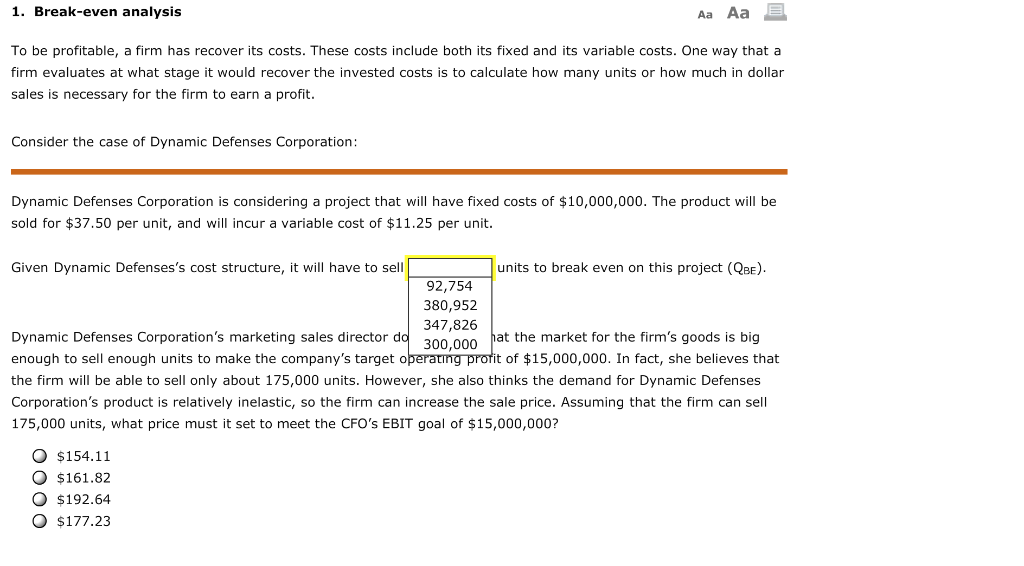

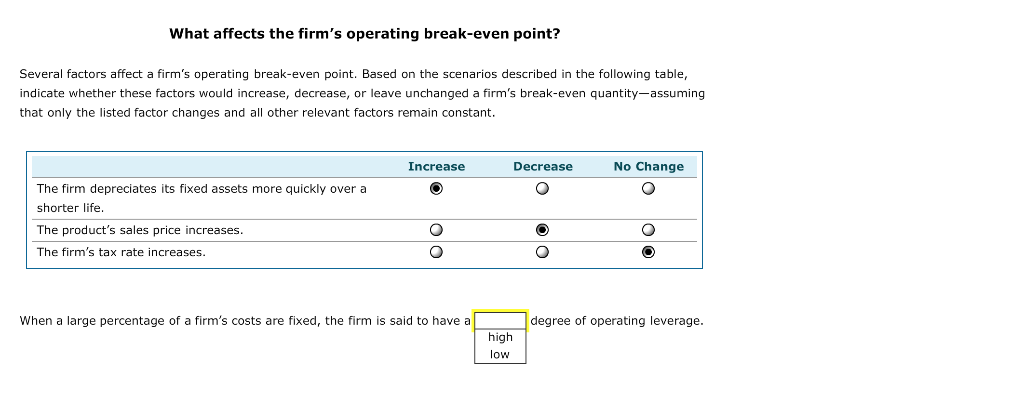

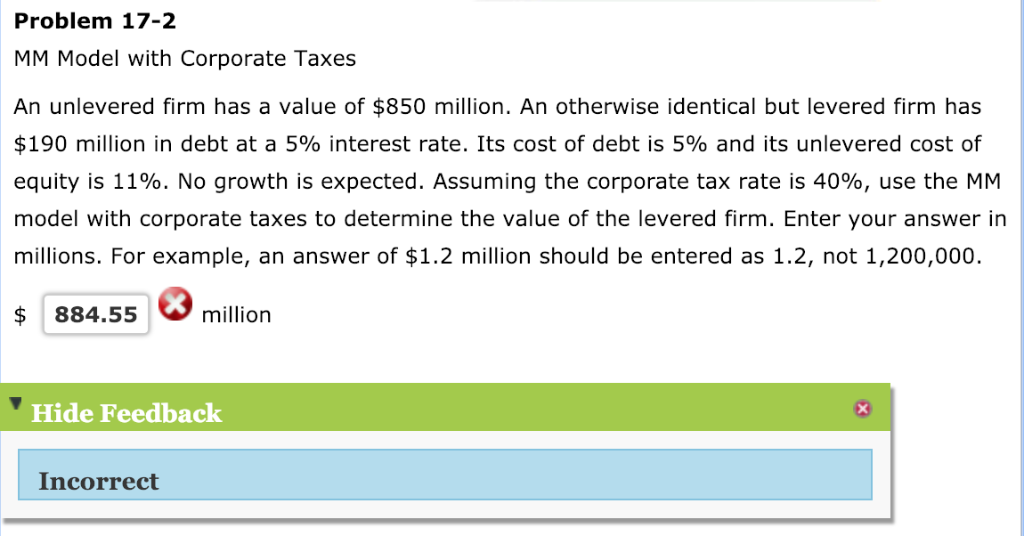

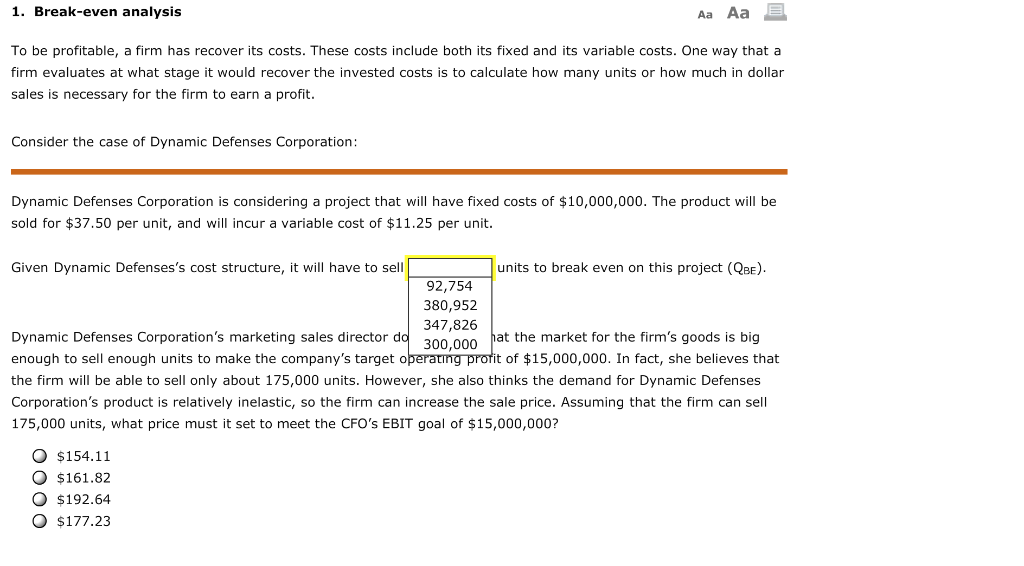

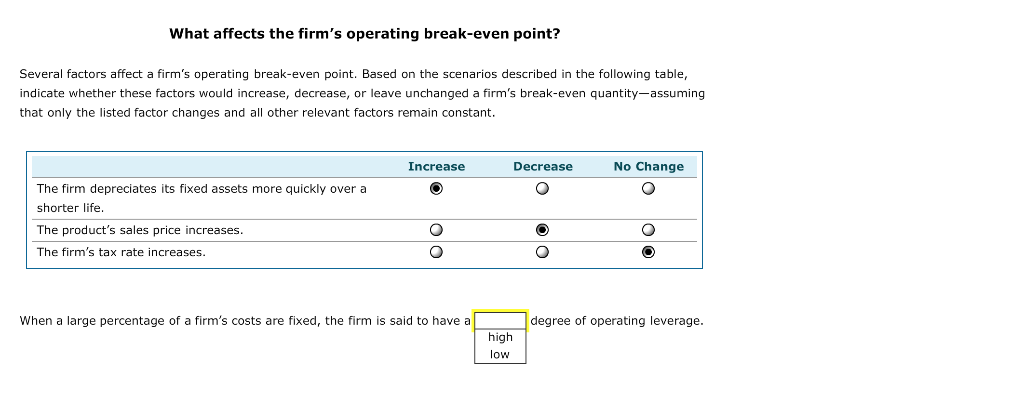

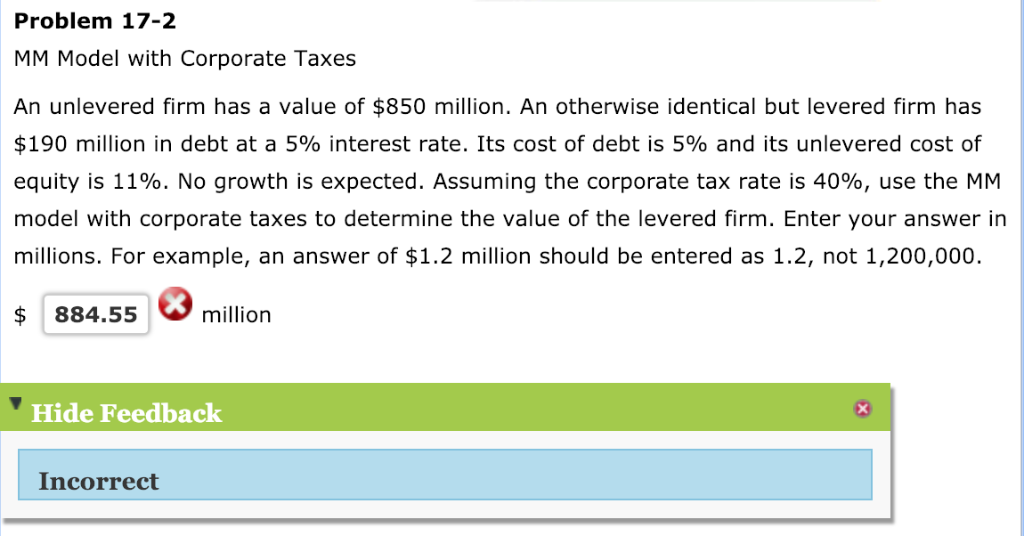

1. Break-even analysis Aa Aa To be profitable, a firm has recover its costs. These costs include both its fixed and its variable costs. One way that a firm evaluates at what stage it would recover the invested costs is to calculate how many units or how much in dollar sales is necessary for the firm to earn a profit. Consider the case of Dynamic Defenses Corporation: Dynamic Defenses Corporation is considering a project that will have fixed costs of $10,000,000. The product will be sold for $37.50 per unit, and will incur a variable cost of $11.25 per unit. Given Dynamic Defenses's cost structure, it will have to sell units to break even on this project (QBE). 92,754 380,952 347,826 300,000 hat the market for the firm's goods is big Dynamic Defenses Corporation's marketing sales director do enough to sell enough units to make the company's target operating profit of $15,000,000. In fact, she believes that the firm will be able to sell only about 175,000 units. However, she also thinks the demand for Dynamic Defenses Corporation's product is relatively inelastic, so the firm can increase the sale price. Assuming that the firm can sell 175,000 units, what price must it set to meet the CFO's EBIT goal of $15,000,000? O $154.11 O $161.82 O $192.64 O $177.23 What affects the firm's operating break-even point? Several factors affect a firm's operating break-even point. Based on the scenarios described in the following table, indicate whether these factors would increase, decrease, or leave unchanged a firm's break-even quantity-assuming that only the listed factor changes and all other relevant factors remain constant. Increase Decrease No Change The firm depreciates its fixed assets more quickly over a shorter life. The product's sales price increases. The firm's tax rate increases When a large percentage of a firm's costs are fixed, the firm is said to have a degree of operating leverage high low Problem 17-2 MM Model with Corporate Taxes An unlevered firm has a value of $850 million. An otherwise identical but levered firm has $190 million in debt at a 5% interest rate. Its cost of debt is 5% and its unlevered cost of equity is 11%. No growth is expected. Assuming the corporate tax rate is 40%, use the MM model with corporate taxes to determine the value of the levered firm. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000 $884.55 million Hide Fedback Incorrect