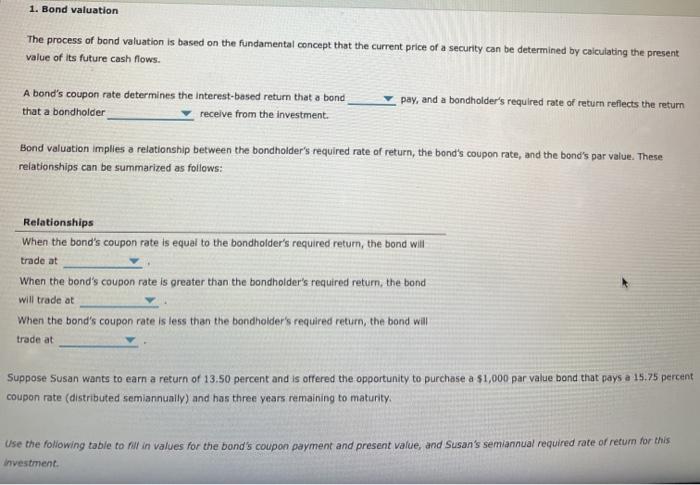

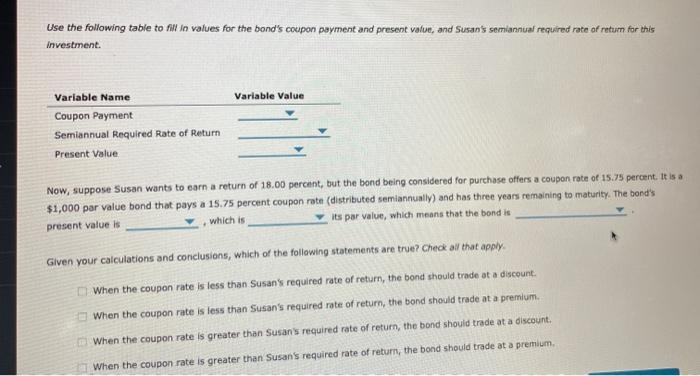

1. Bond valuation The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of its future cash flows. A bond's coupon rate determines the Interest-based return that a bond that a bondholder receive from the investment. pay, and a bondholder's required rate of return reflects the return Bond Valuation implies a relationship between the bondholder's required rate of return, the band's coupon rate, and the bond's par value. These relationships can be summarized as follows: Relationships When the bond's coupon rate is equal to the bondholder's required return, the bond will trade at When the bond's coupon rate is greater than the bondholder's required return, the bond will trade at When the bord's coupon rate is less than the bondholder's required return, the bond will trade at Suppose Susan wants to earn a return of 13.50 percent and is offered the opportunity to purchase a $1,000 par value bond that pays a 15.75 percent coupon rate (distributed semiannuaily) and has three years remaining to maturity Use the following table to fill in values for the band's coupon payment and present value, and Susan's semiannual required rate of return for this investment Use the following table to fill in values for the band's coupon payment and present value, and Susan's semiannual required rate of retum for this investment Variable Value Variable Name Coupon Payment Semiannual Required Rate of Return Present Value Now, suppose Susan wants to earn a return of 18.00 percent, but the bond being considered for purchase offers a coupon rate of 15.75 percent. It is a $1,000 par value bond that pays a 15.75 percent coupon rate (distributed semiannually) and has three years remaining to maturity. The bond's present value is which is its par value, which means that the bond is Given your calculations and conclusions, which of the following statements are true? Check all that apply. When the coupon rate is less than Susan's required rate of return, the bond should trade at a discount. When the coupon rate is less than Susan's required rate of return, the bond should trade at a premium. When the coupon rate is greater than Susan's required rate of return, the bond should trade at a discount, When the coupon rate is greater than Susan's required rate of return, the bond should trade at a premium