Answered step by step

Verified Expert Solution

Question

1 Approved Answer

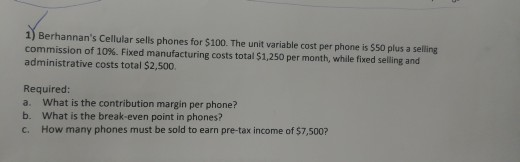

1) Berhannan's Cellular sells phones for $100. The unit variable cost per phone is S50 plus a selling commission of 10%. Fixed manufacturing costs total

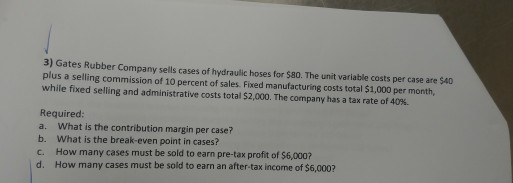

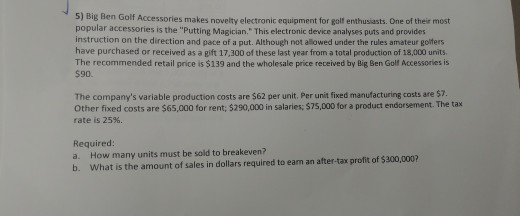

1) Berhannan's Cellular sells phones for $100. The unit variable cost per phone is S50 plus a selling commission of 10%. Fixed manufacturing costs total $1,250 per month, while fixed selling and administrative costs total $2,500 Required: a. What is the contribution margin per phone? b. What is the break-even point in phones? c. How many phones must be sold to earn pre-tax income of $7,500? 3) Gates Rubber Company sells cases of hydraulic hoses for S80. The unit variable costs per case are 540 plus a selling commission of 10 percent of sales, Fored manufacturing costs total $1,000 per month while fixed selling and administrative costs total $2,000. The company has a tax rate of 40% Required: a. What is the contribution margin per case? b. What is the break-even point in cases? c. How many cases must be sold to earn pre-tax profit of $6,000? d. How many cases must be sold to earn an after-tax income of $6,000? 5) Big Ben Golf Accessories makes novelty electronic equipment for golf enthusiasts. One of their most popular accessories is the "Puttine Magician. This electronic device analyses puts and provides instruction on the direction and pace of a put. Although not allowed under the rules amateur golfers have purchased or received as a gift 17.300 of these last year from a total production of 18,000 units The recommended retail price is $139 and the wholesale price received by Big Ben Golf Accessories is $90. The company's variable production costs are 562 per unit. Per unit fixed manufacturing costs are $7. Other fixed costs are $65,000 for rent; $290,000 in salaries; $75,000 for a product endorsement. The tax rate is 25%. Required: a. How many units must be sold to breakeven? b. What is the amount of sales in dollars required to earn an after-tax profit of $300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started