1, Bella inc, pays $2,400,000 for 75% of sockeye's outstanding common stock. sockeye co, has net assets with a book value of $2,350,000. sockeye has

1, Bella inc, pays $2,400,000 for 75% of sockeye's outstanding common stock. sockeye co, has net assets with a book value of $2,350,000. sockeye has land that was originally purchased for 320,000 is now worth $680,000. the remainder of the business combination's purchase price is allocated to goodwill. bella, inc, accounts for its investment in sockeye using the equity method.

using the acquisition method for consolidation, determine the amount that should be attributed to goodwill.

working paper elimination at the date of acquisition with Non controlling

Common stock

| Addition paid in Capital | |||

| Retained Earnings |

prepare working paper elimination at the date of acquisition with Non controlling interest pls do it excel)Show all work and debit and credit

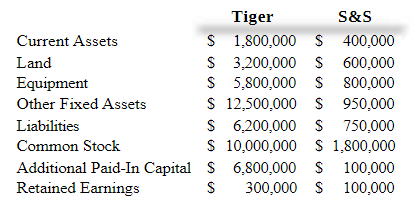

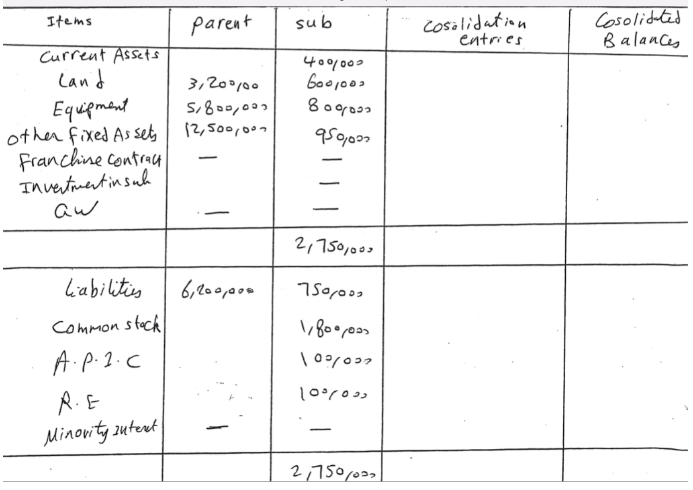

2. .On April 1, 2015, Tiger Inc. acquires 60% of Stripes & Spots Co.s (S&S) outstanding common stock by issuing 45,000 shares of its $1 par value common stock. Tigers stock has a $42 per share market value. Consolidation costs of $210,000 were also paid. Tiger uses the equity method to account for its investment in S&S.S&S has equipment (with an 8-year remaining useful life) undervalued on its books by $400,000.Land on S&Ss books is undervalued by $500,000. S&S has franchise contracts valued at $250,000.The contracts are to be amortized over 5 years. The remainder of the purchase price is allocated to Goodwill. Prior to the business combination, the financial records of the two companies show the following account balances:

Required:

1. prepare Working paper elimination and then complete consolidation entries and consolidated balances . Show all the calculating

2.Computation of goodwill under the acquisition method:(Remember, under the acquisitionmethod, direct combination costs are expensed.)

3. prepare working paper elimination in the subsequent year of acquisition with Non controlling

4. debit - credit

| Common stock | |

| Addition paid in Capital | |

| Retained Earnings |

| Subsequent year of acquisition |

| Devidends Entry: |

| Cash |

| Investment in Sub |

| Income Entry: |

| Investment in Sub |

| Equity in Subsidiary Earnings |

| Depreciation / Amortization: |

| Equity in Subsidiary Earnings |

| Investment in Sub |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started