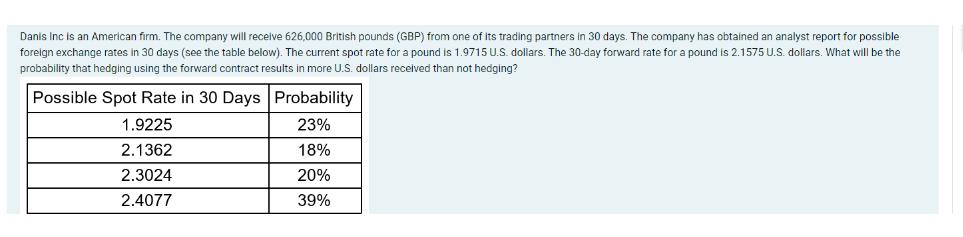

Danis Inc is an American firm. The company will receive 626,000 British pounds (GBP) from one of its trading partners in 30 days. The

Danis Inc is an American firm. The company will receive 626,000 British pounds (GBP) from one of its trading partners in 30 days. The company has obtained an analyst report for possible foreign exchange rates in 30 days (see the table below). The current spot rate for a pound is 1.9715 U.S. dollars. The 30-day forward rate for a pound is 2.1575 U.S. dollars. What will be the probability that hedging using the forward contract results in more U.S. dollars received than not hedging? Possible Spot Rate in 30 Days 1.9225 2.1362 2.3024 2.4077 Probability 23% 18% 20% 39%

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer There is a 39 probability that hedging using the forward contract will result in more US dol...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started