Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Basil buys a forward contract today (t-9/10/21) on 100 shares of CSCO stock from Sally, deliverable T = 31 Dec 21; they agree

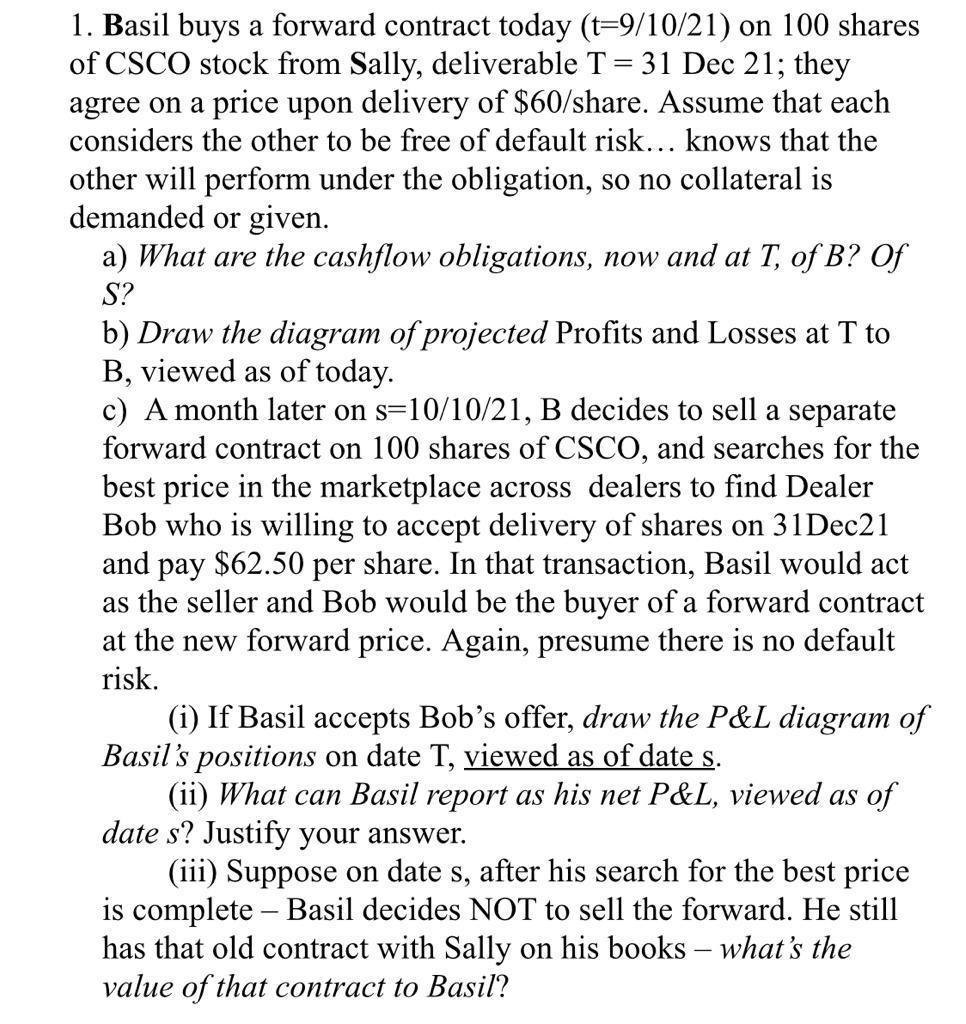

1. Basil buys a forward contract today (t-9/10/21) on 100 shares of CSCO stock from Sally, deliverable T = 31 Dec 21; they agree on a price upon delivery of $60/share. Assume that each considers the other to be free of default risk... knows that the other will perform under the obligation, so no collateral is demanded or given. a) What are the cashflow obligations, now and at T, of B? Of S? b) Draw the diagram of projected Profits and Losses at T to B, viewed as of today. c) A month later on s=10/10/21, B decides to sell a separate forward contract on 100 shares of CSCO, and searches for the best price in the marketplace across dealers to find Dealer Bob who is willing to accept delivery of shares on 31Dec21 and pay $62.50 per share. as the seller and Bob would be the buyer of a forward contract at the new forward price. Again, presume there is no default risk. that transaction, Basil would act (i) If Basil accepts Bob's offer, draw the P&L diagram of Basil's positions on date T, viewed as of date s. (ii) What can Basil report as his net P&L, viewed as of date s? Justify your answer. (iii) is complete Basil decides NOT to sell the forward. He still has that old contract with Sally on his books what's the value of that contract to Basil? on date s, after his search for the best price

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Because S is a forward contract seller she will ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started