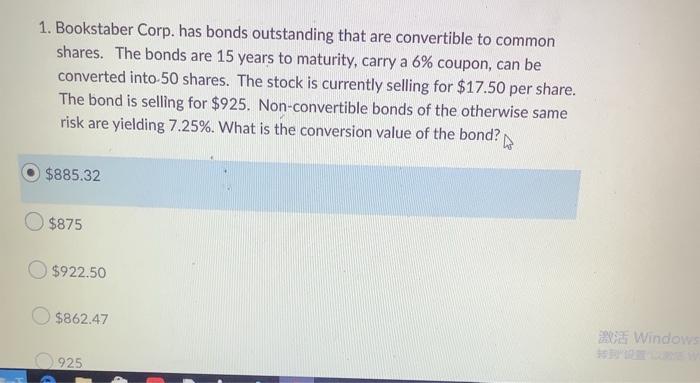

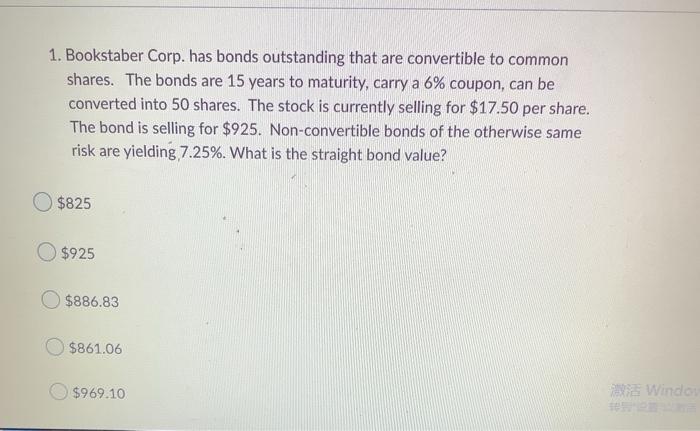

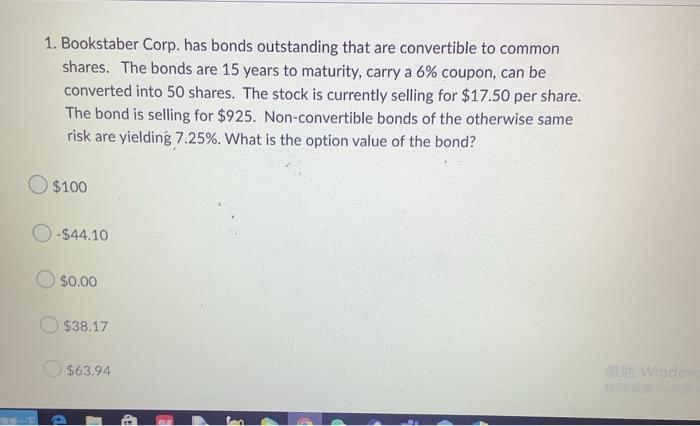

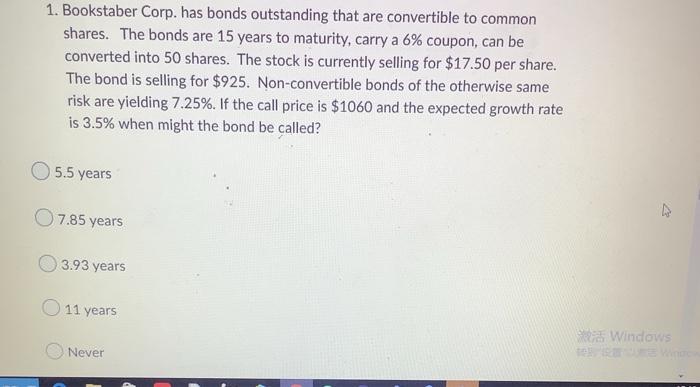

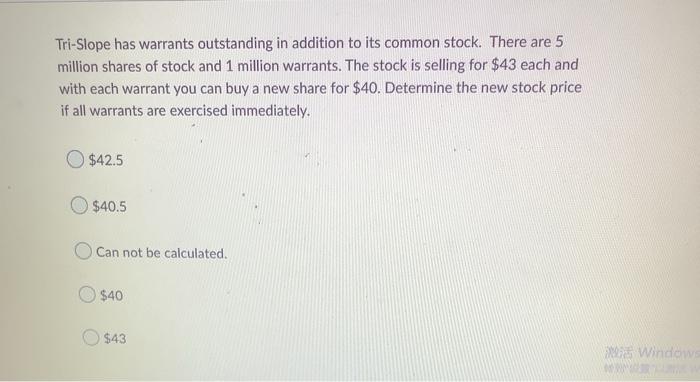

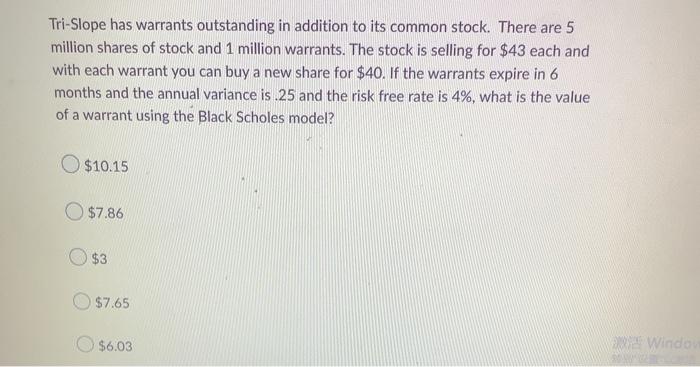

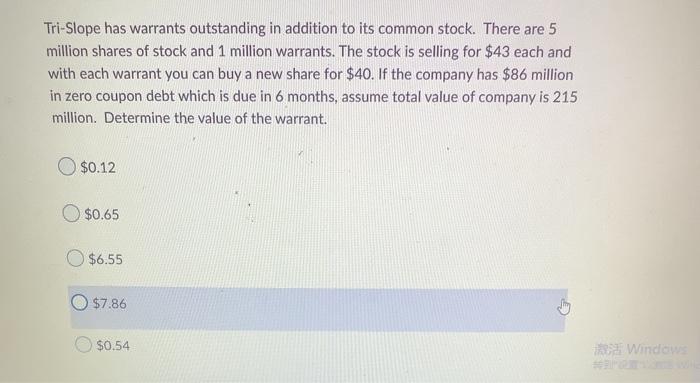

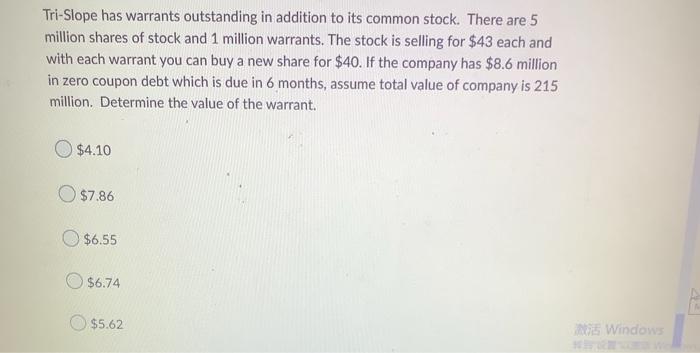

1. Bookstaber Corp. has bonds outstanding that are convertible to common shares. The bonds are 15 years to maturity, carry a 6% coupon, can be converted into 50 shares. The stock is currently selling for $17.50 per share. The bond is selling for $925. Non-convertible bonds of the otherwise same risk are yielding 7.25%. What is the conversion value of the bond? $885.32 $875 $922.50 $862.47 925 Windows 1. Bookstaber Corp. has bonds outstanding that are convertible to common shares. The bonds are 15 years to maturity, carry a 6% coupon, can be converted into 50 shares. The stock is currently selling for $17.50 per share. The bond is selling for $925. Non-convertible bonds of the otherwise same risk are yielding 7.25%. What is the straight bond value? $825 $925 $886.83 $861.06 $969.10 Window 1. Bookstaber Corp. has bonds outstanding that are convertible to common shares. The bonds are 15 years to maturity, carry a 6% coupon, can be converted into 50 shares. The stock is currently selling for $17.50 per share. The bond is selling for $925. Non-convertible bonds of the otherwise same risk are yielding 7.25%. What is the option value of the bond? $100 O-$44.10 0 $0.00 $38.17 $63.94 d Window 1. Bookstaber Corp. has bonds outstanding that are convertible to common shares. The bonds are 15 years to maturity, carry a 6% coupon, can be converted into 50 shares. The stock is currently selling for $17.50 per share. The bond is selling for $925. Non-convertible bonds of the otherwise same risk are yielding 7.25%. If the call price is $1060 and the expected growth rate is 3.5% when might the bond be called? 5.5 years 7.85 years 3.93 years O 11 years Never Windows Tri-Slope has warrants outstanding in addition to its common stock. There are 5 million shares of stock and 1 million warrants. The stock is selling for $43 each and with each warrant you can buy a new share for $40. Determine the new stock price if all warrants are exercised immediately. $42.5 $40.5 Can not be calculated. 0 $40 $43 i Windows Tri-Slope has warrants outstanding in addition to its common stock. There are 5 million shares of stock and 1 million warrants. The stock is selling for $43 each and with each warrant you can buy a new share for $40. If the warrants expire in 6 months and the annual variance is .25 and the risk free rate is 4%, what is the value of a warrant using the Black Scholes model? $10.15 $7.86 $3 $7.65 $6.03 Window $0.12 Tri-Slope has warrants outstanding in addition to its common stock. There are 5 million shares of stock and 1 million warrants. The stock is selling for $43 each and with each warrant you can buy a new share for $40. If the company has $86 million in zero coupon debt which is due in 6 months, assume total value of company is 215 million. Determine the value of the warrant. Windows $0.65 $6.55 $7.86 $0.54 Tri-Slope has warrants outstanding in addition to its common stock. There are 5 million shares of stock and 1 million warrants. The stock is selling for $43 each and with each warrant you can buy a new share for $40. If the company has $8.6 million in zero coupon debt which is due in 6 months, assume total value of company is 215 million. Determine the value of the warrant. $4.10 $7.86 $6.55 $6.74 $5.62 Windows We