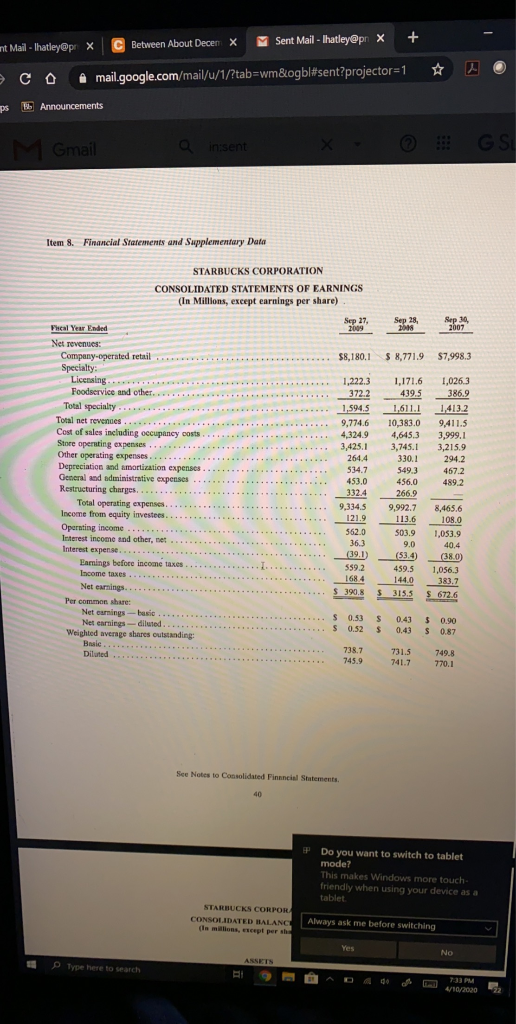

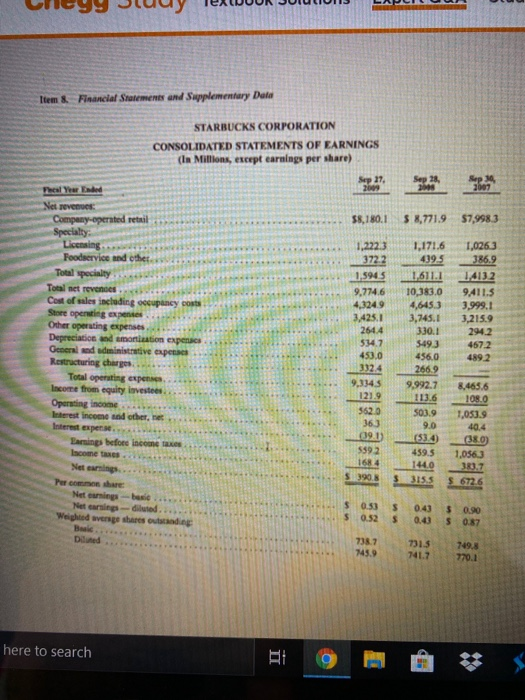

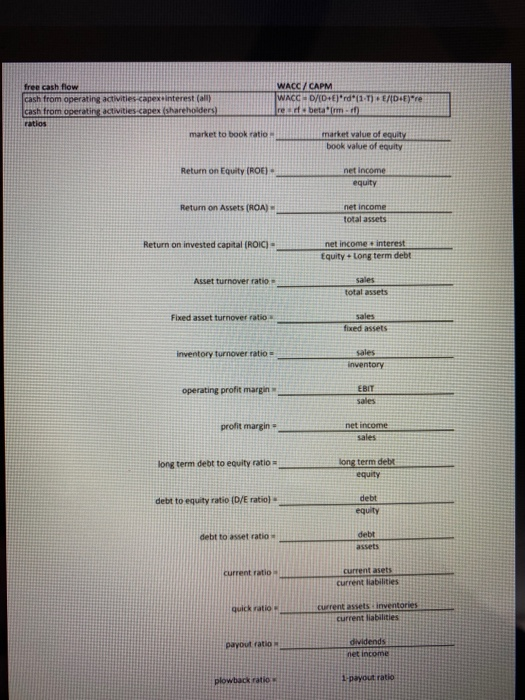

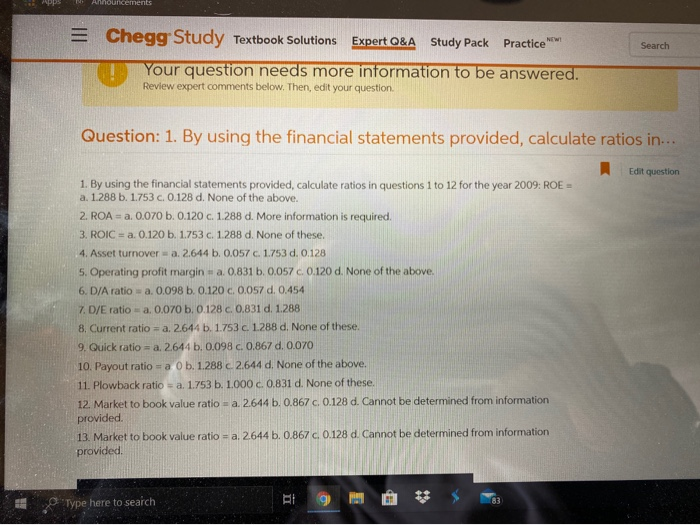

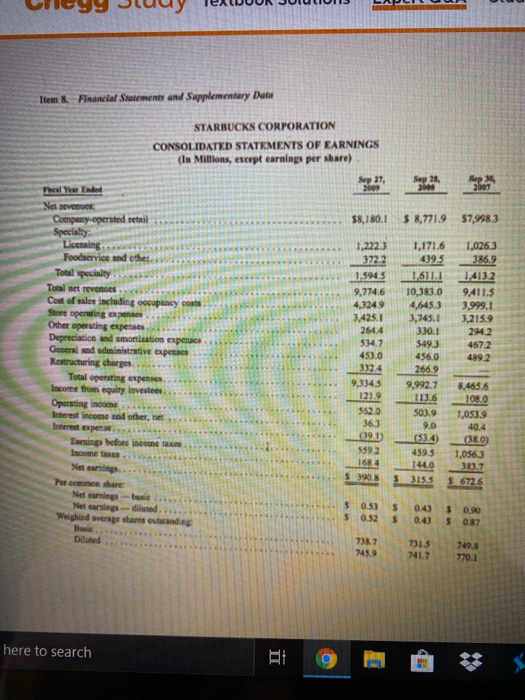

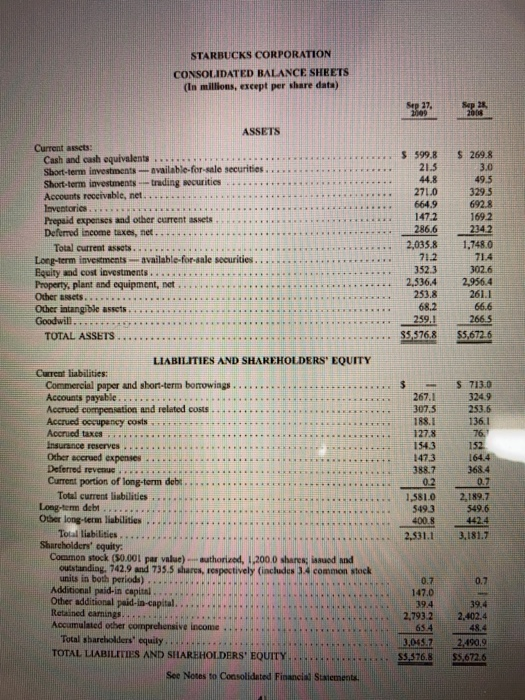

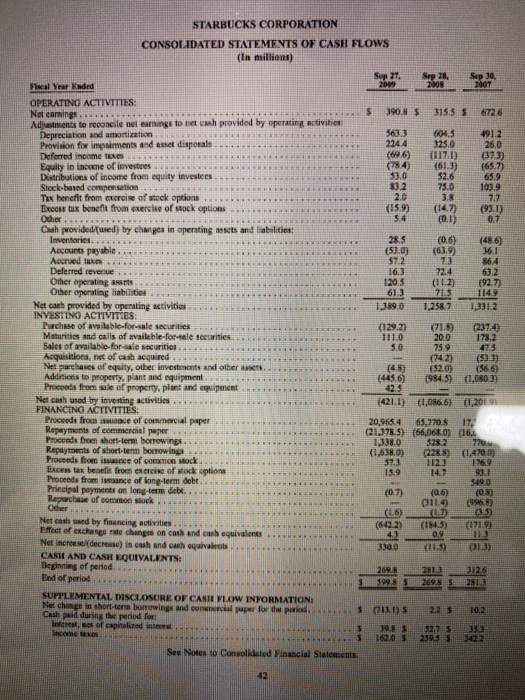

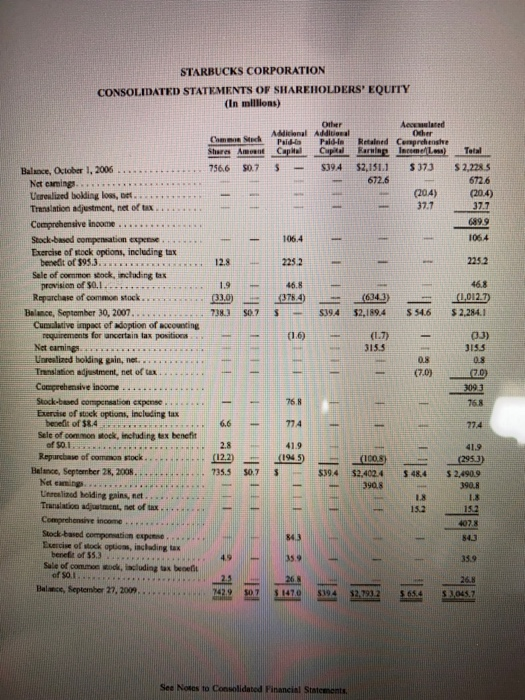

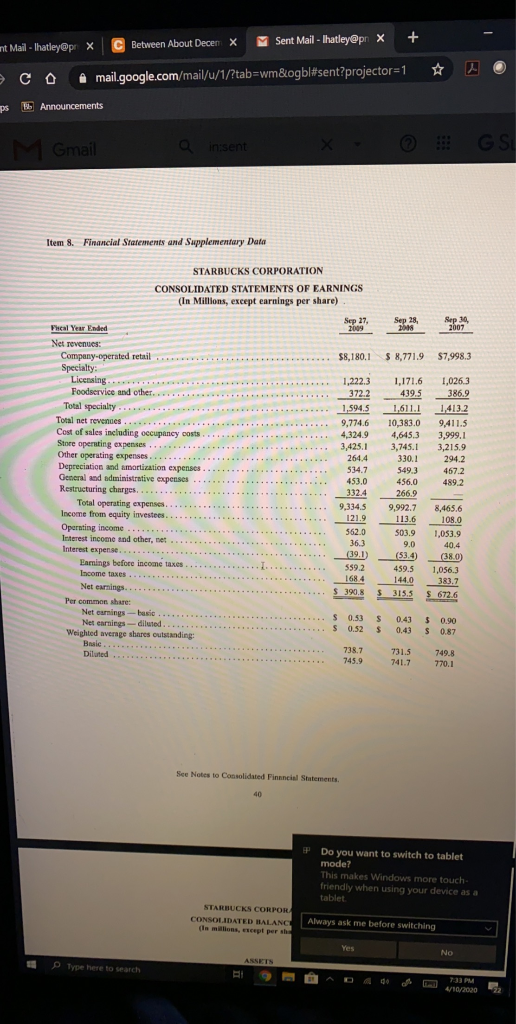

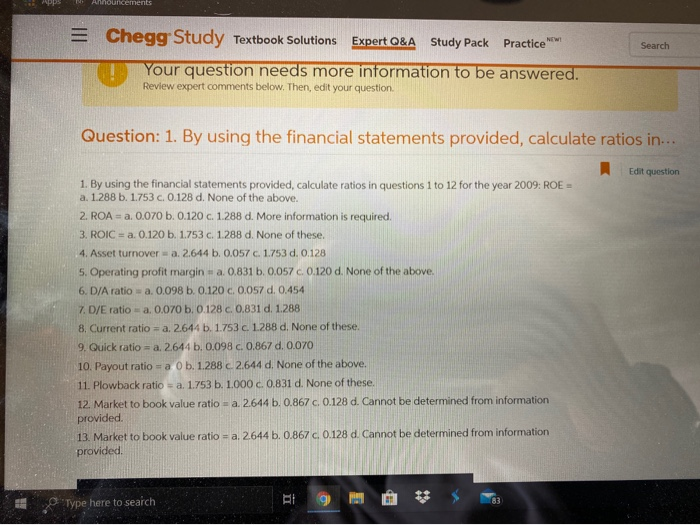

1. By using the financial statements provided, calculate ratios in questions 1 to 12 for the year 2009: ROE = a. 1.288 b. 1.753 c. 0.128 d. None of the above.

2. ROA = a. 0.070 b. 0.120 c. 1.288 d. More information is required.

3. ROIC = a. 0.120 b. 1.753 c. 1.288 d. None of these.

4. Asset turnover = a. 2.644 b. 0.057 c. 1.753 d. 0.128

5. Operating profit margin = a. 0.831 b. 0.057 c. 0.120 d. None of the above.

6. D/A ratio = a. 0.098 b. 0.120 c. 0.057 d. 0.454

7. D/E ratio = a. 0.070 b. 0.128 c. 0.831 d. 1.288

8. Current ratio = a. 2.644 b. 1.753 c. 1.288 d. None of these.

9. Quick ratio = a. 2.644 b. 0.098 c. 0.867 d. 0.070

10. Payout ratio = a. 0 b. 1.288 c. 2.644 d. None of the above.

11. Plowback ratio = a. 1.753 b. 1.000 c. 0.831 d. None of these.

12. Market to book value ratio = a. 2.644 b. 0.867 c. 0.128 d. Cannot be determined from information provided.

13. Market to book value ratio = a. 2.644 b. 0.867 c. 0.128 d. Cannot be determined from information provided.

I know Im asking alot but please please please help me with this!....

please please please help me! ik im asking alot!

- mnt Mail - Thatley@px C Between About Decen x Sent Mail - Thatley@pr X + C o m ail.google.com/mail/u/1/?tab=wm&ogbl#sent?projector=1 ps Announcements 2 O a in:sent GS Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (In Millions, except earnings per share) Sep 27. S2 Sep Sep 30, 2007 Focal Year Ended $8,180.1 $ 8,771.9 $7,998.3 Net revenues: Company-operated retail ...... Specialty: Licensing .. Foodservice and other..... Total specialty ... Total net revendes.................. Cost of sales including occupancy costs.... Store operating expenses ......... Other operating expenses........... Depreciation and amortization expenses... General and administrative expenses Restructuring charges. .. . Total operating expenses...... Income from equity investees........ Operating income .......... .... Interest income and other, net..... Interest expense Earnings before income taxes.... 1,222.3 372. 2 1,594,5 9,774,6 4.324,9 3,425.1 264.4 534.7 453.0 3 1,171,6 4 39.5 1,611.1 10,383.0 4,645. 3 3.745.1 330.1 5493 4560 266.9 9,992.7 1,0263 386.9 1,413.2 9,411.5 .999.1 3,215.9 294.2 4672 489.2 34.5 8,465.6 108.0 21.9 113.6 503.9 1.053.9 40.4 (380) 39.1) 559.2 1,056.3 53.4) 459.5 144.0 315,5 Net earnings............. $390.8 5 $ 672.6 Per common share: Net earnings besio...... Net earnings-diluted .......... Weighted average shares outstanding Basle... Diluted 0.53 0.52 $ $ 0.43 0.43 $ $ 0.90 0.87 738.7 745.9 731.5 741.7 749.8 770.1 See Notes to Consolidated Financial Statements P Do you want to switch to tablet mode? This makes Windows more touch- friendly when using your device as a tablet STARBUCKS CORPOR CONSOLIDATED BALANCE la milions, except per she Always ask me before switching Yes No ASSETS Type here to search 7:33 PM Clicy9 Juuy TexWUUR JUILLION Item & Financial Statements and Supplementary Date STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in Millions, except earnings per share) 58,180.1 5 8,771.9 $7,998.3 12723 1.594 5 9.774.6 Net revenues Company operated retail Specialty Licensing Foodservice and other Total specialty Total net revenues. . Cost of sales including occupancy Store operating expenses Other operating expenses Depreciation and amortization expens General and ministrative expense Restructuring charges.. Total operating expenses Income from equity investees.... Operating income Interest income and other, net Interest expert E s before con Income taxes 1,171,6 439. 5 1,611.1 10,383.0 4,645.3 3,745.1 3301 5493 456.0 266.9 1,0263 386.9 1.4132 9,411.5 3,999.1 3.215.9 294.2 4672 489 2 8.465.6 1080 113.6 SO3.9 1.053.9 1,056) Netering Per c here Net earnings-bes Net caring-diluted Weighted average shares 031 $ $ 0.90 0 and 0.43 Dild. 738.7 731.5 741.7 749,8 here to search free cash flow cash from operating activities.capex interest (ally cash from operating activities capex (shareholders WACC/CAPM WACC-D/CD+EJrd (1-1) rearbeta imm-10) /(DIE)re market to book ratio market value of equity book value of equity Return on Equity (ROE) - net income equity Return on Assets (ROA) net income total assets Return on invested capital (OIC) - net income interest Equity Long term debt Asset turnover ratio- sales total assets Fixed asset turnover ratio Sales fixed assets inventory turnover ratio = sales inventory operating profit margin profit margin- net income sales long term debt to equity ratio = long term debet equity debt to equity ratio (D/E ratio) debt equity debt to asset ratio debt assets current liabilities Inventories current liabilities payout ratio net income payout ratio Apps Announcements = Search Chegg Study Textbook Solutions Expert Q&A Study Pack Practice w Your question needs more information to be answered. Review expert comments below. Then, edit your question Question: 1. By using the financial statements provided, calculate ratios in... Edit question 1. By using the financial statements provided, calculate ratios in questions 1 to 12 for the year 2009: ROE = a. 1.288 b. 1.753 c. 0.128 d. None of the above. 2. ROA = a. 0.070 b. 0.120 c. 1.288 d. More information is required. 3. ROIC = a. 0.120 b. 1.753 c. 1.288 d. None of these 4. Asset turnover = a. 2.644 b. 0.057 c. 1.753 d. 0.128 5. Operating profit margin - a. 0.831 b. 0.057 c 0.120 d. None of the above. 6. D/A ratio - a. 0.098 b. 0.120 c 0.057 d. 0.454 7. D/E ratio-a, 0.070 b. 0.128 c 0.831 d. 1.288 8. Current ratio=a.2644 b. 1753c 1.288 d. None of these. 9. Quick ratio = a. 2644 b. 0.098 c. 0.867 d. 0.070 10. Payout ratio - a Ob. 1.288 C 2.644 d. None of the above. 11. Plowback ratio - a. 1.753 b. 1.000 c.0.831 d. None of these. 12. Market to book value ratio-a. 2.644 b. 0.867c0.128 d. Cannot be determined from information provided. 13. Market to book value ratio=a.2644 b. 0.867 c 0.128 d. Cannot be determined from information provided Type here to search Clicy9 Juuy TexWUUR JUILLION Item & Financial Statements and Supplementary Date STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in Millions, except earnings per share) 58,180.1 5 8,771.9 $7,998.3 12723 1.594 5 9.774.6 Net revenues Company operated retail Specialty Licensing Foodservice and other Total specialty Total net revenues. . Cost of sales including occupancy Store operating expenses Other operating expenses Depreciation and amortization expens General and ministrative expense Restructuring charges.. Total operating expenses Income from equity investees.... Operating income Interest income and other, net Interest expert E s before con Income taxes 1,171,6 439. 5 1,611.1 10,383.0 4,645.3 3,745.1 3301 5493 456.0 266.9 1,0263 386.9 1.4132 9,411.5 3,999.1 3.215.9 294.2 4672 489 2 8.465.6 1080 113.6 SO3.9 1.053.9 1,056) Netering Per c here Net earnings-bes Net caring-diluted Weighted average shares 031 $ $ 0.90 0 and 0.43 Dild. 738.7 731.5 741.7 749,8 here to search STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share data) ASSETS $ 269.8 3.0 Current assets: Cash and cash equivalents. Short-term investments available-for-salo securit Short-term investments - trading socurities Accounts receivable, nel.... . Inventories.. Prepaid expenses and other current Assets Deferred income taxes, net... Total current assets.... Long-term investments available for sale securities Equity and cost investments .... Property, plant and equipment, net. Other assets........ Other intangible assets Goodwill.. TOTAL ASSETS.. 599,8 21.5 44 8 271.0 664.9 147.2 286.6 2,035.8 71.2 3523 2.336.4 2518 62.2 25941 $5,576.8 49,5 3295 692.8 1692 2342 1.748.0 714 302.6 2.956.4 261.1 55,6726 267.1 3075 188.1 127.8 154.3 1473 388.7 $ 713.0 3249 2535 136.1 76 152 164.4 368.4 1.581.0 5493 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Commercial paper and short-term borrowings. Accounts payable. .. Accrued compensation and related costs... Accrued occupancy costs.. Acered taxes.. * *** Insurance reserves ........ Other accrued expenses.. Deferred revenue ...... Current portion of long-term deb Total current liabilities Long-term debt ......... Other long-term liabilities ... Total liabilities..... Shareholders equity Common stock (50.001 par value) --suthorized, 1,200.0 shares lued and outstanding. 742.9 and 735.5 shares, respectively includes 34 common stock units in both periods) ........ Additional paid-in capital... Other additional paid-in-capital... Retained camnings...... . Accumulated other comprehensive income Total shareholders' equily..... TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY.. See Notes to Consolidated Financial 2.531.1 147.0 2402 4 13.03.2 5576,8 $5,6726 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) 390.8 5 315.5 S 6726 5633 2244 (696) (784) 53.0 604.5 325.0 (171) (61.3) $26 25.0 378 (14.7 (0.1) 4912 26.0 (373) (65.7) 65.9 100.9 2 (15.93 S4 (93.1) 0.7 25 (52.01 (0.6) (639) (486) $7.2 564 (11.21 92.7 613 1389.0 1,2587 1312 scal Year Ended OPERATING ACTIVITIES: Nel camings. . . Adjustments to reconcile nel earings to net cash provided by operating activities Depreciation and amortization Provision fow imeniments and asset disposals Deferred income taxe Equity in income of investees Distributions of income from equity investees Steck-band compensation Tex benefit from exercise of stock options Bucest to benefit from exercise of stock options Other Cash provided (used) by changes in operating assets and liabilities Inventaries. . . Accounts payable ..... Accued ta Deferred revenue Other operating Other operating liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchase of available for sale securities Maturities and calls of available for sale securities Saics of available for sale securities Acquisitions, net or cash acquired Net purchases of equity, other investments and others Add to property, plant and equipment Proceeds from sale of property, plant and equipment Net cash used by investing activities FINANCING ACTIVITIES Proceeds from sunce of commercial paper Repayments of commercial peper. Proceeds from short-term borrowings Repayments of short-term borrowing Proceeds from sange of common stock Excelax beoel from exercise of wock options Proceeds from image of long-term debt Principal payments on long-term Geb... Repurchase of common stock Other Net cash wed by financing activities..... Effect of exchange rate changes on cash and chequ Net increase (decrease in cash and can equivale CASH AND CASH EQUIVALENTS: Beginning of period End of period (129.23 111.0 5.0 21 2010 (2310 172 75. (742) (520) 19845) (1,080.3 499 (445) 23 (421.1) 41,0866) 1,2093 20.9654 65.970. 177 (21.378.5) (66,068.0) (16.1 1338. 0 9282 1.63HO) (2288) (1.470 1259 15.9 147 1490 (07) 03 311.4 (9968) (16) (1.77 (6422) (1843) (1719) (06) 35 3300 (11. PO 399.8 78113 269. 3:26 281 SUPPLEMENTAL DISCLOSURE OF CASIYLOW INFORMATION: Net change in short-term bomwing and Con a l paper for the period Cash paid during the period for Interest, of capitalized interes... Incene u 5 2 10,2 $ 213.1) 39.8 16230 S 827 5 259.5 333 342 See Notes to Consolidated Financial Stal STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions) A lated Other Other Adicional Additional Care ERP Pelin hares Amon Capital Capital Earning $2,151.1 Income Los) 5373 5394 Total $2,2285 6726 (2004) (204) 37.1 1064 !!!!! 225.2 46.8 (1,012.) $2,284.1 S546 (33) 3155 Balance, October 1, 2006 Net camings Urealized bolding loss, et Translation adjustment, net of tax Comprehensive income ....... Stock-based compensation expense... Exercise of stock options, including tax best of $99.3.. Sale of common stock, including tax provision of $0.1..--- Repurchase of common stock Balance, September 30, 2007.... Cuolative impact of adoption of accounting requirements for uncertain tax positions. Net Gaming Unrealized holding gain, net.... Translation adjustment, net of tax. Comprehensive income Stock-based compensation expense . Exercise of stock options, including tax becedit of $8.4 Sale of common Mock, including tex benefit of 50. .. +** Repurchase of common stock..... Halance, September 28, 2008. ... Neti ng.. .. . Uhrined holding gains, net Translatie adient set of tax Comprehensive income ..... Stock-based compensation expose Eure of wock options, including tax benet of 55.3 .. . Sale of comm o d, including tax b elt !!! $ 2,490.9 390.8 !!!!! 1:1 Balce, September 27, 2009... See Notes to Consolidated Financial Statements. free cash flow cash from operating activities.capex interest (ally cash from operating activities capex (shareholders WACC/CAPM WACC-D/CD+EJrd (1-1) rearbeta imm-10) /(DIE)re market to book ratio market value of equity book value of equity Return on Equity (ROE) - net income equity Return on Assets (ROA) net income total assets Return on invested capital (OIC) - net income interest Equity Long term debt Asset turnover ratio- sales total assets Fixed asset turnover ratio Sales fixed assets inventory turnover ratio = sales inventory operating profit margin profit margin- net income sales long term debt to equity ratio = long term debet equity debt to equity ratio (D/E ratio) debt equity debt to asset ratio debt assets current liabilities Inventories current liabilities payout ratio net income payout ratio - mnt Mail - Thatley@px C Between About Decen x Sent Mail - Thatley@pr X + C o m ail.google.com/mail/u/1/?tab=wm&ogbl#sent?projector=1 ps Announcements 2 O a in:sent GS Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (In Millions, except earnings per share) Sep 27. S2 Sep Sep 30, 2007 Focal Year Ended $8,180.1 $ 8,771.9 $7,998.3 Net revenues: Company-operated retail ...... Specialty: Licensing .. Foodservice and other..... Total specialty ... Total net revendes.................. Cost of sales including occupancy costs.... Store operating expenses ......... Other operating expenses........... Depreciation and amortization expenses... General and administrative expenses Restructuring charges. .. . Total operating expenses...... Income from equity investees........ Operating income .......... .... Interest income and other, net..... Interest expense Earnings before income taxes.... 1,222.3 372. 2 1,594,5 9,774,6 4.324,9 3,425.1 264.4 534.7 453.0 3 1,171,6 4 39.5 1,611.1 10,383.0 4,645. 3 3.745.1 330.1 5493 4560 266.9 9,992.7 1,0263 386.9 1,413.2 9,411.5 .999.1 3,215.9 294.2 4672 489.2 34.5 8,465.6 108.0 21.9 113.6 503.9 1.053.9 40.4 (380) 39.1) 559.2 1,056.3 53.4) 459.5 144.0 315,5 Net earnings............. $390.8 5 $ 672.6 Per common share: Net earnings besio...... Net earnings-diluted .......... Weighted average shares outstanding Basle... Diluted 0.53 0.52 $ $ 0.43 0.43 $ $ 0.90 0.87 738.7 745.9 731.5 741.7 749.8 770.1 See Notes to Consolidated Financial Statements P Do you want to switch to tablet mode? This makes Windows more touch- friendly when using your device as a tablet STARBUCKS CORPOR CONSOLIDATED BALANCE la milions, except per she Always ask me before switching Yes No ASSETS Type here to search 7:33 PM Clicy9 Juuy TexWUUR JUILLION Item & Financial Statements and Supplementary Date STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in Millions, except earnings per share) 58,180.1 5 8,771.9 $7,998.3 12723 1.594 5 9.774.6 Net revenues Company operated retail Specialty Licensing Foodservice and other Total specialty Total net revenues. . Cost of sales including occupancy Store operating expenses Other operating expenses Depreciation and amortization expens General and ministrative expense Restructuring charges.. Total operating expenses Income from equity investees.... Operating income Interest income and other, net Interest expert E s before con Income taxes 1,171,6 439. 5 1,611.1 10,383.0 4,645.3 3,745.1 3301 5493 456.0 266.9 1,0263 386.9 1.4132 9,411.5 3,999.1 3.215.9 294.2 4672 489 2 8.465.6 1080 113.6 SO3.9 1.053.9 1,056) Netering Per c here Net earnings-bes Net caring-diluted Weighted average shares 031 $ $ 0.90 0 and 0.43 Dild. 738.7 731.5 741.7 749,8 here to search free cash flow cash from operating activities.capex interest (ally cash from operating activities capex (shareholders WACC/CAPM WACC-D/CD+EJrd (1-1) rearbeta imm-10) /(DIE)re market to book ratio market value of equity book value of equity Return on Equity (ROE) - net income equity Return on Assets (ROA) net income total assets Return on invested capital (OIC) - net income interest Equity Long term debt Asset turnover ratio- sales total assets Fixed asset turnover ratio Sales fixed assets inventory turnover ratio = sales inventory operating profit margin profit margin- net income sales long term debt to equity ratio = long term debet equity debt to equity ratio (D/E ratio) debt equity debt to asset ratio debt assets current liabilities Inventories current liabilities payout ratio net income payout ratio Apps Announcements = Search Chegg Study Textbook Solutions Expert Q&A Study Pack Practice w Your question needs more information to be answered. Review expert comments below. Then, edit your question Question: 1. By using the financial statements provided, calculate ratios in... Edit question 1. By using the financial statements provided, calculate ratios in questions 1 to 12 for the year 2009: ROE = a. 1.288 b. 1.753 c. 0.128 d. None of the above. 2. ROA = a. 0.070 b. 0.120 c. 1.288 d. More information is required. 3. ROIC = a. 0.120 b. 1.753 c. 1.288 d. None of these 4. Asset turnover = a. 2.644 b. 0.057 c. 1.753 d. 0.128 5. Operating profit margin - a. 0.831 b. 0.057 c 0.120 d. None of the above. 6. D/A ratio - a. 0.098 b. 0.120 c 0.057 d. 0.454 7. D/E ratio-a, 0.070 b. 0.128 c 0.831 d. 1.288 8. Current ratio=a.2644 b. 1753c 1.288 d. None of these. 9. Quick ratio = a. 2644 b. 0.098 c. 0.867 d. 0.070 10. Payout ratio - a Ob. 1.288 C 2.644 d. None of the above. 11. Plowback ratio - a. 1.753 b. 1.000 c.0.831 d. None of these. 12. Market to book value ratio-a. 2.644 b. 0.867c0.128 d. Cannot be determined from information provided. 13. Market to book value ratio=a.2644 b. 0.867 c 0.128 d. Cannot be determined from information provided Type here to search Clicy9 Juuy TexWUUR JUILLION Item & Financial Statements and Supplementary Date STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in Millions, except earnings per share) 58,180.1 5 8,771.9 $7,998.3 12723 1.594 5 9.774.6 Net revenues Company operated retail Specialty Licensing Foodservice and other Total specialty Total net revenues. . Cost of sales including occupancy Store operating expenses Other operating expenses Depreciation and amortization expens General and ministrative expense Restructuring charges.. Total operating expenses Income from equity investees.... Operating income Interest income and other, net Interest expert E s before con Income taxes 1,171,6 439. 5 1,611.1 10,383.0 4,645.3 3,745.1 3301 5493 456.0 266.9 1,0263 386.9 1.4132 9,411.5 3,999.1 3.215.9 294.2 4672 489 2 8.465.6 1080 113.6 SO3.9 1.053.9 1,056) Netering Per c here Net earnings-bes Net caring-diluted Weighted average shares 031 $ $ 0.90 0 and 0.43 Dild. 738.7 731.5 741.7 749,8 here to search STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share data) ASSETS $ 269.8 3.0 Current assets: Cash and cash equivalents. Short-term investments available-for-salo securit Short-term investments - trading socurities Accounts receivable, nel.... . Inventories.. Prepaid expenses and other current Assets Deferred income taxes, net... Total current assets.... Long-term investments available for sale securities Equity and cost investments .... Property, plant and equipment, net. Other assets........ Other intangible assets Goodwill.. TOTAL ASSETS.. 599,8 21.5 44 8 271.0 664.9 147.2 286.6 2,035.8 71.2 3523 2.336.4 2518 62.2 25941 $5,576.8 49,5 3295 692.8 1692 2342 1.748.0 714 302.6 2.956.4 261.1 55,6726 267.1 3075 188.1 127.8 154.3 1473 388.7 $ 713.0 3249 2535 136.1 76 152 164.4 368.4 1.581.0 5493 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Commercial paper and short-term borrowings. Accounts payable. .. Accrued compensation and related costs... Accrued occupancy costs.. Acered taxes.. * *** Insurance reserves ........ Other accrued expenses.. Deferred revenue ...... Current portion of long-term deb Total current liabilities Long-term debt ......... Other long-term liabilities ... Total liabilities..... Shareholders equity Common stock (50.001 par value) --suthorized, 1,200.0 shares lued and outstanding. 742.9 and 735.5 shares, respectively includes 34 common stock units in both periods) ........ Additional paid-in capital... Other additional paid-in-capital... Retained camnings...... . Accumulated other comprehensive income Total shareholders' equily..... TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY.. See Notes to Consolidated Financial 2.531.1 147.0 2402 4 13.03.2 5576,8 $5,6726 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) 390.8 5 315.5 S 6726 5633 2244 (696) (784) 53.0 604.5 325.0 (171) (61.3) $26 25.0 378 (14.7 (0.1) 4912 26.0 (373) (65.7) 65.9 100.9 2 (15.93 S4 (93.1) 0.7 25 (52.01 (0.6) (639) (486) $7.2 564 (11.21 92.7 613 1389.0 1,2587 1312 scal Year Ended OPERATING ACTIVITIES: Nel camings. . . Adjustments to reconcile nel earings to net cash provided by operating activities Depreciation and amortization Provision fow imeniments and asset disposals Deferred income taxe Equity in income of investees Distributions of income from equity investees Steck-band compensation Tex benefit from exercise of stock options Bucest to benefit from exercise of stock options Other Cash provided (used) by changes in operating assets and liabilities Inventaries. . . Accounts payable ..... Accued ta Deferred revenue Other operating Other operating liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchase of available for sale securities Maturities and calls of available for sale securities Saics of available for sale securities Acquisitions, net or cash acquired Net purchases of equity, other investments and others Add to property, plant and equipment Proceeds from sale of property, plant and equipment Net cash used by investing activities FINANCING ACTIVITIES Proceeds from sunce of commercial paper Repayments of commercial peper. Proceeds from short-term borrowings Repayments of short-term borrowing Proceeds from sange of common stock Excelax beoel from exercise of wock options Proceeds from image of long-term debt Principal payments on long-term Geb... Repurchase of common stock Other Net cash wed by financing activities..... Effect of exchange rate changes on cash and chequ Net increase (decrease in cash and can equivale CASH AND CASH EQUIVALENTS: Beginning of period End of period (129.23 111.0 5.0 21 2010 (2310 172 75. (742) (520) 19845) (1,080.3 499 (445) 23 (421.1) 41,0866) 1,2093 20.9654 65.970. 177 (21.378.5) (66,068.0) (16.1 1338. 0 9282 1.63HO) (2288) (1.470 1259 15.9 147 1490 (07) 03 311.4 (9968) (16) (1.77 (6422) (1843) (1719) (06) 35 3300 (11. PO 399.8 78113 269. 3:26 281 SUPPLEMENTAL DISCLOSURE OF CASIYLOW INFORMATION: Net change in short-term bomwing and Con a l paper for the period Cash paid during the period for Interest, of capitalized interes... Incene u 5 2 10,2 $ 213.1) 39.8 16230 S 827 5 259.5 333 342 See Notes to Consolidated Financial Stal STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions) A lated Other Other Adicional Additional Care ERP Pelin hares Amon Capital Capital Earning $2,151.1 Income Los) 5373 5394 Total $2,2285 6726 (2004) (204) 37.1 1064 !!!!! 225.2 46.8 (1,012.) $2,284.1 S546 (33) 3155 Balance, October 1, 2006 Net camings Urealized bolding loss, et Translation adjustment, net of tax Comprehensive income ....... Stock-based compensation expense... Exercise of stock options, including tax best of $99.3.. Sale of common stock, including tax provision of $0.1..--- Repurchase of common stock Balance, September 30, 2007.... Cuolative impact of adoption of accounting requirements for uncertain tax positions. Net Gaming Unrealized holding gain, net.... Translation adjustment, net of tax. Comprehensive income Stock-based compensation expense . Exercise of stock options, including tax becedit of $8.4 Sale of common Mock, including tex benefit of 50. .. +** Repurchase of common stock..... Halance, September 28, 2008. ... Neti ng.. .. . Uhrined holding gains, net Translatie adient set of tax Comprehensive income ..... Stock-based compensation expose Eure of wock options, including tax benet of 55.3 .. . Sale of comm o d, including tax b elt !!! $ 2,490.9 390.8 !!!!! 1:1 Balce, September 27, 2009... See Notes to Consolidated Financial Statements. free cash flow cash from operating activities.capex interest (ally cash from operating activities capex (shareholders WACC/CAPM WACC-D/CD+EJrd (1-1) rearbeta imm-10) /(DIE)re market to book ratio market value of equity book value of equity Return on Equity (ROE) - net income equity Return on Assets (ROA) net income total assets Return on invested capital (OIC) - net income interest Equity Long term debt Asset turnover ratio- sales total assets Fixed asset turnover ratio Sales fixed assets inventory turnover ratio = sales inventory operating profit margin profit margin- net income sales long term debt to equity ratio = long term debet equity debt to equity ratio (D/E ratio) debt equity debt to asset ratio debt assets current liabilities Inventories current liabilities payout ratio net income payout ratio