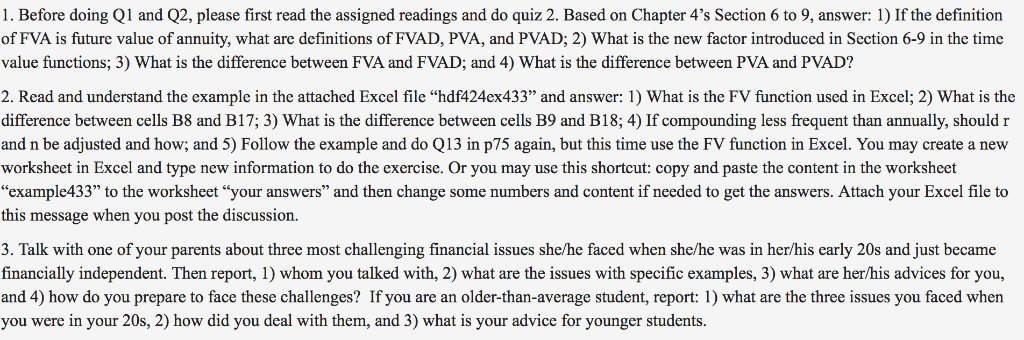

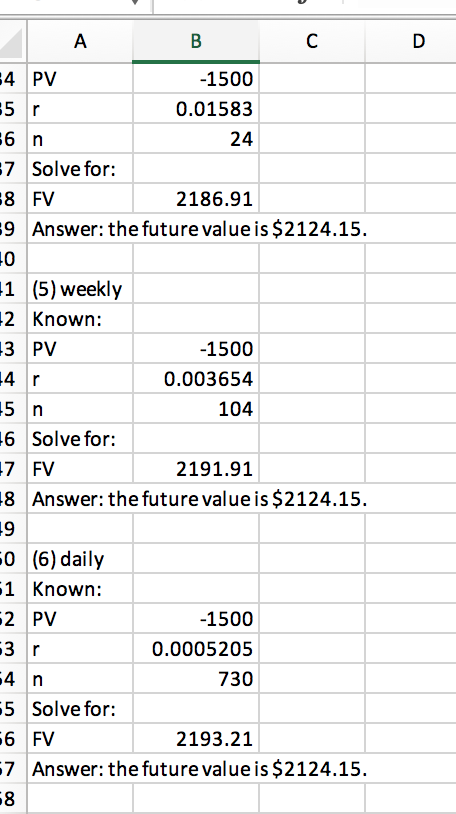

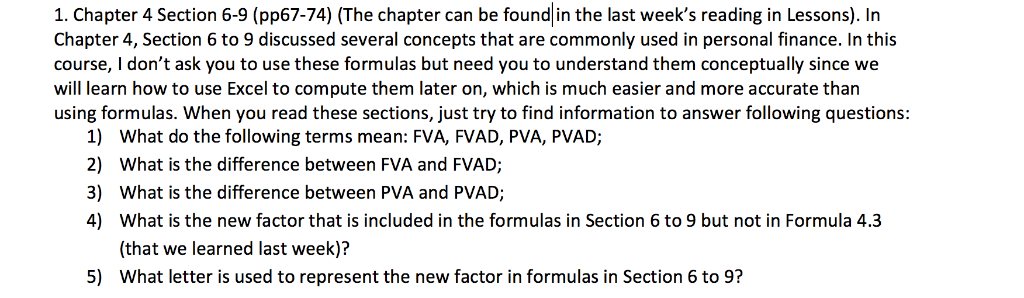

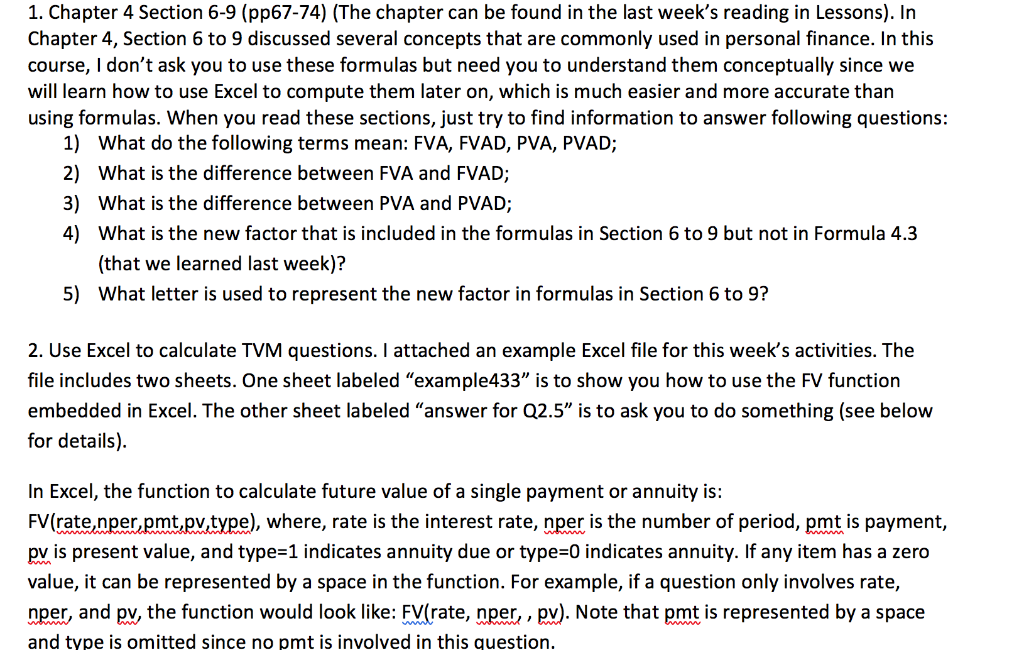

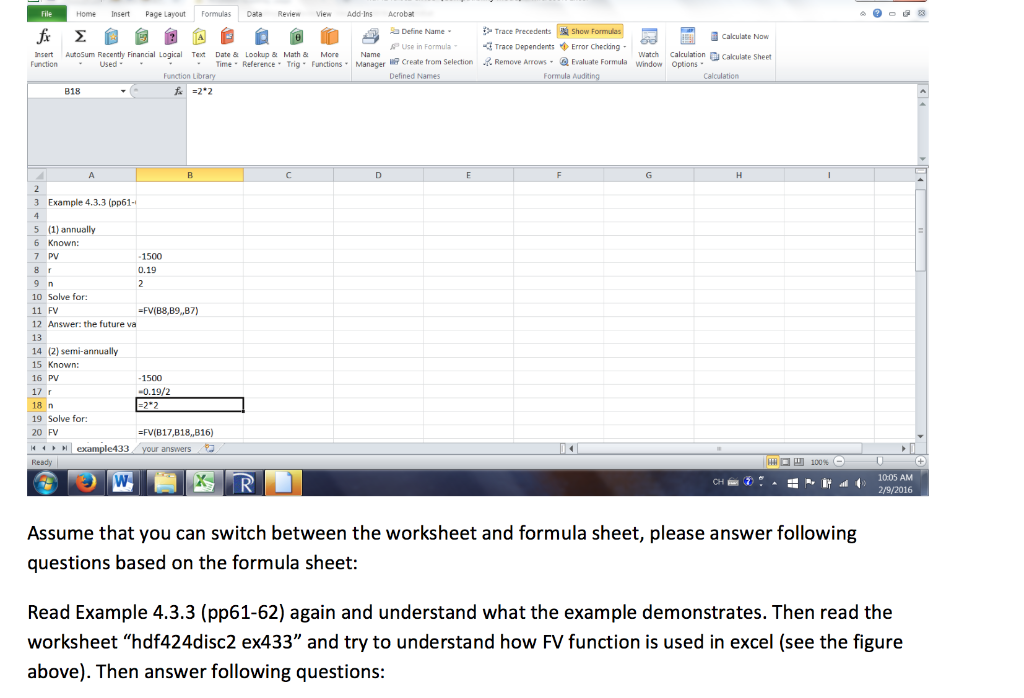

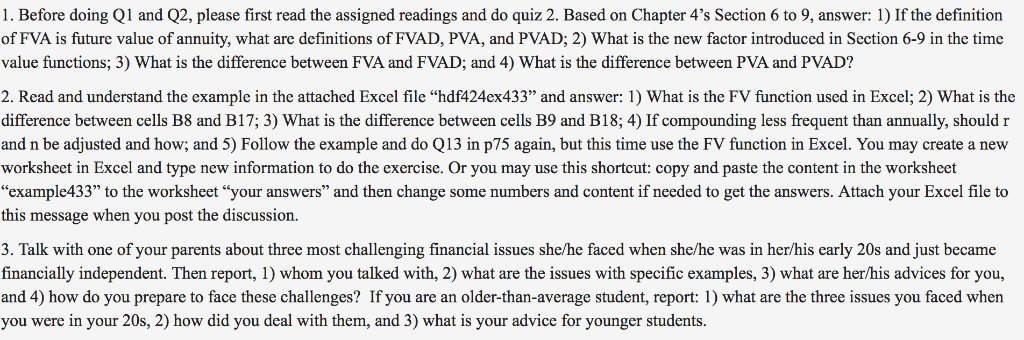

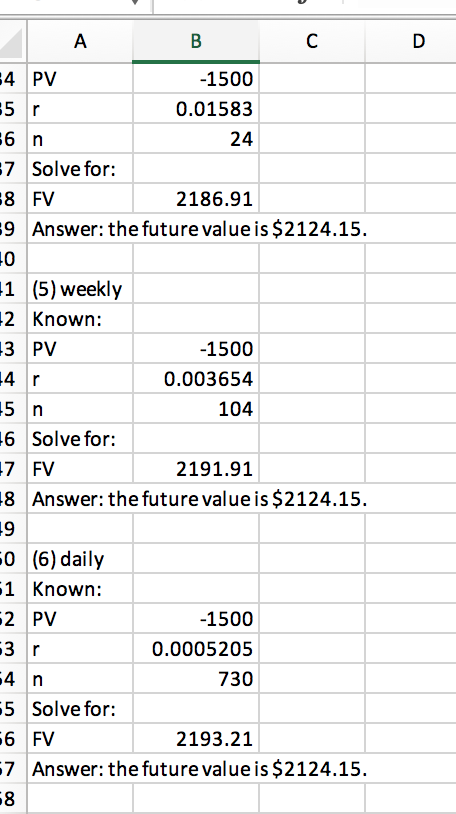

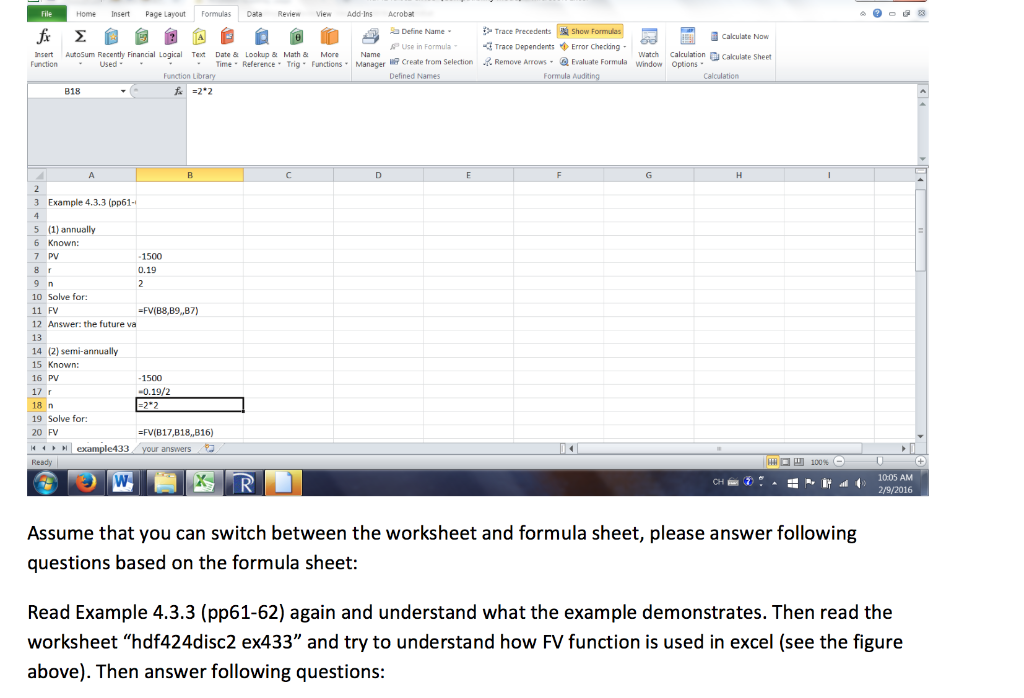

1. Before doing Q1 and Q2, please first read the assigned readings and do quiz 2. Based on Chapter 4's Section 6 to 9, answer: 1) If the definition of FVA is future value of annuity, what are definitions of FVAD, PVA, and PVAD; 2) What is the new factor introduced in Section 6-9 in the time value functions; 3) What is the difference between FVA and FVAD; and 4) What is the difference between PVA and PVAD? 2. Read and understand the example in the attached Excel file "hdf424cx433" and answer: 1) What is the FV function used in Excel; 2) What is the difference between cells B8 and B17; 3) What is the difference between cells B9 and B18; 4) If compounding less frequent than annually, should r and n be adjusted and how; and 5) Follow the example and do Q13 in p75 again, but this time use the FV function in Excel. You may create a new worksheet in Excel and type new information to do the exercise. Or you may use this shortcut: copy and paste the content in the worksheet example433" to the worksheet "your answers" and then change some numbers and content if needed to get the answers. Attach your Excel file to this message when you post the discussion. 3. Talk with one of your parents about three most challenging financial issues she/he faced when she/he was in her/his early 20s and just became financially independent. Then report, 1) whom you talked with, 2) what are the issues with specific examples, 3) what are her/his advices for you, and 4) how do you prepare to face these challenges? If you are an older-than-average student, report: 1) what are the three issues you faced when you were in your 20s, 2) how did you deal with them, and 3) what is your advice for younger students. 1500 0.01583 24 4 PV 7 Solve for: 8 FV 9 Answer:the future value is $2124.15. 0 1(5) weekly 2 Known: 3 PV 2186.91 1500 0.003654 104 6 Solve for: 7 FV 8 Answer:the future value is $2124.15. 9 0 (6) daily 1 Known: 2 PV 2191.91 1500 0.0005205 730 5 Solve for: 6 FV 7 Answer:the future value is $2124.15. 2193.21 1. Chapter 4 Section 6-9 (pp67-74) (The chapter can be found in the last week's reading in Lessons). In Chapter 4, Section 6 to 9 discussed several concepts that are commonly used in personal finance. In this course, I don't ask you to use these formulas but need you to understand them conceptually since we will learn how to use Excel to compute them later on, which is much easier and more accurate than using formulas. When you read these sections, just try to find information to answer following questions: 1) What do the following terms mean: FVA, FVAD, PVA, PVAD; 2) What is the difference between FVA and FVAD; 3) What is the difference between PVA and PVAD 4) What is the new factor that is included in the formulas in Section 6 to 9 but not in Formula 4.3 (that we learned last week)? What letter is used to represent the new factor in formulas in Section 6 to 9? 5) 1. Chapter 4 Section 6-9 (pp67-74) (The chapter can be found in the last week's reading in Lessons). In Chapter 4, Section 6 to 9 discussed several concepts that are commonly used in personal finance. In this course, I don't ask you to use these formulas but need you to understand them conceptually since we will learn how to use Excel to compute them later on, which is much easier and more accurate than using formulas. When you read these sections, just try to find information to answer following questions: 1) What do the following terms mean: FVA, FVAD, PVA, PVAD; 2) What is the difference between FVA and FVAD; What is the difference between PVA and PVAD; 3) 4) What is the new factor that is included in the formulas in Section 6 to 9 but not in Formula 4.3 (that we learned last week)? What letter is used to represent the new factor in formulas in Section 6 to 9? 5) 2. Use Excel to calculate TVM questions.I attached an example Excel file for this week's activities. The file includes two sheets. One sheet labeled "example433" is to show you how to use the FV function embedded in Excel. The other sheet labeled "answer for Q2.5" is to ask you to do something (see below for details) In Excel, the function to calculate future value of a single payment or annuity is FV(rate.nper.pmt.pv.type), where, rate is the interest rate, nper is the number of period, pmt is payment, pv is present value, and type-1 indicates annuity due or type-0 indicates annuity. If any itemhas azero value, it can be represented by a space in the function. For example, if a question only involves rate, nper, and py, the function would look like: FV(rate, nper, pv). Note that pmt is represented by a space and type is omitted since no pmt is involved in this question File Home Insert Page Layout Fomulas t ReviAdd-InsAcrobat fi : Trace Depenents:Show Fomong Define Name . Calculate Now Use in Formula Trace Dependents Error Checking Remove Arrows Evaluate Formula Window options . watch Calculation calculate sheet t AutoSum Recently Financial LogicalText Date&Lookup& Math&MrName Create from Selection Defined Names Used Time Reference Trig Functions Manager Arrows Function Libra Formula 818 3 Example 4.3.3 (pp61- 5 (1) annually 6 Known: 7 PV 1500 0.19 9 n 10 Solve for 11 FV 12 Answer: the future va 13 14 (2) semi-annually 15 Known: 16 PV 17 r 18 n 19 Solve for: 20 FV 1500 0.19/2 -FV(B17,818,816) your answers Ready 10:05 AM Assume that you can switch between the worksheet and formula sheet, please answer following questions based on the formula sheet Read Example 4.3.3 (pp61-62) again and understand what the example demonstrates. Then read the worksheet "hdf424disc2 ex433" and try to understand how FV function is used in excel (see the figure above). Then answer following questions: 1. Before doing Q1 and Q2, please first read the assigned readings and do quiz 2. Based on Chapter 4's Section 6 to 9, answer: 1) If the definition of FVA is future value of annuity, what are definitions of FVAD, PVA, and PVAD; 2) What is the new factor introduced in Section 6-9 in the time value functions; 3) What is the difference between FVA and FVAD; and 4) What is the difference between PVA and PVAD? 2. Read and understand the example in the attached Excel file "hdf424cx433" and answer: 1) What is the FV function used in Excel; 2) What is the difference between cells B8 and B17; 3) What is the difference between cells B9 and B18; 4) If compounding less frequent than annually, should r and n be adjusted and how; and 5) Follow the example and do Q13 in p75 again, but this time use the FV function in Excel. You may create a new worksheet in Excel and type new information to do the exercise. Or you may use this shortcut: copy and paste the content in the worksheet example433" to the worksheet "your answers" and then change some numbers and content if needed to get the answers. Attach your Excel file to this message when you post the discussion. 3. Talk with one of your parents about three most challenging financial issues she/he faced when she/he was in her/his early 20s and just became financially independent. Then report, 1) whom you talked with, 2) what are the issues with specific examples, 3) what are her/his advices for you, and 4) how do you prepare to face these challenges? If you are an older-than-average student, report: 1) what are the three issues you faced when you were in your 20s, 2) how did you deal with them, and 3) what is your advice for younger students. 1500 0.01583 24 4 PV 7 Solve for: 8 FV 9 Answer:the future value is $2124.15. 0 1(5) weekly 2 Known: 3 PV 2186.91 1500 0.003654 104 6 Solve for: 7 FV 8 Answer:the future value is $2124.15. 9 0 (6) daily 1 Known: 2 PV 2191.91 1500 0.0005205 730 5 Solve for: 6 FV 7 Answer:the future value is $2124.15. 2193.21 1. Chapter 4 Section 6-9 (pp67-74) (The chapter can be found in the last week's reading in Lessons). In Chapter 4, Section 6 to 9 discussed several concepts that are commonly used in personal finance. In this course, I don't ask you to use these formulas but need you to understand them conceptually since we will learn how to use Excel to compute them later on, which is much easier and more accurate than using formulas. When you read these sections, just try to find information to answer following questions: 1) What do the following terms mean: FVA, FVAD, PVA, PVAD; 2) What is the difference between FVA and FVAD; 3) What is the difference between PVA and PVAD 4) What is the new factor that is included in the formulas in Section 6 to 9 but not in Formula 4.3 (that we learned last week)? What letter is used to represent the new factor in formulas in Section 6 to 9? 5) 1. Chapter 4 Section 6-9 (pp67-74) (The chapter can be found in the last week's reading in Lessons). In Chapter 4, Section 6 to 9 discussed several concepts that are commonly used in personal finance. In this course, I don't ask you to use these formulas but need you to understand them conceptually since we will learn how to use Excel to compute them later on, which is much easier and more accurate than using formulas. When you read these sections, just try to find information to answer following questions: 1) What do the following terms mean: FVA, FVAD, PVA, PVAD; 2) What is the difference between FVA and FVAD; What is the difference between PVA and PVAD; 3) 4) What is the new factor that is included in the formulas in Section 6 to 9 but not in Formula 4.3 (that we learned last week)? What letter is used to represent the new factor in formulas in Section 6 to 9? 5) 2. Use Excel to calculate TVM questions.I attached an example Excel file for this week's activities. The file includes two sheets. One sheet labeled "example433" is to show you how to use the FV function embedded in Excel. The other sheet labeled "answer for Q2.5" is to ask you to do something (see below for details) In Excel, the function to calculate future value of a single payment or annuity is FV(rate.nper.pmt.pv.type), where, rate is the interest rate, nper is the number of period, pmt is payment, pv is present value, and type-1 indicates annuity due or type-0 indicates annuity. If any itemhas azero value, it can be represented by a space in the function. For example, if a question only involves rate, nper, and py, the function would look like: FV(rate, nper, pv). Note that pmt is represented by a space and type is omitted since no pmt is involved in this question File Home Insert Page Layout Fomulas t ReviAdd-InsAcrobat fi : Trace Depenents:Show Fomong Define Name . Calculate Now Use in Formula Trace Dependents Error Checking Remove Arrows Evaluate Formula Window options . watch Calculation calculate sheet t AutoSum Recently Financial LogicalText Date&Lookup& Math&MrName Create from Selection Defined Names Used Time Reference Trig Functions Manager Arrows Function Libra Formula 818 3 Example 4.3.3 (pp61- 5 (1) annually 6 Known: 7 PV 1500 0.19 9 n 10 Solve for 11 FV 12 Answer: the future va 13 14 (2) semi-annually 15 Known: 16 PV 17 r 18 n 19 Solve for: 20 FV 1500 0.19/2 -FV(B17,818,816) your answers Ready 10:05 AM Assume that you can switch between the worksheet and formula sheet, please answer following questions based on the formula sheet Read Example 4.3.3 (pp61-62) again and understand what the example demonstrates. Then read the worksheet "hdf424disc2 ex433" and try to understand how FV function is used in excel (see the figure above). Then answer following questions