Answered step by step

Verified Expert Solution

Question

1 Approved Answer

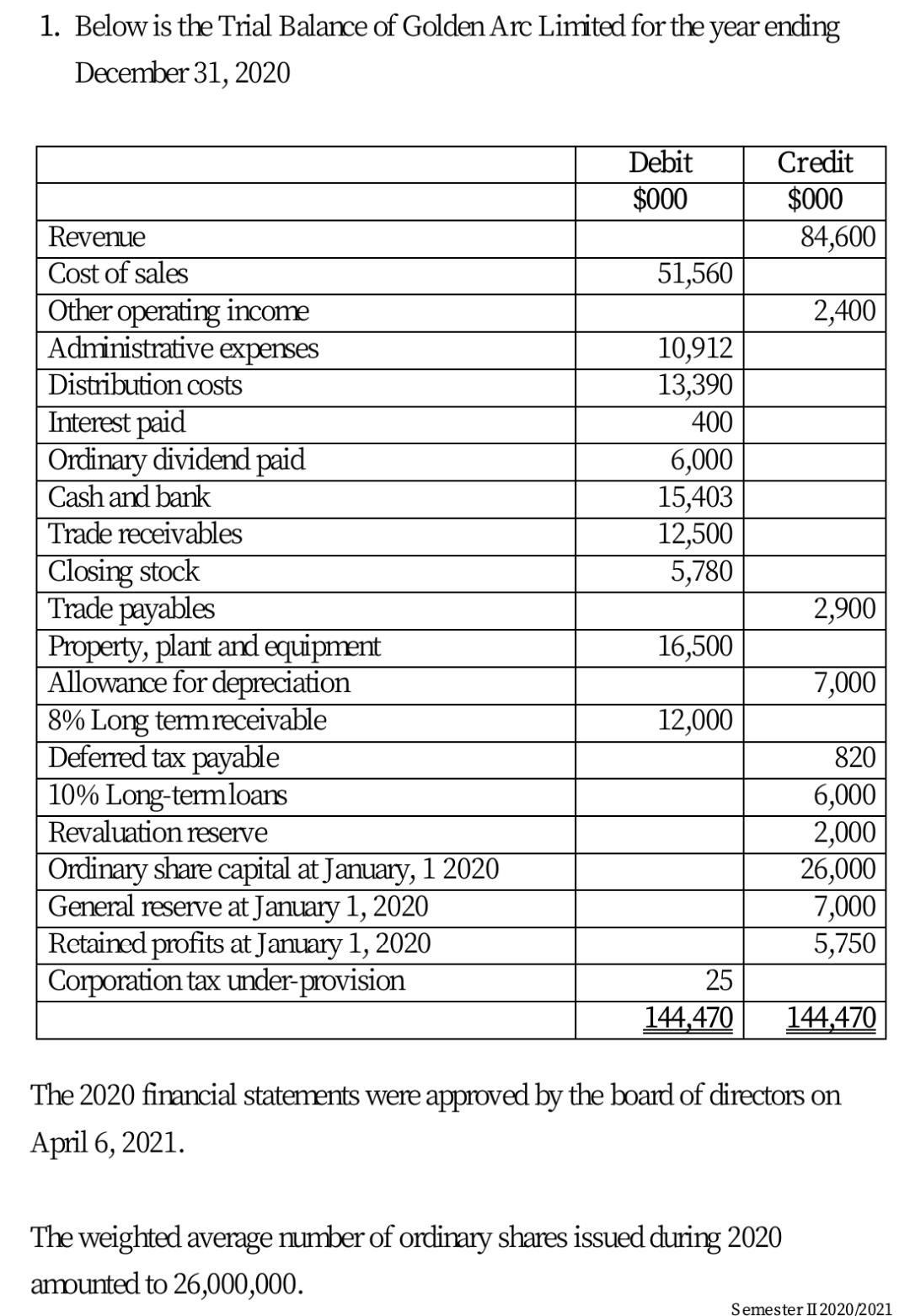

1. Below is the Trial Balance of Golden Arc Limited for the year ending December 31, 2020 Revenue Cost of sales Other operating income

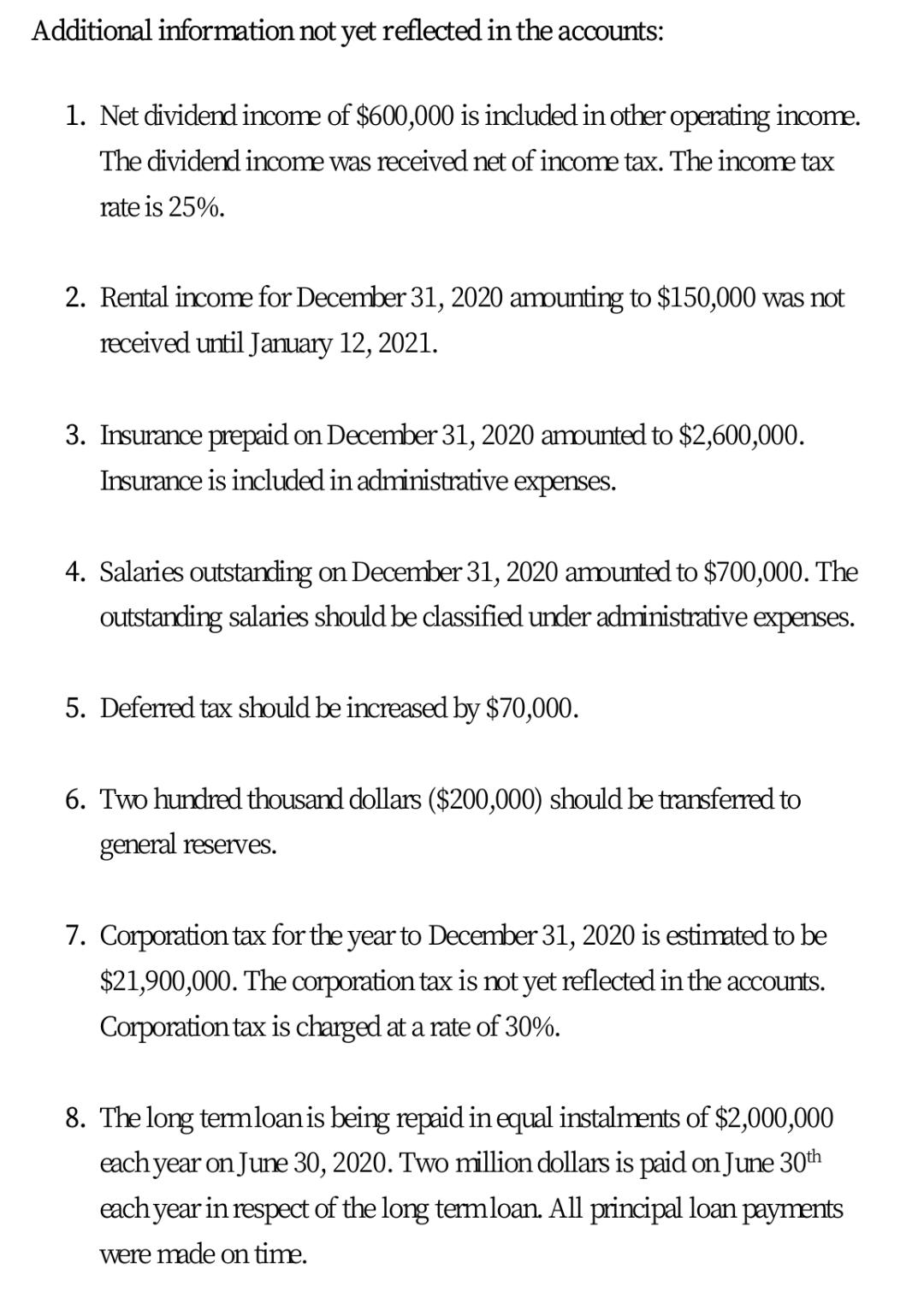

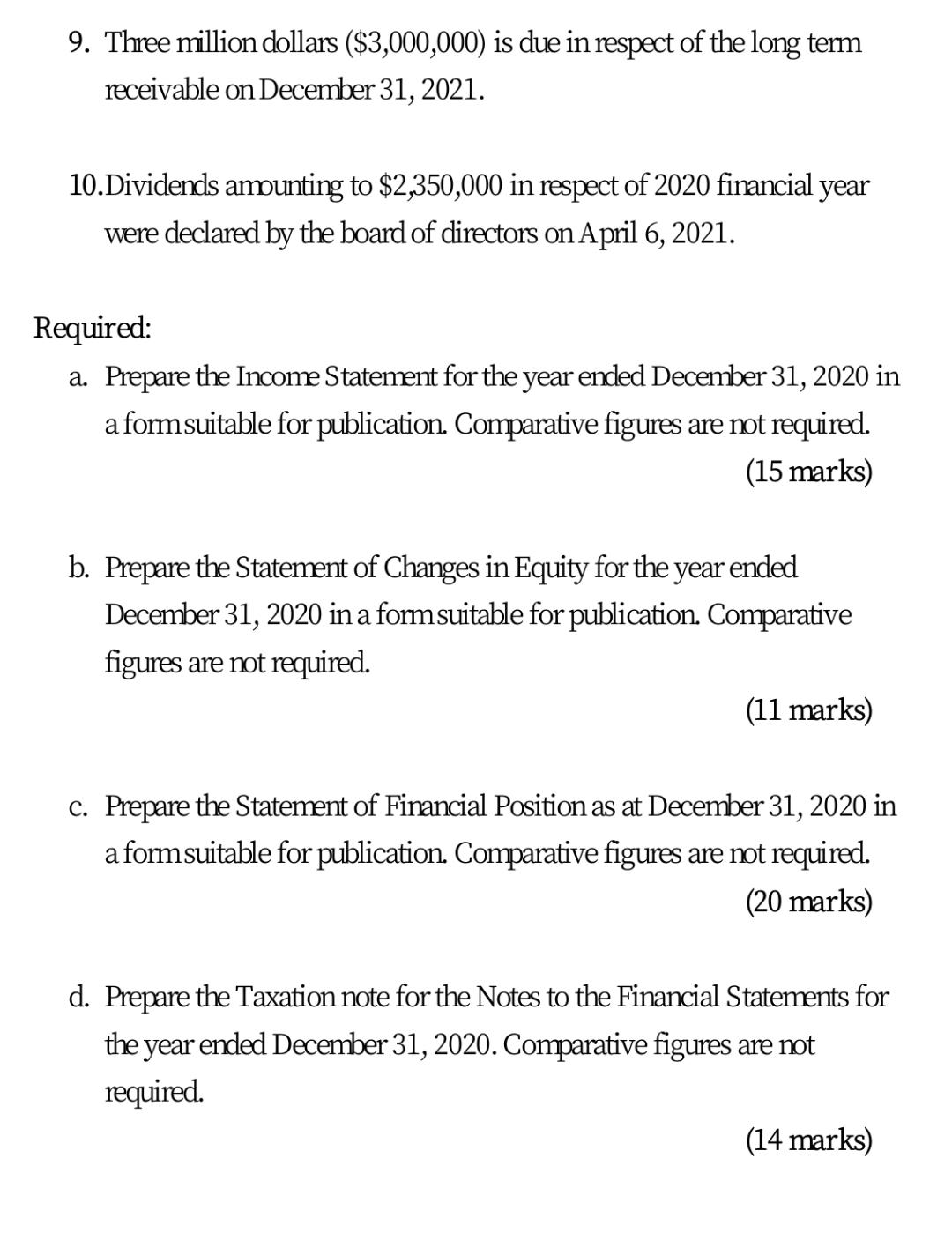

1. Below is the Trial Balance of Golden Arc Limited for the year ending December 31, 2020 Revenue Cost of sales Other operating income Administrative expenses Distribution costs Interest paid Ordinary dividend paid Cash and bank Trade receivables Closing stock Trade payables Property, plant and equipment Allowance for depreciation 8% Long term receivable Deferred tax payable 10% Long-term loans Revaluation reserve Ordinary share capital at January, 1 2020 General reserve at January 1, 2020 Retained profits at January 1, 2020 Corporation tax under-provision Debit $000 51,560 10,912 13,390 400 6,000 15,403 12,500 5,780 16,500 12,000 25 144.470 Credit $000 84,600 The weighted average number of ordinary shares issued during 2020 amounted to 26,000,000. 2,400 2,900 7,000 820 6,000 2,000 26,000 7,000 5,750 144,470 The 2020 financial statements were approved by the board of directors on April 6, 2021. Semester II 2020/2021 Additional information not yet reflected in the accounts: 1. Net dividend income of $600,000 is included in other operating income. The dividend income was received net of income tax. The income tax rate is 25%. 2. Rental income for December 31, 2020 amounting to $150,000 was not received until January 12, 2021. 3. Insurance prepaid on December 31, 2020 amounted to $2,600,000. Insurance is included in administrative expenses. 4. Salaries outstanding on December 31, 2020 amounted to $700,000. The outstanding salaries should be classified under administrative expenses. 5. Deferred tax should be increased by $70,000. 6. Two hundred thousand dollars ($200,000) should be transferred to general reserves. 7. Corporation tax for the year to December 31, 2020 is estimated to be $21,900,000. The corporation tax is not yet reflected in the accounts. Corporation tax is charged at a rate of 30%. 8. The long term loan is being repaid in equal instalments of $2,000,000 each year on June 30, 2020. Two million dollars is paid on June 30th each year in respect of the long term loan. All principal loan payments were made on time. 9. Three million dollars ($3,000,000) is due in respect of the long term receivable on December 31, 2021. 10.Dividends amounting to $2,350,000 in respect of 2020 financial year were declared by the board of directors on April 6, 2021. Required: a. Prepare the Income Statement for the year ended December 31, 2020 in a form suitable for publication. Comparative figures are not required. (15 marks) b. Prepare the Statement of Changes in Equity for the year ended December 31, 2020 in a form suitable for publication. Comparative figures are not required. (11 marks) c. Prepare the Statement of Financial Position as at December 31, 2020 in a form suitable for publication. Comparative figures are not required. (20 marks) d. Prepare the Taxation note for the Notes to the Financial Statements for the year ended December 31, 2020. Comparative figures are not required. (14 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started