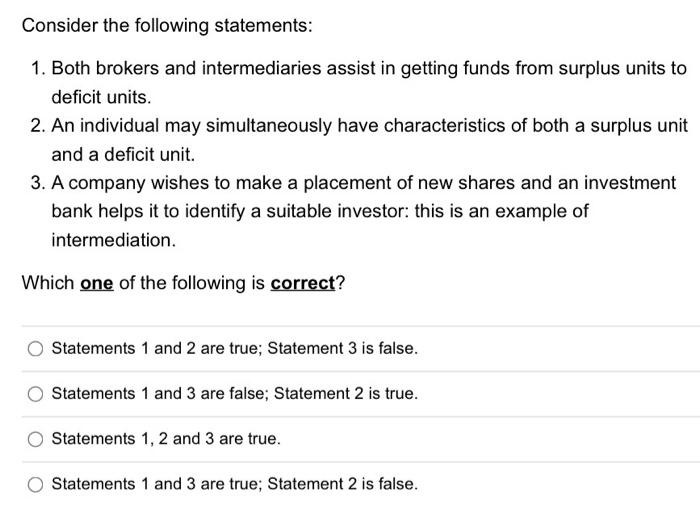

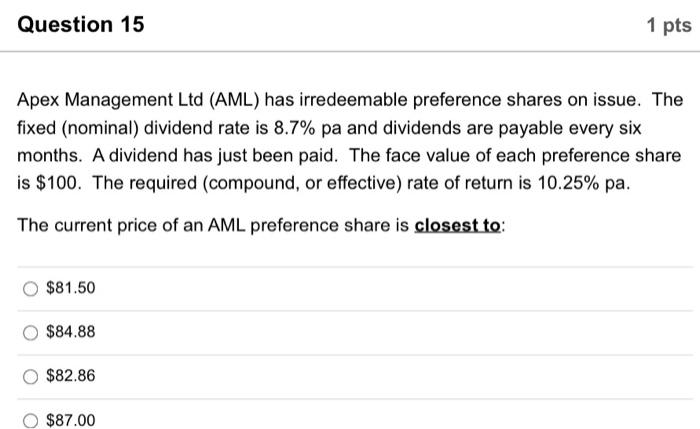

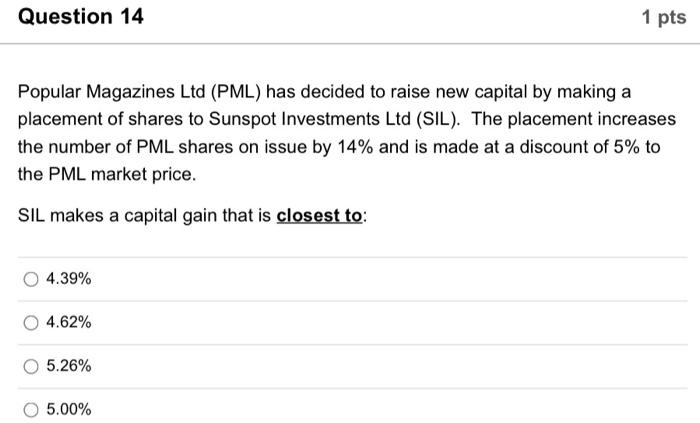

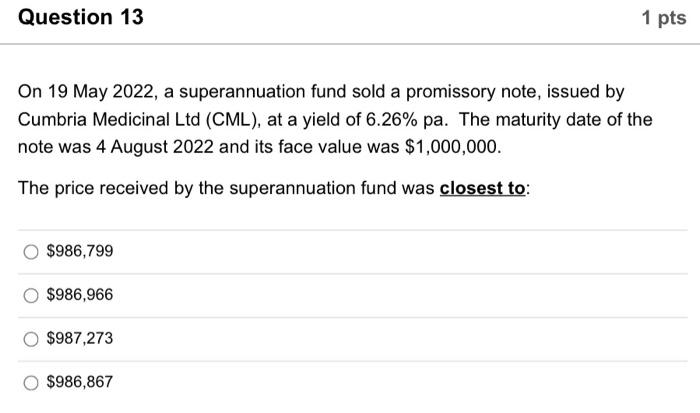

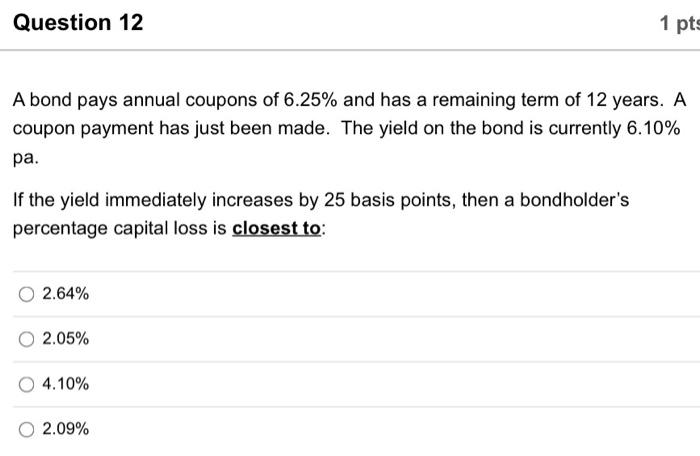

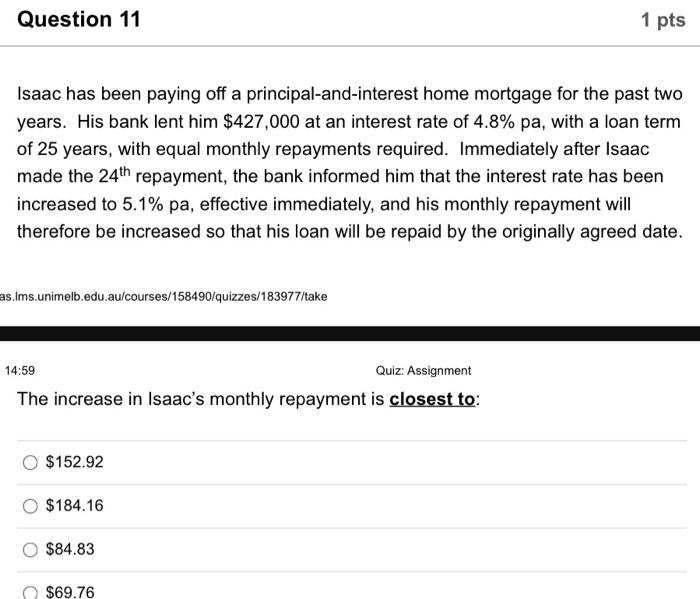

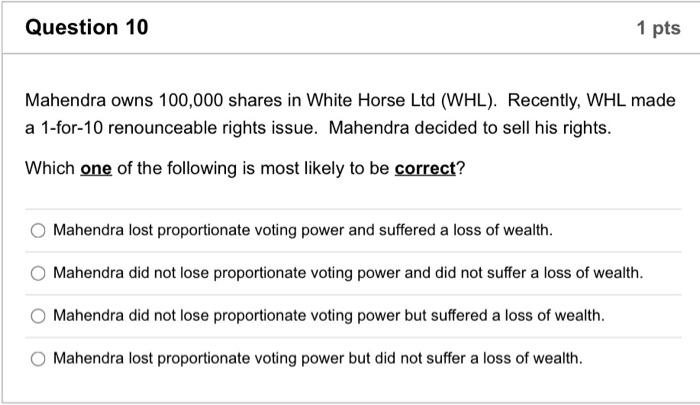

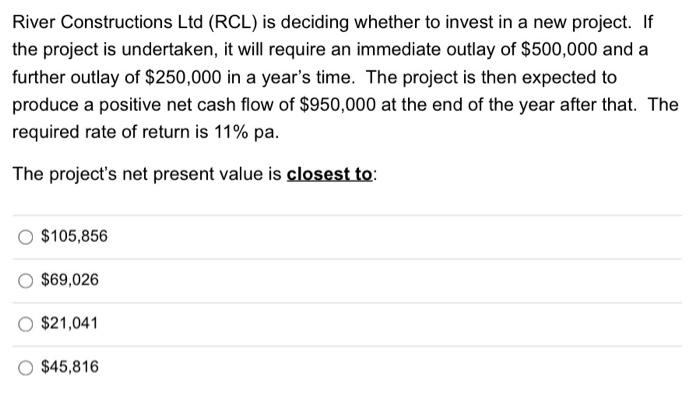

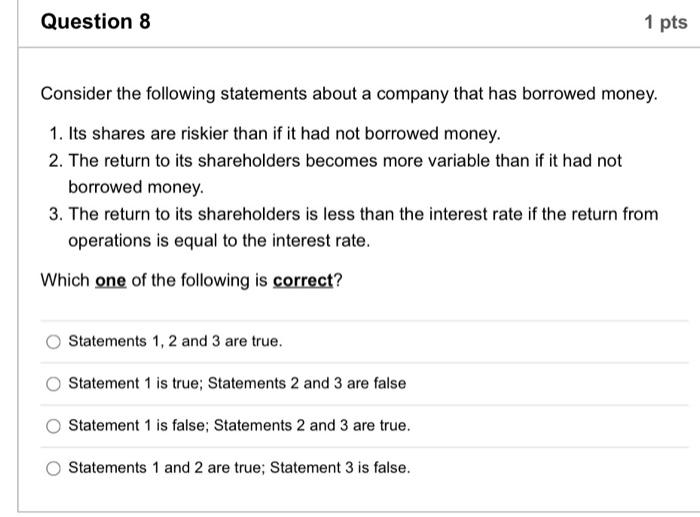

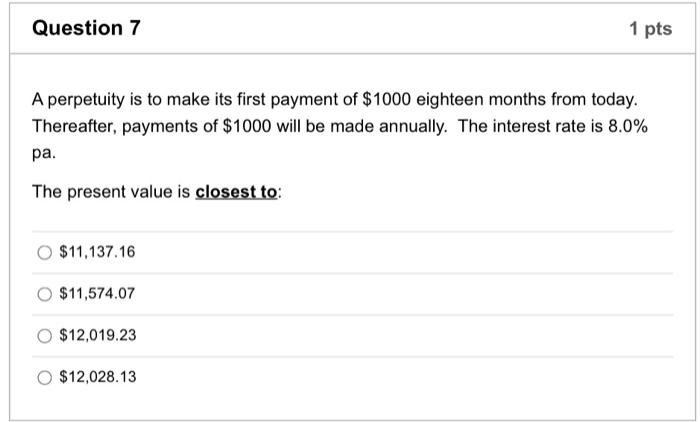

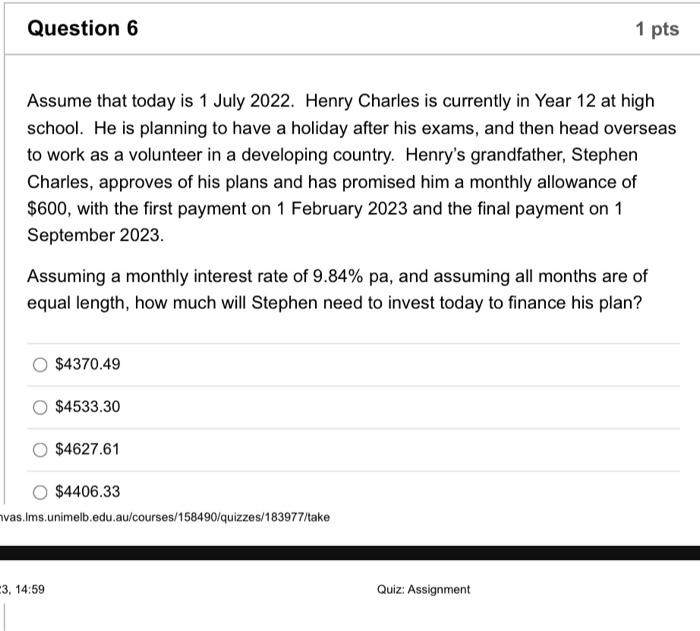

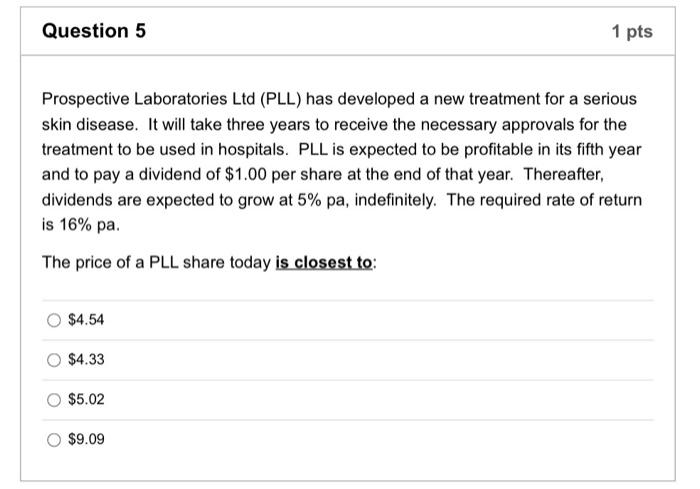

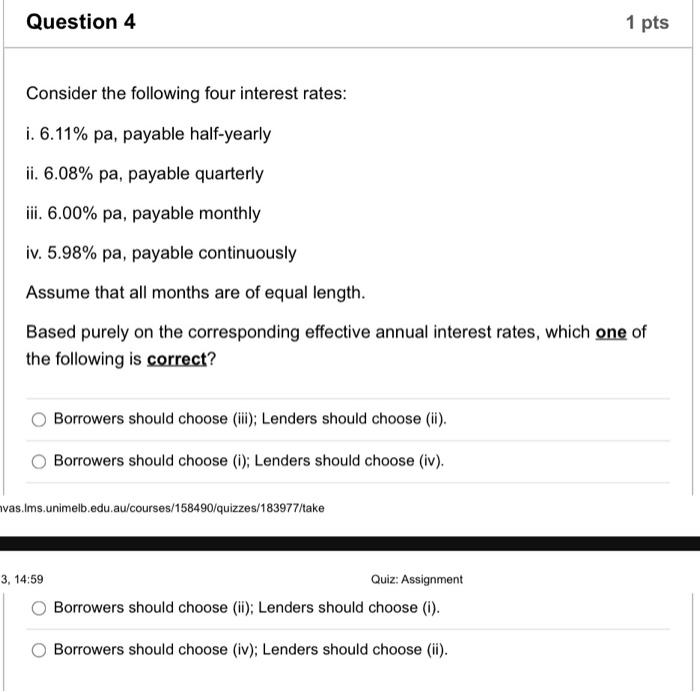

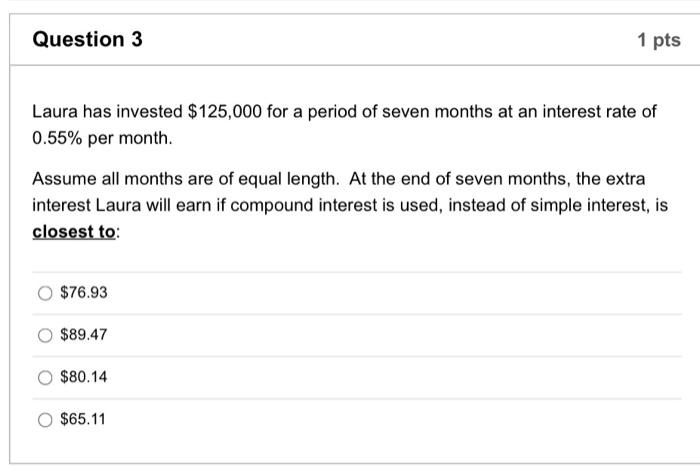

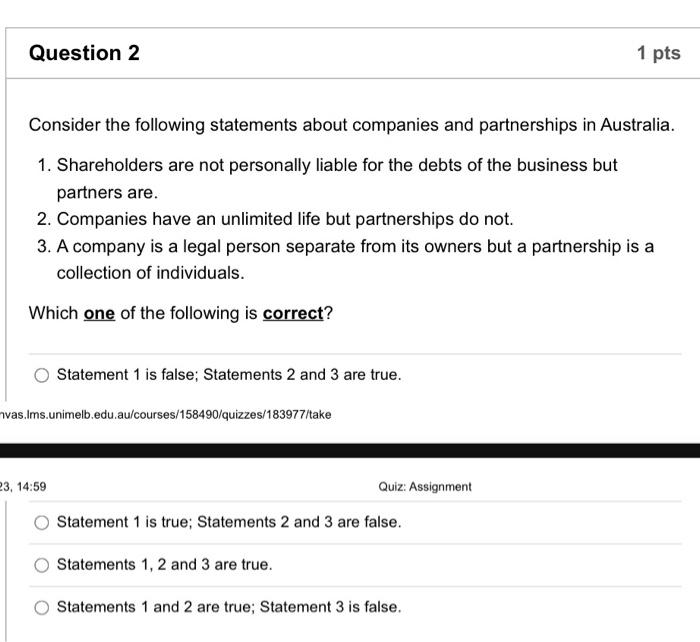

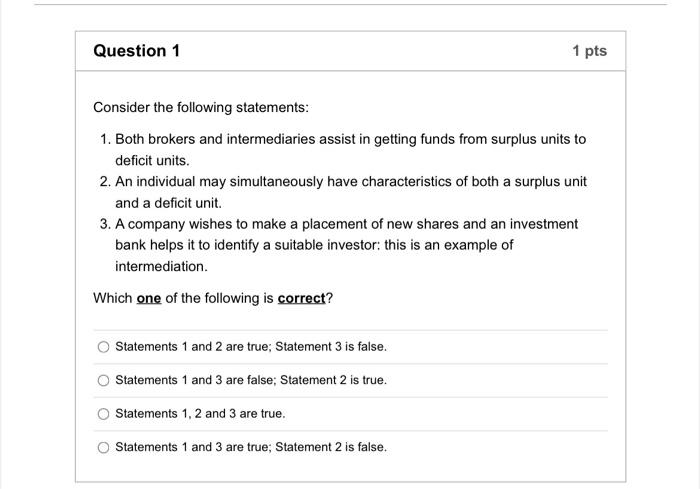

1. Both brokers and intermediaries assist in getting funds from surplus units to deficit units. 2. An individual may simultaneously have characteristics of both a surplus unit and a deficit unit. 3. A company wishes to make a placement of new shares and an investment bank helps it to identify a suitable investor: this is an example of intermediation. Which one of the following is correct? Statements 1 and 2 are true; Statement 3 is false. Statements 1 and 3 are false; Statement 2 is true. Statements 1,2 and 3 are true. Statements 1 and 3 are true; Statement 2 is false. Apex Management Ltd (AML) has irredeemable preference shares on issue. The fixed (nominal) dividend rate is 8.7% pa and dividends are payable every six months. A dividend has just been paid. The face value of each preference share is $100. The required (compound, or effective) rate of return is 10.25% pa. The current price of an AML preference share is closest to: $81.50$84.88$82.86$87.00 Popular Magazines Ltd (PML) has decided to raise new capital by making a placement of shares to Sunspot Investments Ltd (SIL). The placement increases the number of PML shares on issue by 14% and is made at a discount of 5% to the PML market price. SIL makes a capital gain that is closest to: \begin{tabular}{|l|} \hline 4.39% \\ \hline 4.62% \\ \hline 5.26% \\ \hline 5.00% \\ \hline \end{tabular} On 19 May 2022 , a superannuation fund sold a promissory note, issued by Cumbria Medicinal Ltd (CML), at a yield of 6.26% pa. The maturity date of the note was 4 August 2022 and its face value was $1,000,000. The price received by the superannuation fund was closest to: $986,799 $986,966 $987,273 $986,867 A bond pays annual coupons of 6.25% and has a remaining term of 12 years. A coupon payment has just been made. The yield on the bond is currently 6.10% pa. If the yield immediately increases by 25 basis points, then a bondholder's percentage capital loss is closest to: 2.64%2.05%4.10%2.09% Isaac has been paying off a principal-and-interest home mortgage for the past two years. His bank lent him $427,000 at an interest rate of 4.8% pa, with a loan term of 25 years, with equal monthly repayments required. Immediately after Isaac made the 24th repayment, the bank informed him that the interest rate has been increased to 5.1% pa, effective immediately, and his monthly repayment will therefore be increased so that his loan will be repaid by the originally agreed date. as.Ims.unimelb.edu.au/courses/158490/quizzes/183977/take 14:59 Quiz: Assignment The increase in Isaac's monthly repayment is closest to: $152.92 $184.16 $84.83 $69.76 Mahendra owns 100,000 shares in White Horse Ltd (WHL). Recently, WHL made a 1-for-10 renounceable rights issue. Mahendra decided to sell his rights. Which one of the following is most likely to be correct? Mahendra lost proportionate voting power and suffered a loss of wealth. Mahendra did not lose proportionate voting power and did not suffer a loss of wealth. Mahendra did not lose proportionate voting power but suffered a loss of wealth. Mahendra lost proportionate voting power but did not suffer a loss of wealth. River Constructions Ltd (RCL) is deciding whether to invest in a new project. If the project is undertaken, it will require an immediate outlay of $500,000 and a further outlay of $250,000 in a year's time. The project is then expected to produce a positive net cash flow of $950,000 at the end of the year after that. The required rate of return is 11% pa. The project's net present value is closest to: \begin{tabular}{c} $105,856 \\ \hline$69,026 \\ \hline$21,041 \\ \hline$45,816 \end{tabular} Consider the following statements about a company that has borrowed money. 1. Its shares are riskier than if it had not borrowed money. 2. The return to its shareholders becomes more variable than if it had not borrowed money. 3. The return to its shareholders is less than the interest rate if the return from operations is equal to the interest rate. Which one of the following is correct? Statements 1,2 and 3 are true. Statement 1 is true; Statements 2 and 3 are false Statement 1 is false; Statements 2 and 3 are true. Statements 1 and 2 are true; Statement 3 is false. A perpetuity is to make its first payment of $1000 eighteen months from today. Thereafter, payments of $1000 will be made annually. The interest rate is 8.0% pa. The present value is closest to: $11,137.16$11,574.07$12,019.23$12,028.13 Assume that today is 1 July 2022 . Henry Charles is currently in Year 12 at high school. He is planning to have a holiday after his exams, and then head overseas to work as a volunteer in a developing country. Henry's grandfather, Stephen Charles, approves of his plans and has promised him a monthly allowance of $600, with the first payment on 1 February 2023 and the final payment on 1 September 2023. Assuming a monthly interest rate of 9.84% pa, and assuming all months are of equal length, how much will Stephen need to invest today to finance his plan? \begin{tabular}{|l|} \hline$4370.49 \\ \hline$4533.30 \\ \hline$4627.61 \\ \hline$4406.33 \end{tabular} Prospective Laboratories Ltd (PLL) has developed a new treatment for a serious skin disease. It will take three years to receive the necessary approvals for the treatment to be used in hospitals. PLL is expected to be profitable in its fifth year and to pay a dividend of $1.00 per share at the end of that year. Thereafter, dividends are expected to grow at 5% pa, indefinitely. The required rate of return is 16%pa. The price of a PLL share today is closest to: \begin{tabular}{|r|} \hline$4.54 \\ \hline$4.33 \\ \hline$5.02 \\ \hline$9.09 \\ \hline \end{tabular} Consider the following four interest rates: i. 6.11% pa, payable half-yearly ii. 6.08% pa, payable quarterly iii. 6.00% pa, payable monthly iv. 5.98% pa, payable continuously Assume that all months are of equal length. Based purely on the corresponding effective annual interest rates, which one of the following is correct? Borrowers should choose (iii); Lenders should choose (ii). Borrowers should choose (i); Lenders should choose (iv). vas.Ims.unimelb.edu.au/courses/158490/quizzes/183977/take 3, 14:59 Quiz: Assignment Borrowers should choose (ii); Lenders should choose (i). Borrowers should choose (iv); Lenders should choose (ii). Laura has invested $125,000 for a period of seven months at an interest rate of 0.55% per month. Assume all months are of equal length. At the end of seven months, the extra interest Laura will earn if compound interest is used, instead of simple interest, is closest to: $76.93 $89.47 $80.14 $65.11 Consider the following statements about companies and partnerships in Australia. 1. Shareholders are not personally liable for the debts of the business but partners are. 2. Companies have an unlimited life but partnerships do not. 3. A company is a legal person separate from its owners but a partnership is a collection of individuals. Which one of the following is correct? Statement 1 is false; Statements 2 and 3 are true. as.Ims.unimelb.edu.au/courses/158490/quizzes/183977/take 3,14:59 Quiz: Assignment Statement 1 is true; Statements 2 and 3 are false. Statements 1, 2 and 3 are true. Statements 1 and 2 are true; Statement 3 is false. Consider the following statements: 1. Both brokers and intermediaries assist in getting funds from surplus units to deficit units. 2. An individual may simultaneously have characteristics of both a surplus unit and a deficit unit. 3. A company wishes to make a placement of new shares and an investment bank helps it to identify a suitable investor: this is an example of intermediation. Which one of the following is correct? Statements 1 and 2 are true; Statement 3 is false. Statements 1 and 3 are false; Statement 2 is true. Statements 1, 2 and 3 are true. Statements 1 and 3 are true; Statement 2 is false