Answered step by step

Verified Expert Solution

Question

1 Approved Answer

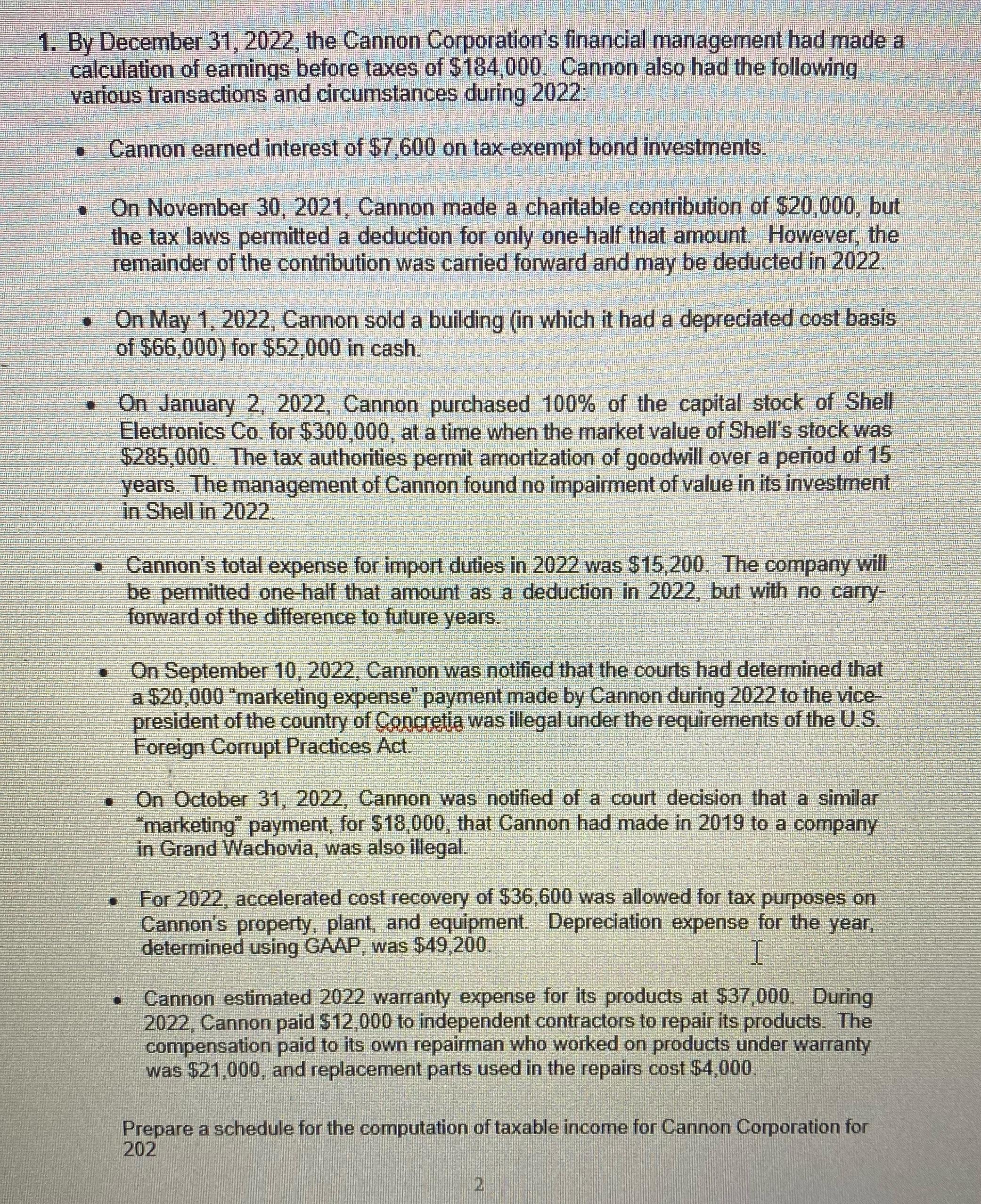

1. By December 31, 2022, the Cannon Corporation's financial management had made a calculation of eamings before taxes of $184,000. Cannon also had the

1. By December 31, 2022, the Cannon Corporation's financial management had made a calculation of eamings before taxes of $184,000. Cannon also had the following various transactions and circumstances during 2022: Cannon earned interest of $7,600 on tax-exempt bond investments. On November 30, 2021, Cannon made a charitable contribution of $20,000, but the tax laws permitted a deduction for only one-half that amount. However, the remainder of the contribution was carried forward and may be deducted in 2022. On May 1, 2022, Cannon sold a building (in which it had a depreciated cost basis of $66,000) for $52,000 in cash. On January 2, 2022, Cannon purchased 100% of the capital stock of Shell Electronics Co. for $300,000, at a time when the market value of Shell's stock was $285,000. The tax authorities permit amortization of goodwill over a period of 15 years. The management of Cannon found no impairment of value in its investment in Shell in 2022 Cannon's total expense for import duties in 2022 was $15,200. The company will be permitted one-half that amount as a deduction in 2022, but with no carry- forward of the difference to future years. On September 10, 2022, Cannon was notified that the courts had determined that a $20,000 "marketing expense" payment made by Cannon during 2022 to the vice- president of the country of Concretia was illegal under the requirements of the U.S. Foreign Corrupt Practices Act. On October 31, 2022, Cannon was notified of a court decision that a similar "marketing" payment, for $18,000, that Cannon had made in 2019 to a company in Grand Wachovia, was also illegal. For 2022, accelerated cost recovery of $36,600 was allowed for tax purposes on Cannon's property, plant, and equipment. Depreciation expense for the year, determined using GAAP, was $49,200. I Cannon estimated 2022 warranty expense for its products at $37,000. During 2022, Cannon paid $12,000 to independent contractors to repair its products. The compensation paid to its own repairman who worked on products under warranty was $21,000, and replacement parts used in the repairs cost $4,000. Prepare a schedule for the computation of taxable income for Cannon Corporation for 202 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the taxable income for Cannon Corporation for the year 2022 we need to consider various t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started