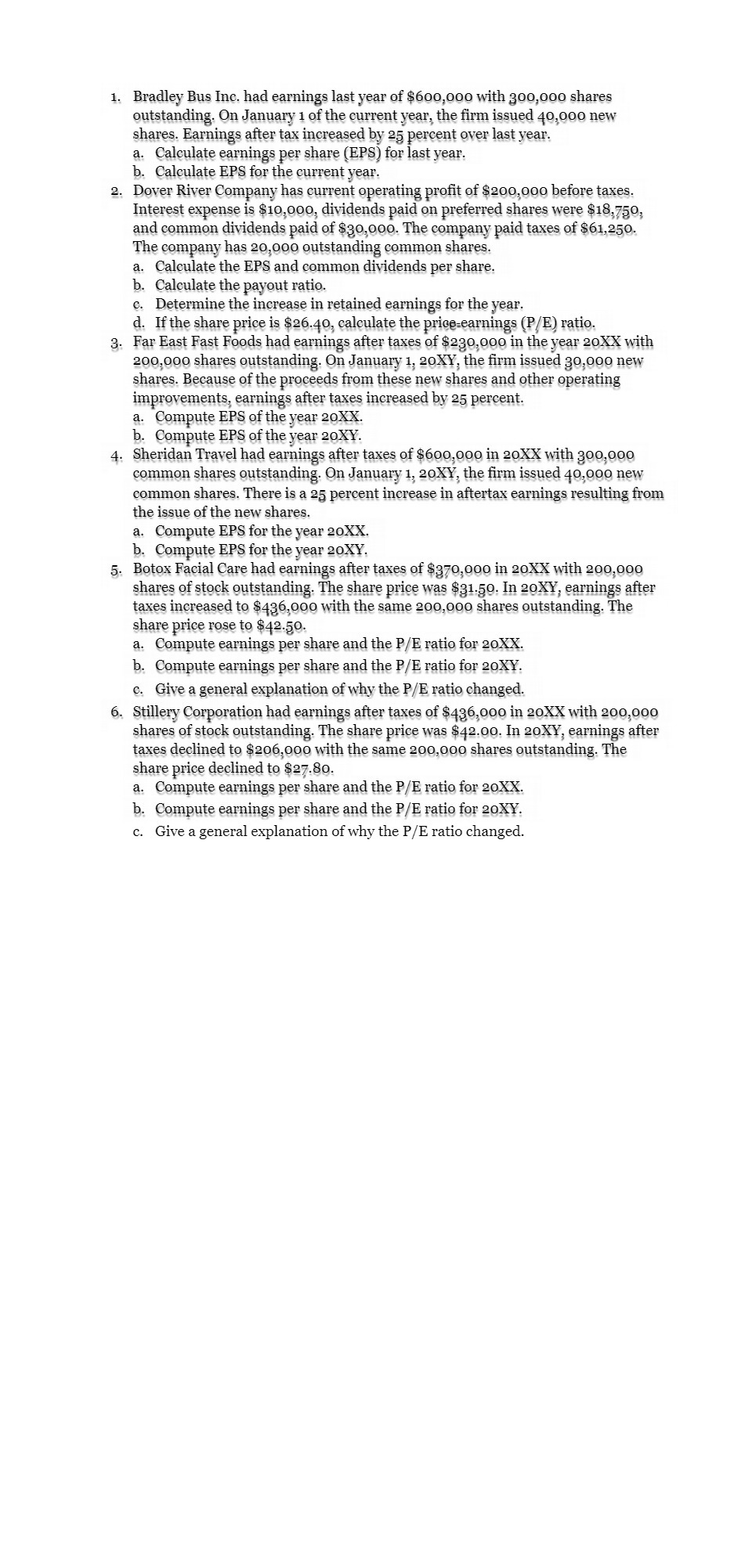

1. Bradley Bus Inc. had earnings last year of $600,000 with 300,000 shares outstanding. On January 1 of the current year, the firm issued 40,000 new shares. Earnings after tax increased by 25 percent over last year. a. Calculate earnings per share (EPS) for last year. b. Calculate EPS for the current year. 2. Dover River Company has current operating profit of $200,000 before taxes. Interest expense is $10,000, dividends paid on preferred shares were $18,750, and common dividends paid of $30,000. The company paid taxes of $61,250. The company has 20,000 outstanding common shares. a. Calculate the EPS and common dividends per share. b. Calculate the payout ratio. c. Determine the increase in retained earnings for the year. d. If the share price is $26.40, calculate the price-earnings (P/E) ratio. 3. Far East Fast Foods had earnings after taxes of $230,000 in the year 20XX with 200,090 shares outstanding. On January 1, 20XY, the firm issued 30,909 new shares. Because of the proceeds from these new shares and other operating improvements, earnings after taxes increased by 25 percent. a. Compute EPS of the year 20XX. b. Compute EPS of the year 20XY. 4: Sheridan Travel had earnings after taxes of $600,090 in 20XX with 300,090 common shares outstanding. On January 1, 20XY, the firm issued 40,090 new common shares. There is a 25 percent increase in aftertax earnings resulting from the issue of the new shares. a. Compute EPS for the year 20XX. b. Compute EPS for the year 20XY. 5. Botox Facial Care had earnings after taxes of $370,000 in 20XX with 200,000 shares of stock outstanding. The share price was $31.50. In 20XY, earnings after taxes increased to $436,000 with the same 200,000 shares outstanding. The share price rose to $42.50. a. Compute earnings per share and the P/E ratio for 20XX. b. Compute earnings per share and the P/E ratio for 20XY. c. Give a general explanation of why the P/E ratio changed. 6. Stillery Corporation had earnings after taxes of $436,000 in 20XX with 200,000 shares of stock outstanding. The share price was $42.00. In 20XY, earnings after taxes declined to $206,000 with the same 200,000 shares outstanding. The share price declined to $27.80. a. Compute earnings per share and the P/E ratio for 20XX. b. Compute earnings per share and the P/E ratio for 20XY. c. Give a general explanation of why the P/E ratio changed