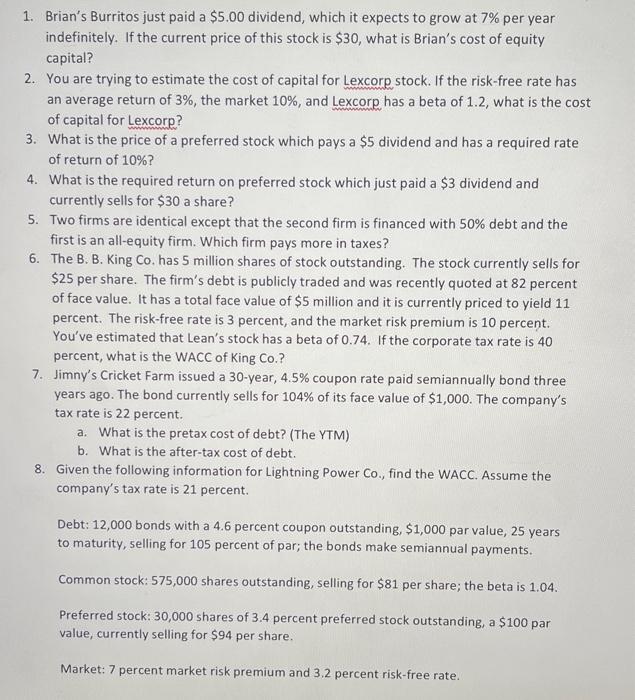

1. Brian's Burritos just paid a $5.00 dividend, which it expects to grow at 7% per year indefinitely. If the current price of this stock is $30, what is Brian's cost of equity capital? 2. You are trying to estimate the cost of capital for Lexcorp stock. If the risk-free rate has an average return of 3%, the market 10%, and Lexcorp has a beta of 1.2 , what is the cost of capital for Lexcorp? 3. What is the price of a preferred stock which pays a $5 dividend and has a required rate of return of 10% ? 4. What is the required return on preferred stock which just paid a $3 dividend and currently sells for $30 a share? 5. Two firms are identical except that the second firm is financed with 50% debt and the first is an all-equity firm. Which firm pays more in taxes? 6. The B. B. King Co, has 5 million shares of stock outstanding. The stock currently sells for $25 per share. The firm's debt is publicly traded and was recently quoted at 82 percent of face value. It has a total face value of $5 million and it is currently priced to yield 11 percent. The risk-free rate is 3 percent, and the market risk premium is 10 percent. You've estimated that Lean's stock has a beta of 0.74 . If the corporate tax rate is 40 percent, what is the WACC of King Co.? 7. Jimny's Cricket Farm issued a 30-year, 4.5% coupon rate paid semiannually bond three years ago. The bond currently sells for 104% of its face value of $1,000. The company's tax rate is 22 percent. a. What is the pretax cost of debt? (The YTM) b. What is the after-tax cost of debt. 8. Given the following information for Lightning Power Co., find the WACC. Assume the company's tax rate is 21 percent. Debt: 12,000 bonds with a 4.6 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 105 percent of par; the bonds make semiannual payments. Common stock: 575,000 shares outstanding, selling for $81 per share; the beta is 1.04 . Preferred stock: 30,000 shares of 3.4 percent preferred stock outstanding, a $100 par value, currently selling for $94 per share. Market: 7 percent market risk premium and 3.2 percent risk-free rate