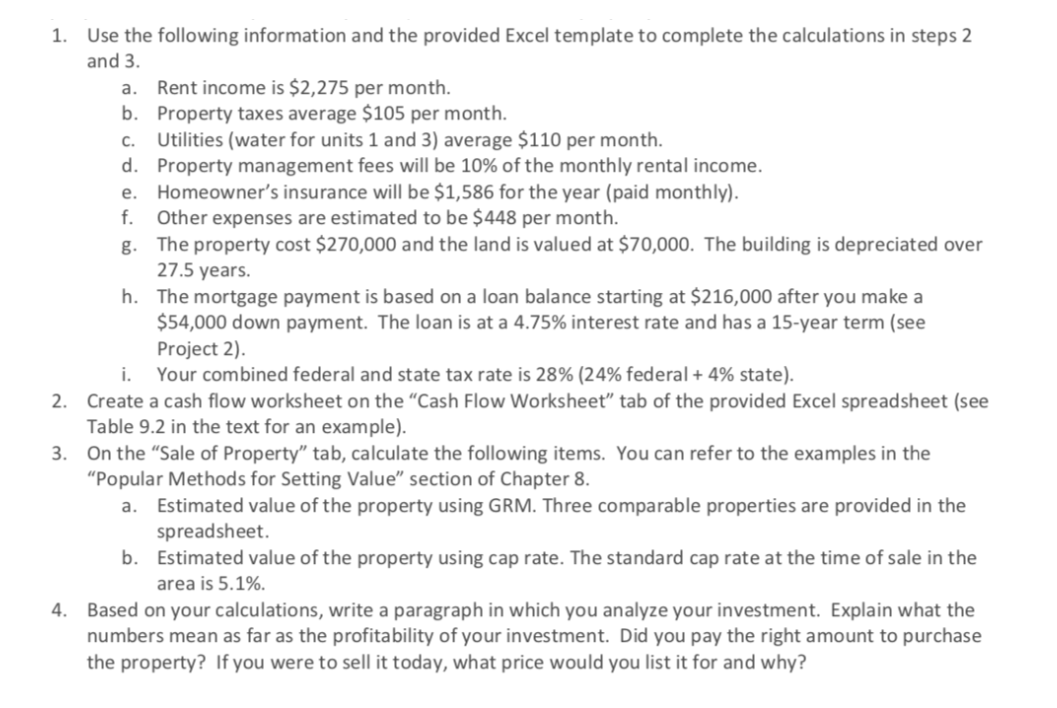

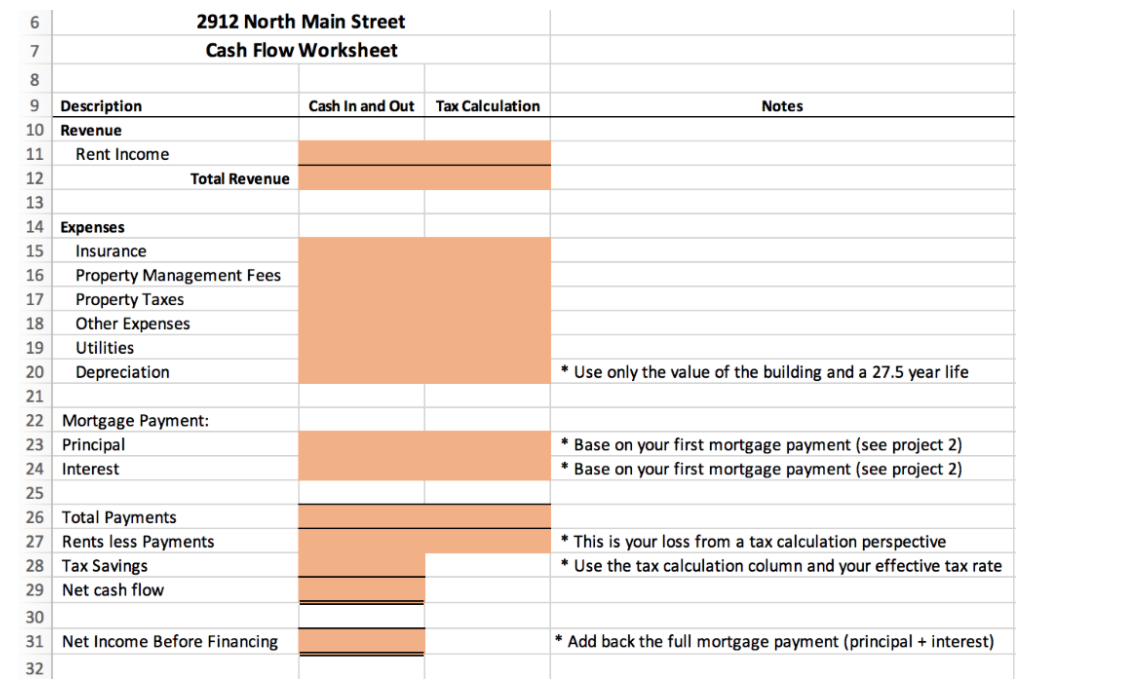

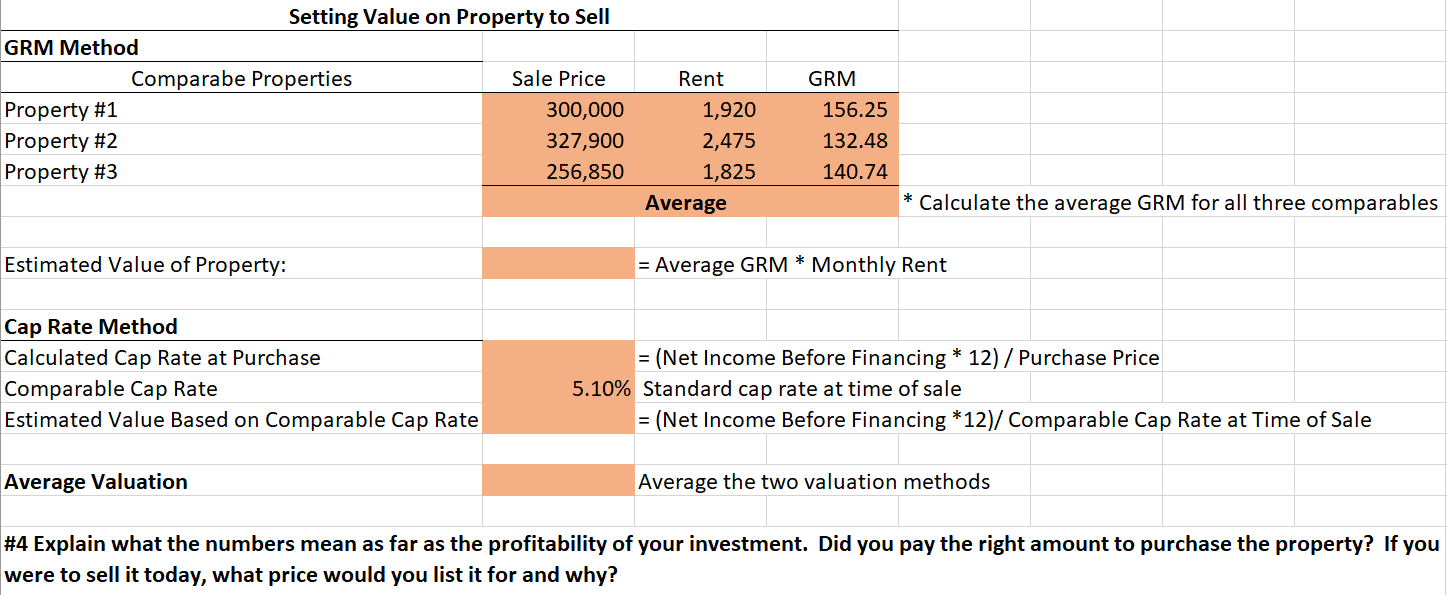

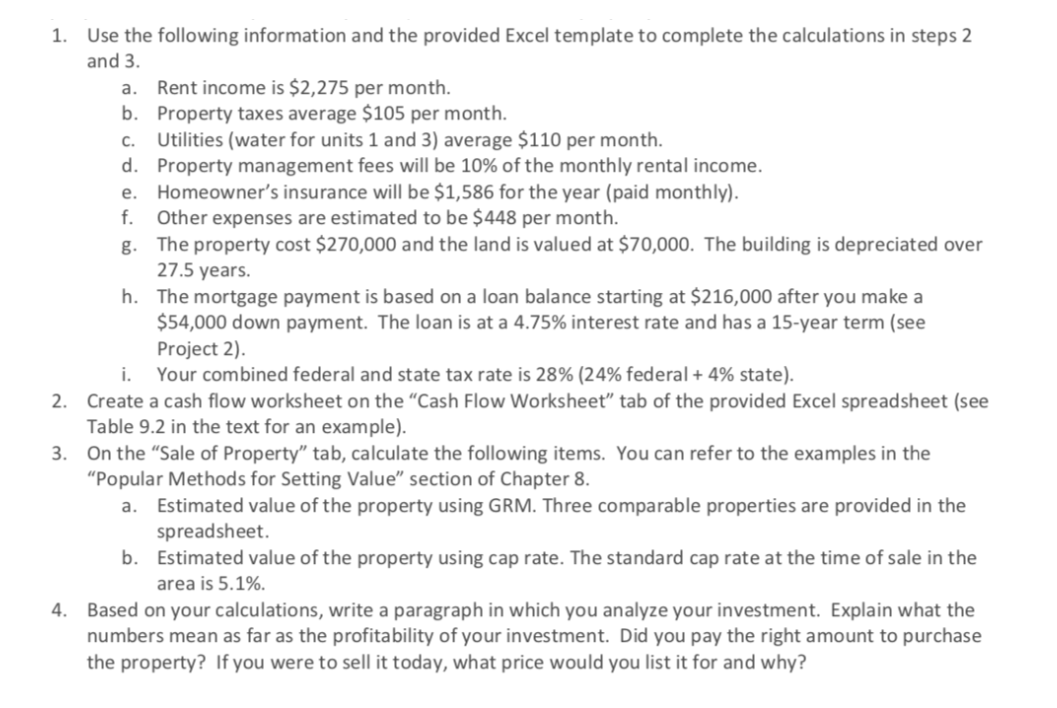

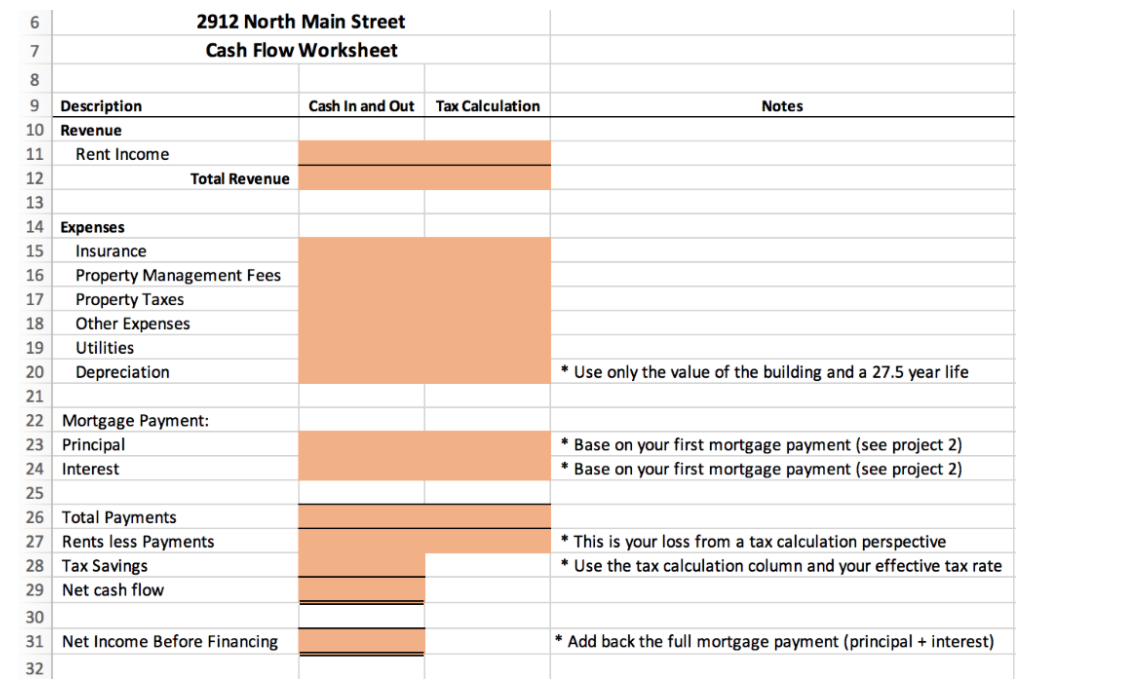

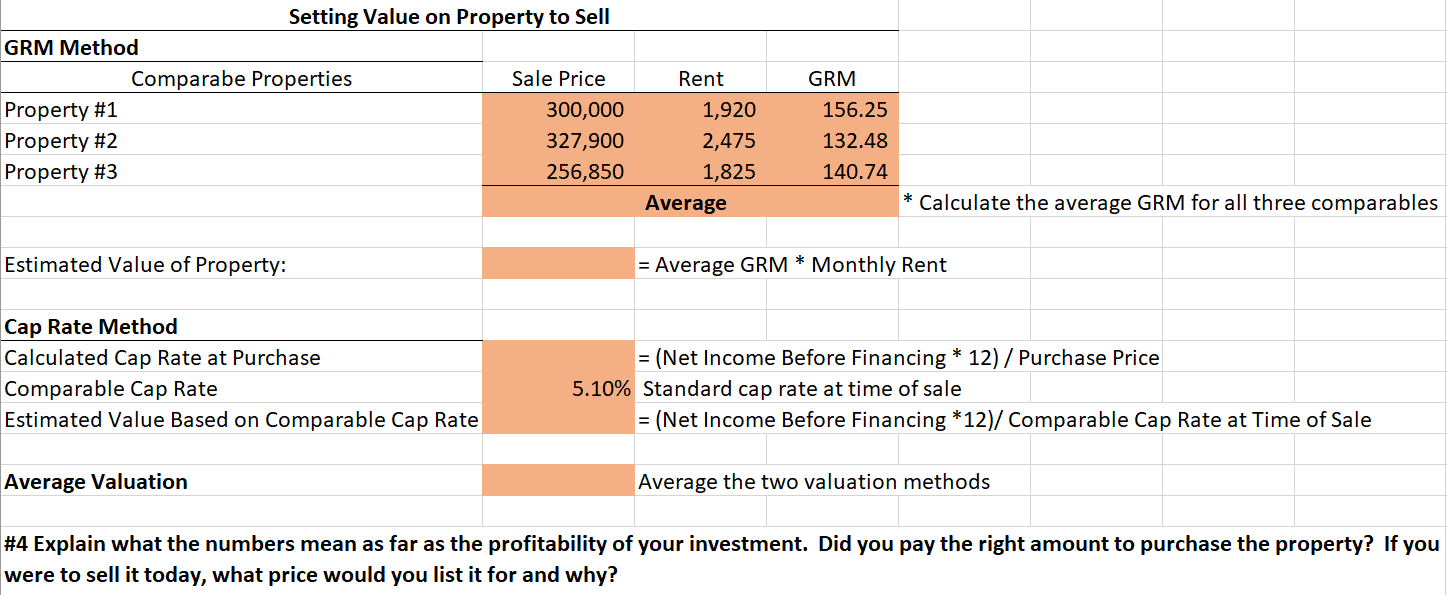

1. C. Use the following information and the provided Excel template to complete the calculations in steps 2 and 3. a. Rent income is $2,275 per month. b. Property taxes average $105 per month. Utilities (water for units 1 and 3) average $110 per month. d. Property management fees will be 10% of the monthly rental income. e. Homeowner's insurance will be $1,586 for the year (paid monthly). f. Other expenses are estimated to be $448 per month. g. The property cost $270,000 and the land is valued at $70,000. The building is depreciated over 27.5 years. h. The mortgage payment is based on a loan balance starting at $216,000 after you make a $54,000 down payment. The loan is at a 4.75% interest rate and has a 15-year term (see Project 2). i. Your combined federal and state tax rate is 28% (24% federal + 4% state). 2. Create a cash flow worksheet on the Cash Flow Worksheet" tab of the provided Excel spreadsheet (see Table 9.2 in the text for an example). 3. On the Sale of Property tab, calculate the following items. You can refer to the examples in the "Popular Methods for Setting Value section of Chapter 8. a. Estimated value of the property using GRM. Three comparable properties are provided in the spreadsheet. b. Estimated value of the property using cap rate. The standard cap rate at the time of sale in the area is 5.1%. 4. Based on your calculations, write a paragraph in which you analyze your investment. Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why? 6 2912 North Main Street Cash Flow Worksheet 7 8 Cash In and Out Tax Calculation Notes * Use only the value of the building and a 27.5 year life 9 Description 10 Revenue 11 Rent Income 12 Total Revenue 13 14 Expenses 15 Insurance 16 Property Management Fees 17 Property Taxes 18 Other Expenses 19 Utilities 20 Depreciation 21 22 Mortgage Payment: 23 Principal 24 Interest 25 26 Total Payments 27 Rents less Payments 28 Tax Savings 29 Net cash flow 30 31 Net Income Before Financing 32 Base on your first mortgage payment (see project 2) Base on your first mortgage payment (see project 2) * This is your loss from a tax calculation perspective * Use the tax calculation column and your effective tax rate * Add back the full mortgage payment (principal + interest) Rent Setting Value on Property to Sell GRM Method Comparabe Properties Sale Price Property #1 300,000 Property #2 327,900 Property #3 256,850 1,920 2,475 1,825 Average GRM 156.25 132.48 140.74 * Calculate the average GRM for all three comparables Estimated Value of Property: = Average GRM * Monthly Rent Cap Rate Method Calculated Cap Rate at Purchase Comparable Cap Rate Estimated Value Based on comparable Cap Rate = (Net Income Before Financing * 12) / Purchase Price 5.10% Standard cap rate at time of sale = (Net Income Before Financing *12)/ Comparable Cap Rate at Time of Sale Average Valuation Average the two valuation methods #4 Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why? 1. C. Use the following information and the provided Excel template to complete the calculations in steps 2 and 3. a. Rent income is $2,275 per month. b. Property taxes average $105 per month. Utilities (water for units 1 and 3) average $110 per month. d. Property management fees will be 10% of the monthly rental income. e. Homeowner's insurance will be $1,586 for the year (paid monthly). f. Other expenses are estimated to be $448 per month. g. The property cost $270,000 and the land is valued at $70,000. The building is depreciated over 27.5 years. h. The mortgage payment is based on a loan balance starting at $216,000 after you make a $54,000 down payment. The loan is at a 4.75% interest rate and has a 15-year term (see Project 2). i. Your combined federal and state tax rate is 28% (24% federal + 4% state). 2. Create a cash flow worksheet on the Cash Flow Worksheet" tab of the provided Excel spreadsheet (see Table 9.2 in the text for an example). 3. On the Sale of Property tab, calculate the following items. You can refer to the examples in the "Popular Methods for Setting Value section of Chapter 8. a. Estimated value of the property using GRM. Three comparable properties are provided in the spreadsheet. b. Estimated value of the property using cap rate. The standard cap rate at the time of sale in the area is 5.1%. 4. Based on your calculations, write a paragraph in which you analyze your investment. Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why? 6 2912 North Main Street Cash Flow Worksheet 7 8 Cash In and Out Tax Calculation Notes * Use only the value of the building and a 27.5 year life 9 Description 10 Revenue 11 Rent Income 12 Total Revenue 13 14 Expenses 15 Insurance 16 Property Management Fees 17 Property Taxes 18 Other Expenses 19 Utilities 20 Depreciation 21 22 Mortgage Payment: 23 Principal 24 Interest 25 26 Total Payments 27 Rents less Payments 28 Tax Savings 29 Net cash flow 30 31 Net Income Before Financing 32 Base on your first mortgage payment (see project 2) Base on your first mortgage payment (see project 2) * This is your loss from a tax calculation perspective * Use the tax calculation column and your effective tax rate * Add back the full mortgage payment (principal + interest) Rent Setting Value on Property to Sell GRM Method Comparabe Properties Sale Price Property #1 300,000 Property #2 327,900 Property #3 256,850 1,920 2,475 1,825 Average GRM 156.25 132.48 140.74 * Calculate the average GRM for all three comparables Estimated Value of Property: = Average GRM * Monthly Rent Cap Rate Method Calculated Cap Rate at Purchase Comparable Cap Rate Estimated Value Based on comparable Cap Rate = (Net Income Before Financing * 12) / Purchase Price 5.10% Standard cap rate at time of sale = (Net Income Before Financing *12)/ Comparable Cap Rate at Time of Sale Average Valuation Average the two valuation methods #4 Explain what the numbers mean as far as the profitability of your investment. Did you pay the right amount to purchase the property? If you were to sell it today, what price would you list it for and why