Question

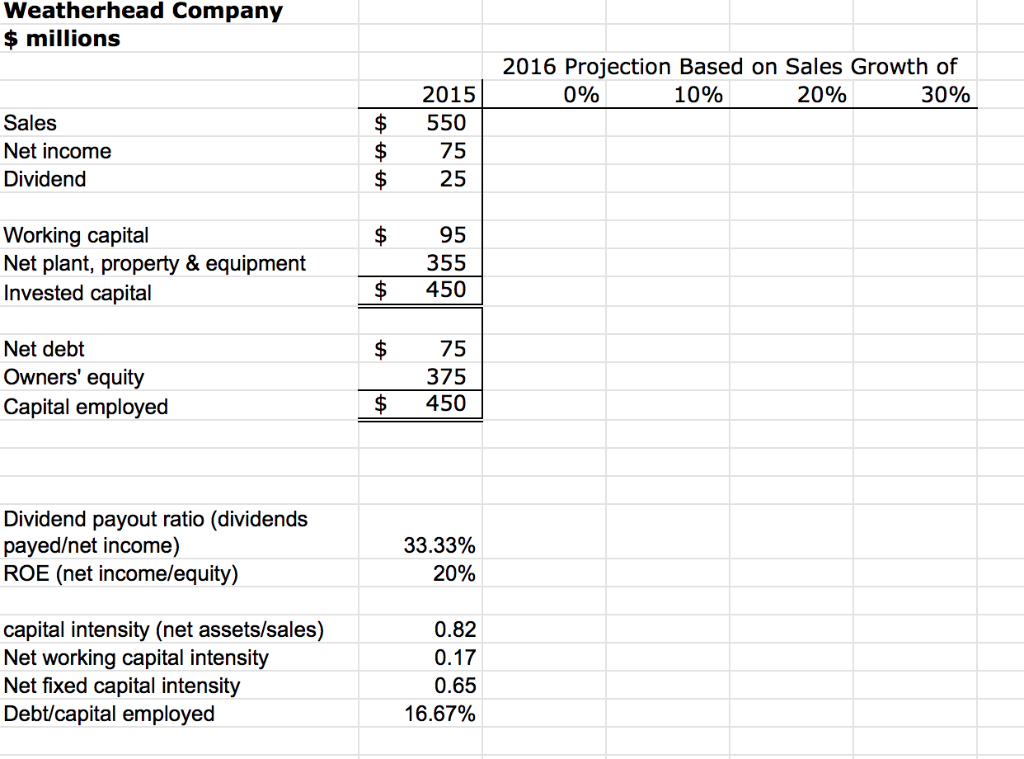

1. Calculate a pro forma income statements and managerial balance sheets assuming sales growth of 0, 10, 20 and 30% and also that the key

1. Calculate a pro forma income statements and managerial balance sheets assuming sales growth of 0, 10, 20 and 30% and also that the key assumptions and policies above stay the same (i.e., dividend payout ratio, net margins, productivity/capital intensity). Show your managerial balance sheet plug clearly. Analyze each scenario by calculating the following key ratios:

1. Calculate a pro forma income statements and managerial balance sheets assuming sales growth of 0, 10, 20 and 30% and also that the key assumptions and policies above stay the same (i.e., dividend payout ratio, net margins, productivity/capital intensity). Show your managerial balance sheet plug clearly. Analyze each scenario by calculating the following key ratios:

a. Sales growth

b. Net margins

c. ROE

d. Productivity (Saleset assets)

e. Leverage (Net assets/Owners equity) and assuming the plug is all debt

** If possible, please also answer: Calculate the Internal growth rate and Self-sustainable growth rate. Demonstrate that these growth rates, in fact, live up to their description in the manner we discussed in class.

Weatherhead Company $ millions 2016 Projection Based on Sales Growth of 2015 0% 10% 2090 30% Sales Net income Dividend $ 550 $ 75 $25 Working capital Net plant, property & equipment Invested capital $95 355 $ 450 Net debt Owners' equity Capital employed $ 75 375 $ 450 Dividend payout ratio (dividends payedet income) ROE (net income/equity) 33.33% 20% capital intensity (net assets/sales) Net working capital intensity Net fixed capital intensity Debt/capital employed 0.82 0.17 0.65 16.67%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started