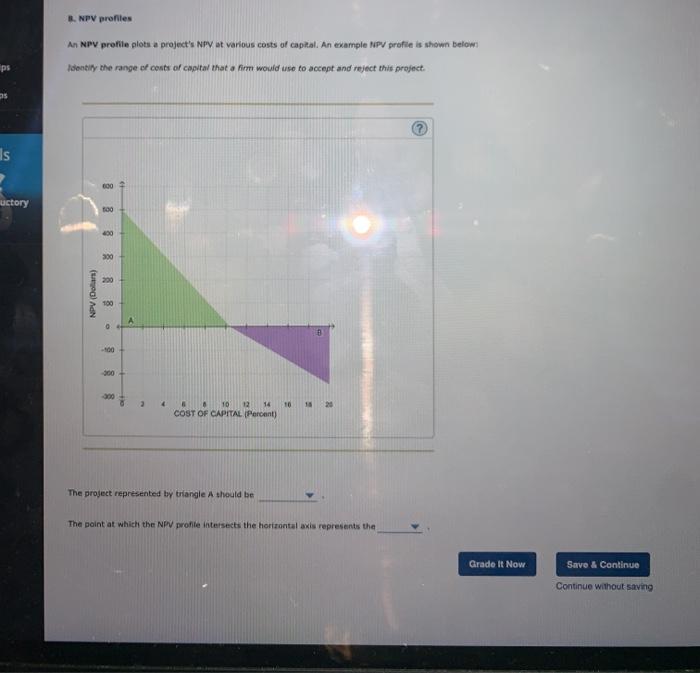

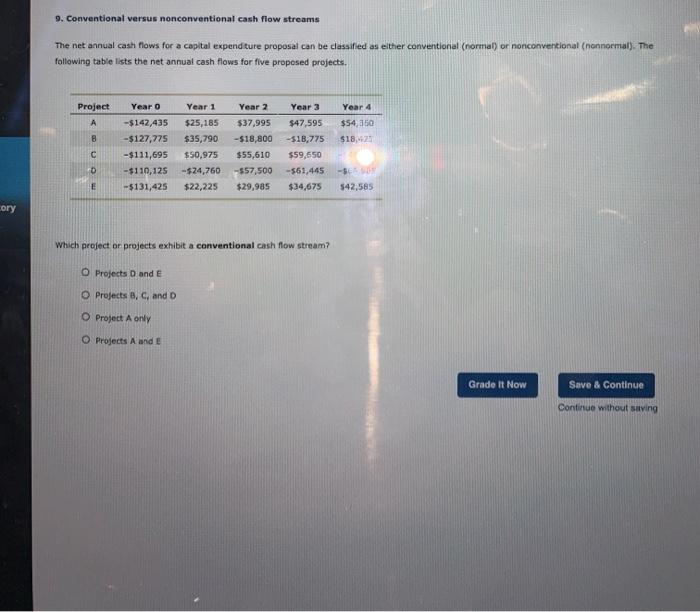

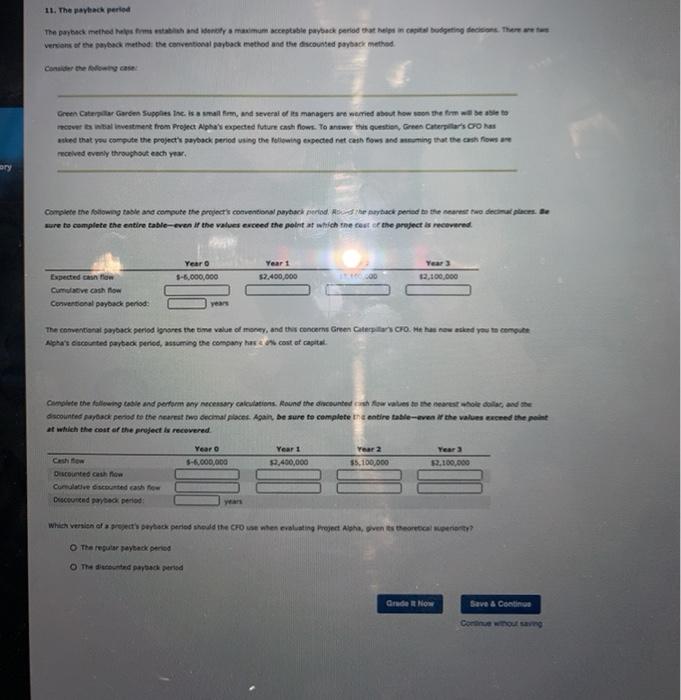

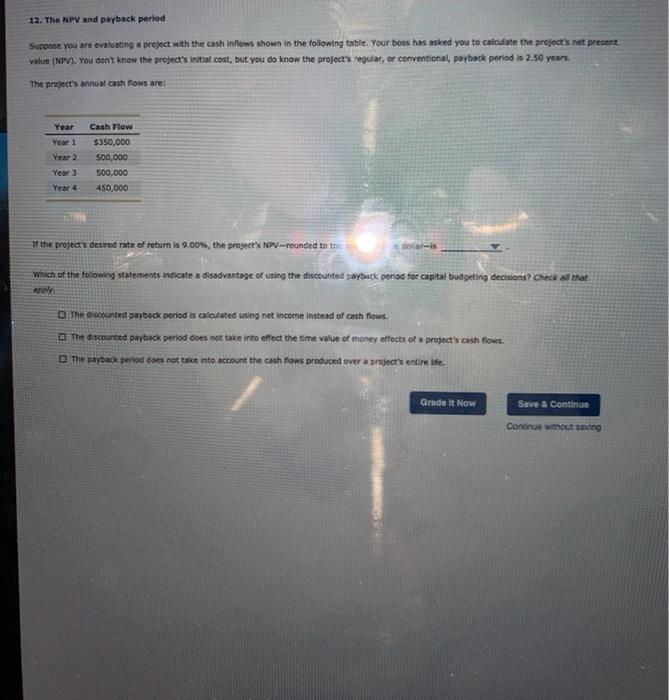

1. Basic concepts Select the correct term for each of the following descriptions Hint: These are not necessarily complete definitions, but there is only one possible description for each term. Descriptions Terms The decision rule for this capital budgeting method states a project should be considered acceptable is calculated retum is greater than or equal to the firm's required rate of retum. Net present value Capital budgeting This value is calculated by summing a project's expected annual cash inflows unt their cumulative Value equals the projects intal cost Independent project Internal rate of return Modified internal rate of return A capital budgeting analysis that determines la capital annet should be purchased to take the place of a wom out, damaged or obsolete existing asset The process of anwyzing projects and deciding which are acceptable investments and which actually should be purchased Net present value NPV profile Payback period A term used to describe a firm's required rate of return, this value is used as the hurdle against which a project's internal rate of return is compared to ascertain whether a project is acceptable Posladit nie > Replacement decision A capital Budgeting method whose key value is calculated as the difference between the discounted value of an asset's future cash flows and its purchase price Required rate of return 1 This analysis is conducted following the implementation of an accepted capital project and is rended Improve a firm's forecasting process and to improve the firm's operations Postaudit analysis The capital budgeting technique calculates a discount rate that should be compared to a firm's required ale of return to determine whether a capital project should be accepted or rejected Modified intamal rate of A curve showing the relationship between a projectes not presente NPV) and various discount NPV prufi The concorrection decision made for this type of project does not affect the starce rejection of other proposed capital project Nel present value Grade It Now Save & Contine Continue without se MacBook 2. The importance of capital budgeting and post-audits Indicate whether each of the following statements is true or false. True False o Statements Effective capital budgeting improves the timing and quality of the assets purchased. Capital budgeting is the long term planning for the purchase of assets whose cash flows extend beyond one year. A post-audit is an important step in the capital budgeting process Ideas for capital investment should come from the engineering and sales departments rather than from the finance department. Capital projects are other mutually exclusive or Independent. Which of the following statements are correct? Check all that apply. Acceptance or rejection of an independent project does not affect the cash flows of other projects. Mutually exclusive projects are projects that, whether accepted or rejected, do not affect the cash flows of other projects A project cannot be independent and mutually exclusive at the same time. Acceptance of a mutually exclusive project precludes the acceptance of any competing project. 3. The capital budgeting process Which of the following should be included in the capital budgeting process? Check all that apply. Evaluating the riskiness of the projected cash flows. Estimating sunk costs and adding them to the valuation. Computing the present value of the expected cash flows. Computing depreciation using different methods to include in the analysis. 4. Net present value method Darting the wasting proposed capital budgeting project that will require an intlnvestment of $175,000. The project is expected to generate the Rowing cathews Year Cash Flow 1 346.000 351,000 > 149.200 543,900 ry Asume the desired rate of return on a project of this type is 94. The net present value of this project is Sopote Decling Inc. has enough capital to fund the project, and the project is not competing for funding with other projects. Should During Inc accept or reject this project? O Reject the project O Acort the project 5. Internal rate of return (IRR) Three Waters Co is evaluating a proposed capital budgeting project that will require an initial investment of $1,350,000. The project is expected to generate the following net cash flows: Year 1 2 3 Net Cash Flow $300,000 $425,000 $400,000 $425,000 4 Three Waters Co. has been basing capital budgeting decisions on a project's NPV; however, its new CFO wants to start using the Internal rate of retum (IRR) method for capital budgeting decisions. The CFO says that the IRR is a better method, because percentages and returns are easier to understand and to compare to required returns. Three Waters Co.'s desired rate of return is 5%. Which of the following is the IRR of the project? O 3.80% O. 5.00% O 5.50% O 6.50% If this is an independent project, the IRR method states that the firm should the project If the project's desired rate of return increased, how would that affect the IRR? O The IRR will increase. The IRR will decrease. The IRR will not change. 6. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Puzzy Button Clothing Company lost a portion of its planning and financial data when its server and its backup server crashed. The company's CFO remembers that the Internat rate of return (IRR) of Project Delta is 13.20%, but he can't recall how much Fuzzy Button originally invested in the project nor the project's net present value (NPV). However, he found a note that contained the annual net cash flows expected to be generated by Project Delta. They are: Year 1 2 3 Cash Flow $1,800,000 $3,375,000 $3,375,000 $3,375,000 The CFO has asked you to compute Project Delta's initial investment using the Information currently available to you. He has offered the following suggestions and observations: A project's IRB represents the return the project would generate when its NPV is zero or the discounted value of its cash intlows equals the discounted value of its cash outflows--when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Delta is the same as that exhibited by the company's average project, which means that Project Delta's net cash flows can be discounted using Fuzzy Button's 7.00% desired rate of return Given the data and hints, Project Delta's initial investment is dollar). and its NPV is (both rounded to the nearest whole 7. Understanding the NPV profile 2. 3. STEP 1 of 3 If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods agree. tner Offers mtal Options 8. NPV profiles An NPV profile plots a project's NPV at various costs of capital. An campie NP profile is shown below: Identity the range et costs of capital that a firm would use to accept and reject this project. lege Success Tips reer Success Tips ENDED FOR YOU tudy Tools bols for Introductory te Finance 500 400 elp ve Feedback NPV (D) -100 2 COST OF CAPITAL Percent) The project represented by triangle A should be The point at which the NPV profile intersects the horizontal represents the Grade It Now Save & Continue Continue without sa MacBook A 9. Conventional versus nonconventional cash flow streams The net annual cash flows for a capital expenditure proposal can be classified as other conventional (normal) or nonconventional (nonnormal). The Following table lists the net annual cash flows for live proposed projects. Project B mo >> Year o -$142,435 -$127,775 -$111,695 -$110,125 -$131,425 Year 1 $25,185 $35,790 $50,975 - $24,760 $22,225 Year 2 $37,995 --$18,800 $55,610 -$57,500 $29,985 Year 3 $47,595 -$18,775 $59,650 -$61,445 Year 4 $54,850 $18,425 -$46,510 -566,505 $42,585 $34,675 Which project or projects exhibit a conventional cash flow stream? O Projects and E O Projects B, C, and D O Project A only O Projects A and E Grade It Now Save & Continue Continue without saving 10. Castlow patterns and the modified rate of return catetation Leche Manufacturing the saying set with the pred cestowe Year Cash Flow -51.324.000 1 300.000 450.000 0.000 The thes Ladded to returns 7.009. Given the cash flows expected from the company's new project the priced med merem Hint Round all dollar amounts to the nearest woke dollar, and your final MOR Vw decimal) O. 07 O. 0211 Lady managers are generwy cervative, and mlect project at solely on the project modified ternal rate of retum ( Shout the can managers coups independent project ON Yes Yo wamed that the way whessembled the projects projected cash flow information used above didnt know how to use them Yled the source date and determined that the revised annual cash flow information should be 1 2 -998,750 275,000 300,000 100,000 2 . Ape, der returns 700w, then the project's revised modified woma rate of tum (MIR) thers who dotar, and your final ERR to two decimal) imagens curther recorte che estimates RA O 0 11. The payback period The payback method helps firms establish and identify amarimum acceptable payback period that helps in capital budgeting decisions. There are two versions of the payback method the conventional payback method and the discounted payback method Tips ps Consider the following case ols Green Caterpill Garden Supplies Inc. is a small him, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha's expected future cash flows. To answer this question, Green Caterpillar's CFO has asked that you compute the project's payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year, Suctory Complete the following table and compute the project's conventional payback period. Round the payback period to the nearest two decimales. De sure to complete the entire table-even if the values exceed the point at which the cost of the project is recovered. Year o 5-6,000,000 Year 1 $2,400,000 Year 2 55.100.000 Year 3 $2.100,000 Expected cash flow Cumulative cash flow Conventional payback period: years The conventional payback period ignores the time value of money, and this concerns Green Caterpillar's Cro. He has now asked you to compute Alpha's discounted payback period, assuming the company has a cont of capital Complete the following table and perform any necessary calculations. Hound the discounted cash flow valves to the nearest whole dolar, and the counted payback period to the nearest two decimal places. Again, be sure to complete the entire table-even if the values exceed the point at which the cost of the project is recovered Year Year 1 Year 2 Year 3 Cash flow 5-6,000,000 $2,400,000 5,100,000 12,100,000 Discounted cash now Cumave discounted cash flow Discounted payback period Years Which version of a project's payback period should the Crouse when evaluating Project Alpha, given its theoretical superiority? The regular payback pened The discounted payback period 12. The NPV and payback period Suppose you are evaluating a project with the cash inflows shown in the following table. Your boss has asked you to calculate the project's not present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. The project's annual cash flows are: Year Year 1 Year 2 Year 3 Year 4 Cash Flow $350,000 500,000 500,000 450,000 If the project's desired rate of return is 9.00%, the project's NPV -rounded to the nearest whole dollar-Is Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. The discounted payback period is calculated using net income instead of cash flows, The discounted payback period does not take into effect the time value of money effects of a project's cash flows. The payback period does not take into account the cash flows produced over a project's entire life. 13. Conclusions about capital budgeting Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement lang-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply. For most firms, the reinvestment rate assumption in the MIRR is more realistic than the assumption in the IRR. The discounted payback period improves on the regular payback period by accounting for the time value of money Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp. is the single best method to use when making capital budgeting decisions Grade It Now Save & Continue Continue without saving 1. Basic concepts Select the correct term for each of the following descriptions Wint. These are not necessarily complete definitions, but there is only one one possible description for each to Descriptions Terme The decision nuo tortiu carita budgeting method utate a project would be considera cortable! is calculated retum is greater than or equal to them's required rate of return Capital budgeting The value is calculated by ang precis expected annual can now until the com Value guts the projects into independent 10 from A capital budgeting analysis that determines it a capit should the purchased to the place a wom out, damaged or being Model of turn Ne present The process of analyzna projects and deciding which meble meters and which should be purchased Note Pay period Post-ulit was Atom used to menbe a firm's required rate of return is value is used projects Intemal rate of retum a compared to ascertain whether a pred A capital budgeting method whone bey value in calculated as the difference between discourad value of an ass future cushiniows and to purchase price Replacement con Required to return The analysis is conducted tolowing the implementation of an accepted capitat profit and entended to improve a firm's forecasting process and to improve the firm's operations This capital budgeting technique toutes a discount rattutstould be compared to a fred rol of return to determine whether a capital project should be compted or rejected Nontomater A curve showing the retoh between a project's nest value NPV) and count NPV proti The acceptance e con decer nade for this type of project dont ret uhet the copter rejection of the proposed capital Grade It Now Save & Continue Continue without saving MacBook Ai 3. The capital budgeting process Which of the following should be included in the capital budgeting process? Check all that apply. Evaluating the riskiness of the projected cash flows. Estimating sunk costs and adding them to the va Computing the present value of the expected cash now Computing depreciation using different methods to include in the analysis. Grade It Now Sa tory Conti 4. Net present value method Darling Inc. is evaluating a proposed capital budgeting project that will require an initial investment of $176,000. The project is expected to generate the following net cash flows: Year 1 2 3 Cash Flow $46,000 $51,900 $49,200 548,900 4 Assume the desired rate of return on a project of this type is 9%. The net present value of this project is Suppose Darling Inc. has enough capital to fund the project, and the project is not competing for funding with other projects. Should Darling Inc. accept or reject this project? O Reject the project O Accept the project Grade It Now Save A Continue Continue without saving 5. Internal rate of return (IRR) Three Waters Co. is evaluating a proposed capital budgeting project that will require an initial investment of $1,350,000. The project is expected to generate the following net cash flows: Year 1 2 Net Cash Flow $300,000 $425,000 $400,000 $425,000 3 4 cory Three Waters Co. has been basing capital budgeting decisions on a proiect however, its new Cho wants to start using the internal rate of return IHR) method for capital budgeting decisions. The CFO says that the IRR method, because percentages and returns are easier to understand and to compare to required returns. Three Water Co.'s desired cut of return is 5%. Which of the following is the IRR of the project? O 3.809 O 5.00% 0 5.50% O 6.50% If this is an independent project, the IRR method states that the firm should the project If the project's desired rate of return increased, how would that affect the TAR? The IRR will increase The IRR will decrease The IRR will not change Grade It Now Save & Continue Continue without saving MacBook Air 6. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Fuzzy Button Clothing Company lost a portion of its planning and financial data when its server and its backup server crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Delta is 13.20%, but he can't recall how much Fuzzy Button originally invested in the project nor the project's net present value (NPV). However, he found a note that contained the annual net cash flows expected to be generated by Project Delta. They are: Year Cash Flow 1 2 $1,800,000 $3,375,000 $3,375,000 $3,375,000 3 The CFO has asked you to compute Project Delta's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Delta is the same as that exhibited by the company's average project, which means that Project Delta's net cash flows can be discounted using Fuzzy Button's 7.00% desired rate of return. Given the data and hints, Project Delta's initial investment is dollar). and its NPV is (both rounded to the nearest whole Grade It Now Save & Continue Continue without saving 7. Understanding the NPV profile 1. 2 3. STEP: 1 of 3 If mutually exclusive projects with normal cash flows are being analyzed, tsent value (NPV) and internal rate of return (IRR) methods agree Grade TOTAL SCORE 04 UND cory Grade it Now Save & Continue Continue without saving NPV profiles An NPV profile plots a project's NPV at various costs of capital. An example NPV profile is shown below ps Identify the range of conts of capital that a firm would use to accept and reject this project. es Is uctory 100 400 200 200 () AN -100 200 2 4 TO 18 20 6 10 12 14 COST OF CAPITAL (Percent) The project represented by triangle A should be The point at which the NPV profile intersects the horizontal axis represents the Grade It Now Save & Continue Continue without saving 9. Conventional versus nonconventional cash flow streams The net annual cash flows for a capital expenditure proposal can be classified as either conventional (normal) or nonconventional (nonnormal). The following table lists the net annual cash flows for five proposed projects. Year 1 Project A Year 4 $54,350 $18,23 Year o -$142,435 -$127,775 -$111,695 - $110,125 -5131,425 Year 2 $37,995 -$18,800 $55,610 -$57,500 $29,985 $25,185 $35,790 $50.975 -$24,760 $22,225 Year 3 $47,595 -518,775 $59,650 -561,445 $34,675 D E 542,585 ory Which project or projects exhibit a conventional cash flow stream? O Projects and E O Projects a, , and D O Project A only Projects A and E Grade It Now Save & Continue Continue without saving 10. Cashflow patterns and the modified rate of return calculation Locke Manufacturing Inc. is analysing a project with the following projected cash flows Year D 1 Cash Flow -$1,324,800 300,000 450,000 546,000 360,000 2 3 4 This project exhibits cash flows. Locke's desired rate of return is 7.00%. Given the cash flows expected from the company's new project, compute the projects anticipated modified internal rate of return (MERR). (Hint: Round all dollar amounts to the nearest Whole dollar, and your final MIRR value to two decimal places) 0 6.70% 0 7.53% 08.07 O 9.21% Locke's managers are generally conservative, and select projects based solely on the project's modified Internal rate of return (MIRR). Should the company's managers accept this independent project? O No O Yes You've just learned that the analyst who assembled the project's projected cash flow information used above didn't know his inflows from soutflows. You've reexamined the source data and determined that the revised annuat cash flow information should be Year 1 2 Cash Flow -5998,750 275,000 -300,000 360,000 240,000 4 Again, if coche's desired rate of return is 7.00%, then the project's revised modified internal rate of retur (MIR) should be Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) (Hint 11 again,Locke's managers continue to exhibit their general conservatism and select their investment projects based only on the project's MRR. should they accept the project? O No Yes 11. The payback period The payback methods and you acceptable pwyback period that is being con. There Verner the payback method the conventional payback method and the discounted payback method consider the case Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how on the fome to moet blivestment from Project Alpha's expected future cash flow. To answer this question, Green Caterpillars com ke that you compute the project payback period using the following expected netcafows and ming that the cases flow received evenly throughout each yea. Complete the following table and compute the project's conventional phack period od pack period to se near two decades sure to complete the entire table-even if the values exceed the point at which the cost of the project is recovered Year 3-6,000,000 Year 1 2.400,000 00 2,100,000 Expected now Cum cash now Conversional payback period: now and you to come The comentionat payback period brores the time value of money, and this concerne Green Caterpillar CFO ME Alpha's encounted payback period, assuming the company has cost of capital. Complete the following ble and perform any necessary calculations found the counted show value to the nearesto do and the scounted wyback pened to the nearest two decimal places. Again, be sure to complete me entire table-even if the values and there at which the cost of the project is recovered Year 5-6.000.000 Year 1 2,400,000 Year 2 $5,100,000 Year 2.100.000 Decounted ca Corte de cash Which version of propertiek period shodd the CFOwhen evaluating Project Athavens theoretical The reputar peyback period The pack period Order Now Save & Continue 12. The NPV and payback period Suppose you are evaluating a project with the cash inflows shown in the following table. Your boss has asked you to calculate the project's net present Value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years The project's annual cash flows are: Year Year 1 Year 2 Year 3 Cash Flow $350,000 S00,000 500,000 450,000 Year 4 the project's desired rate of return is 9.00%, the project's NPV-rounded to t dollar- Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check that w The discounted payback period is calculated using net income instead of cash nows. The discounted payback period does not take into effect the time value of money effects of a project's cash flows. The payback period does not take into account the cash flows produced over a project's entire life. Grade it Now Save & Continue Continue without saving 13. Conclusions about capital budgeting Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash Mows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply For most firms, the reinvestment rate assumption in the MIRR is more realistic than the assumption in the IRR. The discounted payback period improves on the regular payback period by accounting for the time value of money. Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp. ory is the single best method to use when making capital budgeting decisions Grade R Now Save & Continue Continue without saving ope capital structure. We get to choose the form of money used to finance Caberto's activities. We can use borrowed (det) money or retained earnings, we can sell new shares of common stock, or we can sell new preferred shares. So, my ouestion to you, Natalia, is how do we know what sources of financing have been used in the past, and how much of each should we use in the future? ... NATALIA: The section of the company's balance sheet reports the forms of financing that have been used in the past. These forms of financing represent ongoing financial commitments of the firm. Since Caberto's current capital structure consists of 54.5% debt and 45.5% common equity, then we know that our current or the proportion of debt in the capital structure, is 54.5% CFO: And? NATALIA: We know that Caberto can exhibit three possible capital structures: its current, actual capital structure, a target capital structure, and an optimal capital structure. The capital structure is the long-run structure at which Caberto ultimately wants to operate, while an capital structure wil macimize the value of Caberto's common stock and make our shareholders very happy. CFO: Good, Natalia Now, is there a relationship between a firm's optimal capital structure and its weighted average cost of capital? NATALIA: Yes, there is a relationship, not only will an optimal capital structure maximize the value of a corporation, it will also the company's weighted average cost of capital. However, the exact value of the corresponds to an organization's optimal capital structure depends on its industry and the characteristics of the firm. that So & $ 4 3 % 5 ( 9 6 7 > 0 8 E R T