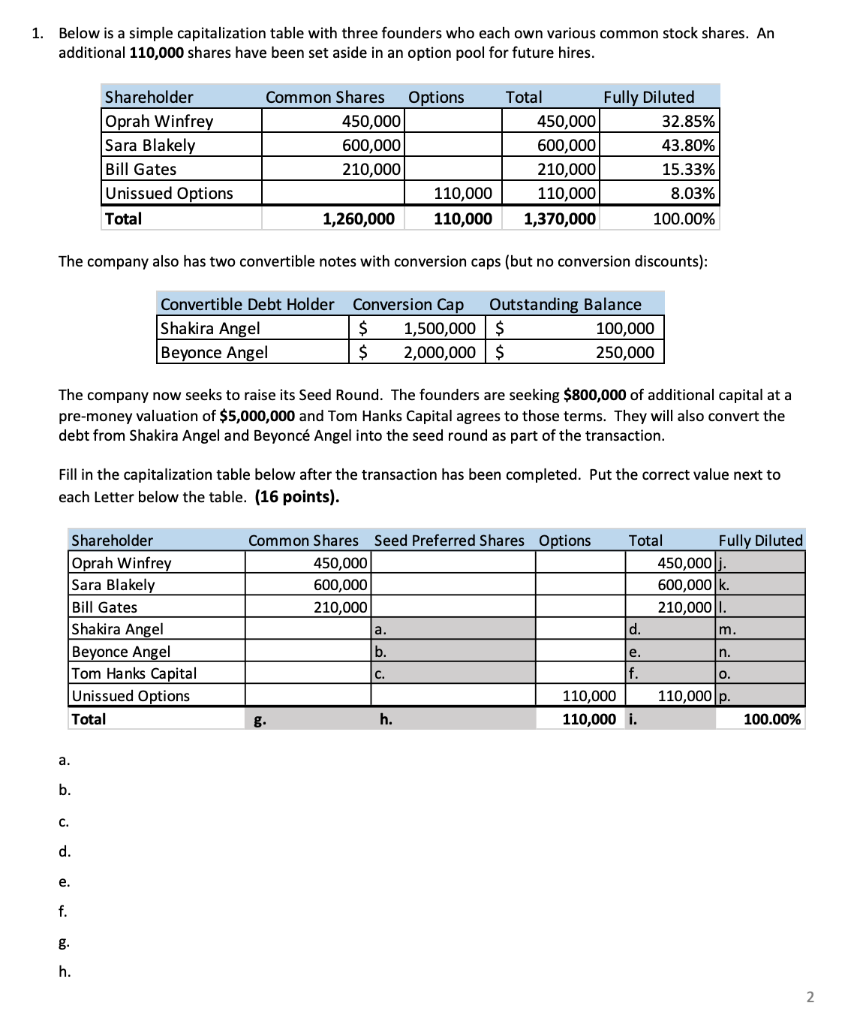

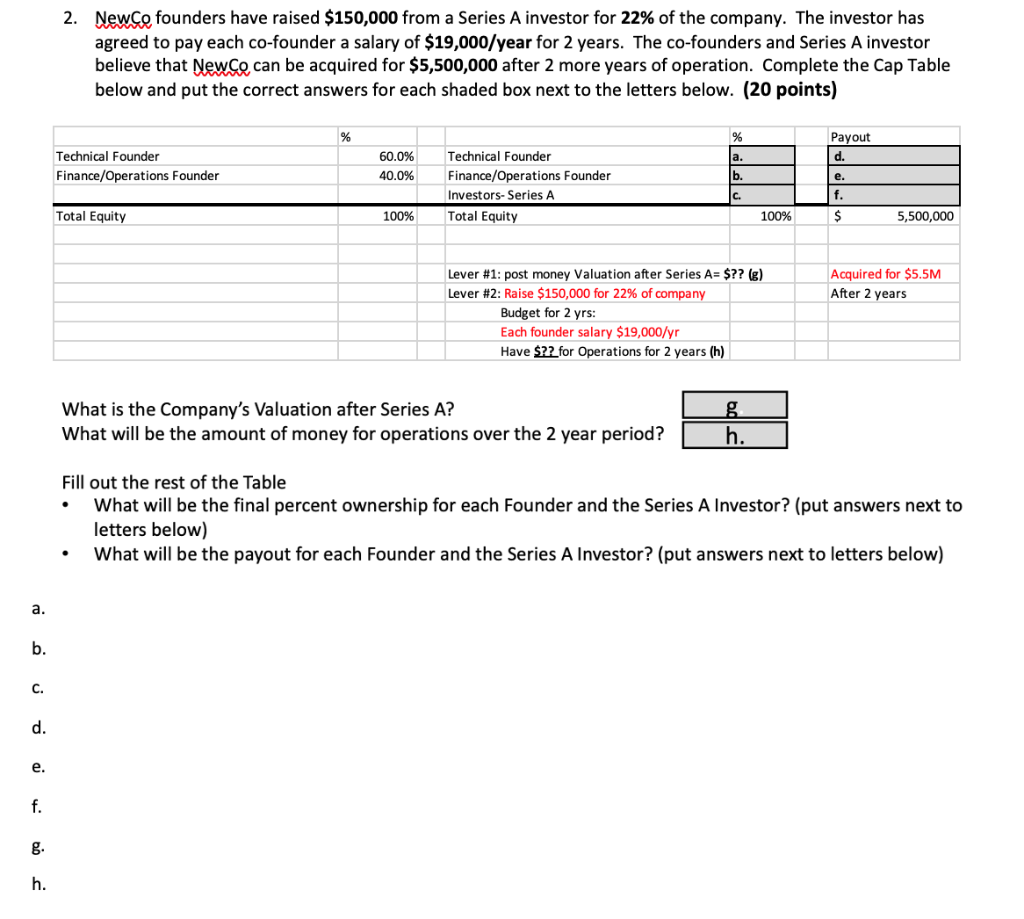

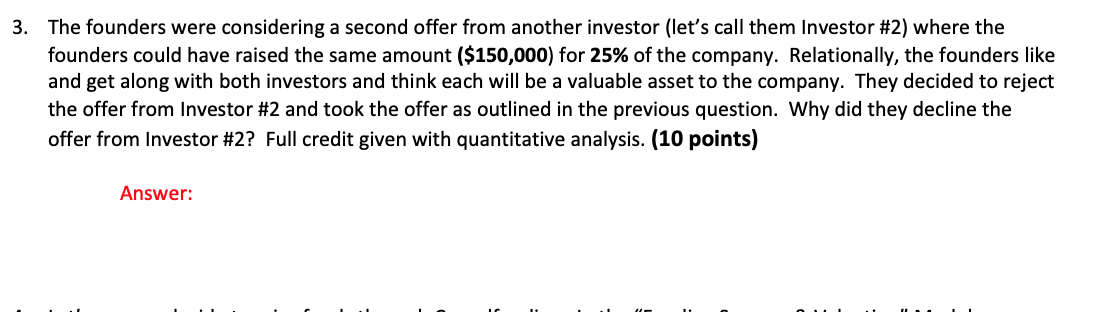

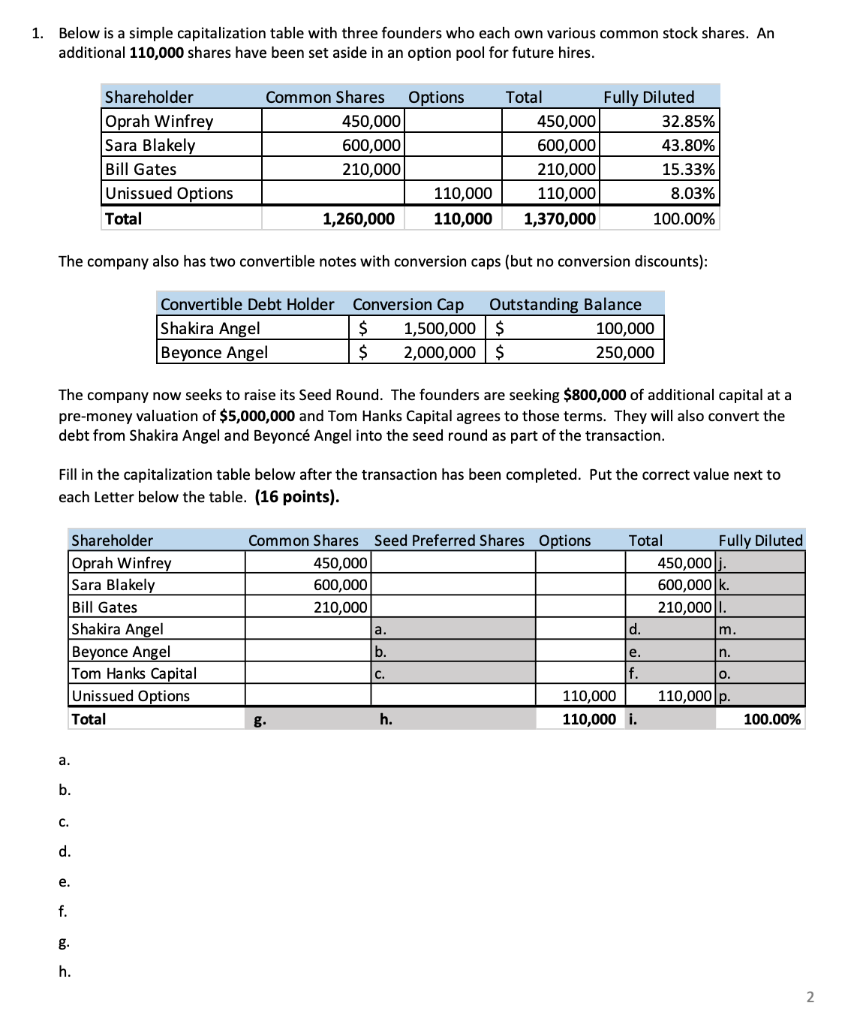

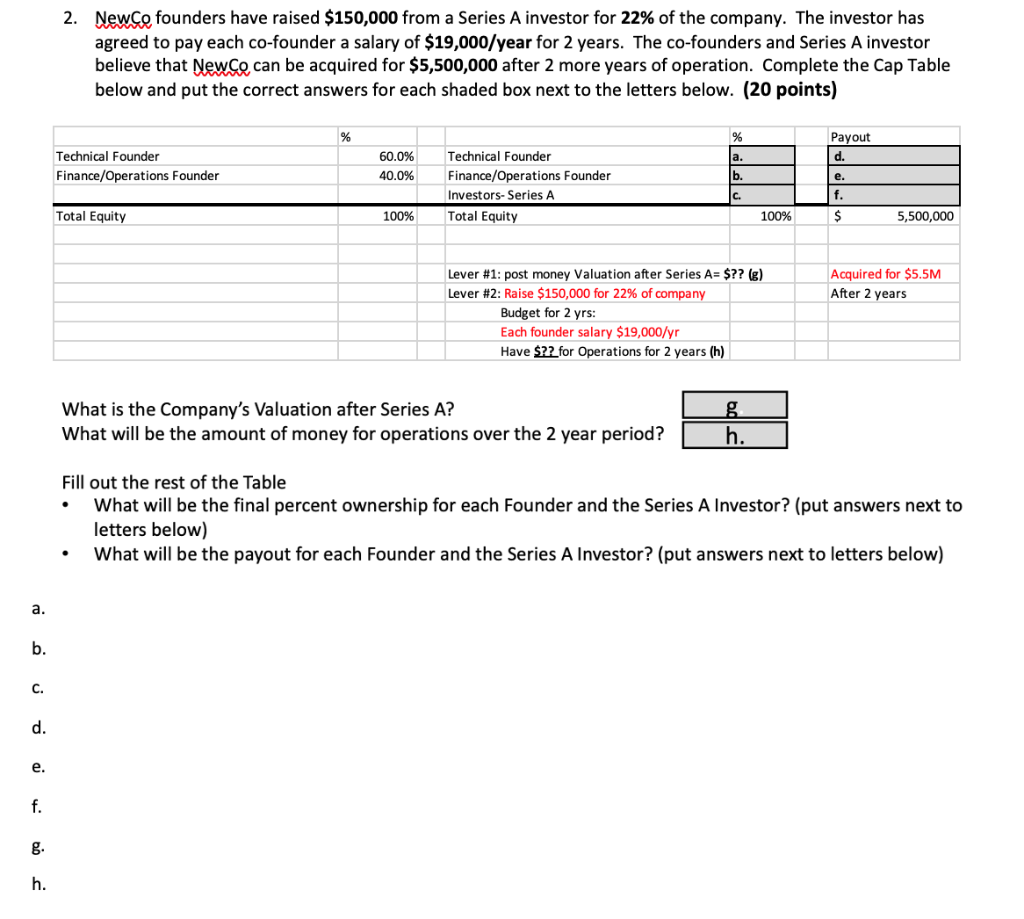

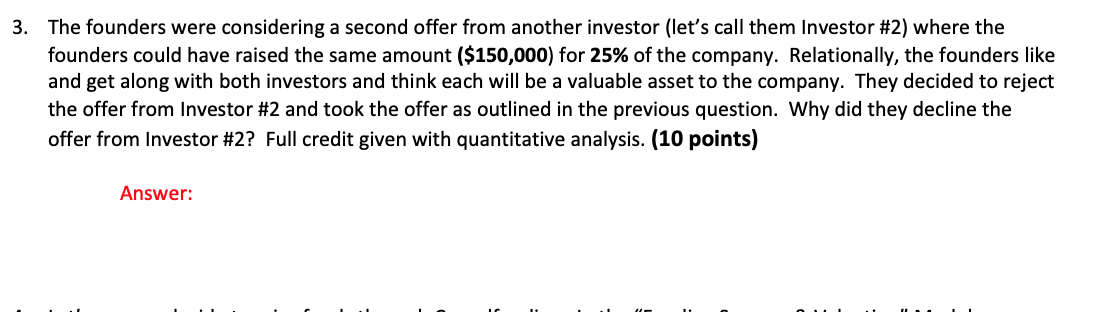

1. Below is a simple capitalization table with three founders who each own various common stock shares. An additional 110,000 shares have been set aside in an option pool for future hires. Options Shareholder Oprah Winfrey Sara Blakely Bill Gates Unissued Options Total Common Shares 450,000 600,000 210,000 Total Fully Diluted 450,000 32.85% 600,000 43.80% 210,000 15.33% 110,000 8.03% 1,370,000 100.00% 110,000 110,000 1,260,000 The company also has two convertible notes with conversion caps (but no conversion discounts): Convertible Debt Holder Conversion Cap Outstanding Balance Shakira Angel $ 1,500,000 $ 100,000 Beyonce Angel $ 2,000,000 $ 250,000 The company now seeks to raise its Seed Round. The founders are seeking $800,000 of additional capital at a pre-money valuation of $5,000,000 and Tom Hanks Capital agrees to those terms. They will also convert the debt from Shakira Angel and Beyonc Angel into the seed round as part of the transaction. Fill in the capitalization table below after the transaction has been completed. Put the correct value next to each Letter below the table. (16 points). Shareholder Oprah Winfrey Sara Blakely Bill Gates Shakira Angel Beyonce Angel Tom Hanks Capital Unissued Options Total Common Shares Seed Preferred Shares Options Total Fully Diluted 450,000 450,000 600,000 600,000 k. 210,000 210,000 1. d. m. b. e. n. f. o. 110,000 110,000 p. g. h. 110,000 i. 100.00% a. C. a. b. c. d. e. f. 8 h. 2 2. Newce founders have raised $150,000 from a Series A investor for 22% of the company. The investor has agreed to pay each co-founder a salary of $19,000/year for 2 years. The co-founders and Series A investor believe that Newce can be acquired for $5,500,000 after 2 more years of operation. Complete the Cap Table below and put the correct answers for each shaded box next to the letters below. (20 points) % % Payout d. Technical Founder Finance/Operations Founder 60.0% 40.0% a. b. e. Technical Founder Finance/Operations Founder Investors-Series A Total Equity c. f. $ Total Equity 100% 100% 5,500,000 Acquired for $5.5M After 2 years Lever #1: post money Valuation after Series A= $?? (8) Lever #2: Raise $150,000 for 22% of company Budget for 2 yrs: Each founder salary $19,000/yr Have $?? for Operations for 2 years (h) What is the Company's Valuation after Series A? What will be the amount of money for operations over the 2 year period? h. Fill out the rest of the Table What will be the final percent ownership for each Founder and the Series A Investor? (put answers next to letters below) What will be the payout for each Founder and the Series A Investor? (put answers next to letters below) . a. b. C. d. e. f. g. h. 3. The founders were considering a second offer from another investor (let's call them Investor #2) where the founders could have raised the same amount ($150,000) for 25% of the company. Relationally, the founders like and get along with both investors and think each will be a valuable asset to the company. They decided to reject the offer from Investor #2 and took the offer as outlined in the previous question. Why did they decline the offer from Investor #2? Full credit given with quantitative analysis. (10 points) Answer: 1. Below is a simple capitalization table with three founders who each own various common stock shares. An additional 110,000 shares have been set aside in an option pool for future hires. Options Shareholder Oprah Winfrey Sara Blakely Bill Gates Unissued Options Total Common Shares 450,000 600,000 210,000 Total Fully Diluted 450,000 32.85% 600,000 43.80% 210,000 15.33% 110,000 8.03% 1,370,000 100.00% 110,000 110,000 1,260,000 The company also has two convertible notes with conversion caps (but no conversion discounts): Convertible Debt Holder Conversion Cap Outstanding Balance Shakira Angel $ 1,500,000 $ 100,000 Beyonce Angel $ 2,000,000 $ 250,000 The company now seeks to raise its Seed Round. The founders are seeking $800,000 of additional capital at a pre-money valuation of $5,000,000 and Tom Hanks Capital agrees to those terms. They will also convert the debt from Shakira Angel and Beyonc Angel into the seed round as part of the transaction. Fill in the capitalization table below after the transaction has been completed. Put the correct value next to each Letter below the table. (16 points). Shareholder Oprah Winfrey Sara Blakely Bill Gates Shakira Angel Beyonce Angel Tom Hanks Capital Unissued Options Total Common Shares Seed Preferred Shares Options Total Fully Diluted 450,000 450,000 600,000 600,000 k. 210,000 210,000 1. d. m. b. e. n. f. o. 110,000 110,000 p. g. h. 110,000 i. 100.00% a. C. a. b. c. d. e. f. 8 h. 2 2. Newce founders have raised $150,000 from a Series A investor for 22% of the company. The investor has agreed to pay each co-founder a salary of $19,000/year for 2 years. The co-founders and Series A investor believe that Newce can be acquired for $5,500,000 after 2 more years of operation. Complete the Cap Table below and put the correct answers for each shaded box next to the letters below. (20 points) % % Payout d. Technical Founder Finance/Operations Founder 60.0% 40.0% a. b. e. Technical Founder Finance/Operations Founder Investors-Series A Total Equity c. f. $ Total Equity 100% 100% 5,500,000 Acquired for $5.5M After 2 years Lever #1: post money Valuation after Series A= $?? (8) Lever #2: Raise $150,000 for 22% of company Budget for 2 yrs: Each founder salary $19,000/yr Have $?? for Operations for 2 years (h) What is the Company's Valuation after Series A? What will be the amount of money for operations over the 2 year period? h. Fill out the rest of the Table What will be the final percent ownership for each Founder and the Series A Investor? (put answers next to letters below) What will be the payout for each Founder and the Series A Investor? (put answers next to letters below) . a. b. C. d. e. f. g. h. 3. The founders were considering a second offer from another investor (let's call them Investor #2) where the founders could have raised the same amount ($150,000) for 25% of the company. Relationally, the founders like and get along with both investors and think each will be a valuable asset to the company. They decided to reject the offer from Investor #2 and took the offer as outlined in the previous question. Why did they decline the offer from Investor #2? Full credit given with quantitative analysis. (10 points)