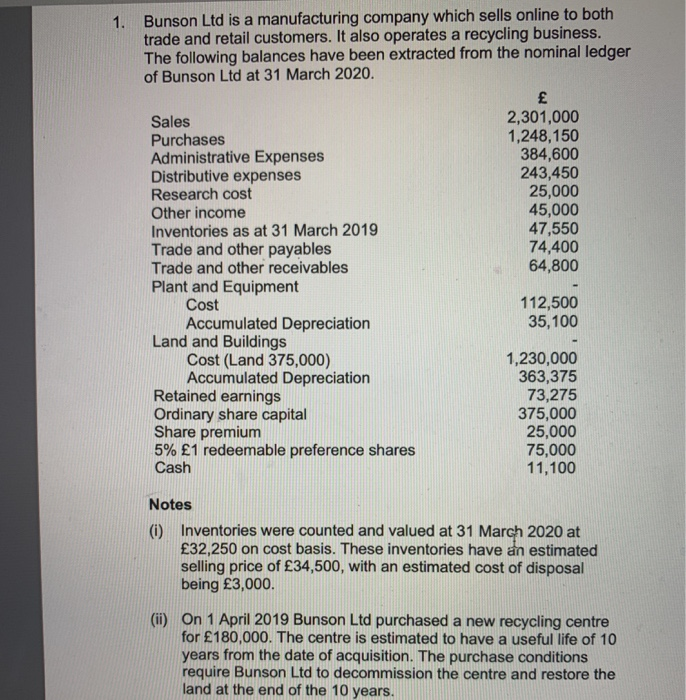

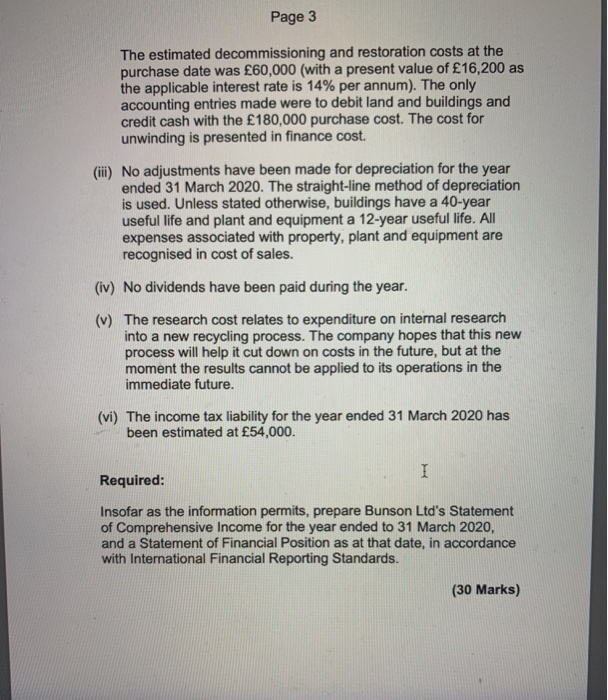

1. Bunson Ltd is a manufacturing company which sells online to both trade and retail customers. It also operates a recycling business. The following balances have been extracted from the nominal ledger of Bunson Ltd at 31 March 2020. 2,301,000 1,248,150 384,600 243,450 25,000 45,000 47,550 74,400 64,800 Sales Purchases Administrative Expenses Distributive expenses Research cost Other income Inventories as at 31 March 2019 Trade and other payables Trade and other receivables Plant and Equipment Cost Accumulated Depreciation Land and Buildings Cost (Land 375,000) Accumulated Depreciation Retained earnings Ordinary share capital Share premium 5% 1 redeemable preference shares Cash 112,500 35,100 1,230,000 363,375 73,275 375,000 25,000 75,000 11,100 Notes (6) Inventories were counted and valued at 31 March 2020 at 32,250 on cost basis. These inventories have an estimated selling price of 34,500, with an estimated cost of disposal being 3,000. (ii) On 1 April 2019 Bunson Ltd purchased a new recycling centre for 180,000. The centre is estimated to have a useful life of 10 years from the date of acquisition. The purchase conditions require Bunson Ltd to decommission the centre and restore the land at the end of the 10 years. Page 3 The estimated decommissioning and restoration costs at the purchase date was 60,000 (with a present value of 16,200 as the applicable interest rate is 14% per annum). The only accounting entries made were to debit land and buildings and credit cash with the 180,000 purchase cost. The cost for unwinding is presented in finance cost. (ili) No adjustments have been made for depreciation for the year ended 31 March 2020. The straight-line method of depreciation is used. Unless stated otherwise, buildings have a 40-year useful life and plant and equipment a 12-year useful life. All expenses associated with property, plant and equipment are recognised in cost of sales. (iv) No dividends have been paid during the year. (v) The research cost relates to expenditure on internal research into a new recycling process. The company hopes that this new process will help it cut down on costs in the future, but at the moment the results cannot be applied to its operations in the immediate future. (vi) The income tax liability for the year ended 31 March 2020 has been estimated at 54,000. Required: Insofar as the information permits, prepare Bunson Ltd's Statement of Comprehensive Income for the year ended to 31 March 2020, and a Statement of Financial Position as at that date, in accordance with International Financial Reporting Standards. (30 Marks)